Going to be interesting

Might be net positive for Alaska, and Texas, but possibly exceedingly negative for Hawaii through California all the way to New York.

bloomberg.com

India to Tell US That Russia Oil Price Cap Needs Consensus

US Treasury officials rallying support to cut Russian revenue India expected to seek consensus among all buyers on price cap

Debjit Chakraborty

August 24, 2022, 5:56 AM EDT

India will seek broader consensus before it supports US-led efforts to cap the price of Russian oil, which American officials are expected to push for this week when they travel to Mumbai and New Delhi.

The South Asian nation, which has emerged as one of the biggest buyers of Russian oil since the invasion of Ukraine, is hesitant to join the plan unless a consensus is reached with all buyers, according to people familiar with the matter, asking not to be identified because the deliberations aren’t public.

That message will likely be conveyed to US Deputy Treasury Secretary Wally Adeyemo and his team at meetings with Indian government officials and company executives from Wednesday to Friday. His boss, Janet Yellen, and the department have led efforts to get allies on board the price cap idea, which they anticipate will starve Russia of revenues that fund its invasion of Ukraine without taking oil off the market and triggering a price spike.

The effectiveness of an oil-price cap could hinge on commitments from key customers such as China and India, which have boosted oil purchases from Russia after most buyers shunned its barrels following the invasion of Ukraine.

The coalition for putting a price cap on Russian oil has broadened and a number of countries have joined, Adeyemo said at an event in Mumbai on Wednesday, adding that he was “not going to get ahead of announcements by the coalition.”

QuickTake: A ‘Price Cap’ on Russian Oil -- Could That Work?

Indian policymakers fear that committing to the price cap will disrupt its access to discounted Russian crude, the people said. The world’s third-largest buyer, which imports 85% of its oil needs, has relied on cheaper Russian supplies to provide relief from inflation near 7% and a record trade deficit.

Adeyemo is also expected to ask India to strengthen its monitoring of where products made from Russian crude are sold, said one of the people. The request comes after Treasury officials flagged that a shipment of a material used to make plastic produced at an Indian refinery from Russian oil had made its way to New York. The US in March banned the import of Russian crude and refined petroleum products.

Treasury spokesman Michael Kikukawa said Adeyemo is in India to discuss “a number of issues,” including energy security. “All tools that will be discussed — including a price cap on Russian oil, clean energy technology, climate finance — are intended to lower the price of energy in India, the United States and globally,” he said in an email.

Kikukawa didn’t comment on how Indian officials view the price cap. An Indian finance ministry spokesperson didn’t respond to calls seeking comments.

