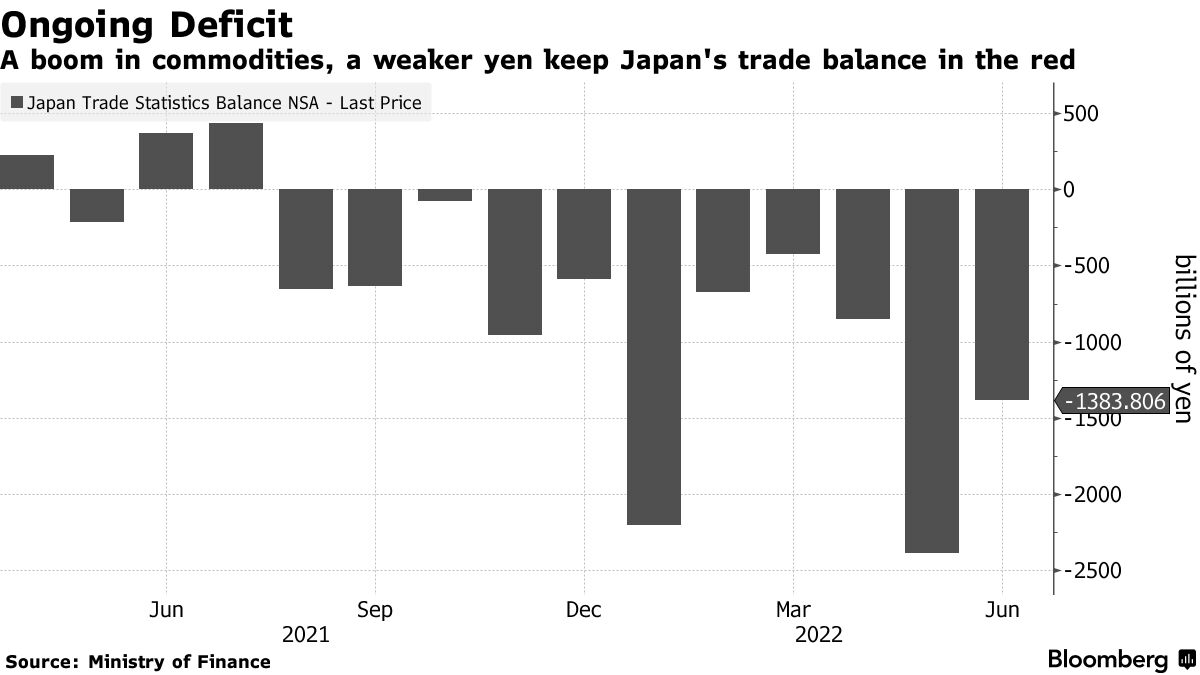

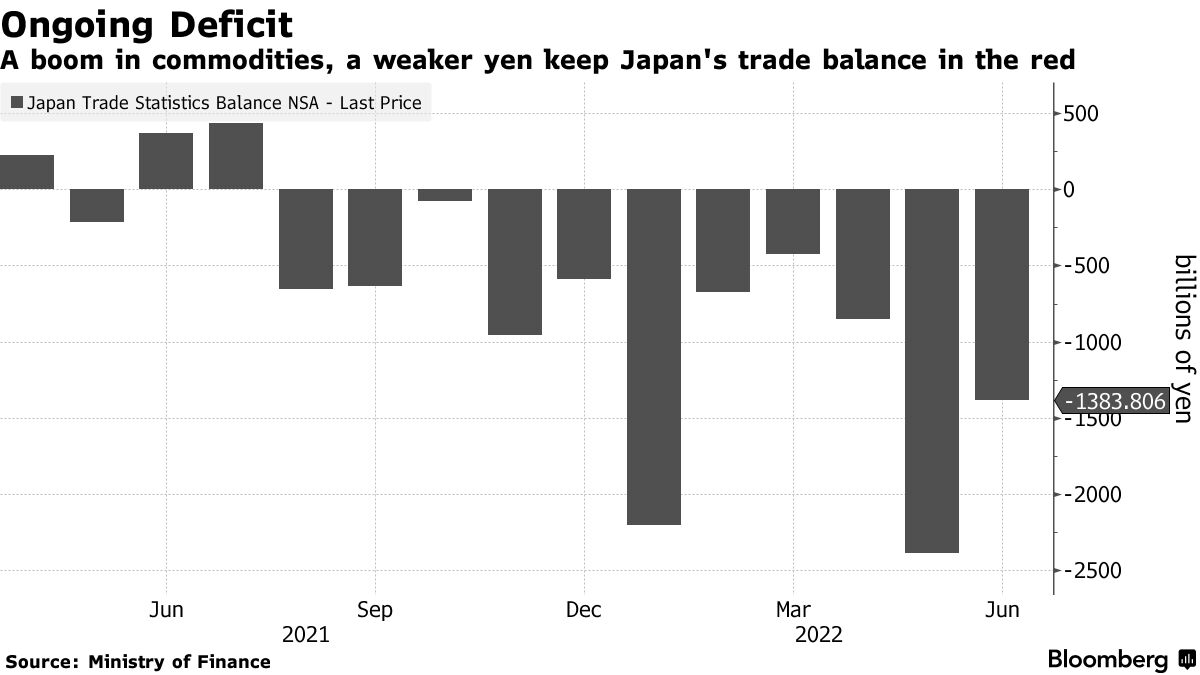

Oops ... Japan scored another monthly trade deficit(!!)

bloomberg.com

Japan Logs Trade Deficit for 11th Month on Energy, Weak Yen

Yoshiaki Nohara

21 July 2022, 08:11 GMT+8

Japan reported a trade deficit for a 11th consecutive month in June as higher energy prices and a weaker yen continued to inflate the nation’s import bill.

The trade deficit narrowed to 1.38 trillion yen ($10 billion) from 2.39 trillion yen, the finance ministry reported Thursday. Imports rose 46.1% from a year ago, with crude oil, coal and liquid natural gas leading the increase as oil and gas prices continued to surge from year-ago levels. Economists had forecast a 46.3% gain.

Exports increased 19.4%, compared with a 17% forecast by analysts, as shipments of mineral fuel, steel and semiconductor parts jumped from the previous year. The value of shipments gained 4% from May.

Japan, which relies on energy and food from overseas, has seen its import costs soar due to the war in Ukraine and supply disruptions including those tied to China’s virus lockdowns. As commodity prices remain high and the yen stays weak, trade deficits are likely here to stay.

Exports may also suffer from a global economic slowdown as major economies try to cool rampant inflation and demand by raising interest rates. Central banks across the globe have been speeding up their rate hike path, with more and more surprising with jumbo increases.

What Bloomberg Economics Says... “Looking ahead, we expect the trade deficit to narrow slightly in July. The import bill is likely to increase at a slower pace due to softer commodity prices. Meanwhile, Shanghai’s reopening from lockdowns should support exports.” --The Asia economists team To read the full report, click here

Later on Thursday, the Bank of Japan is expected to maintain its monetary easing policy framework, highlighting its outlier status among global peers. The BOJ’s dovish stance has helped the yen fall to its 24-year low versus the dollar, making imports more expensive.

For the trade data, the average exchange rate was 130.35 yen to the dollar, 19% weaker than a year ago.

(Updates with more details from the report) |