What's next for agriculture ETFs as Ukraine conflict threatens the global food system?

Apr. 14, 2022 11:56 AM ET iShares, Inc. - iShares MSCI Global Agriculture Producers ETF (VEGI), MOO, KROP, SPY FTAG, W_1:COM, IVV, VOO By: Jason Capul, SA News Editor 1 Comment

Avalon_Studio/E+ via Getty Images Avalon_Studio/E+ via Getty Images

The global food system has been heavily disrupted since Russia invaded Ukraine on Feb. 24, sparking a wave of interest in agricultural exchange traded funds. The sector has seen substantial gains over the past couple months, but what does the future hold as the Ukraine conflict drags on?

The impact of Russia's invasion of Ukraine

As supply chains remained strained and geopolitical issues grow louder, investors have looked to funds like iShares MSCI Global Agriculture Producers ETF (NYSEARCA: VEGI), VanEck Vectors Agribusiness ETF (NYSEARCA: MOO), First Trust Indxx Global Agriculture ETF ( FTAG), and the Global X AgTech & Food Innovation ETF (NASDAQ: KROP).

Epitomizing the reaction among agricultural commodities since the Russian invasion, wheat ( W_1:COM) prices have skyrocketed 25.7%. Moves like these have fueled gains in related ETFs. For instance, since the invasion of Ukraine, VEGI and MOO have exploded by 22.2% and 19.5%. Over the same time, FTAG and KROP have jumped 16.4%, and 15.5%, respectively.

To put these performances into context, the world’s three largest benchmark ETFs, ones that mirror the returns of the S&P 500, have shown more modest gains over the same period of time. SPDR S&P 500 Trust ETF (NYSEARCA: SPY), iShares Core S&P 500 ETF ( IVV), and the Vanguard S&P 500 ETF ( VOO), are +7.3% since Feb. 24, providing investors with half the gains the agriculture space has brought in.