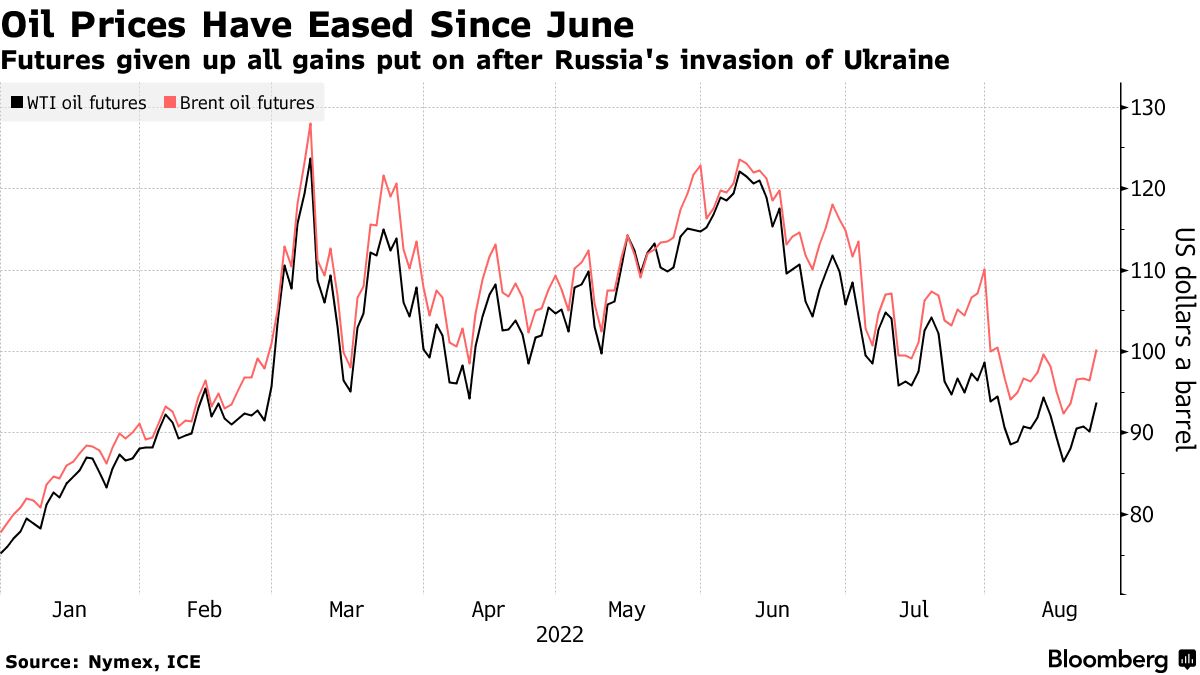

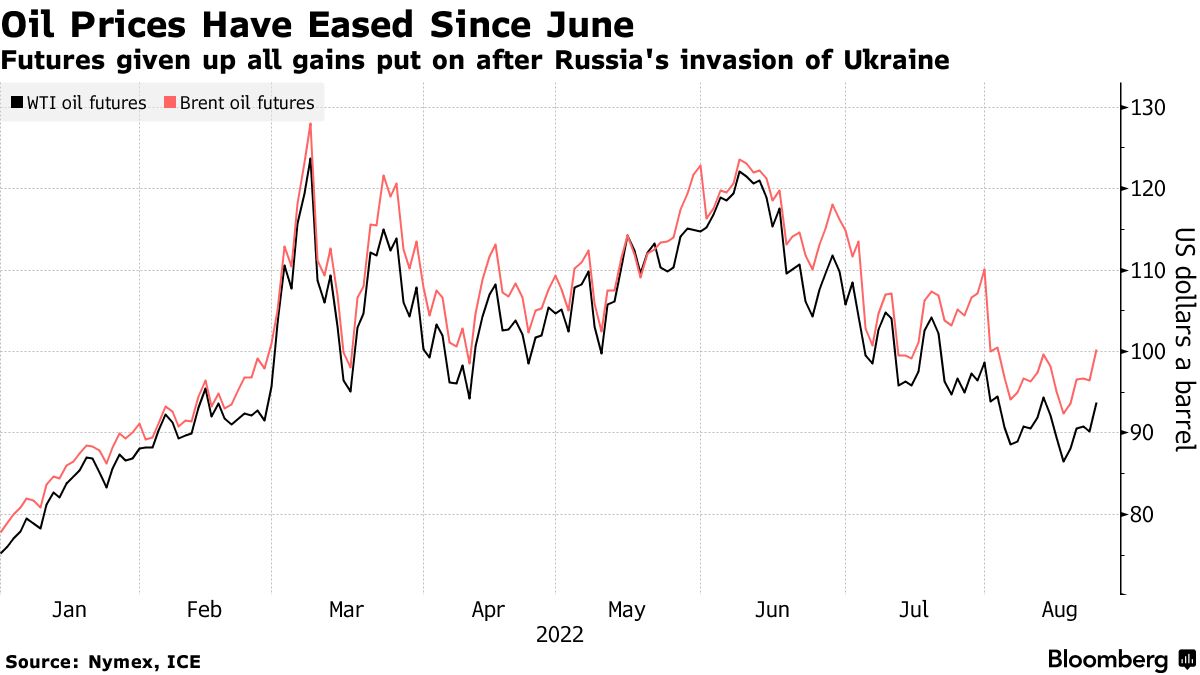

The European Union has approved a ban on imports of seaborne Russian oil at the end of the year, and along with the UK, prohibit its companies from financing or insuring such shipments. US officials fear those bans will shut in substantial portions of Russia’s production and cause prices globally to spike to around $140 a barrel.

Brent oil, the global benchmark, settled Tuesday above $100 a barrel for the first time since the beginning of August, although it has come off a recent peak near $140 in March.

— With assistance by Christopher Condon, Julia Fanzeres, Vrishti Beniwal, Anup Roy, and Atul Prakash

(Updates to add Adeyemo’s comments in fifth paragraph)

Sent from my iPad |