Nvidia: Now This Is Some Guidance

May 25, 2023

Bold Investor

Summary

- Nvidia's Q2 guidance far surpassed expectations.

- I estimate Nvidia's earnings for the next quarter and consider the outlook for the rest of the year.

- Nvidia looks poised to sequentially double its earnings per share next quarter.

- The rest of the year also looks bullish.

Justin Sullivan

Yesterday, Nvidia reported strong Q1 results, but the big story is the lofty guidance. In this piece, I will work through Nvidia's guidance and estimate the implied EPS for Q2, and also consider the outlook for the rest of the year. Based on the new information, I conclude that Nvidia should roughly double its EPS quarter-over-quarter, and this trend may continue for multiple quarters. Nvidia's valuation is not heroic in light of these new developments.

The Guidance

Nvidia provided the following guidance for Q2:

- Revenue: $11.0 billion, plus or minus 2%.

- Gross Margins: 68.6% (GAAP), 70.0% (non GAAP), plus or minus 50 basis points.

- Operating Expenses: $2.71 billion (GAAP), $1.90 billion (non-GAAP).

- Other income: $90 million (GAAP and non-GAAP), excluding gains and losses from non-affiliated investments.

- Tax rate: 14.0% (GAAP and non-GAAP), plus or minus 1%, excluding any discrete items.

Implied Earnings Per Share

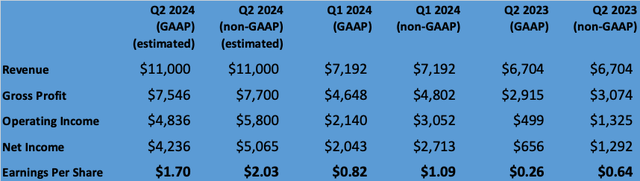

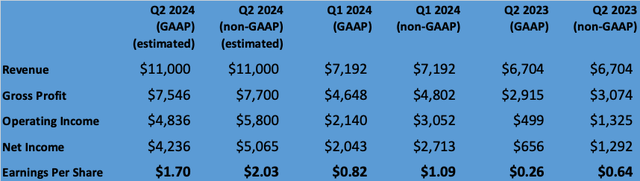

From the guidance provided, we can estimate Nvidia's expected Q2 earnings per share. Using the midpoint of Nvidia's guidance numbers and a diluted share count (as of the end of Q1) of 2,490 million, we derive the following results:

Nvidia Q2 outlook (Nvidia CFO's Commentary for Fiscal Q1 2024, Q2 2023, and author's calculations)

As we can see, if Nvidia delivers on its guidance, its EPS should roughly double sequentially to about $2/quarter, which gives us a run rate of about $8/year. The year-over-year growth is even more impressive, though slightly less relevant due to a weaker comparison quarter. At any rate, Nvidia's top and bottom lines seem poised for tremendous growth, and the updated guidance blows current analysts' estimates out of the water - before earnings, the consensus estimate was $1.07 for next quarter and $4.62 for fiscal 2024. Nvidia should handily surpass both figures.

Growth Will Likely Continue

Per the Q1 earnings call, Nvidia's lofty guidance is driven by outstanding growth in its AI business. As CFO Colette Kress noted, "when we talk about our sequential growth that we're expecting between Q1 and Q2, our generative AI large language models are driving the surge in demand." And to meet this escalating demand for AI chips, Nvidia is "substantially" increasing its supply in the latter half of the fiscal year. According to Kress, Nvidia is "working on both supply today for this quarter, but we have also procured a substantial amount of supply for the second half."

Although management did not quantify how "substantial" the increase in supply will be, it seems likely that Nvidia should see significant growth beyond Q2. Ramps in the semiconductor industry tend to span multiple quarters, so we should see Nvidia's supply - and via that its top and bottom lines - grow through at least the end of the year. This seems particularly likely given that, in addition to its H100 accelerators, Nvidia is also ramping output for a slew of other products, most notably its Grace and Grace Hopper chips which, per the earnings call, are currently "sampling with customers" (and should therefore be ramping for some time).

Hence, it seems likely that Nvidia should continue to grow its top and bottom lines at a solid clip over the rest of the year (and possibly beyond). Nvidia's EPS run-rate (after next quarter) will be about $8/year, and this could realistically become $10-12/year by the end of the year, perhaps with additional upside given how big a surprise the company's latest guidance is compared to analyst's expectations. At those levels, Nvidia's current valuation makes sense - and if rapid growth continues for a few quarters, it may very well be too low despite the massive increase over the last few months). We will have to wait and see, of course, but all signs from Nvidia are extremely positive for both Q2 and the remainder of the year.

Conclusion

For the time being, there is no real substitute for Nvidia's newest chips. The most likely alternative would be AMD's upcoming MI300 chip, but even if it is competitive, it will only launch at the end of the year and then require more time for production to ramp. So at least for a few quarters (and possibly longer), it should be smooth sailing for Nvidia. There may be challenges in the long run, of course, but for now investors can probably wait comfortably for a couple of quarters while Nvidia rapidly grows and then evaluate how the market for AI chips is evolving.

siliconinvestor.com |