March News from Anaconda- goldboro 335 g of gold, 3/4 of a pound, per ton...

(scroll to see next article, after this one regarding early March's news)

Anaconda Mining Announces the Results of an Independent Socioeconomic Assessment for the Goldboro Gold Project

With a projected $2.1 billion impact on provincial GDP and the potential to generate 735 new jobs, the Goldboro Gold Project is currently the largest private sector project in Nova Scotia

feeds.issuerdirect.com

TORONTO, ON / ACCESSWIRE / March 3, 2022 / Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX)(OTCQX:ANXGF) is pleased to announce results of an independent socio-economic impact assessment of the Company's 100%-owned Goldboro Gold Project located in Nova Scotia, Canada ("Goldboro", or the "Project"). The independent assessment was prepared to demonstrate the potential social and economic impacts of the Goldboro Gold Project throughout an approximately 15 years of construction, operations and eventual reclamation, based on the Phase I Open Pit Feasibility Study ("Feasibility Study") outlined in the technical report entitled "NI 43-101 Technical Report and Feasibility Study for the Goldboro Gold Project, Eastern Goldfields District, Nova Scotia" with an effective date of December 16, 2021 and available under the Company's profile on SEDAR at www.sedar.com and on the Company's website at www.anacondamining.com.

The socio-economic assessment, completed by Group ATN, an Atlantic-wide third-party independent consulting and applied research firm, outlines the potential benefits accruing to the Province of Nova Scotia and also to the Mi'kmaq of Nova Scotia. The full report is available on the Company's website at www.anacondamining.com.

Highlights of the Socio-Economic Impact of the Goldboro Gold Project

Over approximately 15 years Anaconda anticipates spending up to $1.7 billion on goods and services, the majority of which is expected to be in Nova Scotia, resulting in a potential provincial GDP impact of $2.1 billion.Household income in Nova Scotia may potentially increase by up to $1.1 billion from the development of the Project.Up to 538 full time direct jobs could be created during the two-year construction phase, of which 325 of those jobs are expected to be directly on site at the Project, along with a further 213 full time spinoff jobs each year over this period.Once operational, the Project is estimated to provide direct annual employment for approximately 215 full time positions at the Project site and 517 spin off jobs, in the Eastern Region of Nova Scotia where the current unemployment level of 14.2% exceeds the provincial average.Over the life cycle of the Project, including construction, operations and reclamation, the Goldboro Gold Project has the potential to create 735 new jobs a year in Nova Scotia for 15 years.Based on the current plan outlined in the Feasibility Study, the Project is estimated to generate $528 million in income and mining taxes at the federal, provincial and municipal level from direct and spin-off economic activityAt $1.7 billion in direct spending and $2.1 billion impact on provincial GDP, the Goldboro Gold Project is currently the largest private sector undeveloped project in the Province of Nova Scotia and would be comparable to other planned projects including the Halifax Infirmary Expansion and the Sydney Container Terminal"We are pleased to announce the results of this independent socio-economic impact assessment which demonstrates the significant potential of the Goldboro Gold Project to contribute substantially to the local and provincial economy over its long operating life. It is currently the largest undeveloped private sector project in the Province of Nova Scotia, with the potential to contribute $2.1 billion to the provincial GDP, $528 million in taxes to all levels of government, and importantly the creation of up to 735 new full-time equivalent jobs annually in Nova Scotia. We note that the results of the assessment are based on the current Phase I Feasibility Study which at this point contemplates only surface mining from the existing Mineral Reserve. However, there continues to be tremendous upside potential at the Goldboro Deposit, which remains open in all directions for potential expansion, particularly to the west and at depth. We believe Goldboro could have the potential to be a multi-decade gold operation which can create significant value for our shareholders, rightsholders and stakeholders, including the Mi'kmaq of Nova Scotia, the Municipality of the District of Guysborough, and the Province of Nova Scotia."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc.

Socio-Economic Assessment of the Goldboro Gold Project

The Goldboro Gold Project is a modern mining project being undertaken with a focus on environmental probity and with a clear interest in earning a social license to operate by engaging key stakeholders and rightsholders, including the local community, the Mi'kmaq of Nova Scotia, the Municipality of the District of Guysborough, as well as government departments, agencies and regulators. Based on the Feasibility Study, which projects approximately 11 years of production at an average of 100,000 ounces per annum, the Company estimates it will be required to spend almost $1.7 billion over 15 years on a variety of good and services in support of the full range of activities surrounding the Project, from pre-production development efforts, through to commissioning and operations, to site reclamation. This includes over $271 million in construction work related to the pre-production mine development, with the balance of nearly $1.4 billion spent on mine operations and related costs.

