Everything We Like And Dislike About Amazon's Q1 2022 Earnings

Apr. 29, 2022 5:19 PM ET Amazon.com, Inc. (AMZN) DASH, MSFT, SHOP, UBER 33 Comments14 Likes

SummaryAmazon's market value plunged by more than 10% overnight after releasing weaker-than-expected first quarter results and a soft guidance for the current quarter.Investors were largely taken back by the company's report of its first consolidated net loss in years.The disappointing results highlight the "triple whammy" from an excess capacity build, inflationary environment, and normalizing consumer demand to pre-pandemic levels.While Amazon's e-commerce and cloud-computing moat remains intact even in the face of current challenges, investors will be searching for proof of a consistent ability in improving profits over coming quarters.

hapabapa/iStock Editorial via Getty Images hapabapa/iStock Editorial via Getty Images

Amazon's (NASDAQ: AMZN) first quarter results and second quarter guidance have brought forth a soured near-term outlook for the stock as the company grapples with a "triple whammy" from excess capacity build from COVID-era investments, rising inflationary pressures, and normalizing consumer demand patterns that make prior-year results a tough compare. While core commerce sales in the first quarter remained in line with consensus expectations and management's previous guidance with strong Prime uptake despite a price hike, investors were largely taken back by the consolidated business' return to net losses, especially in North America. The rare sighting of net losses that many thought Amazon was beyond continues to highlight the pressures of an inflationary environment that have rippled across all industry, even for the biggest and strongest.

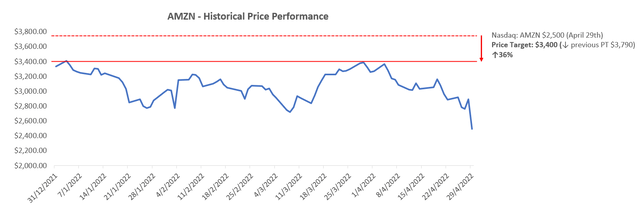

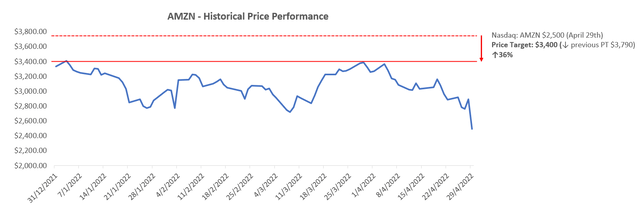

Amazon's shares fell more than 10% in pre-market trading Friday after closing at $2,891.93 the previous day. It has been a whirlwind of a year for Amazon, with its stock consistently fluctuating in the range of $2,700 to $2,400. Counting its latest decline, the stock has lost more than 13% of its value this year, underperforming the S&P 500 (-10.6% YTD).

But in light of Amazon's unmatched market leadership in both its core e-commerce and cloud businesses, the near-term headwinds all seem temporary. AWS continues to exhibit robust double-digit growth, underscoring its continued strength in capitalizing on cloud demands led by digital transformation trends ahead. Amazon's emerging advertising business is also accumulating gradual market share gains as it continues to rely on its massive data trove generated from first-party ("1P") sales to drive better ad targeting and conversion rates for third-party ("3P") sellers. And despite stabilizing online spending trends, Amazon's continued leadership in providing end-to-end e-commerce solutions from fulfilment to post-sales customer service continues to underpin strong market share growth ahead of continued adoption of omnichannel storefronts in coming years. Although we have lowered our fundamental estimates and price target for Amazon to reflect the company's efforts in managing near-term headwinds, the overall bullish narrative surrounding the stock remains.

Recap of 1Q22 Performance

Consolidated first quarter sales were largely in line with consensus estimates and management's previously provided guidance. Amazon generated total sales of $116.4 billion (+7% y/y; -15% q/q) in the first quarter, compared with the average consensus estimate of $116.0 billion (+7% y/y; -16% q/q) and within management's guided range of $112 billion to $117 billion.

