Unsure how this below initiative would work, and work out, but gold weaponised, therefore made more useful

let's watch & brief

bloomberg.com

G-7 Set to Ban New Russian Gold Imports in Pledge Backed by US

Announcement planned at summit in Germany: person familiar US, European markets already mostly closed under sanctions

Jordan Fabian

26 June 2022, 03:19 GMT+8

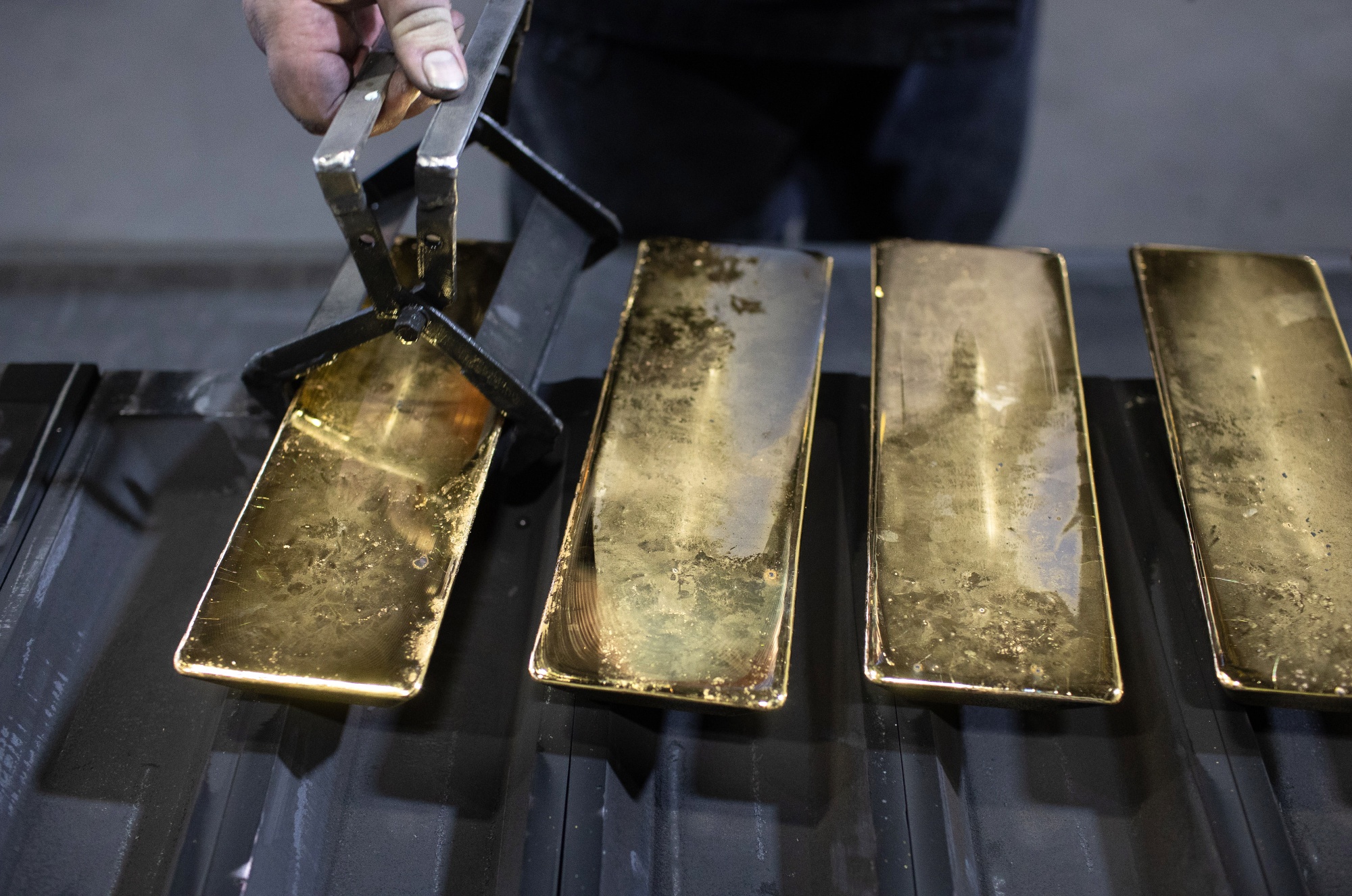

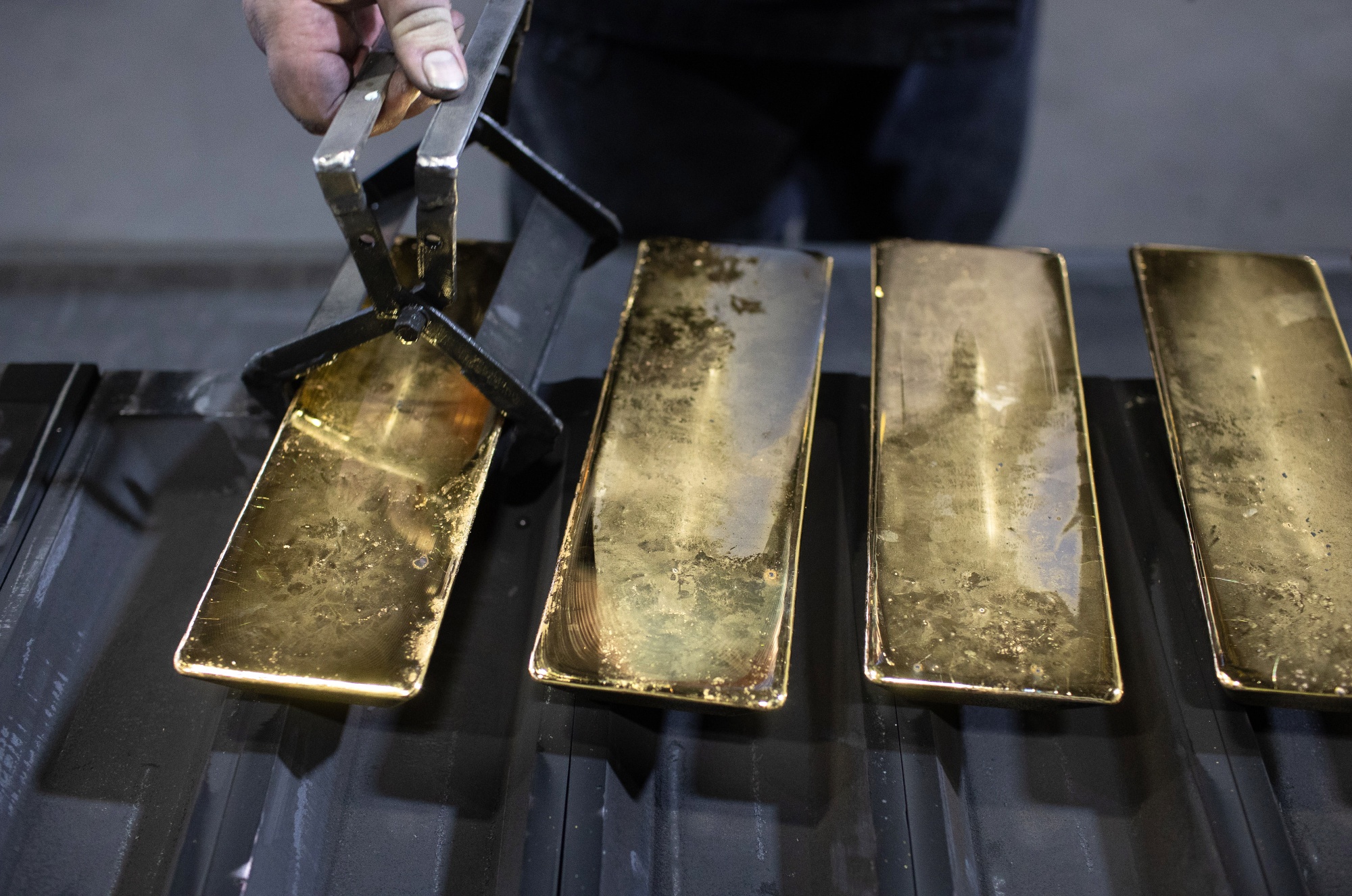

A worker removes gold ingots from molds at a metals plant in Kasimov, Russia.

Photographer: Andrey Rudakov/Bloomberg

US President Joe Biden and fellow Group of Seven leaders will agree to announce a ban on new gold imports from Russia, a person familiar with the plan said, the latest sanction in response to the Russian invasion of Ukraine.

The leaders will reveal the joint pledge at a summit in Germany that begins on Sunday, the person said, speaking on condition of anonymity ahead of a public announcement. The ban will apply to gold leaving Russia for G-7 countries for the first time. The US Treasury Department will issue a ban on Tuesday, prohibiting US imports, the person said.

While Western sanctions to punish Russia have largely closed European and US markets to gold from the world’s second-biggest bullion miner, the G-7 pledge would mark a total severance between Russia and the world’s top two trading centers, London and New York.

“What this does is formalize what the gold industry has already done anyway,” said Adrian Ash, head of research at brokerage BullionVault.