The cumulative direct and spinoff impacts for Nova Scotia resulting from the construction and operational Goldboro Gold Project at its conclusion could amount to $2.1 billion in direct and spinoff GDP and $1.1 billion in direct and spinoff household income. During the construction period, it is anticipated that 325 direct jobs will be created for a two-year period and a further 213 full-time equivalent spin-off jobs each year over that period. Once operational, it is anticipated there will be 215 direct on-site jobs over the life of the operations and a further 517 spin-off jobs each year during that period. In total, the Goldboro Gold Project has the potential to create up to 735 new full time equivalent jobs a year in Nova Scotia for approximately 15 years.

Based on these projections, the Project expects to contribute a further $528 million in income and mining taxes at the federal, provincial and municipal level from direct and spin-off economic activity, such tax revenues enabling governments to deliver programs and services such as health care, education, road maintenance, and recreation infrastructure.

The Company believes there continues to be significant upside both to the west of the deposit and at-depth, however for the purposes of this study, Group ATN have factored information solely on the Feasibility Study which contemplates a 15-year project life cycle including construction (2 years), operations (11 years), and initial remediation (2 years).

About Group ATN

Group ATN is an Atlantic Canada-wide consulting and applied research firm registered in Nova Scotia, New Brunswick, Prince Edward Island, and Newfoundland and Labrador serving both Canadian and International clients. Incorporated in 2013, Group ATN brings a seasoned team with deep experience at senior levels within the public and private sectors. The Group ATN team is comprised of professionals with a wide range of complimentary expertise. We have completed hundreds of assignments throughout Canada and internationally for all levels of government, private-sector clients, and NGOs, and have deep experience working with Indigenous communities, organizations and individuals throughout Atlantic Canada.

Methodology

Group ATN assessed the economic impacts of the Goldboro Gold Project by collecting expenditure data from the Company and reviewing the financial projections of the proposed mine site near Goldboro, Nova Scotia. This includes an examination of the construction cost estimates and mine operations, taking place over a period of 15 years, from construction to pre-production, to mining and commercial production, to mine decommissioning and reclamation, based on the recently published independent Feasibility Study.

Existing secondary information was secured and referenced to complement this primary research. This included an examination of input-output ("I-O") tables, as well as documents provided by the Company. Supplemental primary sources included interviews with Company staff. A significant component of these materials reflects an innovative goal of engaging the Mi'kmaq of Nova Scotia as partners and to actively leverage opportunities going forward so that maximum social and economic benefits are realized.

A proprietary inter-provincial I-O model was used to map the economic relationships of the Project, and ultimately quantify its contribution to the Nova Scotian economy across the life cycle of the mine operations, from development to decommissioning. The I-O simulation model was tailored to the Nova Scotia economy to generate all mine-related economic impacts. The results of this I-O analysis provides a detailed measure of the impact of the Goldboro Gold Project and its relationship to the Nova Scotian economy including:

Economic impact in terms of direct, indirect, and induced activity reflecting the entire Goldboro Gold Project supply chain:Employment (jobs)Household income; andContribution to federal, provincial, and local taxes.The key assumptions used in this analysis relate to the financial information and are based on information from the recently completed Feasibility Study and have been outlined in further detail in the full report made available at www.anacondamining.com.

ABOUT ANACONDA

Anaconda Mining is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in the top-tier Canadian mining jurisdictions of Newfoundland and Nova Scotia. The Company is advancing the Goldboro Gold Project in Nova Scotia, a significant growth project subject to a positive Feasibility Study with Probable Mineral Reserves of 1.15 million ounces of gold (15.80 million tonnes at 2.26 g/t gold), Measured and Indicated Mineral Resources inclusive of Mineral Reserves of 2.58 million ounces (21.6 million tonnes at 3.72 g/t gold) and additional Inferred Mineral Resources of 0.48 million ounces (3.18 million tonnes at 4.73 g/t gold) (Please refer to the report entitled "NI 43-101 Technical Report and Feasibility Study for the Goldboro Gold Project, Eastern Goldfields District, Nova Scotia", dated January 11, 2022, which is available on SEDAR at www.sedar.com). Anaconda also operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~15,000 hectares of highly prospective mineral property, including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project.

Kevin Bullock, P. Eng., President and Chief Executive Officer of Anaconda Mining Inc. is a "qualified person" as such term is defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects and has reviewed and approved the scientific and technical information and data included in this news release.

