| | |

Biden Betrayed As CNN, NYT Fact Checkers Set Stage For Downfall

"Starkly at odds with the reality..."

SNIP:

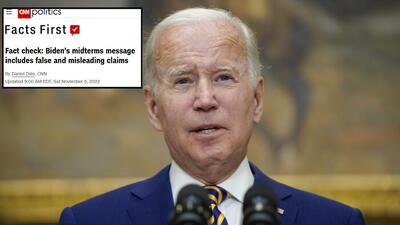

CNN, meanwhile, put out the following piece Saturday morning:

[url=] [/url] [/url]

They ding Biden on the Social Security propaganda and lying about corporate taxes.

Biden repeatedly suggested in speeches in October and early November that a new law he signed in August, the Inflation Reduction Act, will stop the practice of successful corporations paying no federal corporate income tax. Biden made the claim explicitly in a tweet last week: “Let me give you the facts. In 2020, 55 corporations made $40 billion. And they paid zero in federal taxes. My Inflation Reduction Act puts an end to this.”

But “puts an end to this” is an exaggeration. The Inflation Reduction Act will reduce the number of companies on the list of non-payers, but the law will not eliminate the list entirely.

That’s because the law’s new 15% alternative corporate minimum tax, on the “book income” companies report to investors, only applies to companies with at least $1 billion in average annual income. (There are lots of nuances; you can read more specifics here.) According to the Institute on Taxation and Economic Policy, the think tank that in 2021 published the list of 55 large and profitable companies that avoided paying any federal income tax in their previous fiscal year, only 14 of these 55 companies reported having US pre-tax income of at least $1 billion in that year.

In other words, there will clearly still be some large and profitable corporations paying no federal income tax even after the minimum tax takes effect in 2023. The exact number is not yet known. -CNN

CNN then called out Biden for lying about the national debt and the deficit, the unemployment rate, his student debt cancellation scheme, gas prices, Chinese President Xi Jinping, and the Trump tax cuts.

What's going on here?

|

|

[/url]

[/url]