step by step, something is happening, and that be globalisation 2.0, the flipping

the huge difference between 2.0 domain and 1.0 protocol be that Team China only wants its own global trade with counterparties to be denominated and settled in RMB, whereas Team USA wishes third-parties trades to also be denominated and settled in USD

the China way involves minimal if any hollowing of the economy, for the great-good and common prosperity

whereas the US method necessitates trade deficits without end until end

“But at the same time we are still talking about a long way from dollar dominance, and the yuan’s share in global payment might be forever small.” bloomberg.com

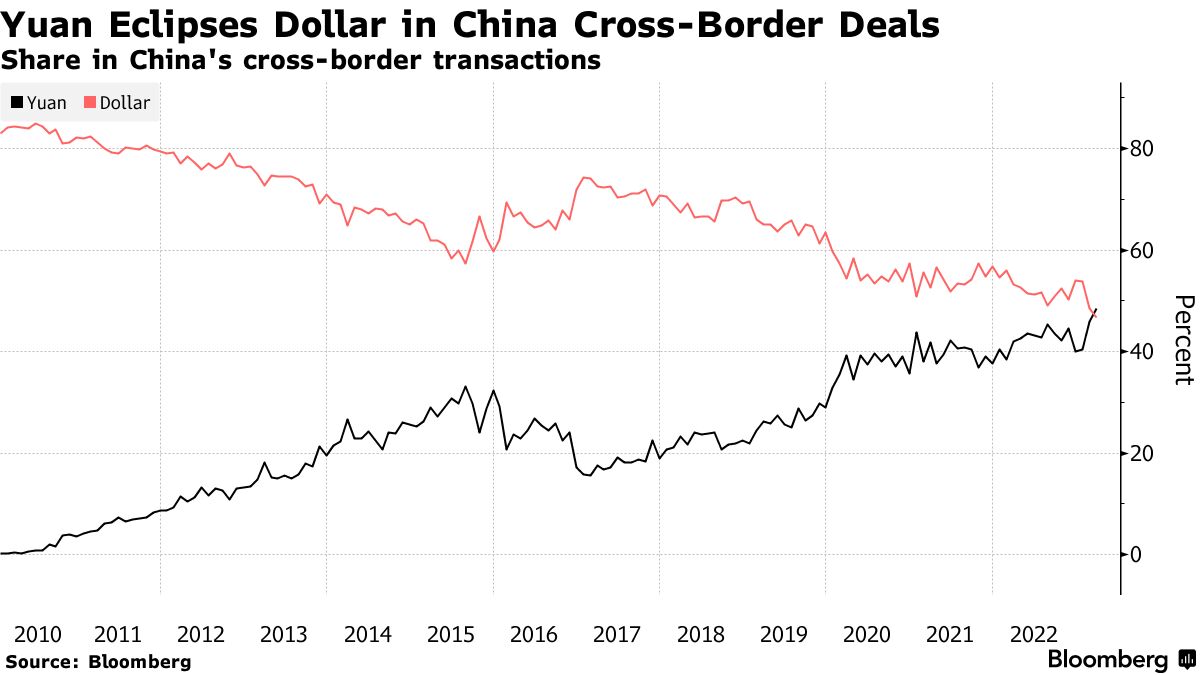

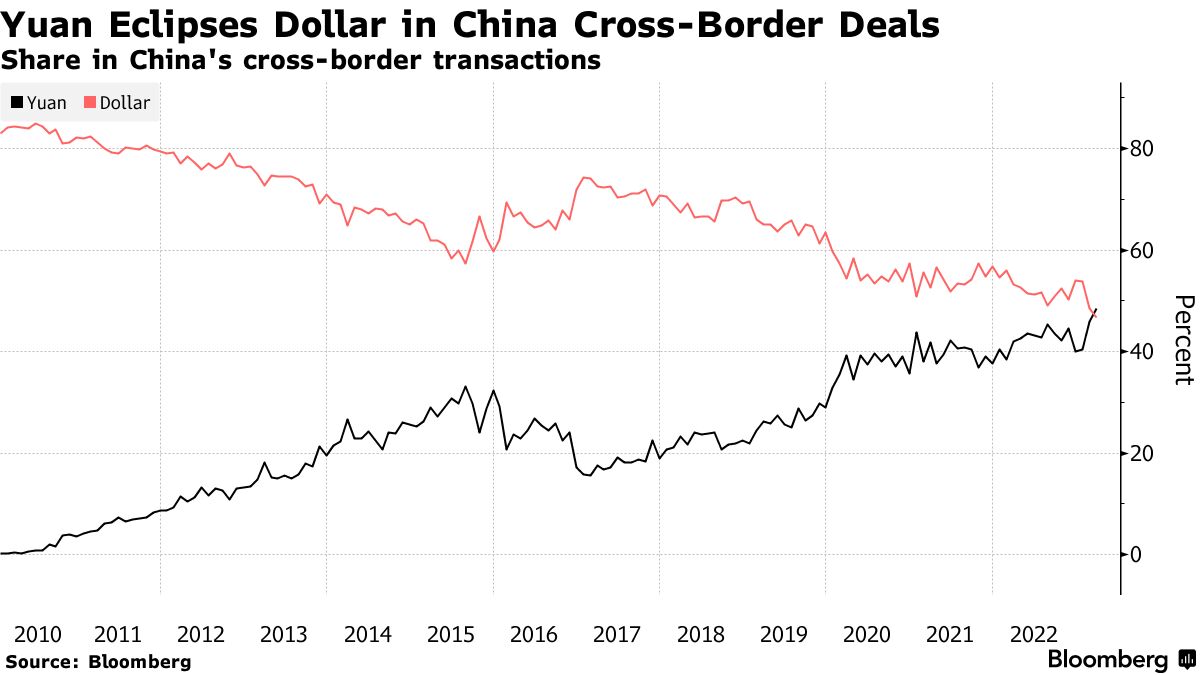

Yuan Overtakes Dollar as China’s Most Used Cross-Border Currency

Local currency’s share of China transactions rises to record Share in global transactions was little changed in March

26 April 2023 at 13:15 GMT+8

China passed another milestone in its bid to reduce reliance on the dollar, as yuan usage in its cross-border transactions jumped ahead of the greenback’s for the first time in March.

The local currency’s share of China’s cross-border payments and receipts rose to a record high 48% at the month end from nearly zero in 2010, according to research by Bloomberg Intelligence citing data from the State Administration of Foreign Exchange. The dollar’s share declined to 47% from 83% over the same period, the figures showed.

The ratio is calculated based on the volume on all types of transactions, which includes securities trading through the links between mainland China and Hong Kong’s capital markets. It doesn’t represent transactions used by the rest of the world — the yuan’s share in global payments was little changed at 2.3% in March, according to SWIFT.

“The rise in yuan usage could be a natural consequence of China opening up its capital account, with rising inflows for China bonds and outflows for Hong Kong stocks,” Stephen Chiu, chief Asia foreign-exchange and rates strategist at BI, wrote in a note.

The rising share allows local firms to reduce the risks of currency mismatch in transactions, a spokeswoman at the State Administration of Foreign Exchange said at a Friday briefing. China will further expand yuan settlement in cross-border transactions, the State Council said in a guideline aimed at boosting foreign trade issued Tuesday.

“Yuan internationalization is speeding up as other countries seek an alternative payment currency to diversify risks and as the credibility of the Federal Reserve is not as good as before,” said Chris Leung, an economist at DBS Bank. “But at the same time we are still talking about a long way from dollar dominance, and the yuan’s share in global payment might be forever small.”

— With assistance by Charlie Zhu, Wenjin Lv and Ran Li |