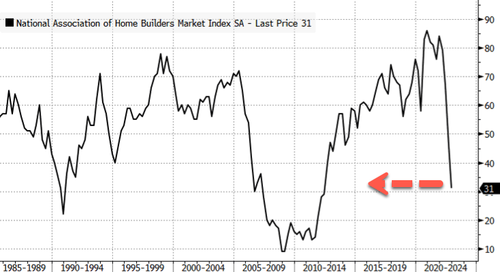

| | | Lumber Prices Collapse As Homebuilder Sentiment Falters

BY TYLER DURDEN

THURSDAY, DEC 22, 2022 - 01:15 AM

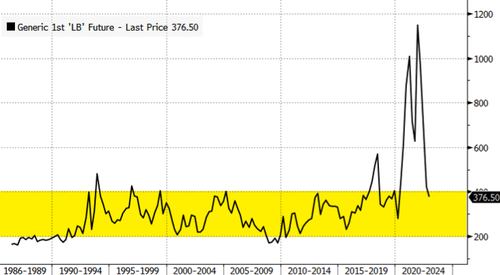

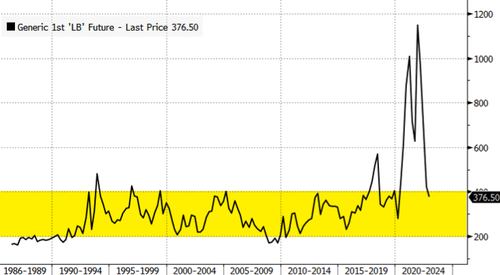

Lumber peaked at $1,336 per thousand board feet in late February but has settled at around $380 this week, representing a dramatic 72% decline in prices, primarily due to elevated mortgage rates, slowing housing activity, waning builder confidence, and overall mounting macroeconomic headwinds.

The plunge in lumber prices is no surprise as builder confidence for newly-built single-family homes posted its 12th consecutive month of declines in December, according to the National Association of Home Builders. Confidence is at its lowest reading since mid-2012.

[url=] [/url] [/url]

Besides dismal homebuilder sentiment, housing starts and building permits for November also showed deterioration in the housing industry. The number of housing starts (SAAR) is at the lowest since June 2020.

[url=] [/url] [/url]

Forward-looking housing Permits are down over 22% YoY - the most significant drop since 2009 (with single-family permits -29.7% YoY and multi-family down 10.7%)...

[url=] [/url] [/url]

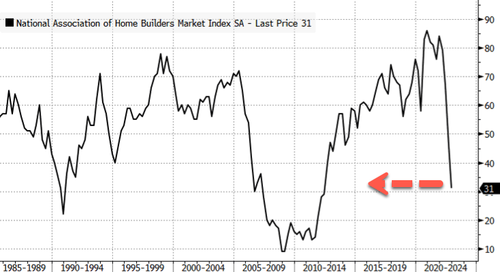

Single-family building permits will likely move lower as homebuilder expectations for future sales are at decade lows..

[url=] [/url] [/url]

Weaker housing conditions will persist into 2023 and are explicitly weighing on lumber demand, and thus lumber prices.

Lumber prices are expected to remain range bound between $400 and $200 until Jay Powell is forced to cut interest rates back to zero due to the recession and sparks the next housing craze.

[url=] [/url] [/url]

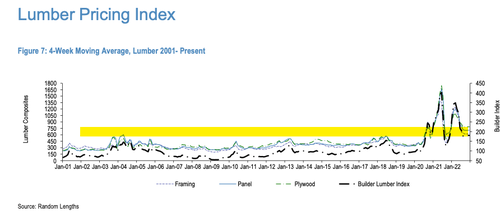

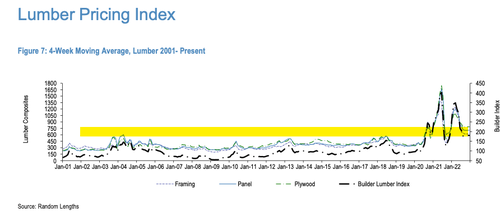

Framing, paneling, and plywood, types of lumber used to build a home, are well off their highs. Remember when plywood at Home Depot was fetching nearly $100 per sheet?

[url=] [/url] [/url]

If you waited for the lumber bubble to deflate -- this might be the perfect time to buy.

zerohedge.com |

|

[/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url]