Anaconda Mining Intersects 335.0 g/t gold over 0.5 metres at the Goldboro Gold Project, Commences 4,000 metre Infill Drill Program

feeds.issuerdirect.com

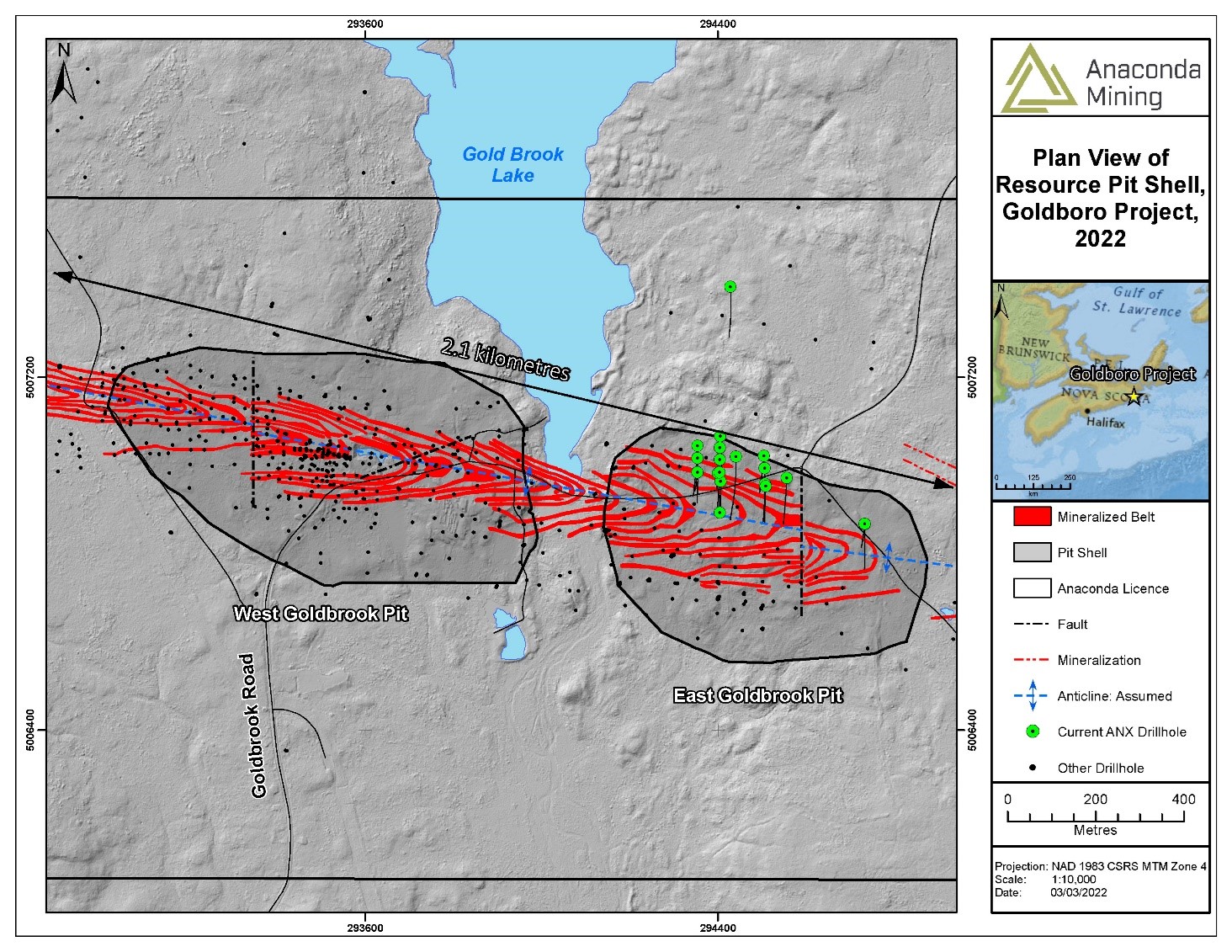

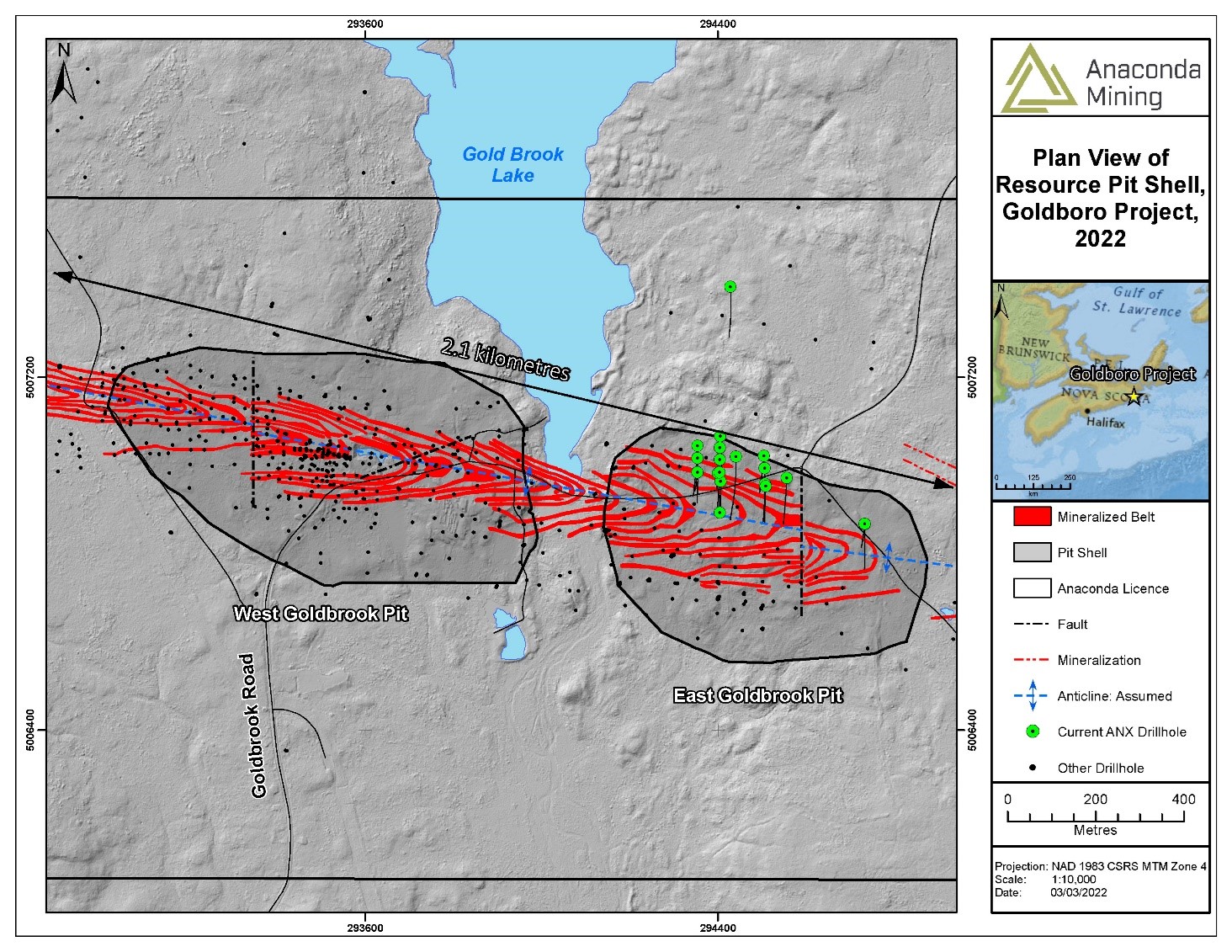

TORONTO, ON / ACCESSWIRE / March 8, 2022 / Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX)(OTCQX:ANXGF) is pleased to announce results from a recent drill program focused on the East Goldbrook Pit and that it has commenced a further 4,000-metre diamond drill program at its 100%-owned Goldboro Gold Project ("Goldboro" or the "Project") in Nova Scotia. The infill drill program has been designed to convert Inferred Mineral Resources within the East Goldbrook Pit into Indicated Mineral Resources (the "Infill Drill Program"). The existing constrained open pits outlined in the Feasibility Study1 were designed using only Measured and Indicated Resources (Exhibit A), however they captured 975,000 tonnes of Inferred Mineral Resources at a grade of 2.11 grams per tonne ("g/t"), representing a potential opportunity to positively impact Project economics by upgrading these Mineral Resources which are currently captured as waste tonnes.

