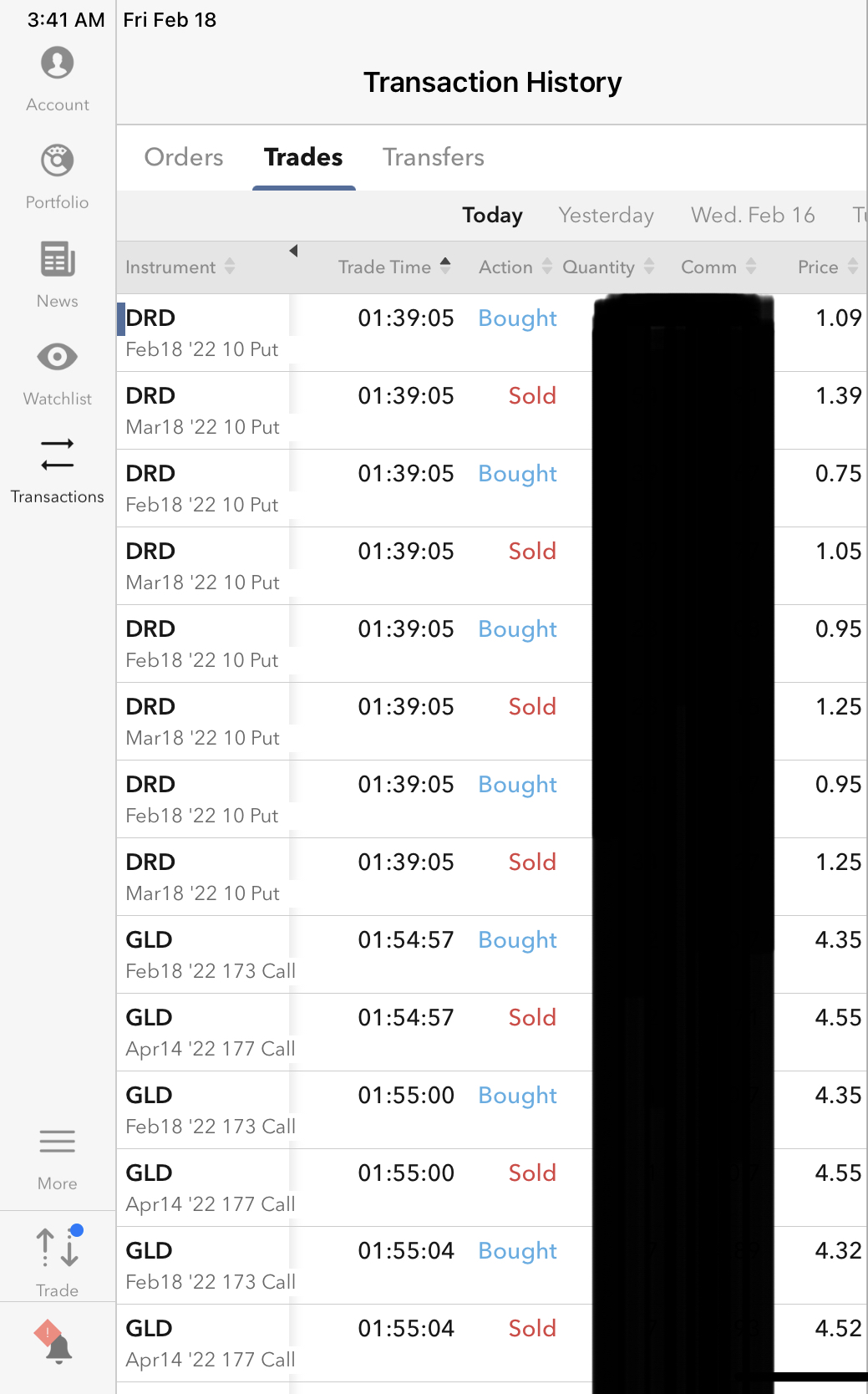

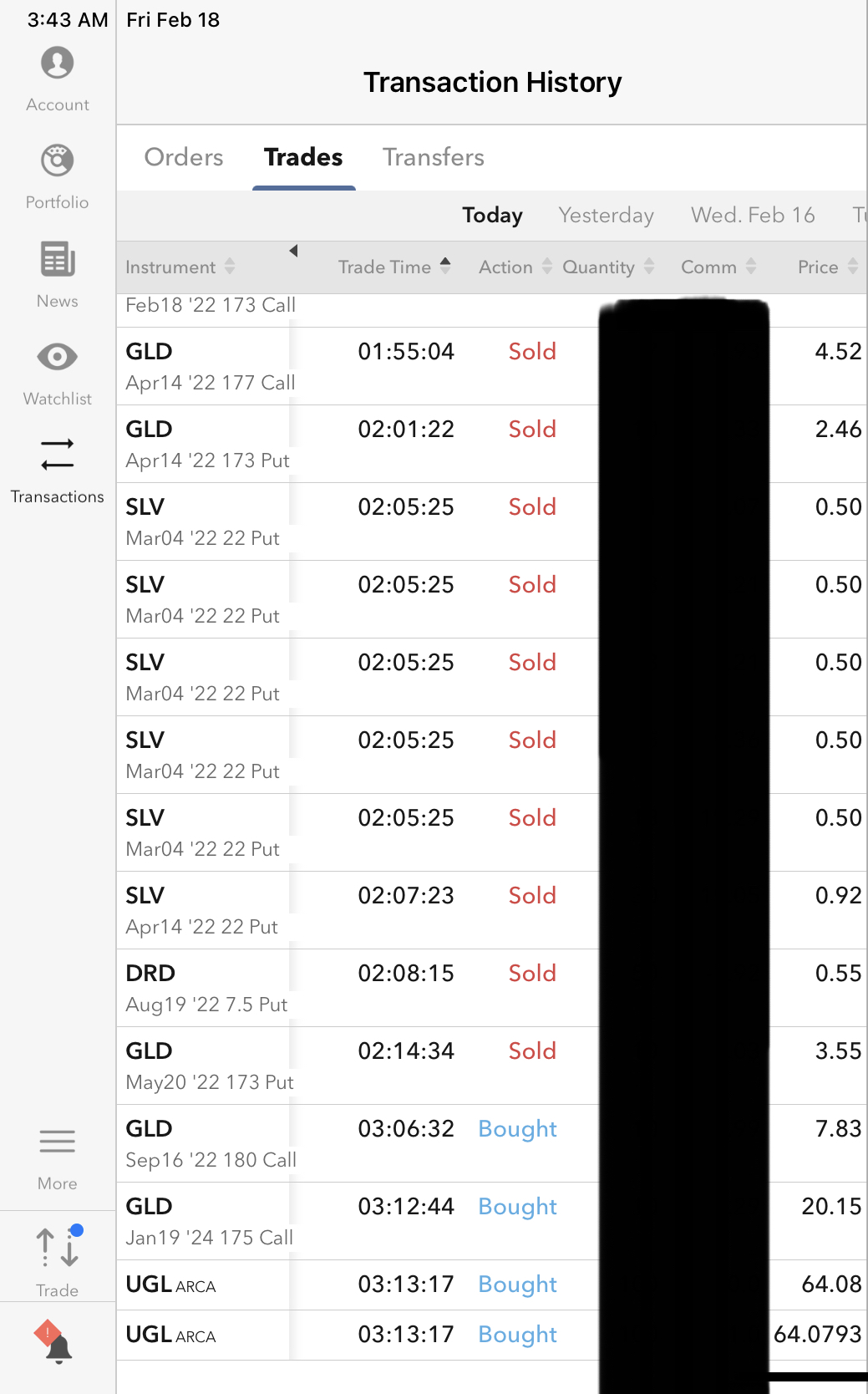

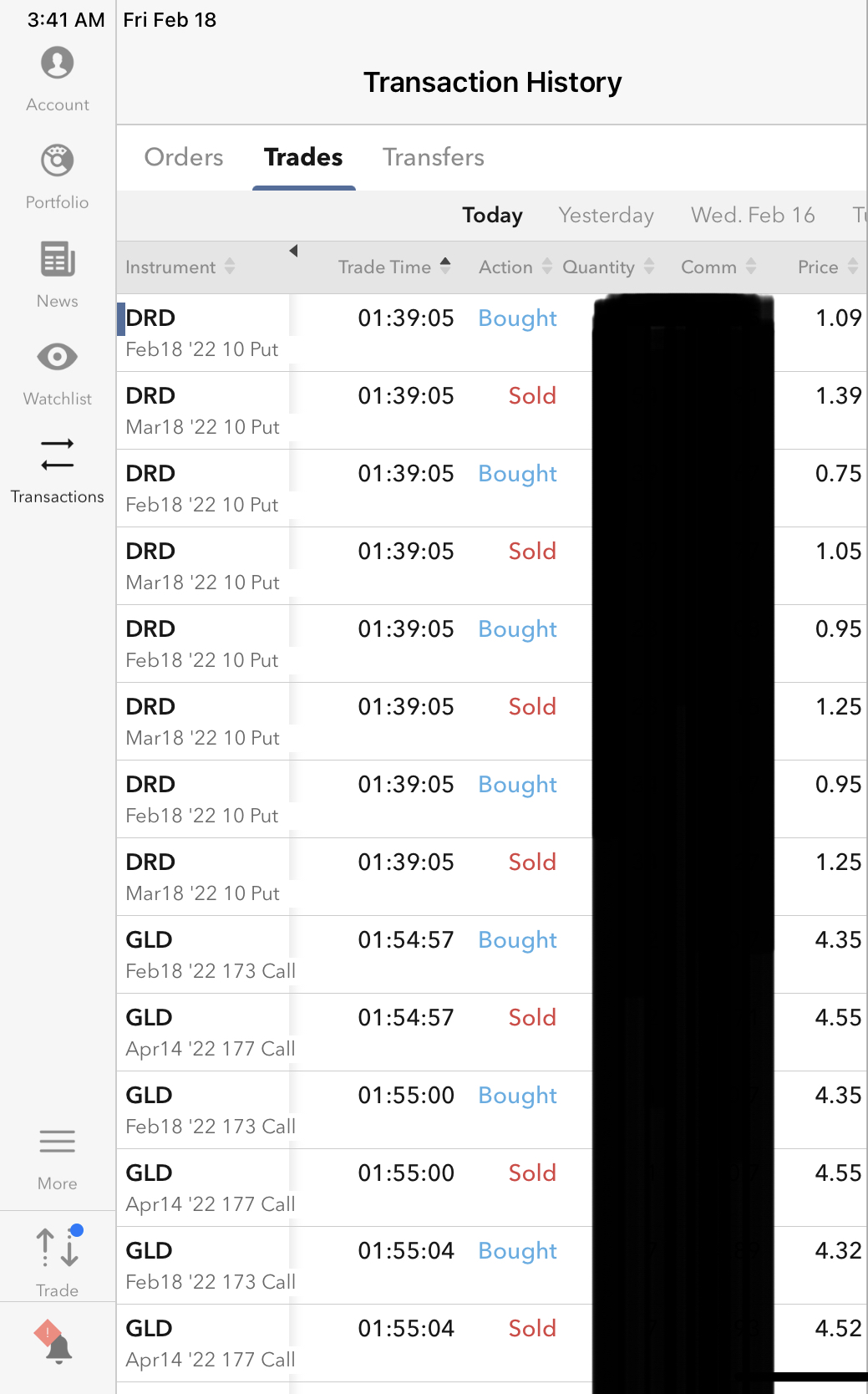

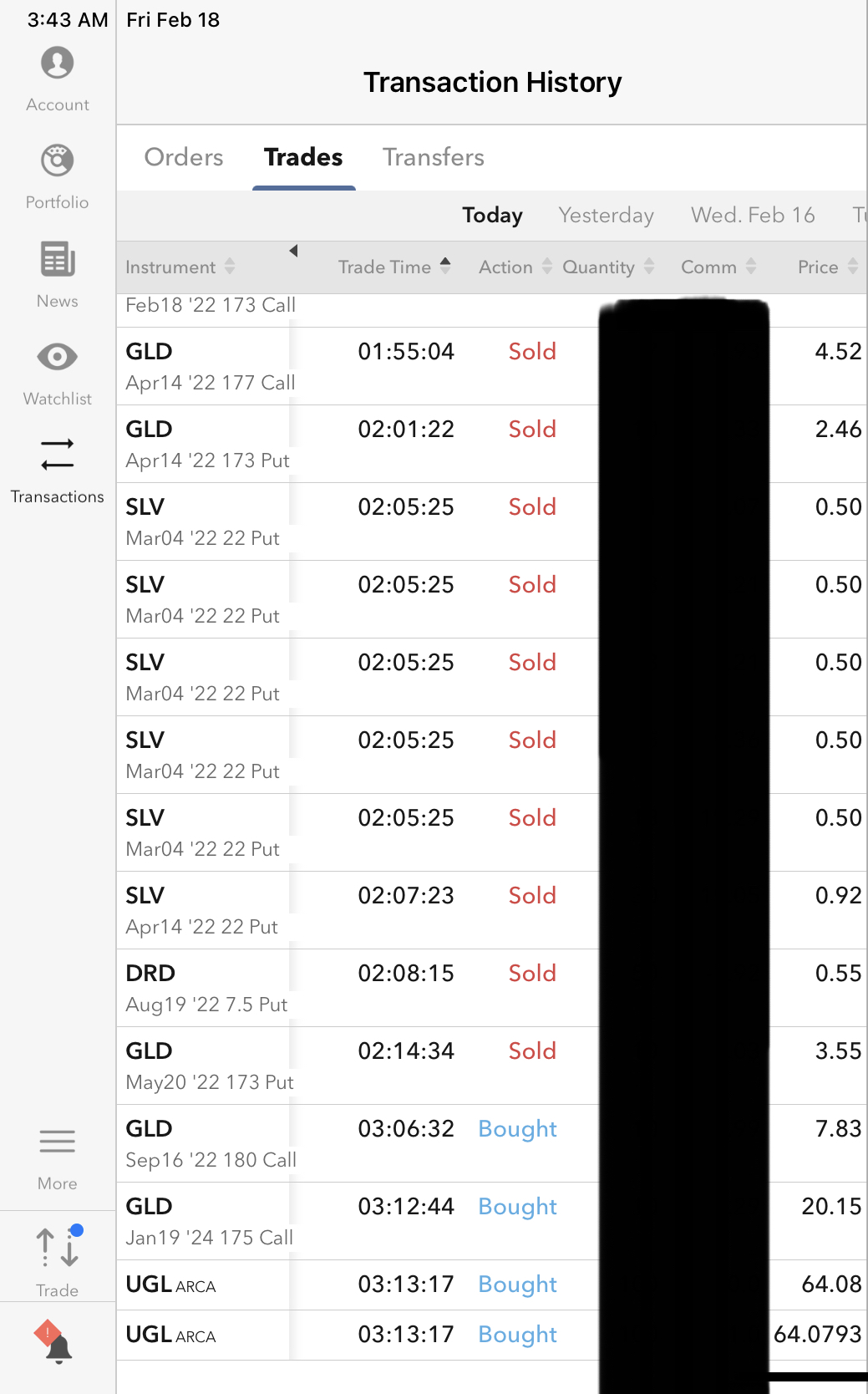

(1) Rolled short GLD covered-calls (to hold on to underlying GLD) so as to hold on to every single nugget of obligated gold, but

(2) Also long GLD calls and Leap-calls (Jan 2024) so as to control more goodness

(3) Re-shorted GLD puts, as much puts shall expire worthless tomorrow and need to restock ammunition

(4) Shorted SLV puts, in case silver follows gold. Silver essentially did nothing.

(5) Long UGL (ultra gold), because if gold is good, then leverage might make good better

(6) Rolled DRD short-puts strike 10s, per standard monthly protocol, going out to August (have short puts March, May, August, and shall open shorts on April - I call it farming

(7) Shorted more DRD puts strike 7.50

(8) Would observe that am bullish on gold.

Someone might have woken up gold, but so far barely stirred silver.

The sudden volatility ramped premiums, that which we must sell, even as we buy.

Time to add Junior Gold? To put another way, is gold being sincere even though 2022 is definitely not 2023 ?

IOW, is Martin Armstrong fallible ? (Reminder, check Martin Armstrong once true mornin g gets underway)

(9) If the FED panics at all, ought to be soon. Whichever way the FED panics, a mistake.

Should the FED not panic, then ‘they’ do not understand the situation.

Either way, puts a floor to gold and takes out the possibility of 900 gold, unless everything else craters.

(10) Given that am loaded up on anti-everything else for bear season, not fearful of everything else cratering.

Speaking of which, must check on VIX / UVXY finance.yahoo.com

This night’s deployments. Tout Ou Rien.

|