(75) summary, 'all over the place'

zerohedge.com

Wall Street's Most Accurate Analyst: The Fed Will Pivot In November, Unless There Is A Market Meltdown In The Next 8 Weeks

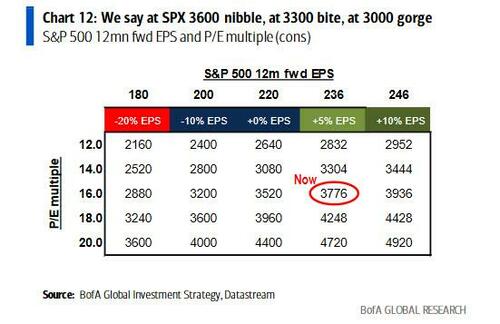

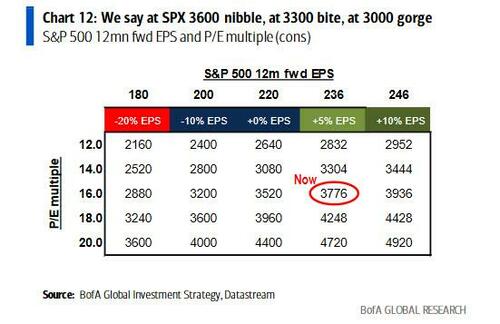

When a few weeks ago, Wall Street's biggest and most vocal sellside bear, not to mention most accurate analyst, BofA chief investment strategist Michael Hartnett - who has been calling for S&P 3000 for months and predicting the recession would end some time in October when the S&P hit his bogey - started turning every so slightly bullish (see " At SPX 3600 Nibble, At 3300 Bite, At 3000 Gorge"), we predicted that it was only a matter of time before BofA itself turned bearish with Hartnett having cleared the way and prepared all those clients who look beyond just the "house call" (courtesy of websites such as this which have been following Hartnett's much more accurate takes for the past decade.

Sure enough, on Thursday BofA capitulated when the bank's official chief equity strategist Savita Subramanian published a note (available to professional subscribers) explaining why she was slashing her S&P year-end price target by 20% from 4,500 to a street low 3,600 (which Hartnett would say is nowhere near enough).

So is Hartnett now content and - ever the contrarian - is he about to turn decisively bullish now? Well, since his ultimate target is 3,000 (to be hit some time in the next three months), the question is mostly rhetorical. The answer is no: more pain is coming.

Which then brings us to the next question: what does Hartnett think is the best way to trade markets now? Below we excerpt from his thoughts published in his latest weekly Flows and Liquidity note (which is also available to pro subs in the usual place) but before we get to the core, let's first take a look some of the bigger pictures discussed by Hartnett, starting with..

Big bears, big levels: According to Hartnett, many think bad Q2 EPS elicits a bounce in stocks, i.e., bad news = good news... but if bad news = bad news then expect a proper capitulation. In the bullish camp, Hartnett says that "summer risk-on" requires:

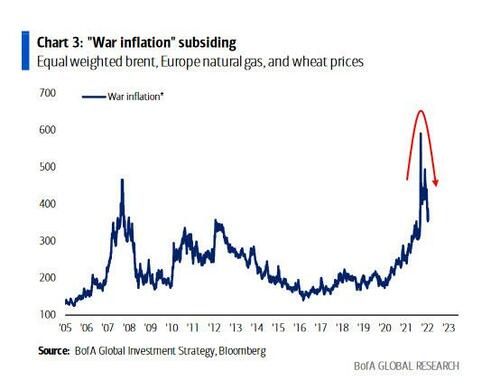

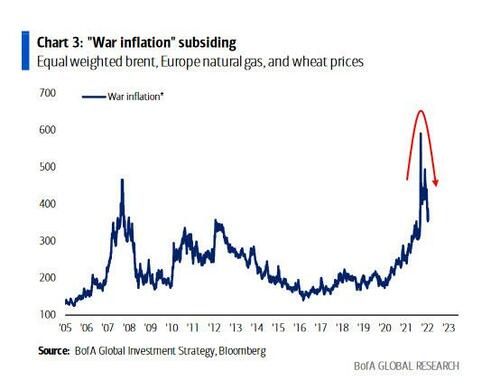

Bitcoin 20k,EUR 1.00 to hold,BKX 100 to hold,US IG CDX not to break 100,GT30 below 3.0%,US$ reversalWar inflation subsiding: Wheat prices -44%, brent oil - 24%, Europe natural gas -21% from recent peaks as investors discount “less war” in H2, and because according to Hartnett, it makes little sense for Russia to close Nord Stream 1 gas pipeline indefinitely (we disagree).