However, the company saw significant incremental cost headwinds due to compounding external and internal costs. On the external front, Amazon faced rising inflationary pressures during the first quarter. The latest COVID outbreak across China and subsequent lockdowns at its key shipping ports have weighed on already-fragile logistic links, causing air and ocean transportation rates to double from pre-pandemic levels. Russia's invasion of Ukraine has also complicated the outlook on oil supplies, causing the cost of fuel to rise by 1.5x for Amazon during the first quarter compared to the same period last year. Paired with the uptick in wages due to inflation adjustments, the external cost headwinds dented first quarter margins by $2 billion. Internal cost impacts related to productivity and other fixed costs were even more prominent. Lowered productivity due to overstaffing and excess capacity built from the booming COVID era added another $4 billion in incremental damage to margins, bringing the total bill to $6 billion in the first quarter.

As a result, operating income dropped 59% from the prior year (+6%, q/q) to $3.7 billion in the first quarter, falling short of consensus expectations of $5.3 billion (-40% y/y; +53% q/q). As the harsh reality of an evolving inflationary environment and normalizing consumer demand continues to weigh on Amazon's top and bottom line, management is expecting incremental cost pressures of $4 billion in the second quarter. Specifically, 2Q22 will see a "seasonal step-up" in stock-based compensation expenses as employees receive inflation-adjusted annual restricted stock unit ("RSU") grants. Related expenses are expected to total $6 billion, up from $3.3 billion incurred in 1Q22 to ensure adequate talent retention and acquisition in "high-demand areas, including engineers and other tech workers". Improving productivity and fixed cost leverage will provide some offset. As a result, 2Q22 operating income was guided at -$1 billion (-113% y/y; -127% q/q) to $3 billion (-61% y/y; -18% q/q).

As mentioned in earlier sections, Amazon's first quarter ended in a consolidated net loss for the first time in years. Earnings per share came in at -$7.55, missing Wall Street consensus of $8.35 by a far cry. The results included a $7.6 billion negative impact related to non-operating, mark-to-market losses on its Rivian investment. Despite record-setting AWS margins of 35% in the first quarter, which sets a strong tone for the rest of the year, rising first quarter cost pressures experienced in North America e-commerce product and service sales are expected to spill into the second quarter, driving another potential loss.

Everything We Like and Dislike About Amazon's 1Q22 Results

1. Soft 2Q22 Guidance

What we did not like: Amazon guided revenues of $116 billion (+3% y/y; -0.4% q/q) to $121 billion (+7% y/y; +4% q/q) for the current quarter, which misses the consensus estimate of $125 billion (+11% y/y; +7% q/q). The softer-than-expected 2Q22 guidance indicates risks of a structural slowdown in e-commerce growth as the moderating pandemic backdrop brings consumers back to brick-and-mortar stores. There is also softening in 3P data, indicating third-party sellers' struggles with handing off increased costs to consumers in the inflationary environment.

What we like:Nonetheless, Amazon's 1P business remains strong. Soft 2Q22 growth will likely be the "trough for the year", as Amazon navigates through a tough PY compare (2Q21 outperformed on pandemic-driven demand and Prime Day) and near-term inflationary pressures. The second half will likely see stronger results, with Prime Day in the third quarter and a historically strong showing in the subsequent holiday quarter keeping the company's overall bullish thesis intact.

The company has also managed to remain competitively priced compared to "reputable competitors" thanks to its massive audience, which backs robust pricing power against suppliers over the longer term. Prime uptake also remains strong, with millions of new members added to the program during the first quarter. Management observed a meaningful increase to Prime member spending since the onset of the pandemic, with "consistently high member renewal rates" still despite the recent price increases. Amazon Prime is clearly a key growth driver for Amazon.com, as members become more reliant on the program for both their shopping and entertainment needs - American consumers alone are expected to " spend $445 billion on the site this year". Increased Prime benefits in recent years, which includes a fast-expanding content catalogue on Prime Video, as well as improved delivery speed have been key for making the program an accretive part of the consolidated business.