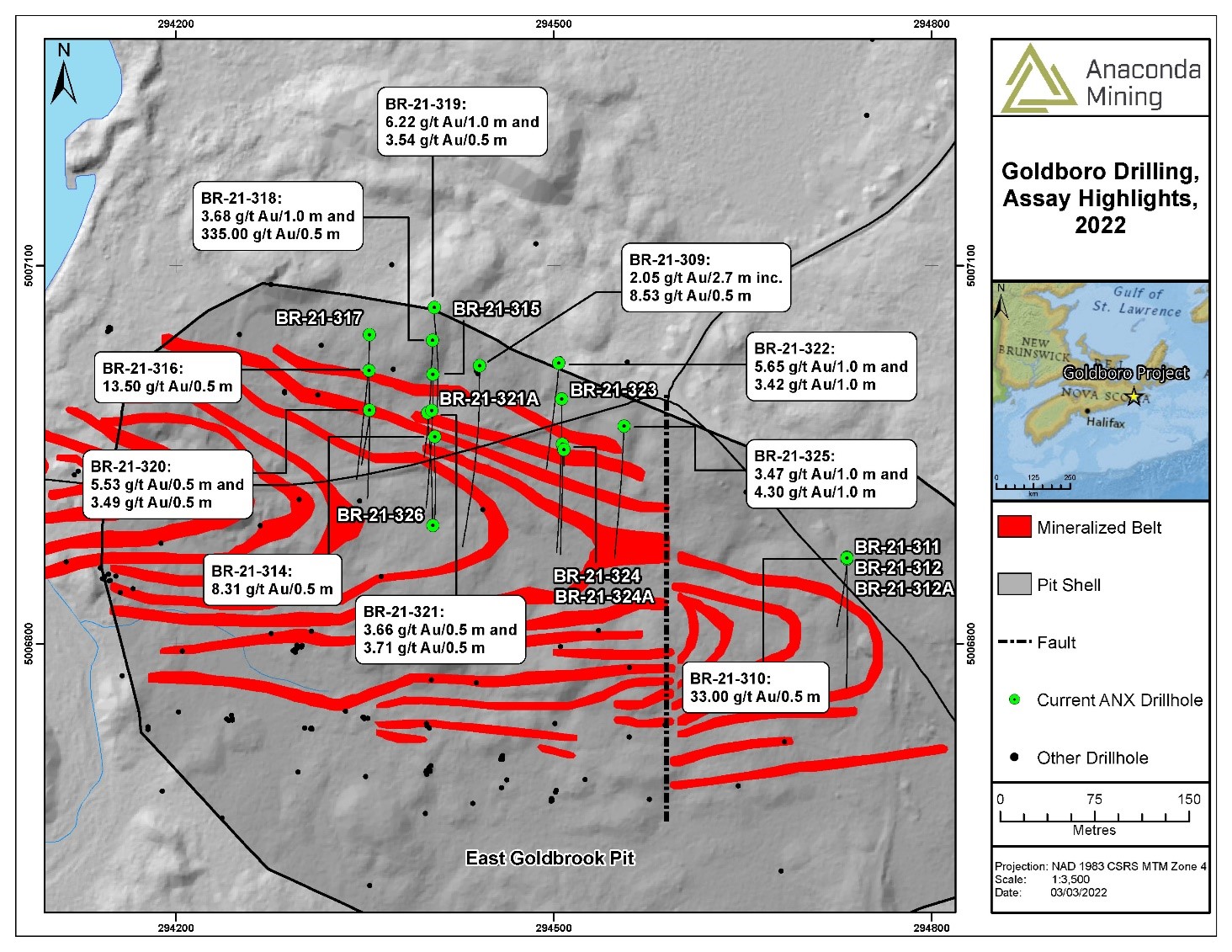

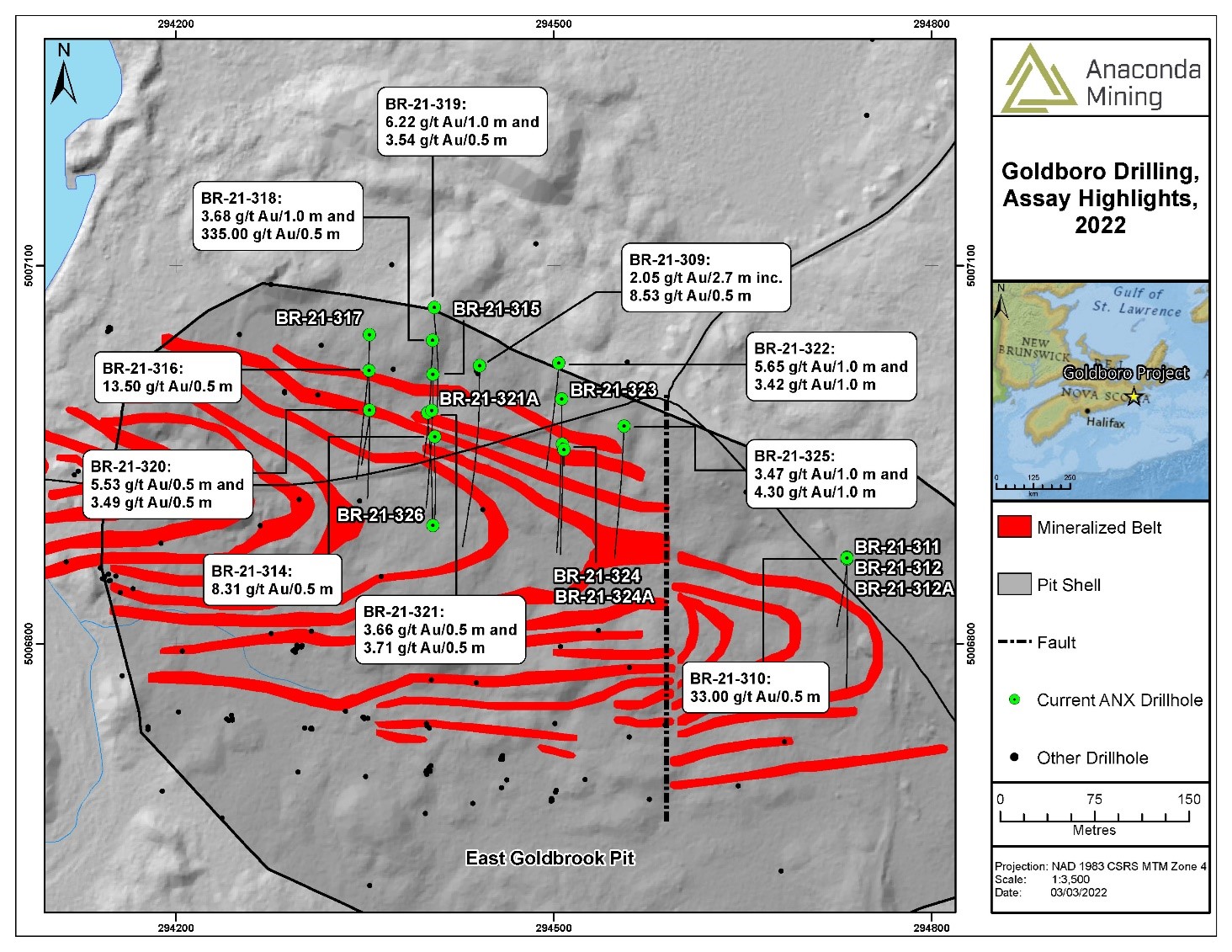

The Company has also received assays from a recent exploration drill program which included 3,681 metres of diamond drilling from 18 holes (BR-21-309 to BR-21-326), which was primarily aimed at expanding mineralization within the northern edge of the East Goldbrook Pit and upgrading existing Inferred Mineral Resources within this area (Exhibit B).

Selected composited highlights from the Exploration Program include:

335.0 g/t gold over 0.5 metres (121.4 to 121.9 metres) in diamond drill hole BR-21-318;33.0 g/t gold over 0.5 metres (181.8 to 182.3 metres) in diamond drill hole BR-21-310;13.5 g/t gold over 0.5 metres (32.1 to 32.6 metres) in diamond drill hole BR-21-316;6.22 g/t gold over 1.0 metres (15.0 to 16.0 metres) in diamond drill hole BR-21-319; and2.05 g/t gold over 2.7 metres (58.0 to 60.7 metres) in diamond drill hole BR-21-309.The results are important as they support the continuity of high-grade gold mineralization along the north limb of the Goldboro Anticline in an area that was previously sparsely drilled. Significant gold has been intersected in 15 of 18 drill holes that largely coincide with modelled mineralized belts, with nine (9) occurrences of visible gold.

"We have identified significant opportunities to optimize the Goldboro Gold Project and potentially increase the overall economics and longevity of the Project including the upgrading of Inferred Mineral Resources in the East Goldbrook Pit as well as exploring adjacent to, and along strike, of the existing resource. The Infill Drill Program has the potential to directly impact the Project's economics and key economic metrics, and further exploration drilling may demonstrate project longevity beyond the current Feasibility Study. Two key components of our growth strategy include upgrading and expanding Mineral Resources at Goldboro while advancing the Project through the submission of the Environmental Assessment Registration Document and moving towards detailed engineering."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc.

1 Please refer to the Phase I Open Pit Feasibility Study ("Feasibility Study") entitled "NI 43-101 Technical Report and Feasibility Study for the Goldboro Gold Project, Eastern Goldfields District, Nova Scotia" with an effective date of December 16, 2021 and available under the Company's profile on SEDAR at www.sedar.com and on the Company's website at www.anacondamining.com.

Table of selected composited assay results from the Goldboro Exploration Program

Hole ID

| From (m)

| To (m)

| Interval (m)

| Gold (g/t)