[url=] [/url] [/url]

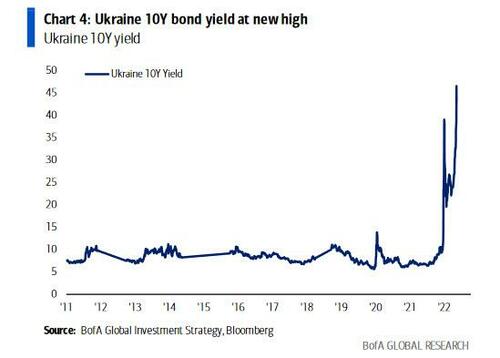

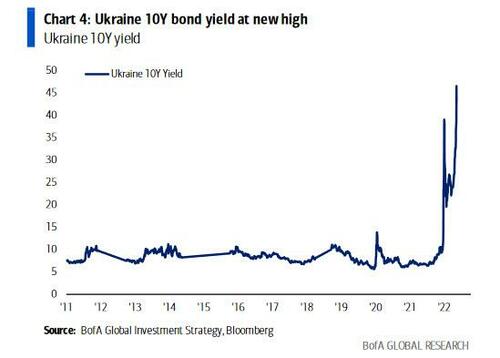

Tale of the Tape: Euro-area sentiment remains dire: Ukraine 10-year bond yield @ new high.

[url=] [/url] [/url]

Italian politics are a mess, and have sent euro bank stocks -38% from Feb highs, while Euro IG & HY @ widest spread to US since ‘12. Hartnett warns that should ECB fail to hike 50bps (fragmentation > inflation) the Euro will tank.

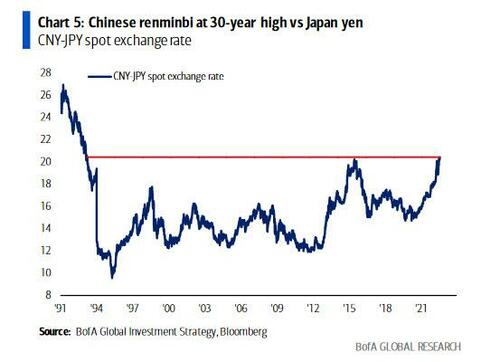

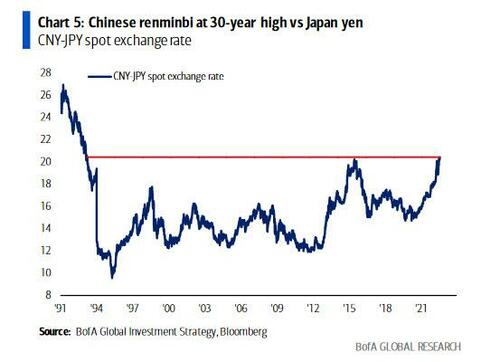

But an even bigger Q3 risk-off surprise is Asia FX war (as we first said in March in " Yen At Risk Of "Explosive" Downward Spiral With Kuroda Trapped... And Why China May Soon Devalue"). Indeed, China's renminbi is now at a 30-year high vs Japan yen...

[url=] [/url] [/url]

... and since the only source of China growth in 2022 is exports, Beijing is facing growing pressure to devalue (which would send gold and cryptos through the roof).

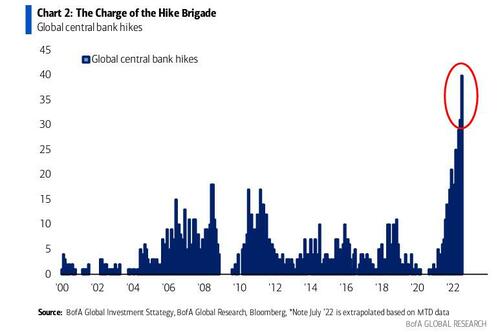

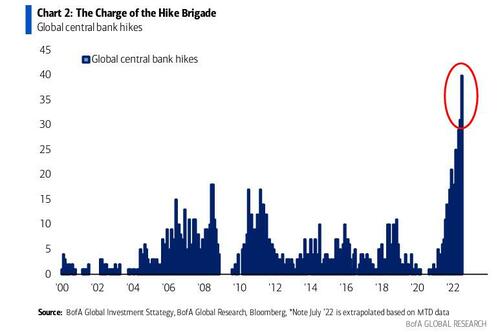

The Biggest Picture: hike, hike, hike... until everything breaks. The intense central bank hiking cycle which has seen virtually every developed and developing world central bank tighten financial conditions...

