Nvidia May Grow Even Faster Than Expected (Complete Article)

Feb. 24, 2022

The Asian Investor

Summary

- Nvidia’s Q4’22 earnings card showed continual business strength in core segments.

- Nvidia is swimming in cash which could pave the way for a massive share buyback now that the ARM acquisition fell through.

- FY 2023 could be a year of revenue acceleration for the firm.

David Becker/Getty Images News

Shares of Nvidia ( NVDA) have experienced a couple of setbacks lately, but the semiconductor firm still delivered an impressive earnings sheet for Q4'22. The firm is experiencing accelerating momentum in its Data Center business, which is set to overtake Nvidia's Gaming segment, regarding total dollar contributions, for the first time in FY 2023. The current fiscal year could also be a successive year of top line acceleration as new RTX products come to market and the RTX 30 series upgrade cycle is going to support Nvidia's sales growth!

Q4'22 earnings sheet: as impressive as everNvidia ended its fiscal 2022 year with a strong fourth quarter that showed continual momentum in both the Gaming business, which is chiefly dealing with graphics cards, and the Data Center business. Total revenues for the quarter were $7.64B, showing a massive 53% increase compared to the same quarter in the year-earlier period.

Revenues in the Gaming segment were chiefly driven by volume and price growth related to Nvidia's GeForce RTX 30-Series GPUs, which continue to be super popular with gamers that want to upgrade their equipment to the latest graphics cards. Nvidia's results were also supported by gains made in the laptop segment where models equipped with the latest GeForce RTX 3070 Ti and 3080 Ti GPUs continue to sell extremely well. In the Data Center business, Nvidia benefited from record demand for high-performance computing and growing demand for artificial intelligence solutions.

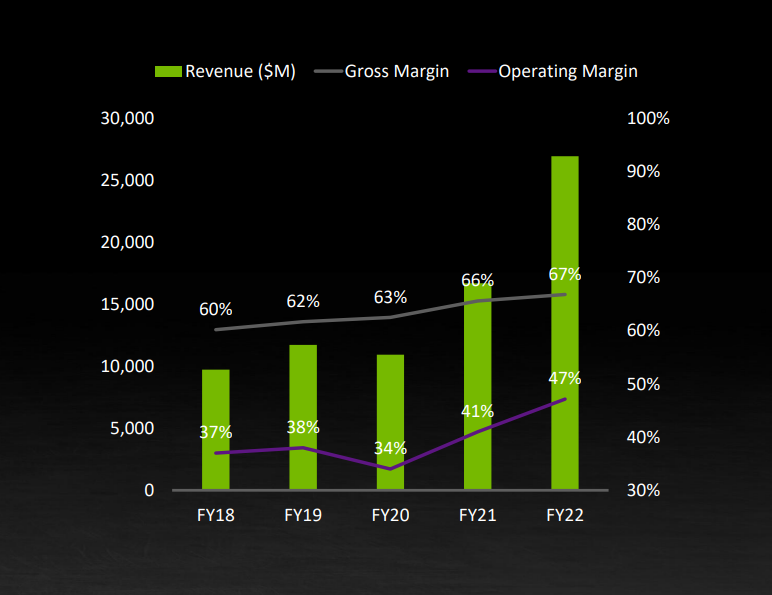

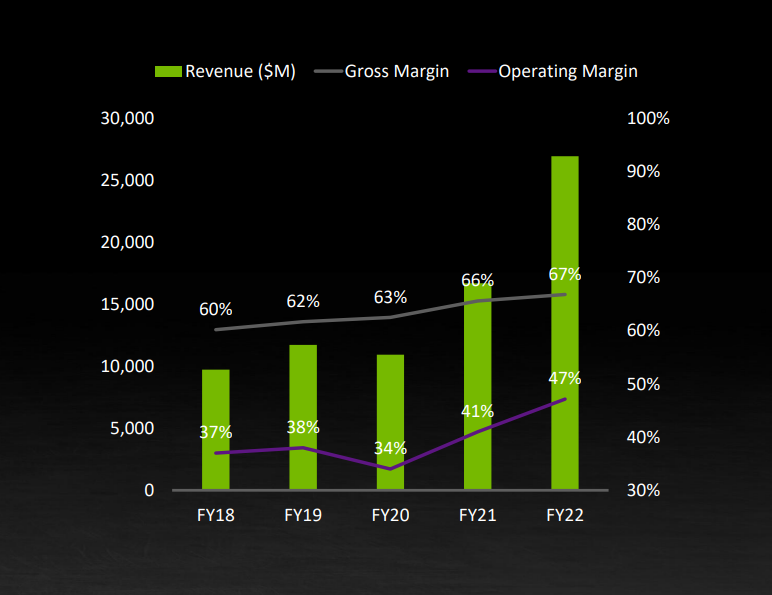

Nvidia's gross margins also kept expanding...

