Is NVIDIA Stock A Good Choice For 2022? Buy While You Still Can

Feb. 23, 2022

JR Research

Summary

- NVIDIA released an impressive FQ4 report card. It shows that its Data Center segment will be even more critical moving forward.

- It also explained that its supply chain dynamics would improve throughout the year. NVIDIA has also committed to significant long-term supply.

- We discuss why investors should capitalize on its recent volatility to add exposure.

David Becker/Getty Images News

Investment Thesis

NVIDIA Corporation ( NVDA) reported a rock-solid quarter as it dazzled investors with continued strength in its critical Gaming and Data Center revenue segments. Furthermore, it also highlighted that automotive revenue is at an inflection point, and we should see further accretion from this year moving forward. In addition, the adoption of AI Enterprise and its Omniverse engine is also gaining traction and is still in its early innings.

CEO Jensen Huang & Team also guided for a strong FQ1'23. Data Center is also expected to take center stage in FY23. It's also in line with stronger spending from enterprise, cloud service providers, and hyperscalers that we have observed. We believe NVIDIA's multi-year secular accelerated computing growth story in Data Center will be even more critical for its growth thesis moving forward.

NVIDIA also took the opportunity to address the loss of Arm. We also covered it in a recent article. While NVIDIA could have missed the opportunity to better integrate its stack with Arm architecture, it's immaterial to its fundamental thesis and close partnership with Arm. NVIDIA also unveiled that investors should expect numerous product launches involving Arm moving ahead.

We discuss why we think NVIDIA is a great choice for growth investors in 2022.

Robust Results Show Data Center Gaining Prominence

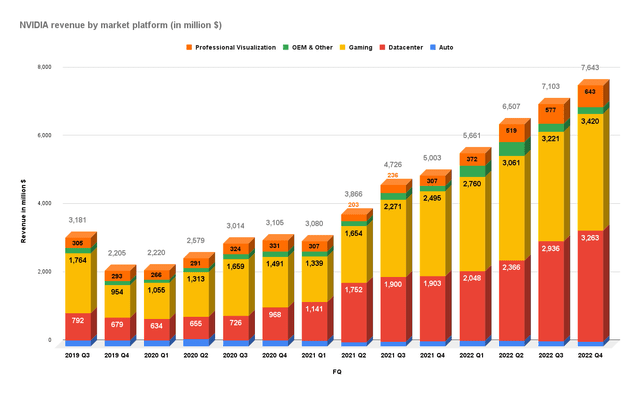

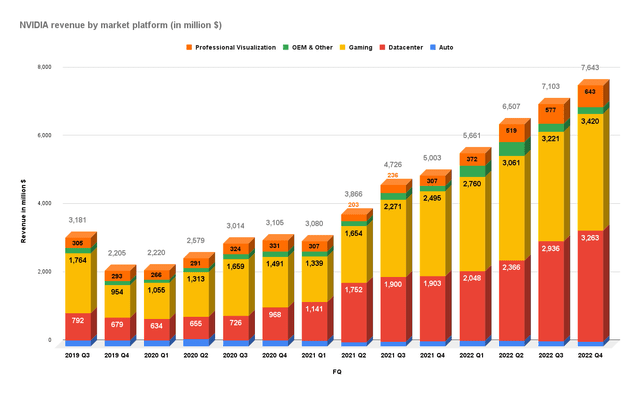

NVIDIA revenue segments (Company filings)

