This popular tech ETF leads all funds in capital outflows, despite rising 8% in 2023

Jan. 26, 2023 10:38 AM ET

Invesco QQQ ETF (QQQ) AAPL, GOOG, AMZN, NVDA, META, GOOGL

By: Jason Capul, SA News Editor

solarseven/iStock via Getty Images solarseven/iStock via Getty Images

The popular tech-focused Invesco QQQ Trust (NASDAQ: QQQ) has had an excellent start to 2023, with a year-to-date gain that has approached 10%. However, at the same time, the investment community has pulled more capital out of QQQ than any other ETF on the market.

As January approaches its close, the fund is +8.5% year-to-date supported by a +1.1% start on Thursday. Still, QQQ, with its $148.30B assets under management, has watched $6.04B exit the door. This is more than any of the other 3,000+ ETFs on the market.

The tech-focused fund is packed with many high-profile names that are set to deliver earnings in the coming weeks. This includes Apple ( AAPL), Alphabet ( GOOG) ( GOOGL), Amazon ( AMZN), NVIDIA ( NVDA) and Meta Platforms ( META), among others.

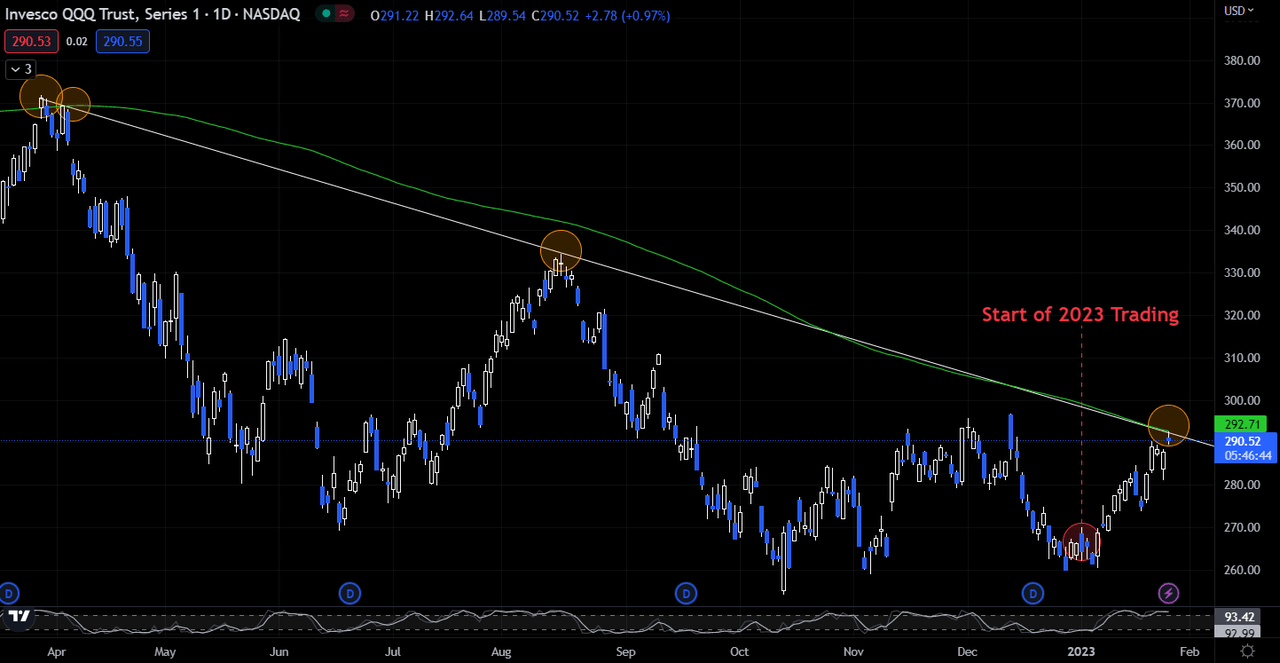

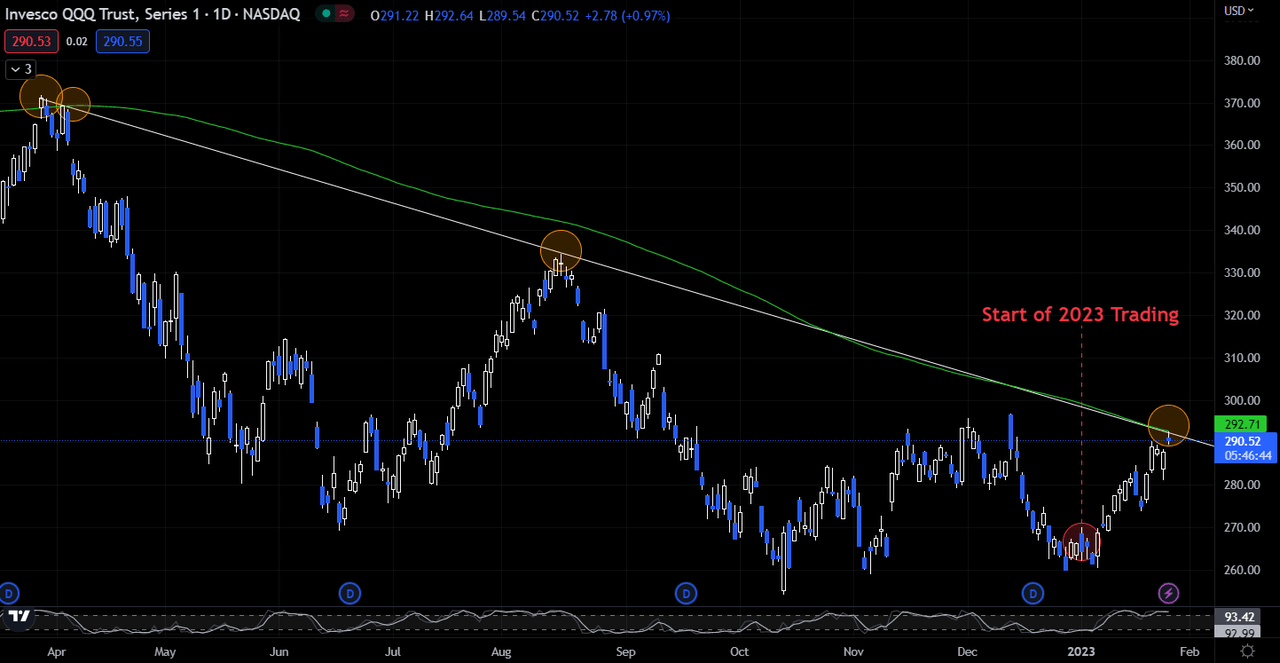

From a technical analysis vantage point, QQQ is touching both the high end of a descending daily trend line and its 200-day moving average. Upcoming tech earnings could provide the crucial catalyst to determine the near-term direction for the ETF.

See the chart below:

While QQQ has watched investors extract a significant amount of capital from the fund, other funds have seen substantial inflows so far in 2023. See what emerging market exchange traded fund leads all funds in net 2023 inflows. |

solarseven/iStock via Getty Images

solarseven/iStock via Getty Images