(57) bloomberg.com

Dollar Surge Shows Caution Reigns Before Asia Open: Markets Wrap

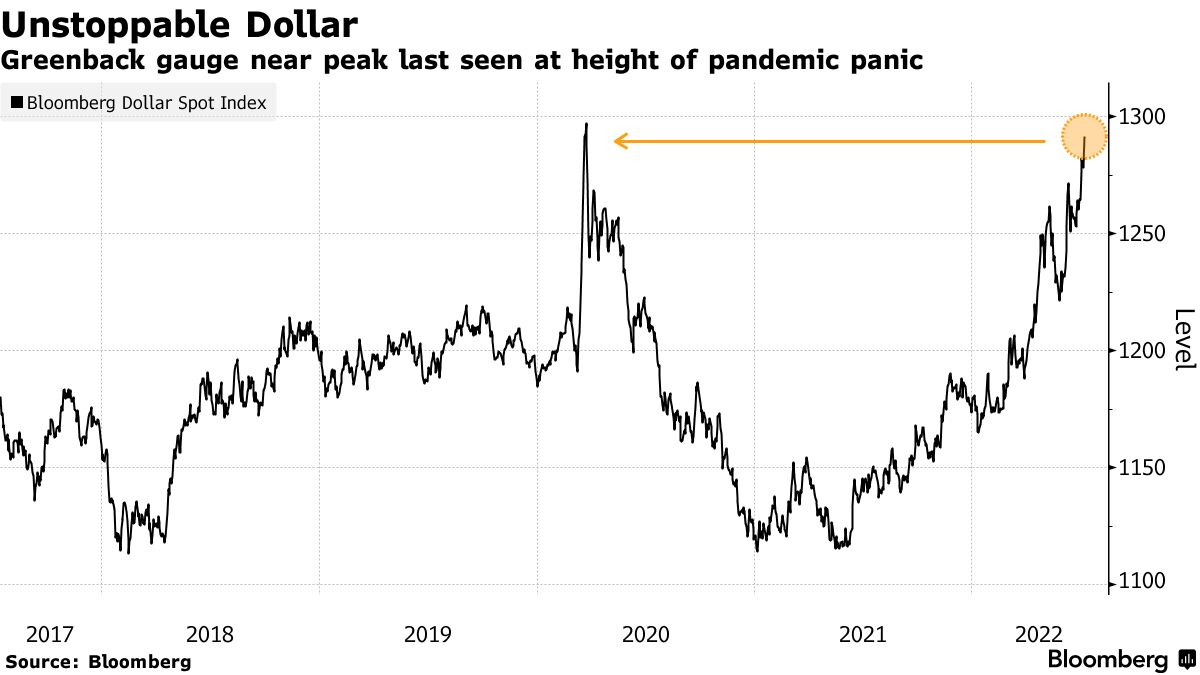

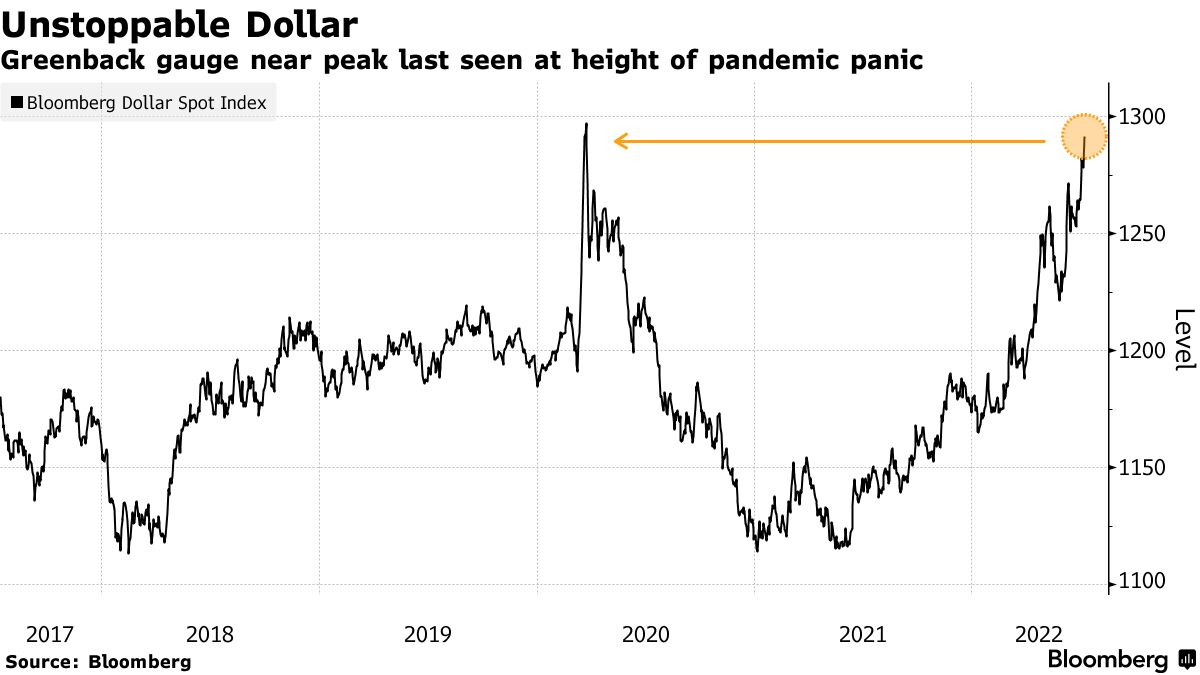

Greenback close to level last seen during 2020 pandemic panic Asia futures mostly lower after drop in US shares, China gauge

Sunil Jagtiani

12 July 2022, 06:13 GMT+8

Stocks in Asia look set for a choppy start Tuesday amid trepidation that the upcoming earnings season, a looming US inflation print and China’s struggle with Covid will all stoke worries about economic prospects.

Futures fell for Japan and edged up for Australia, while Hong Kong’s were in the red following the worst drop in US-traded Chinese shares since May. US contracts fluctuated after technology shares led a Wall Street slide, including a plunge in Twitter Inc. as Elon Musk walked away from his deal to buy the firm.

The dollar’s biggest jump in a month toward levels last seen at the height of the market panic over Covid underlined the caution in global markets. The euro-area’s common currency is closing in on parity with the greenback due to the intensifying gas crisis and acute recession fears in the region.

Treasuries rallied on Monday, extending this year’s volatility in the bond market and taking the US 10-year yield below 3%. Commodities including oil are under pressure. Bitcoin dropped back toward the $20,000 level.

Much is riding on company profit filings and the US inflation data. A brief equity rebound from this year’s selloff is already fizzling ahead of the reports. Risk appetite may struggle to digest evidence of earnings challenges alongside stubborn price pressures that point to sustained monetary tightening.

“Anecdotal evidence so far has indicated that there will be a slowdown in earnings that we’ll probably see translate into weakening guidance,” Tracie McMillion, head of global asset allocation strategy at Wells Fargo Investment Institute, said on Bloomberg Television. “We do see the need for analyst expectations to come down.”