Nvidia

Nvidia's revenue composition is set to change this yearIn FY 2023, Nvidia's current fiscal year, we can expect a shift in segment dominance. While the Gaming segment was the largest contributor of revenue dollars up to FY 2022, Data Centers are seeing real momentum due to an ongoing shift of workloads to the cloud, a long-term trend that accelerated because of COVID-19. Nvidia's Data Center business generated $3.26B in revenues in the fourth quarter, showing 71% year-over-year growth. At the same time, Nvidia's Gaming revenues advanced "only" 37% year-over-year to $3.42B, meaning Nvidia's Data Center business grew its segment top line almost twice as fast as the Gaming segment.

Due to strong demand for high-performance computing solutions, I believe Nvidia's Data Center business is set to overtake Nvidia's Gaming segment in FY 2023 regarding revenue contribution and become the dominant business within Nvidia's portfolio going forward. The Gaming business, however, will continue to grow, just not as fast as the business serving the hyper-scale and public cloud market.

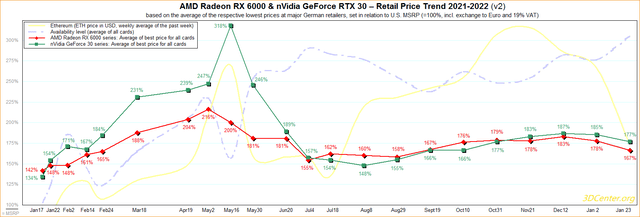

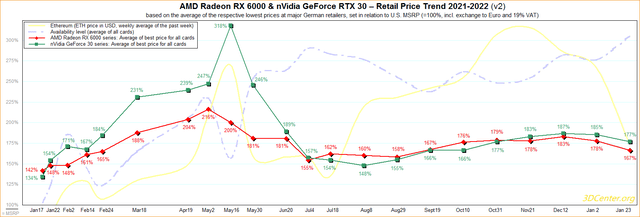

In the Gaming segment, Nvidia just recently released the GeForce RTX 3050 GPU, which is aimed at price-conscious gamers that don't want to pay for Nvidia's high-priced graphics cards. The GeForce RTX 30 GPU series has been a huge success for Nvidia, and the company still benefits from a multi-year upgrade cycle related to GPUs. GPU prices for Nvidia's RTX 30 series also remained elevated in January, indicating strong potential for growth in Nvidia's Gaming segment. In January, market prices for the Nvidia GeForce 30 series remained way above the manufacturer's suggested retail price, at 1.77x MSRP.

3Dcenter.org

Record free cash flow and solid FCF margins

Nvidia achieved record free cash flow on record revenues in FY 2022 while maintaining very high free cash flow margins. Free cash flow in FY 2022 was $8.05B, showing massive 72.1% year-over-year growth due to Nvidia having the strongest product line-up in its existence. Free cash flow of $8.05B was achieved on $26.9B in revenues, which calculates to a free cash flow margin of 29.9%. Due to strength in pricing and new product launches (RTX series), Nvidia even increased its free cash flow margin 1.9 PP year-over-year.

($m)

| FY2018

| FY2019

| FY2020

| FY2021

| FY2022

| Gaming

| $5,513

| $6,246

| $5,518

| $7,759

| $12,462

| Data Centers

| $1,932

| $2,932

| $2,983

| $6,696

| $10,613

| Visualization

| $934

| $1,130

| $1,212

| $1,053

| $2,111

| Automotive

| $558

| $641

| $700

| $536

| $566

| OEM

| $777

| $767

| $505

| $631

| $1,162

| Revenues

| $9,714

| $11,716

| $10,918

| $16,675

| $26,914

| | | | | | | Cash Flow from Operating Activities

| $3,502

| $3,743

| $4,761

| $5,822

| $9,108

| Investments in Property & Equipment

| -$593

| -$600

| -$489

| -$1,145

| -$1,059

| Free Cash Flow

| $2,909

| $3,143

| $4,272

| $4,677

| $8,049

| Free Cash Flow Margin

|

| 26.8%

| 39.1%

| 28.0%

| 29.9%

|

|