let's see if Turkey gets flipped

I am naturally suspicious of anyone championed by suspect Bloomberg, especially if such attended or worked at certain schools, and particularly if they cry on TV.

But, as in however, I keep open mind, and agnostic

I assume Erdogan knows what he is doing, that his literal survival might be on the line

bloomberg.com

A Wharton Professor Pledges Revolution in Turkish Economy After Elections

Bilge Yilmaz is likely to become economy czar if Erdogan loses Finance professor vows revamp of policy and more transparency

Onur Ant

22 March 2023 at 18:00 GMT+8

Bilge YilmazPhotographer: Kerim Arslan

As a Turkish opposition alliance tries to mastermind a victory at the polls against President Recep Tayyip Erdogan, a small coterie of economic advisers is hatching plans for what happens next.

Among them, Bilge Yilmaz may get the biggest say.

A likely pick for the job of Turkey’s economy czar if the ballot breaks the opposition’s way, the finance professor at the University of Pennsylvania’s Wharton School oversees economic policies for the second-largest party in the bloc assembled to face down Erdogan in May elections.

Read more: Why Turkey’s Next Election Is a Real Test for Erdogan

Though he’s dabbled in politics before, Yilmaz took on the role at the Iyi party just over a year ago, after coming back to Turkey during the pandemic and traveling the country with his son. It was a trip he’s said opened his eyes to the poverty and punishing living costs faced by many people.

“The current system is unsustainable,” he said in a rare interview with foreign press. “They’ll hardly manage it until the elections.”

Speaking at his unassuming office in the capital Ankara, Yilmaz, 55, held court on how he’d go about dismantling Erdogan’s programs should the president suffer repudiation by voters.

Yilmaz promises nothing short of a revolution in undoing policies blamed for the worst inflation crisis in decades, even as his talking points don’t stray far from textbook prescriptions for how to fix what ails Turkey — from rebuilding international reserves and a new commitment to inflation targeting to overhauling and recapitalizing state lenders.

People First

But it’s a vision that starts with getting “the right personnel” to take charge of key institutions, from the central bank and the Treasury to the banking watchdog, he said.

Insisting he’s “not a daydreamer” in thinking it will be easy to achieve economic stability, Yilmaz warned the Erdogan government’s near-daily tinkering with rules and regulations leaves Turkey at risk of “being dragged into chaos” and facing the possibility of a balance-of-payments crisis.

“We are going to have to pay for the wrong staffing of the past 20 years,” he said.

In his quest to shape the economy to his liking, Erdogan has ousted three central bank governors between 2019 and 2021, largely in the service of unconventional economic ideas and with frequent forays into conspiracy-mongering that invoked an “interest-rate lobby” he’s accused to trying to undermine Turkey.

More recently, Erdogan’s choice often fell on those with family ties or others that came to prominence for their political or religious views. At the helm of Turkey’s central bank is now a man best known previously as a columnist at a pro-government newspaper.

At a time of a makeover at home that sidelined much of the technocrat elite under Erdogan, a generation of Turkish economists came of age that found renown abroad and includes the likes of MIT’s Daron Acemoglu, a likely future Nobel Prize winner.

Yilmaz himself is a case in point. Born in the north-western city of Balikesir, he graduated from the top Turkish university with a degree in electrical engineering and physics and then earned a PhD in economics from Princeton.

Following a short stint at Stanford, he’s spent a quarter of a century at Wharton focusing on subjects ranging from corporate finance to game theory.

Choking Up

Yilmaz makes no secret that the subject of Turkey’s brain drain is close to his heart, even tearing up when talking about it on television last year. Renewal hinges on building a “coherent team,” he said. “We will repatriate those who left the country,” he said.

