Re <<dji drones still available at best buy>>

... yes, the value for $ is hard to beat.

In the meantime, parts of Congress wishes to deny CPC China the precious USA SPR, and am guessing that should such be the case, EU + Nato shall be short diesel, in which case ... etc etc

Such be consequences of wing-it seat-of-the-pants on-the-fly policy making.

Who can know, perhaps events can work out for the better by chance, and benefit to war-parties by accident

scmp.com

US House bans emergency oil sales to Chinese Communist Party-linked entities in rebuke to Biden policy - Republicans argue the American leader’s decision last year to release 180 million barrels from the national reserve hurt energy security - Bill next goes to Democratic-controlled Senate, where passage is expected to be difficult amid criticism the legislation achieves little

bloomberg.com

China’s Flood of Fuels May Provide Some Relief to Diesel Crunch

Refiners to prioritize diesel due to strong margins: traders Europe facing deficit of 1.19 million b/d, Energy Aspects says

Elizabeth Low11 October 2022 at 14:30 GMT+8

11 October 2022 at 14:30 GMT+8

A flood of fuel exports from China may provide some relief to a tight global diesel market ahead of sanctions on Russian flows that are expected to squeeze supply even further.

China recently allocated refiners the biggest fuel-export quota this year, and traders expect diesel output will be prioritized because it’s more profitable for producers compared with other products such as gasoline. Europe has already increased diesel imports from the Middle East and Asia as the region looks to replenish stockpiles ahead of winter and the Russian sanctions.