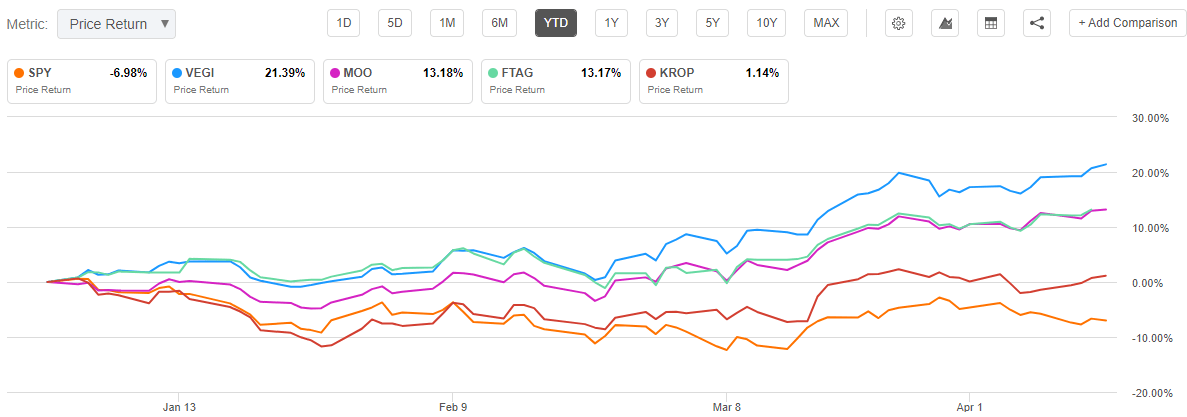

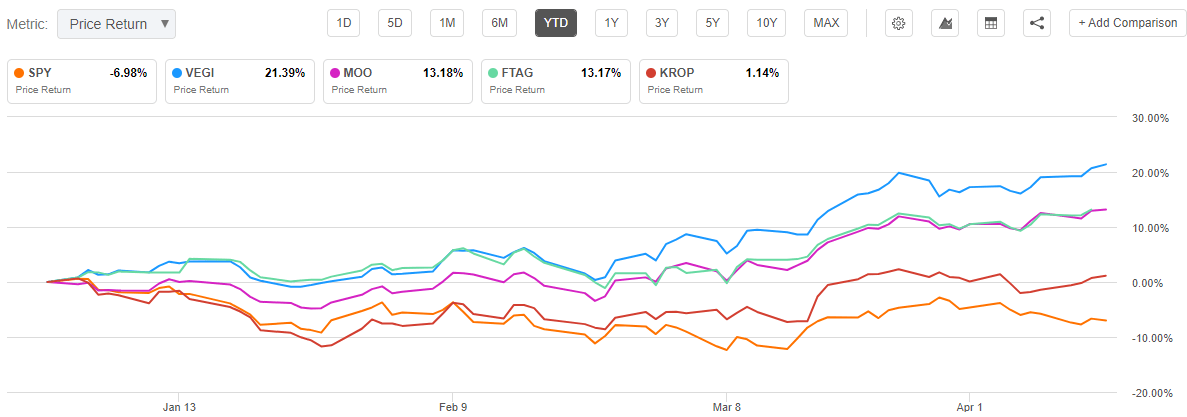

Widening the lens over the entire 2022 landscape, the YTD gains remain strong. VEGI is +21%, MOO +13.2%, FTAG +12.3%, and KROP is +0.5%. Whereas SPY, VOO, and IVV have lost 7.4% YTD. See the chart below:

Agriculture funds have had a great start but what does the future hold?

There are four driving factors that may signal how agricultural funds will perform on an ongoing basis: inflation, demand, supply chain issues and war.

The latest CPI report marked an 8.5% year over year inflation mark, the highest level in 40 years, but food was hit even harder. The un-adjusted 12-month figure for food was 8.8%. Pair that figure with the high energy costs required to operate the agriculture business and a recipe for higher prices can be seen.

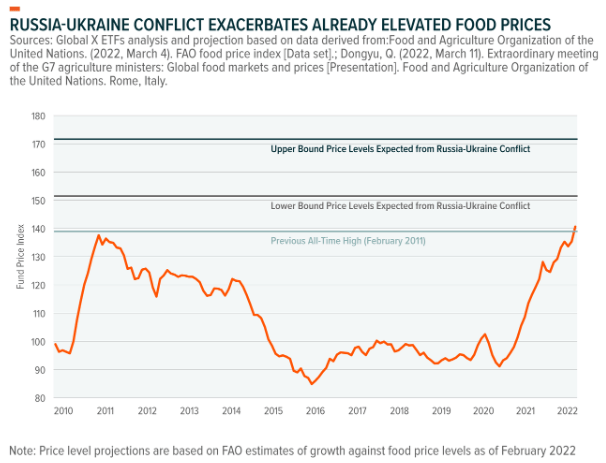

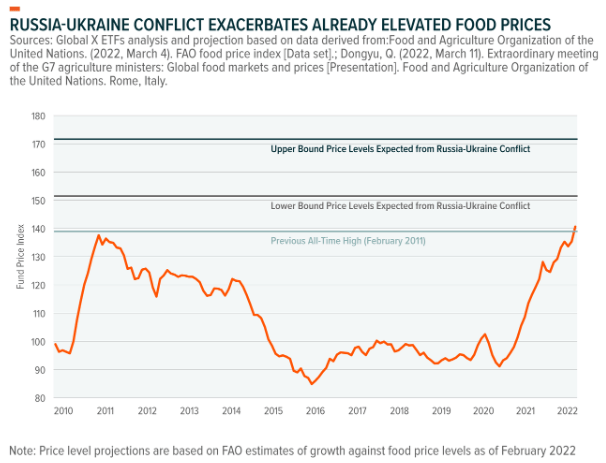

At the same time, demand continues to grow. With prices rising, the food system could have problems reaching everyone. As Global X reported: “According to the Food and Agriculture Organization 'FAO', international food prices reached an all-time high in February 2022, and the number of people facing food insecurity globally increased by an estimated 32% in 2021.”

The global supply chain issues still remain in focus as well. Transportation and logistics operations around the world are still not operating in full swing, which adds pressure to the food industry.

The war between Russia and Ukraine also has major implications on the agriculture world, as Russia and Ukraine together represent nearly a third of the world's grain exports. And a near-term end to the conflict seems remote, as the war appears to be ratcheting up. As a signal of the likelihood of ongoing fighting, Vladimir Putin vowed to push forward with Russia’s war efforts until its goals are met.

Global X also stated in a recent note: “All together the Russia-Ukraine conflict could cause food prices to rise 8%–22%, leading to food insecurity for tens of millions more people.”

For further detail on these four exchange traded funds and how they fared against each other, see Seeking Alpha's quantitative and fundamental metrics. |

Avalon_Studio/E+ via Getty Images

Avalon_Studio/E+ via Getty Images