| Visible Gold

| | BR-21-309 | 58.0

| 60.7

| 2.7

| 2.05

| VG

| including

| 58.0

| 58.5

| 0.5

| 8.53

| VG

| and

| 232.0

| 233.0

| 1.0

| 0.85

| | | BR-21-310 | 54.9

| 55.4

| 0.5

| 1.73

| | and

| 60.9

| 61.5

| 0.6

| 0.63

| | and

| 181.8

| 182.3

| 0.5

| 33.00

| VG

| and

| 195.5

| 196.0

| 0.5

| 1.03

| | and

| 220.0

| 223.0

| 3.0

| 0.52

| | | BR-21-312 | 153.0

| 155.0

| 2.0

| 0.55

| | | BR-21-314 | 26.0

| 26.6

| 0.6

| 2.73

| | and

| 42.6

| 43.1

| 0.5

| 8.31

| VG

| | BR-21-315 | 57.0

| 58.0

| 1.0

| 1.05

| | | BR-21-316 | 32.1

| 32.6

| 0.5

| 13.50

| VG

| and

| 106.0

| 106.5

| 0.5

| 0.82

| VG

| and

| 180.6

| 182.0

| 1.4

| 1.07

| | | BR-21-317 | 208.3

| 209.0

| 0.7

| 2.34

| | | BR-21-318 | 108.0

| 109.0

| 1.0

| 3.68

| | and

| 121.4

| 121.9

| 0.5

| 335.00

| VG

| | BR-21-319 | 15.0

| 16.0

| 1.0

| 6.22

| | and

| 56.1

| 56.6

| 0.5

| 3.54

| | | BR-21-320 | 32.5

| 33.0

| 0.5

| 5.53

| VG

| and

| 119.8

| 120.3

| 0.5

| 2.47

| | and

| 127.2

| 127.7

| 0.5

| 3.49

| VG

| | BR-21-321 | 15.0

| 15.5

| 0.5

| 3.66

| | and

| 62.8

| 63.3

| 0.5

| 3.71

| VG

| and

| 145.0

| 145.8

| 0.8

| 2.89

| | | BR-21-322 | 27.9

| 28.9

| 1.0

| 5.65

| | and

| 33.3

| 34.1

| 0.8

| 2.64

| | and

| 145.0

| 146.0

| 1.0

| 3.42

| | | BR-21-323 | 195.0

| 196.0

| 1.0

| 2.55

| | | BR-21-324 | 120.5

| 121.0

| 0.5

| 1.78

| | and

| 152.0

| 153.0

| 1.0

| 1.16

| | | BR-21-325 | 133.7

| 134.7

| 1.0

| 3.47

| | and

| 142.7

| 143.7

| 1.0

| 4.30

| |

Intervals are reported as core length only. True widths are estimated to be between 70% and 100% of the core length.All drill hole results are reported using fire assay only. See notes on QAQC procedures at the bottom of this press release.BR-21-313 was drilled ~400 metres north of the East Goldbrook Pit to test a geophysical anomaly and did not encounter significant mineralization.All drill holes not reported in the table above did not encounter significant mineralization.Goldboro Gold Project - Mineral Resource Estimate

The Mineral Resource Estimate presented was prepared by Independent Qualified Person Glen Kuntz, P. Geo., of Nordmin Engineering Ltd. The Mineral Resource Estimate is based on validated results of 681 surface and underground drill holes for a total of 121,540 metres of diamond drilling completed between 1984 and the effective date of November 15, 2021, including 55,803 metres conducted by Anaconda.

Mineral Resource Estimate for the Goldboro Gold Project - Effective Date November 15, 2021

Resource Type

| Gold Cut-off (g/t gold)

| Category

| Tonnes

| Grade

(g/t gold)

| Gold Troy Ounces

| | Open Pit | 0.45

| Measured

| 7,680,000

| 2.76

| 681,000

| Indicated

| 7,988,000

| 2.89

| 741,000

| Measured + Indicated

| 15,668,000

| 2.82

| 1,422,000

| Inferred

| 975,000

| 2.11

| 66,000

| | Underground | 2.40

| Measured

| 1,576,000

| 7.45

| 377,000

| Indicated

| 4,350,000

| 5.59

| 782,000

| Measured + Indicated

| 5,925,000

| 6.09

| 1,159,000

| Inferred

| 2,206,000

| 5.89

| 418,000

| | Combined Open Pit and Underground* | 0.45

and

2.40

| Measured

| 9,255,000

| 3.56

| 1,058,000

| Indicated

| 12,338,000

| 3.84

| 1,523,000

| Measured + Indicated

| 21,593,000

| 3.72

| 2,581,000

| Inferred

| 3,181,000

| 4.73

| 484,000

|

* Combined Open Pit and Underground Mineral Resources; The Open Pit Mineral Resource is based on a 0.45 g/t gold cut-off grade, and the Underground Mineral Resource is based on 2.40 g/t gold cut-off grade.

Mineral Resource Estimate Notes

Mineral Resources were prepared in accordance with NI 43-101 and the CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (2019). Mineral Resources that are not mineral reserves do not have demonstrated economic viability. This estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.Mineral Resources are inclusive of Mineral Reserves.Open Pit Mineral Resources are reported at a cut-off grade of 0.45 g/t gold that is based on a gold price of C$2,000/oz (~US$1,600/oz) and a metallurgical recovery factor of 89% around cut-off as calculated from ((GRADE-(0.0262*LN(GRADE)+0.0712))/GRADE*100)-0.083.Underground Mineral Resource is reported at a cut-off grade of 2.60 g/t gold that is based on a gold price of C$2,000/oz (~US$1,600/oz) and a gold processing recovery factor of 97%.Assays were variably capped on a wireframe-by-wireframe basis.Specific gravity was applied using weighted averages to each individual wireframe.Effective date of the Mineral Resource Estimate is November 15, 2021.All figures are rounded to reflect the relative accuracy of the estimates and totals may not add correctly.Excludes unclassified mineralization located within mined out areas.Reported from within a mineralization envelope accounting for mineral continuity.The Company has critically considered logistical matters given the ongoing COVID-19 pandemic, to ensure that this Infill Drill Program and any other programs are executed in a way that ensures the absolute health and safety of our personnel, contractors, and the communities where we operate.