[url=] [/url] [/url]

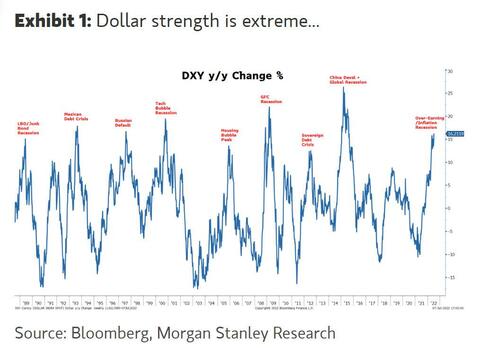

... means there is now risk for consensus of shallow recession + "shallow recession kills inflation allowing Fed pivot" but real policy rates are still extremely negative (-6.7% Fed, -8.8% ECB, -6.1% BoE, -2.5% BoJ) which means the current hiking cycle followed by a pivot would result in even greater inflation around the world! On the other hand, fresh, "big" rate hikes in the coming months as central banks play catch up risks the “recession shock” morphing into a full-blown credit event (as the soaring USD heavily hints at).

[url=] [/url] [/url]

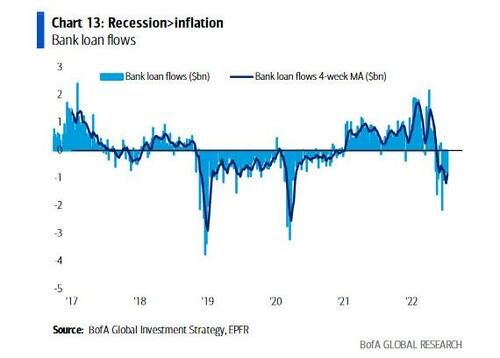

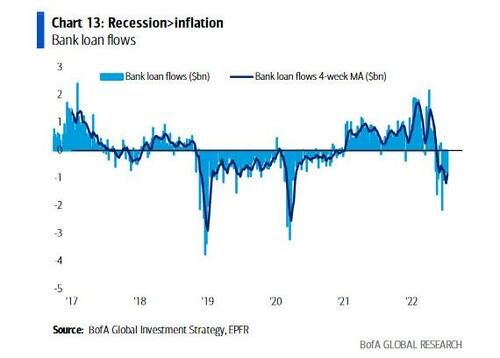

Flows to Know: As Hartnett puts it ever so succinctly, "recession>inflation" - i.e., the largest inflow Treasuries in 9 weeks ($8.3bn) which comes just as foreign central banks piled into the 30Y auction...

[url=] [/url] [/url]