The pandemic has significantly overhauled consumer expectations for e-commerce, with American consumers being "especially elastic to shipping times". And Amazon has continued to deliver on this aspect, with continued ramp of One-day and Same-Day Prime Delivery in both the U.S. and other regions through Amazon Logistics being a key driver of additional e-commerce share gains over the longer term. Prime Same-Day Delivery has now reached 12 cities across the U.S., with "1 to 2 hour grocery [delivery times]" being a key feature in competing against rivals Uber ( UBER), DoorDash ( DASH) and Instacart.

Amazon's unmatched fulfilment capabilities enabled by Amazon Logistics also reinforce demand from 3P sellers for " Fulfilment by Amazon" ("FBA") and pave the way for ramping " Buy with Prime". FBA currently facilitates more than half of 3P sales on Amazon.com. And with a growing calls from consumers for fast shipping, 3P seller demand for FBA will likely increase going forward in order to remain competitive within the fast-expanding e-commerce landscape.

Continued expansion of Amazon Logistics and improvements to shipping and handling efficiencies will also complement the company's newest Buy with Prime feature. Announced just a week ago, Buy with Prime will "let merchants sell products they list [on Amazon.com] directly from their websites", while Amazon will take care of payments and fulfilment as part of FBA. Prime members will then be able to check-out from an Amazon-affiliated 3P seller's website using their Prime membership and "receive fast-shipping and other [Prime] benefits". For now, the feature is in the beta phase and offered to merchants on an "invite-only" basis. But as roll-out and ramp continue to work hand-in-hand with Amazon's fulfilment prowess, Buy with Prime will help Amazon better compete against e-commerce infrastructure and turnkey solution providers like Shopify (NYSE: SHOP), and further expand its e-commerce market share.

2. Excess Capacity

What we did not like: The combination of "$2 billion of headwinds owing to having excess capacity built out, [and] $2 billion of ongoing operational inefficiencies and excess labour post-omicron" looks almost like a pandemic era boom and bust for Amazon. Normalization of consumer demand trends toward pre-pandemic levels will continue to weigh on overall productivity levels and impact operational efficiencies until Amazon works toward finding a balance. Although management had "resisted the idea that consumers are pulling back from online shopping", it seems Amazon's aggressive build-out of its logistics capacity in recent years has now backfired by "hampering [its] productivity".

What we like: But we agree with management's observations that consumer demand for online shopping remains strong. As discussed in earlier sections, Prime uptake rate continues to grow despite price increases, while transaction volumes facilitated through Amazon.com are expected to keep growing this year despite a looming economic downturn. The excess capacity will also better prepare Amazon for its upcoming Prime Day sales coming July. The event has always been a hit for the e-commerce giant - last year, Prime Day hit a new gross merchandise volume record at almost $10 billion and contributed an additional 400bps to 2Q21 year-on-year growth. The "temporary over-capacity" will also serve the subsequent holiday season well, and avoid inefficiencies like half full trucks and other "negative consequences of not having [sufficient labour]" experienced last year.

With "trillions of offline retail dollars moving online over the longer-term", Amazon's "post-investment cycle profitability" prospects remain strong and are further bolstered by its unbeatable fulfilment capabilities discussed in earlier sections. Continued ramp-up of new programs like Buy with Prime will also help to absorb the excess capacity over the longer term and drive greater productivity and operational efficiencies and returns on logistics investments.

3. Inflationary Environment

What we did not like: Although inflationary headwinds were largely expected, it was Amazon's net loss in the first quarter (and potentially the current quarter) that caught investors by surprise. Although Amazon's logistics network allows it to take care of much of the domestic transportation and fulfilment of goods in-house, the burn from surging long-haul shipping costs was largely inevitable. The Russia-Ukraine war has also weighed on global fuel costs. As the oil market "continues to be torn between a bullish supply outlook and a bearish demand picture", the "supply risks around Russian oil are longer term in nature compared to the [recent] COVID-related demand hit in China", underscoring continued headaches at the pump for at least the next couple of months. This means the inflation print will likely remain elevated in the near term, forcing Amazon to fork out more spending toward employee compensation. The anticipated trend largely aligns with management's guidance for a continuation of related cost impacts in 2Q22.

What we liked: Newly helmed CEO Andy Jassy reassured investors in the 1Q22 Earnings Press Release that its "teams [remain] squarely focused on improving productivity and cost efficiencies throughout [Amazon's] fulfillment network", and that "[they] know how to do this and have done it before". And he is not entirely wrong on this.