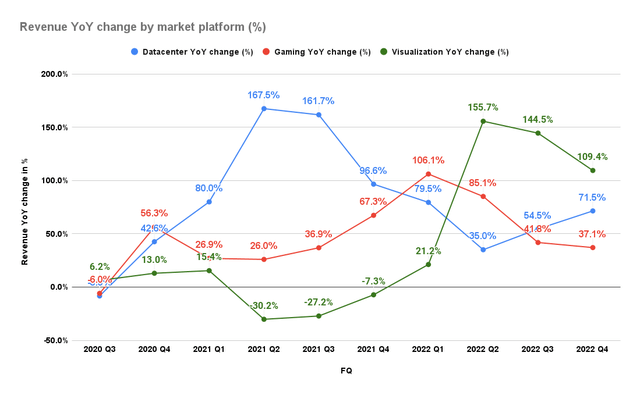

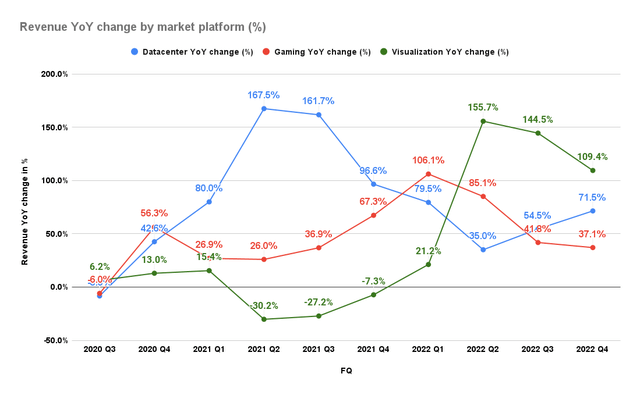

NVIDIA revenue segments YoY change % (Company filings)

NVIDIA posted revenue of $7.64B, up 53% YoY. FY21 revenue reached $26.91B, up 61% YoY. Notably, strength was broad-based, and it also posted robust growth in its crucial Gaming, and Data Center segments. Gaming grew 37.1% YoY to $3.42B. Data Center continued its impressive growth momentum from FQ3 (+54.5% YoY), as it increased by 71.5% YoY to $3.26B. Investors can glean from the second chart and observe that Data Center has strongly supported NVIDIA's growth after lapping the more challenging comps in FQ2 (+35% YoY) previously.

Notably, NVIDIA is also expecting Data Center's cadence to carry on in FY23, as CEO Jensen Huang emphasized (edited):

- We remain early days in our adoption. We're seeing growth across the entire spectrum. There are several different use cases that are particularly exciting. These include large language models, conversational AI used for customer service, chat bots, a whole bunch of customer service applications. Deep learning-based recommender systems are making groundbreaking improvements. And cloud graphics, all of the work that we're doing and putting rendering or putting simulations up in the cloud, cloud gaming, are really driving adoption in the cloud. And so many different use cases across all of the different platforms in data centers. ( NVIDIA's FQ4'22 earnings call)

In a previous article, we also discussed that NVIDIA's Tensor Core A100 GPU has penetrated only about 10% of data center workloads. Moving forward, the use case of AI will broaden and get increasingly complex. Therefore, NVIDIA remains solidly primed to leverage the growth through its AI software and "its 3 chip-strategy."

Notably, astute investors would have picked up that NVIDIA's full-stack strategy is predicated on its AI software to drive growth. That's right. In last year's GTC, Huang shared that many of these technologies were not possible just a few years ago. Thus, these significant breakthroughs have been achieved only very recently. Consequently, it has allowed NVIDIA to rely on its software capability as the foundational driver for its growth moving forward. Huang articulated (edited):

- NVIDIA is a software-driven business. Accelerated computing is a software-driven business. It starts from recognizing what domain of applications we want to accelerate and can accelerate and then building an entire stack from the processor to the system to the system software, the acceleration engines and potentially even the applications itself, like the software that we were mentioning earlier, NVIDIA DRIVE, NVIDIA AI and NVIDIA Omniverse. There are some 20 million, 25 million servers that are installed in the world today in enterprises, not including clouds. We believe that every single server in the future will be running AI software. (NVIDIA's FQ4'21 earnings call)

Therefore, investors need to "reconfigure" how they view NVIDIA's opportunities moving forward. We believe Gaming will continue to drive growth. Recent data from Tom's Hardware also show that its Gaming GPU prices have moderated, and we believe it's reflective of the current supply chain dynamics. NVIDIA also clarified it's expecting its supply chain to continue improving through FY23 or CY22. But, we believe that NVIDIA's Data Center business will be an even more important growth driver for the company moving ahead. The use cases across Data Center are only accelerating and not decelerating, as explained by NVIDIA.