Qualified Person and Technical Report Notes

A Technical Report titled "NI 43-101 Technical Report and Feasibility Study for the Goldboro Gold Project, Eastern Goldfields District, Nova Scotia", prepared in accordance with NI 43-101 for the Goldboro Gold Project Feasibility Study can be found on SEDAR ( www.sedar.com) under the company's profile. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Resource and Mineral Reserve and Feasibility Study. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

The Qualified Person responsible for the preparation of the Goldboro Gold Project Mineral Resource Estimate contained in this press release is Glen Kuntz, P. Geo. (Ontario, Nova Scotia) of Nordmin Engineering Ltd. Mr. Kuntz, is considered to be "Independent" of Anaconda and a "Qualified Person" under NI 43-101.

All samples and the resultant composites referred to in this release are collected using QA/QC protocols including the regular insertion of standards and blanks within the sample batch for analysis and check assays of select samples. All samples quoted in this release were analyzed at Eastern Analytical Ltd. in Springdale, NL, for Au by fire assay (30 g) with an AA finish.

All assays in this press release are reported as fire assays only. For samples analyzing greater than 0.5 g/t Au via 30 g fire assay, these samples will be re-analyzed at Eastern Analytical Ltd. via total pulp metallics. For the total pulp metallics analysis, the entire sample is crushed to -10mesh and pulverized to 95% -150mesh. The total sample is then weighed and screened to 150mesh. The +150mesh fraction is fire assayed for Au, and a 30 g subsample of the -150mesh fraction analyzed via fire assay. A weighted average gold grade is calculated for the final reportable gold grade. Total pulp metallics assays for drillholes sited within this press release may be updated in a future news release.

The Drill Program is funded using existing flow through funds but has also benefited from a grant received from the Government of Nova Scotia through a Mineral Resources Development Fund, shared funding exploration grant MRDF-2021-SF-11.

Paul McNeill, P. Geo., VP Exploration of Anaconda, is a "Qualified Person" as such term is defined under NI 43-101 Standards for Disclosure for Mineral Projects and has reviewed and approved the scientific and technical information and data included in this press release.

A version of this press release will be available in French on Anaconda's website ( www.anacondamining.com) in two to three business days.

ABOUT ANACONDA

Anaconda Mining is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in the top-tier Canadian mining jurisdictions of Newfoundland and Nova Scotia. The Company is advancing the Goldboro Gold Project in Nova Scotia, a significant growth project subject to a positive Feasibility Study with Mineral Reserves of 1.15 million ounces of gold (15.80 million tonnes at 2.26 g/t gold), Measured and Indicated Mineral Resources inclusive of Mineral Reserves of 2.58 million ounces (21.6 million tonnes at 3.72 g/t gold) and additional Inferred Mineral Resources of 0.48 million ounces (3.18 million tonnes at 4.73 g/t gold) (Please see the ‘NI43-101 Technical Report and Feasibility Study for the Goldboro Gold Project, Eastern Goldfields District, Nova Scotia' dated January 11, 2022 for further details). Anaconda also operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~15,000 hectares of highly prospective mineral property, including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable Canadian and United States securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved". Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda's annual information form for the year ended December 31, 2020, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

FOR ADDITIONAL INFORMATION CONTACT:

Exhibit A. A map showing the location of drill holes from the Infill Drill Program within and adjacent to the East Goldbrook Pit and resource model. One drill hole (BR-21-313) was drilled 400 metres north of the other drill holes as an exploration hole to test a geophysical anomaly but did not intersect significant mineralization. Exhibit A. A map showing the location of drill holes from the Infill Drill Program within and adjacent to the East Goldbrook Pit and resource model. One drill hole (BR-21-313) was drilled 400 metres north of the other drill holes as an exploration hole to test a geophysical anomaly but did not intersect significant mineralization.

Exhibit B. A map showing the location of drill holes from the Exploration Program within and adjacent to the East Goldbrook Pit and resource model. Exhibit B. A map showing the location of drill holes from the Exploration Program within and adjacent to the East Goldbrook Pit and resource model.

SOURCE: Anaconda Mining Inc. |

Exhibit A. A map showing the location of drill holes from the Infill Drill Program within and adjacent to the East Goldbrook Pit and resource model. One drill hole (BR-21-313) was drilled 400 metres north of the other drill holes as an exploration hole to test a geophysical anomaly but did not intersect significant mineralization.

Exhibit A. A map showing the location of drill holes from the Infill Drill Program within and adjacent to the East Goldbrook Pit and resource model. One drill hole (BR-21-313) was drilled 400 metres north of the other drill holes as an exploration hole to test a geophysical anomaly but did not intersect significant mineralization. Exhibit B. A map showing the location of drill holes from the Exploration Program within and adjacent to the East Goldbrook Pit and resource model.

Exhibit B. A map showing the location of drill holes from the Exploration Program within and adjacent to the East Goldbrook Pit and resource model.