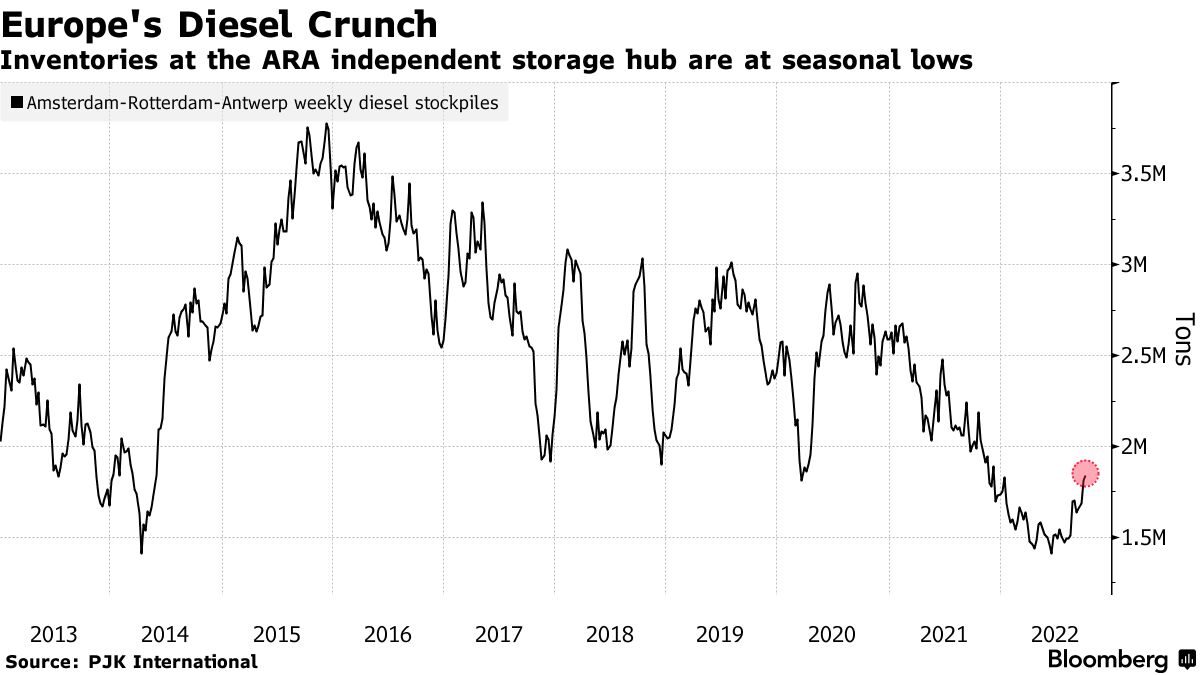

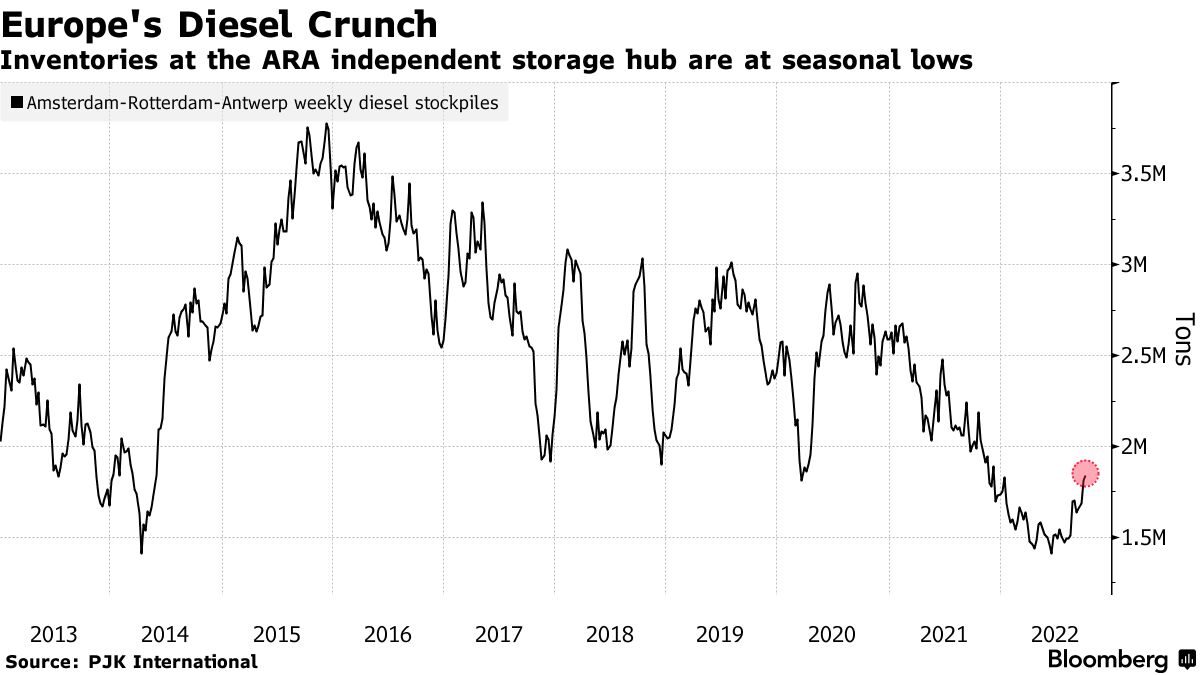

The European Union is set to halt almost all seaborne deliveries of diesel-type fuel as well as other refined petroleum products early next year from Russia, its biggest external supplier. Industry consultant FGE estimates inventories of diesel and jet fuel across five global trading hubs are at the lowest seasonal level since 2005, making Chinese flows even more attractive to consumers.

“As long as the Chinese economy remains weak and product stocks are high, there are incentives for refiners to de-stock and export,” said Michal Meidan, director of the China Energy Research Programme at the Oxford Institute for Energy Studies in the UK.

Beijing is seeking to export more fuels to help revive its economy, which has been hit by Covid lockdowns and a property downturn. Refiners and traders were given 15 million tons of new quota, which could be rolled over into the first quarter of next year, according to industry consultant JLC.

Profits from making diesel are currently the strongest among the transport fuels in Asia, with margins around $40 a barrel Tuesday. They’re near $33 for jet fuel, while refiners are struggling to profit from gasoline. Diesel margins have also climbed in the US after several refineries shut for seasonal maintenance.

China Flows

Overall fuel exports from China are expected to rise by 500,000 barrels a day to near 1.2 million barrels by year-end, according to FGE. That should go some way to helping Europe plug its diesel deficit. The region is likely to have a supply gap of 1.19 million barrels a day in the fourth quarter, said Richard Gorry, head of product development at Energy Aspects Ltd. in Singapore.

While China’s increased exports will offer some relief, it’s unlikely to fully cover Europe’s supply gap this year, said Mukesh Sahdev, head of downstream and oil trading for Rystad Energy. Refiners may also struggle to sufficiently boost operations to meet the 15-million-ton quota by year-end, he added.

“It would have to run its refining system 2.5-3 times higher,” Sahdev said, estimating that the nation is currently exporting nearly 600,000 barrels a day less fuels than it did pre-pandemic.

(Updates diesel and jet fuel margins in paragraph six.) |