The London Bullion Market Association, which sets standards for that market, removed Russian gold refineries from its accredited list. Shipments between Russia and London have collapsed to almost zero since the invasion of Ukraine.

Read more: Swiss Gold Refiners Say They Didn’t Import Mystery Russian Metal

London has been one of the most important destinations for Russian precious metals: the $15 billion in Russian gold that arrived there last year made up 28% of UK gold imports, according to UN Comtrade data.

An executive order signed by Biden on April 15 explicitly prohibits U.S. persons from engaging in gold-related transactions involving Russia’s central bank, the country’s National Wealth Fund or its finance ministry.

While refineries in theory could still import Russian gold directly, most of have sworn off doing so. The association for Swiss refiners, which dominate the industry, denied that its members bought gold from Russia after trade data indicated the nation’s bullion had entered the country.

Read more: Russia Seeks New Ways to Sell Its $20-Billion-a-Year Gold Output

Flows of other metals from Russia such as copper, nickel and palladium have continued as the commodities industry grapples with managing a long-held relationship with a major supplier of the world’s raw materials.

Meanwhile, Russia’s gold industry is looking for new sales options, such as exporting more to China and the Middle East, which aren’t part of the G-7.

— With assistance by Eddie Spence

(Updates with gold analyst’s comment in fourth paragraph.) |