In China, investors are concerned more Covid lockdowns may lie ahead as Beijing continues with a strategy of mass testing and mobility curbs. A government push for stimulus to shore up growth is starting to have an impact: credit jumped last month to the highest on record for June.

Meanwhile, the latest Fed commentary highlighted both the central bank’s hawkishness and the risks that come with aggressive interest-rate hikes.

Fed Bank of Atlanta President Raphael Bostic said the US economy can copewith higher interest rates and repeated his support for another jumbo move this month. Fed Bank of Kansas City President Esther George, who dissented last month against the central bank’s 75 basis-point rate increase, cautioned that rushing to tighten policy could backfire.

What to watch this week:

- Earnings due from JPMorgan, Morgan Stanley, Citigroup, Wells Fargo

- BOE Governor Andrew Bailey discusses the economic landscape, Tuesday

- Amazon.com Inc. kicks off its Prime Day event, Tuesday

- South Korea, New Zealand rate decisions, Wednesday

- US CPI data, Wednesday

- Federal Reserve Beige Book, Wednesday

- US PPI, jobless claims, Thursday

- China GDP, Friday

- US business inventories, industrial production, University of Michigan consumer sentiment, Empire manufacturing, retail sales, Friday

- G-20 finance ministers, central bankers meet in Bali, from Friday

- Atlanta Fed President Raphael Bostic speaks, FridayWATCH: Winnie Cisar at CreditSights discusses how the strength in the US dollar impacts credit markets.

Source: Bloomberg

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 7:02 a.m. in Tokyo. The S&P 500 fell 1.2%

- Nasdaq 100 futures climbed 0.1%. The Nasdaq 100 fell 2.2%

- Nikkei 225 futures fell 0.4%

- S&P/ASX 200 futures rose 0.3%

- Hang Seng futures fell 0.6%

Currencies

- The Bloomberg Dollar Spot Index rose 1%

- The euro was at $1.0038

- The Japanese yen was at 137.43 per dollar

- The offshore yuan was at 6.7248 per dollar

Bonds

- The yield on 10-year Treasuries declined nine basis points to 2.99%

Commodities

- West Texas Intermediate crude fell 0.7% to $103.32 a barrel

- Gold was at $1,734.00 an ounce

— With assistance by Rita Nazareth |