Amazon's decision to increase Prime prices earlier this year has been a positive strategy that has continued to pay off. Not only was it a more-than-welcomed surprise by investors (as observed per the stock's +12% rally immediately following the announcement), robust renewal rates and new membership adds observed in the first quarter also provided tangible evidence proving Amazon.com's pricing power.

And as Amazon continues to build out its Prime benefits (e.g. delivery time improvements, Prime Video content catalogue, Amazon Music, etc.), we see it becoming a sustainably accretive service even in the toughest economy. Its continued build-out of focused features for apparel shopping in North America, which includes " The Drop" and " Style Feed" is expected to buoy greater demand from discretionary spending, in addition to dollars from everyday household necessities. And the recent acquisition of MGM and integration of its massive catalogue will also complement Amazon's fast-expanding entertainment business, making it better positioned within the increasingly competitive industry and ensuring adequate growth while reducing churn.

4. Other Developments - Continued Strength in AWS and Digital Ads

There is nothing really to complain about here.

As the most profitable arm of the business, AWS margins expanded to 35%. Being already the leading public cloud service provider in the world, with second runner-up Microsoft Azure ( MSFT) still far in the distance, AWS' continued build-out of its service portfolio and availability is expected to bolster its share gains going forward.

And the efforts are already showing results, as the segment continues to show "significant customer momentum". New customers acquired in the first quarter continued to expand across all industries from telecommunications to aerospace. AWS' continued success is further corroborated by its massive backlog of $89 billion, up 68% from the prior year. And with a weighted average fulfilment term of 3.8 years on backlog contracts, the segment also benefits from greater visibility into longer-term performance.

Longer-term cloud-computing trends are also favourable for AWS, which spells for more positivity for Amazon's overall valuation prospects ahead. With only 11% of the corporate landscape feeling confident that their legacy business models will be "economically viable through 2023" and another 64% raising the need to step up on digitization plans, corporate spending on digital transformation is fast approaching an inflection point. These statistics continue to support a robust demand environment for public cloud service providers like AWS, even under a potentially tightening economic environment in the near term. More than half of the corporate scene have expressed that they would rather "tighten the belt" in other parts of the business than to miss out on digital transformation, which is considered a strategic investment in differentiating themselves from competitors, while also enabling cost efficiencies.

Amazon has also continued to show steady progress in penetrating the digital advertising market. Related revenues grew 23% y/y to almost $8 billion. Amazon's advertising market share has consistently grown from under 4% in 2019 to almost 7% this year. And as FBA continues to attract greater 3P demand, the company is expected to better build-out and monetize its trove of consumer data. Over the next two years, Amazon is expected to further expand its market share in digital advertising at an average annual rate of one percentage point, and command close to 10% of related opportunities by the end of 2023.

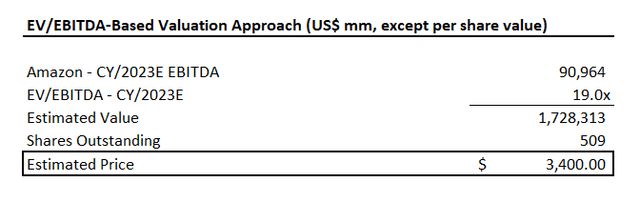

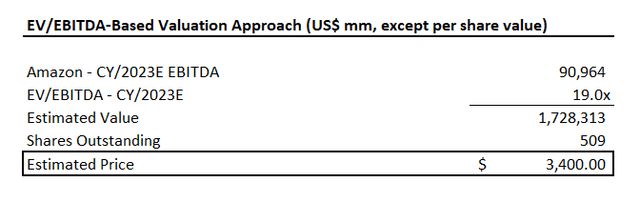

Fundamental and Valuation Analysis UpdateDespite having to lower some growth estimates, and accordingly, our price target to reflect the latest headwinds facing Amazon and the broader markets, our outlook on the stock remains positive. Our revised price target for Amazon is now at $3,400, which represents upside potential of 36% based on the stock's last traded share price of about $2,500 on April 29th.