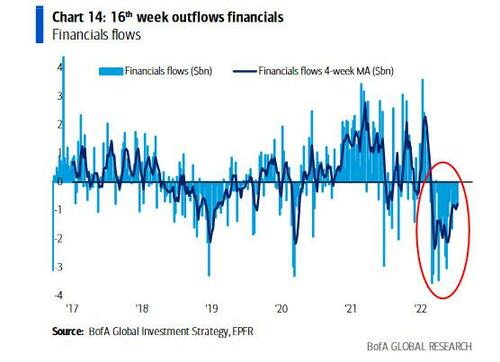

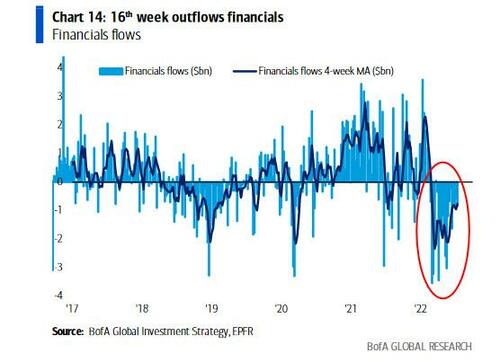

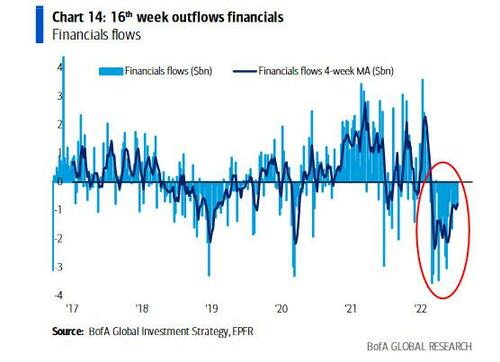

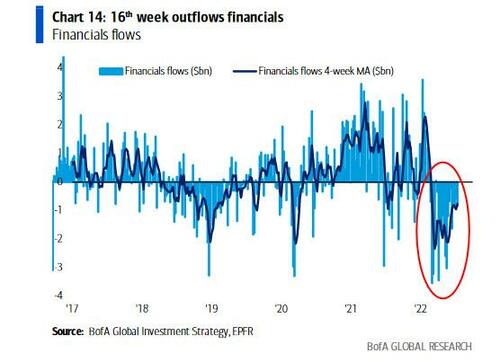

... as investors dumped inflation-sensitive assets, i.e. - the largest 5-week outflow bank loans since Apr’20 ($5.6bn), outflows from IG/EM/HY, 16th week outflows financials ($0.8bn)...

[url=] [/url] [/url]

... 7th week of consumer outflows (longest since Nov’16), and 4th week resources outflows (longest since Sep’19).

[url=] [/url] [/url]

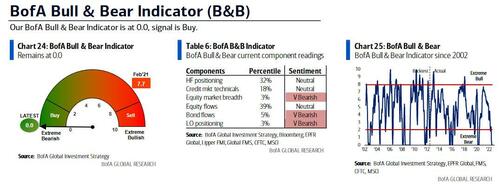

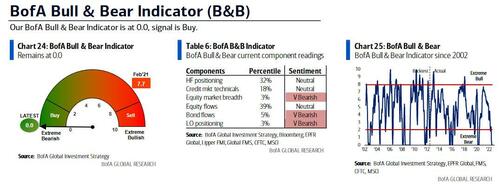

Hartnett next look at both weekly (15.1bn to cash, $1.6bn to bonds, $0.9bn from gold, $2.9bn from stocks) and annual fund flows, where he notes that YTD we have seen +$181bn into stocks, vs $206bn out of bonds and cash outflows of $199bn, or as Hartnett puts it, "everyone bearish stocks but few have sold" an observation further validated by the fact that the Bank of America Bull and Bear indicator remains for yet another week at the lowest on record: 0.0.

[url=] [/url] [/url]

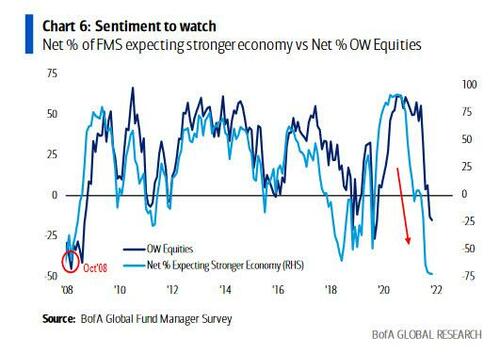

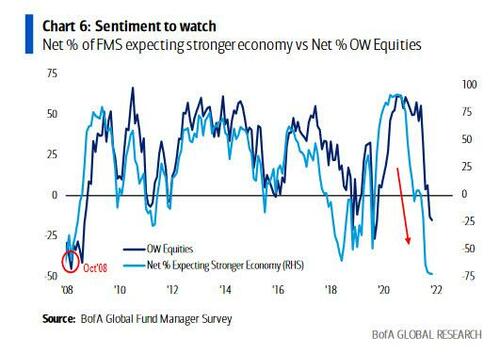

Which is also why Hartnett took a stab at one of our biggest peeves: the complete disconnect between the "residual equity allocation optimism" in the Fund Manager Survey and the dire economic and market pessimism, and whether these two series will ever catch up (or rather catch down).

[url=] [/url] [/url]

That to Hartnett is a "necessary capitulation event" for markets to bottom.

With that in mind, we go back to how Hartnett sees the world on a secular, cyclical and tactical basis. It probably won't come as a surprise that the BofA strategist is extremely bearish on both. Here's why, starting with:

Secular base case = bearish (low volatile asset returns)...

2020s a decade of regime shift to higher inflation, higher rates, higher volatility = lower asset valuations, driven by trends in society (inequality), economic policies (QT, redistribution, taxation), politics (populism/progressivism), geopolitics (war), environment (net-zero), economy (de-globalization), demographics (China population decline), all inflationary.