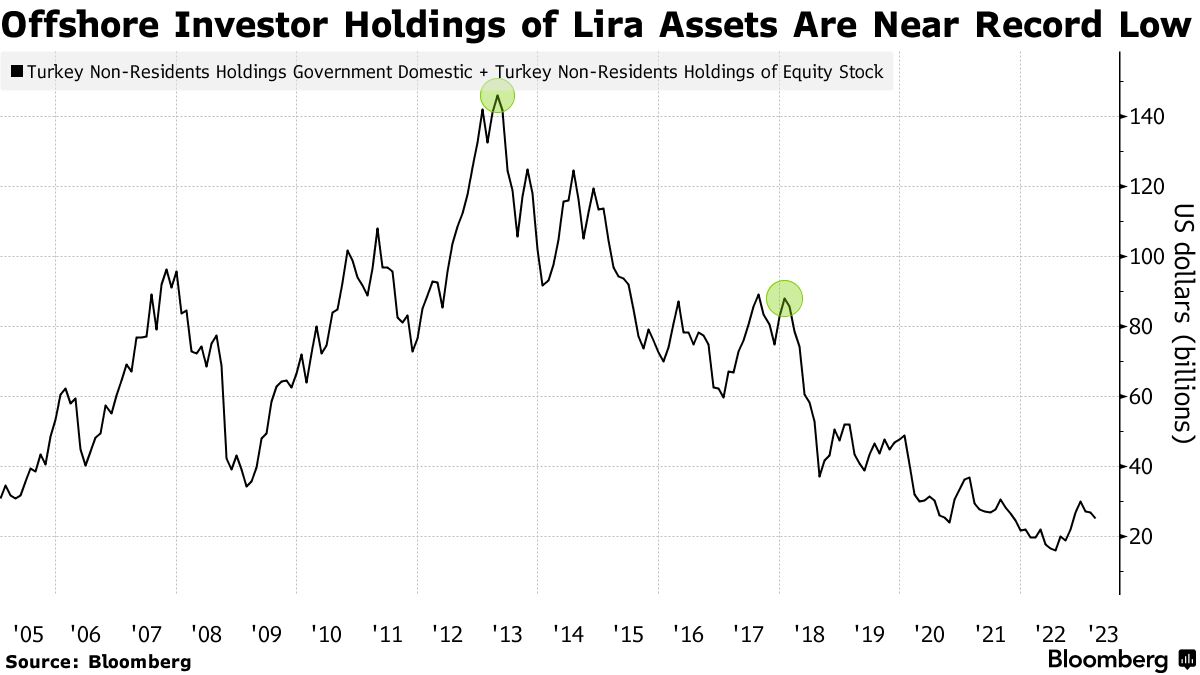

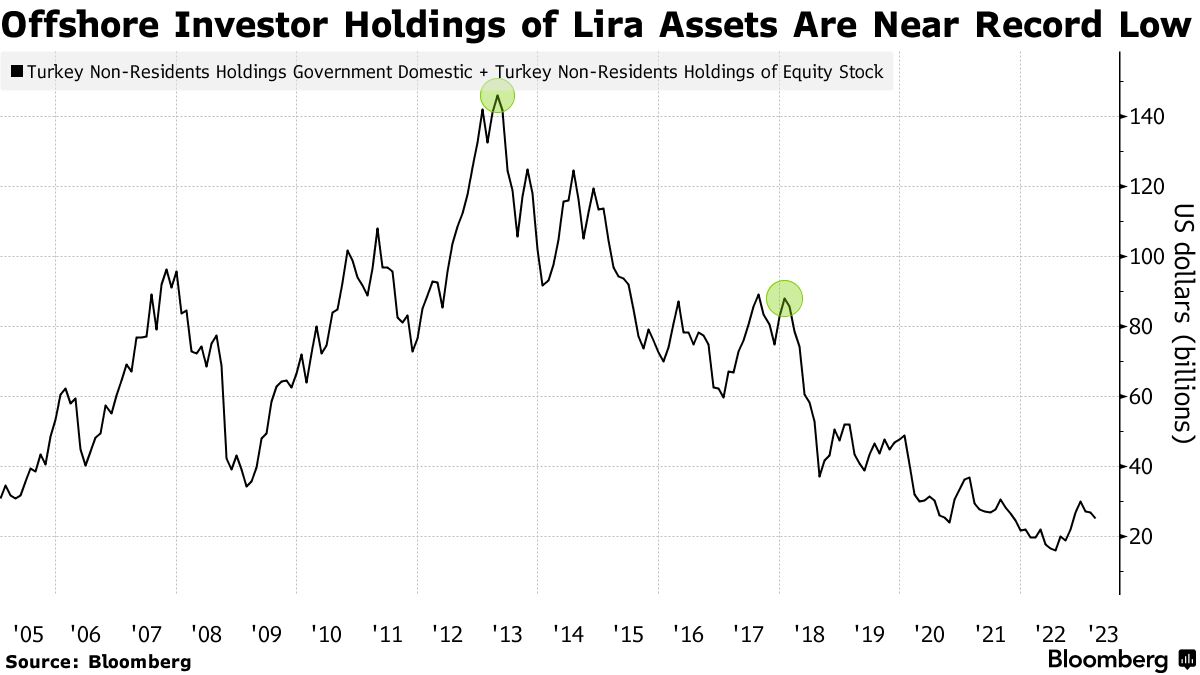

Yilmaz’s views would resonate with a market that expects a sharp reversal of Erdogan’s policies if he were to lose at the ballot box and already positioning for the chance that the president’s rein over the $900 billion economy might be nearing an end.

With just over a month left before the elections, however, the opposition faces a hard slog ahead. Polls predict a neck-to-neck race.

The drama around the vote is only adding urgency for Yilmaz to focus on an approach he believes will allow international capital to flow back into Turkish assets and eventually prompt enough foreign direct investment to help finance Turkey’s yawning current-account deficit.

What’s Next

Dire as the situation has become for the economy, he isn’t calling for shock therapy and doesn’t think Turkey will need to turn to the International Monetary Fund for assistance. Some of the unorthodox measures implemented under Erdogan, such as currency-protected deposits that stabilized the lira, will be unwound only gradually, he said.

Though planning to turn “immediately” to inflation targeting, he envisages a “transition” over three-month periods since the central bank’s 5% goal has become unrealistic. Price growth shot past 85% late last year in Turkey, which hasn’t met its inflation target for over a decade.

“Once those ‘predictable’ targets are realized, people’s confidence in the bank will increase,” Yilmaz said.

Other priorities for him will include fiscal discipline and reforms in banking, industry and agriculture. Yilmaz wants to devise a set of incentives that would, for example, reward farmers by encouraging them to favor certain crops and plant them in preferred areas.

“We want to ensure trust and transparency,” he said. “Everything will be open to audit.” |