Amazon Valuation Analysis (Author) Amazon Valuation Analysis (Author)

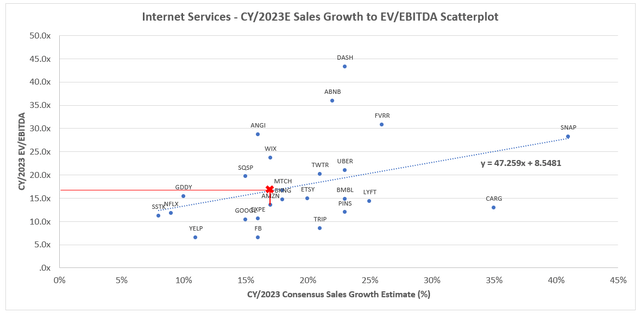

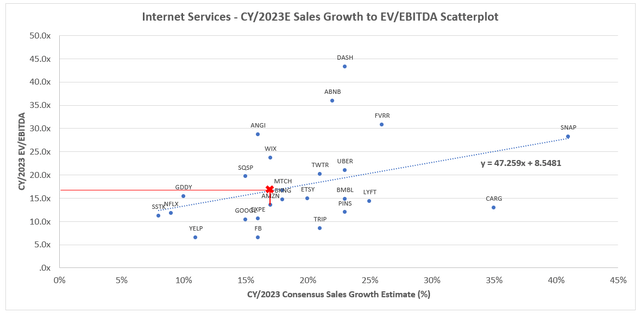

Amazon is currently trading at about 14x forward EV/EBITDA, which is a meaningful discount to its internet peers considering its growth prospects. Based on current peer comps, the stock should really trade closer to about 17x forward EV/EBITDA:

Amazon Peer Comp (Author) Amazon Peer Comp (Author)

But considering Amazon's market leadership and unmatched "scale and advantage" in both e-commerce and cloud-computing solutions, we believe the stock has potential to trade at a further premium, with our price target set at $3,400 based on a 19x CY/2023 EV/EBITDA assumption.

Amazon Valuation Analysis (Author) Amazon Valuation Analysis (Author)

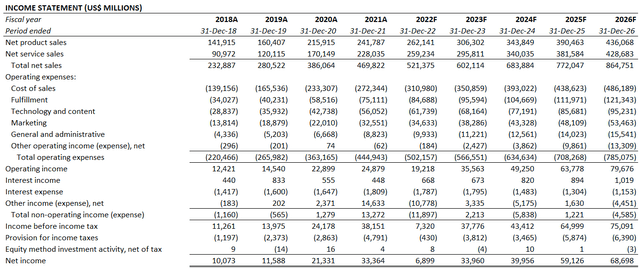

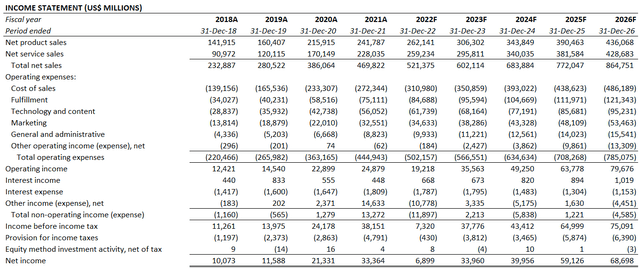

Amazon Financial Forecast (Author) Amazon Financial Forecast (Author)

Amazon - Forecasted_Financial_Information.pdf

Overall Thoughts on Amazon

All in all, we believe the upsides still outweigh the downsides by wide margins for Amazon. The stock's bullish thesis backed by Amazon's e-commerce and cloud-computing moat remains intact despite the near-term headwinds stacked against its odds.

However, as investors remain skittish on high-valuation growth stocks ahead of a potential economic slowdown, the stock could see further volatility alongside broad declines across the equity market in the near term. It could take until the second half of the year when Amazon can leverage added strength from Prime Day and the holiday season to prove it can still improve profits while maintaining market-leading growth.

seekingalpha.com |

hapabapa/iStock Editorial via Getty Images

hapabapa/iStock Editorial via Getty Images