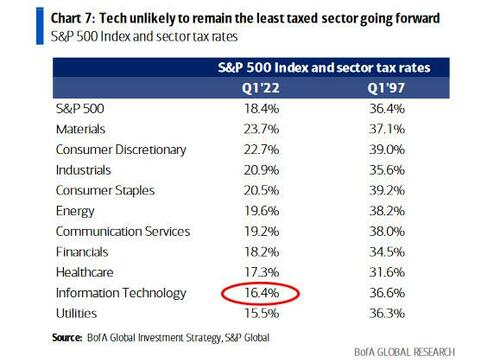

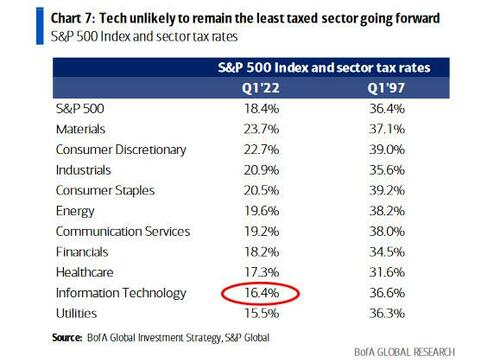

Globalization to isolationism, capitalism to socialism, elitism to populism big investment trends, but others include end of QE, buybacks, low taxation... Fed won't be buying $8tn of financial assets in next 14 years (or maybe it will be, but it needs a huge crisis to justify this)... corporations won't be buying $7tn of stock in next 12 years... corporate taxes won't be cut in half next 25 years (and the richest sector of all, technology, unlikely to remain the least taxed sector going forward, bar utilities).[url=] [/url] [/url]

Higher inflation = higher rates = cash, commodities, real assets, volatility, small cap to significantly outperform bonds, credit, private equity, tech stocks.

Cyclical base case = bearish (defensive now but cyclical once recession/credit event stops Fed)...

Commodities (best year since 1973), govt bonds (worst year since 1931), stocks (worst year since 1917 in real terms) have gone a long, long way to discounting inflation/rates/recession shocks of 2021/22... this is good.

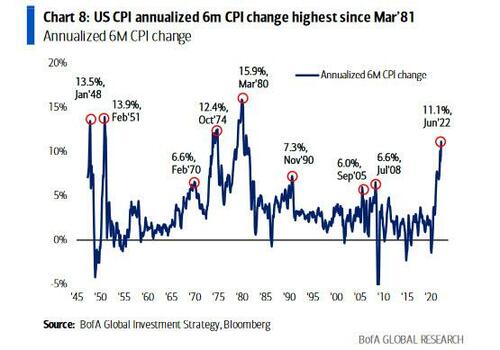

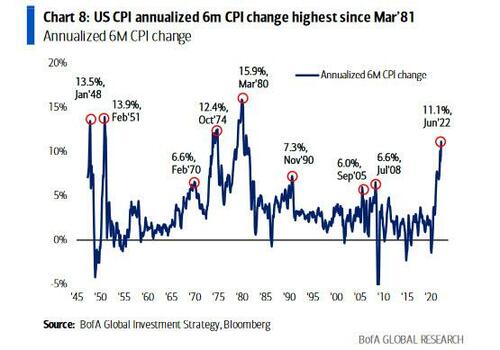

But asset prices determined by two things: 1. interest rates and 2. corporate earnings, and in H2 rates set to rise (US CPI past 6 months annualizing 11.1%, highest since Mar’81), earnings set to fall...

[url=] [/url] [/url]

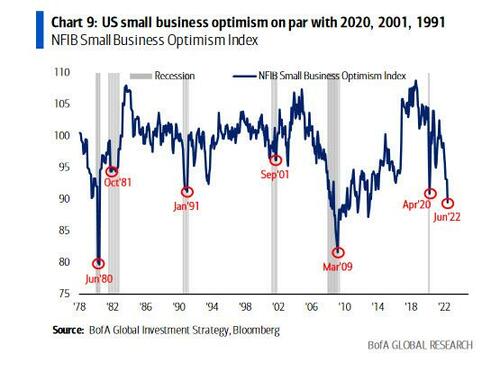

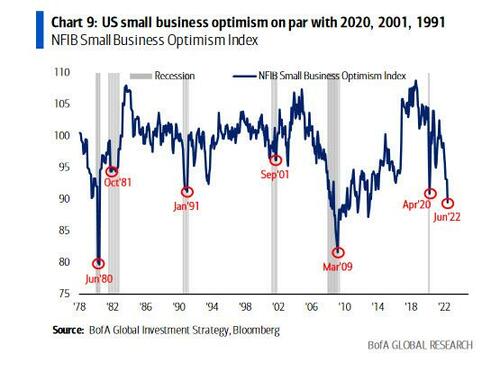

... as charts increasingly point (as does yield curve) to hard rather than soft recession... US small business optimism currently on par with recession levels in 2020, 2001, 1991...