Consequently, an analyst on the call also pointed out that its inventory purchase obligations have increased to $9B, up 30% QoQ. It's also the "first time" that it has exceeded its quarterly revenue guidance (NVIDIA guided to $8.1B for FQ1'23). Huang articulated (edited):

- We expanded our supply chain footprint significantly this year to prepare us for both increased supply base and supply availability in each one of the quarters going forward, but also in preparation for some really exciting product launches. As mentioned, Orin ramping into autonomous vehicles is brand new. This is the inflection point of us growing into autonomous vehicles.This is going to be a very large business for us going forward. Our Arm-based Grace CPU is a brand-new product that has never been on NVIDIA's road map. And we already see great success with customers who love the architecture of it and desperately in need of the type of capability that Grace brings. And so we're preparing for all of that laying the foundation for us to bring all those exciting products to the marketplace. (NVIDIA's FQ4'21 earnings call)

Therefore, we believe NVIDIA is seeing tremendous momentum in its growth drivers and opportunities. It's clearly reflected in its purchase obligations, which we think represents the increasing amount of capacity that NVIDIA is targeting. Therefore, we believe that the company is just getting started. No logical company would commit to massive long-term purchase obligations without expecting robust demand. Investors should get the hint from Huang & Team.

Buy NVDA Stock Now While You Still Can

We are very excited to know what's in store for NVIDIA at next month's GTC. Huang has hyped everyone up by emphasizing that NVIDIA will continue to deepen its work on the Arm architecture, starting with its Grace CPU. Therefore, we are very excited to find out the additional possibilities that NVIDIA has in store for Arm.

Huang emphasized that it has a 20-year architectural license with Arm, allowing NVIDIA to leverage the "full breadth and flexibility" of Arm's IP. He also hinted that NVIDIA has "multiple-arm projects ongoing in the company from connected devices to robotics processors such as the new Orin that's going into autonomous vehicles and robotic systems and industrial automation, robotics and such."

Given Arm's much smaller share (but increasing) of revenue against x86 currently, the opportunities are tremendous. Furthermore, Qualcomm ( QCOM) is also staking its strategic PC roadmap around Arm architecture. CEO Cristiano Amon emphasized at its recent earnings call (edited):

- So our view is very clear. There's going to be a big portion of the PC market is going to transition to Arm architecture. And when you think of everybody else in the industry, we are the best positioned company to do that for the Windows ecosystem. I think that's reflected not only in the developments and the partnership we have with Microsoft for the years, but also the acquisition of NUVIA. ( Qualcomm's FQ1'22 earnings call)

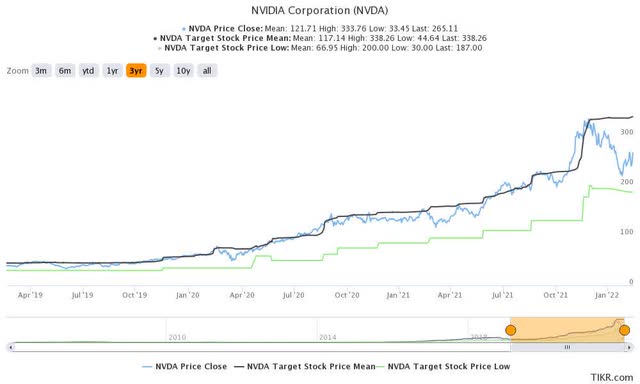

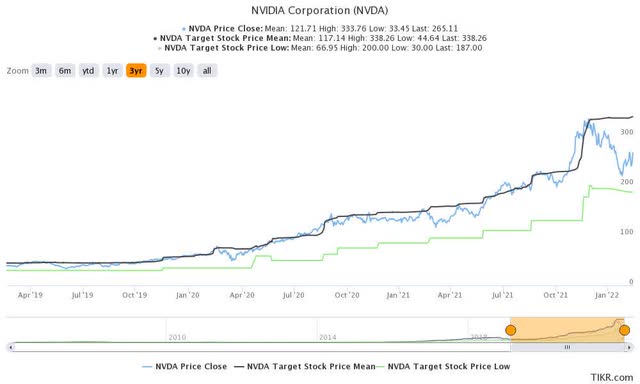

NVDA stock consensus price targets Vs. stock performance (TIKR)

Furthermore, NVDA stock has trended well according to the average consensus price targets over the last three years. Therefore, the current volatility in NVDA stock could represent a fantastic opportunity for investors to add more exposure. It's also within our fair value zone (+/- 10%), and therefore adding at the current price seems reasonable.

Consequently, we reiterate our Buy rating on NVDA stock.

google.com |