[url=] [/url] [/url]

... but US small business optimism + US consumer sentiment (UMich) on par with deep recessions of 1980 and 2009.

[url=] [/url] [/url]

The silver lining: China (COVID) & Russia (war) set to become less aggressive headwinds H2 but if China forced to devalue, very negative for risk, copper, EM... 2015 = risk-off (JPY up, HY down, ACWI down, copper down); in contrast, CNY revaluation 2005 was risk-on.

[url=] [/url] [/url]

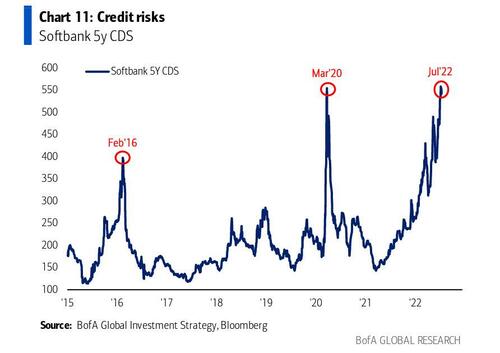

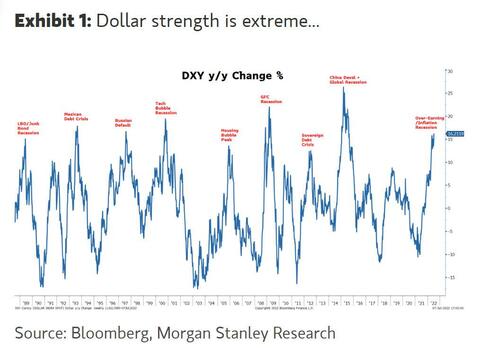

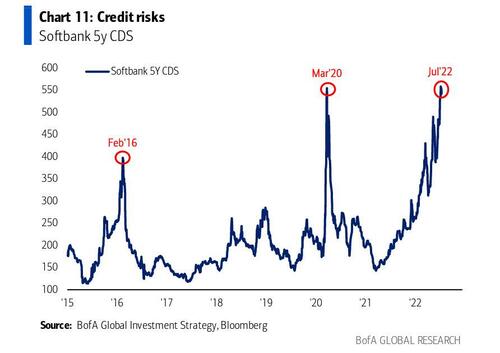

And while US recession means lower US$ in 6-9 months, spiking US dollar often portend of credit event (1998, 2008, 2020), which means liquidation, deleveraging, default risks high, and will hit PEs, VCs (see Softbank CDS)...

[url=] [/url] [/url]

... BNPL, EM, Euro real estate, crypto, CTAs, an many other candidates. Here Hartnett notes that a peak in the USD in Q3 absent a credit event would be the most positive path to year-end rally in distressed cyclicals, and the most difficult decision in investing for the rest of 2022 will be to pick which FOMC one should flip portfolio before - Sep 20th , Nov 1st or Dec 13th - with Hartnett saying it will most likely be Nov... unless market meltdowns next 8 weeks. Which incidentally fits perfectly with what that other BofA (and former NY Fed) rates guru, Marc Cabana said yesterday, when he predicted that QT will end much sooner, most likely in early/mid-2023.

Which brings us to the one place where Hartnett once again shows a slightly bullish side: according to the strategist, the Inflation shock (which started H2'21), and which became the rates shock (H1'22), and is set to transform into a recession shock (H2'22), eventually becomes a crash (i.e., we are not quite done yet).

But once all is done and dusted in H2, opportunity knocks, and repeating what he said a few weeks ago, Hartnett says "at SPX 3600 nibble, at 3300 bite, at 3000 gorge"

[url=] [/url] [/url]

Looking ahead, the BofA strategist sees opportunities in H2 for 2023 bulls within small cap & real assets (inflation), EM (dollar debasement), industrials (infrastructure), Asian consumer, and at lows best strategy humiliated "60-40" strategy..

Finally, there is Hartnett's tactical base case, which he frames as follows:

"sentiment so poor, shallow recession already priced-in, immediate China/Russia risk, biotech rally = peak yields lemons... lemonade [see BofA report "Summer's here, it's time for lemonade" available to pro subs]; best for 2023 returns would be quick Q3 flush lower in risk assets to ultimate destination... but you can see why tape past 4 weeks fighting so hard to avoid abyss."

More in the full Hartnett note available to pro subs. |

[/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url]