Palantir: Fortunes Will Be Made

May 22, 2023

Summary: Palantir’s new AI platform could be a game changer for the business.There are also reasons to believe that Palantir’s stock could retain its momentum in the foreseeable future. At the same time, Palantir has everything going for it to continue to scale its business and create additional shareholder value along the way. Looking for a helping hand in the market?

Palantir (NYSE: PLTR) has all the chances to retain its momentum and extend the rally of its stock as the company is about to release its new AI platform that could help scale the business and create additional shareholder value along the way. Add to this the fact that major bearish arguments against investing in Palantir have become less relevant since the business is now profitable while stock-based compensations decrease with each year, and it becomes obvious that there’s nothing not to like about the company at this stage. Considering all of this, I continue to hold a long position in Palantir and believe that the company’s growth story is far from over despite all the challenges that its business is currently facing.

Palantir’s Growth Story Is Far From OverEarlier this month, Palantir unveiled its Q1 earnings report which showed that the company’s growth story is far from over. Despite the macroeconomic challenges, the company managed to increase its customer count by 41% Y/Y and closed 64 deals that were worth at least $1 million each. This has helped to improve the overall sales as Palantir’s revenue of $525.19 million during the quarter was up 17.8% Y/Y and above the estimates by $19.25 million. At the same time, Q1 has also become the second profitable quarter in a row and the management expects this trend to continue for the rest of the year.

There are several reasons why Palantir managed to report great results, and why it’s likely that it will be able to retain its momentum and continue to create additional shareholder value along the way. First of all, the company has started to scale its cloud-based software deployment solution Apollo, which itself became a standalone product only last year, by closing its first $1 million deal for it in Q1. With a total addressable market of over $1 trillion by the end of the decade, Palantir has everything going for it to capture some portion of the ever-growing cloud market thanks to the help of Apollo in the following years.

At the same time, in addition to the growing commercial business that generated $236 million in revenues in Q1, which is an increase of 15% Y/Y, Palantir is also likely to continue to receive new awards from various federal agencies due to the uniqueness of its software solutions. In Q1 alone, Palantir’s government revenues increased by 20% Y/Y to $289 million and thanks to the successful performance of its solutions on the battlefield in Ukraine, there are reasons to believe that the company’s platforms for the defense sector would remain in high demand in the foreseeable future.

In my other articles on Palantir, I’ve already noted how the company was spying on the Russian army on the eve of the invasion of Ukraine at the beginning of 2022 and how there was an indication that the business’s software is actively and successfully used on the battlefield by the Ukrainian army. Earlier this year, Palantir’s CEO Alex Karp admitted that the company’s software is indeed used for the targeting by Ukraine, while the company’s CTO Shyam Sankar in the latest conference call spoke publicly about his recent visit to the war-torn country by stating the following:

This past February, overlapping with our last earnings call, I had the opportunity to visit Ukraine and witness the incredible speed with which the Ukrainian forces were able to employ AI on the battlefield. It was clear that the future has already arrived.

This indicates that Palantir is not only able to help Ukraine repel the Russian invasion, but that its latest AI solutions are already being tested on a battlefield in real-time. Thanks to this, Palantir is likely to extend its lead in AI development over its competitors and help the company gain an edge in understanding how AI solutions could revolutionize software for government and commercial uses.

In his latest letter to the shareholders, Alex Karp stated that Palantir is about to unveil its new artificial intelligence platform to select customers this month, which would enable enterprises to leverage the power of large language models on their own datasets. The letter also indicates that there’s an organic interest in the new product and the company is currently mobilizing its sales teams to extend the potential reach of the new platform in the future. If successful, Palantir’s new AI platform could be a game changer for the overall business as the company could be ahead of others in AI development thanks to the fact that its solutions are already tested on a real battlefield.

Therefore, by having negotiation and pricing power due to the uniqueness and effectiveness of its software solutions, Palantir has everything going for it to continue to scale its business and create additional value at the same time for years to come. Add to this the fact that Palantir’s management expects the business to remain profitable for the rest of the year and grow its sales at a double-digit rate, and it becomes obvious that the company’s growth story is far from over.

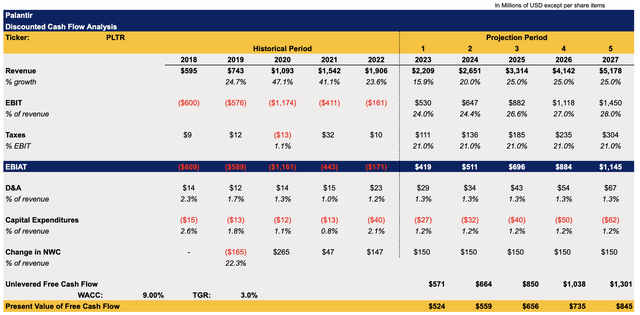

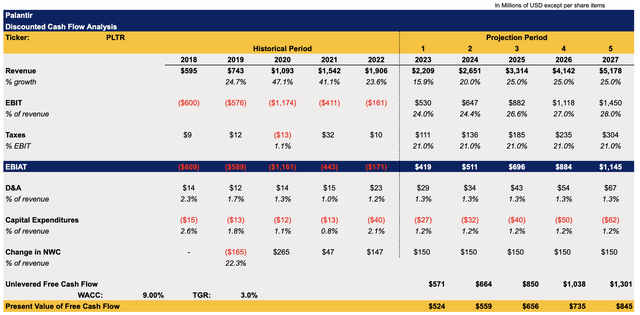

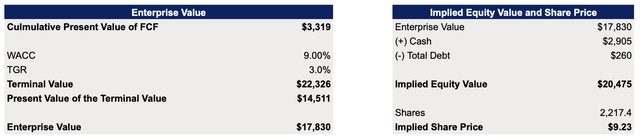

What’s Palantir’s Real Worth?With all of those growth opportunities, Palantir’s shares have everything going for them to keep the momentum going. The only question that remains is whether the upside is big enough to justify opening a position at the current levels. After all, my previous DCF model from late February showed that Palantir’s fair value is $9.03 per share, which is already below the market price due to the latest rally. To figure this out, I’ve updated the model below to better reflect Palantir’s performance in Q1 and the company’s potential improvement of its overall financials in the future.

The top-line growth rate expectations are mostly in-line with the street and management expectations for the next couple of years after which the annual revenue growth rate is capped at 25%. Considering that before 2022 Palantir’s management was expecting to grow the business by at least 30% annually through 2025, it makes sense to expect a growth of 25% in the future due to the potential improvement of the macroeconomic environment thanks to the beginning of the disinflationary processes. The expectations for earnings have been slightly improved as well since the latest earnings report showed that Palantir can exceed expectations thanks to the low-cost and high-margin nature of its business. All the other assumptions in the model mostly remained the same as before.

Palantir's DCF Model (Historical Data: Seeking Alpha, Assumptions: Author) Palantir's DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

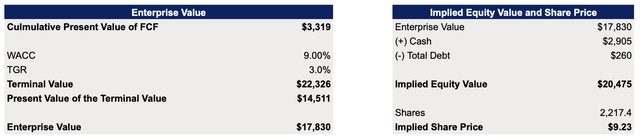

The updated model shows Palantir’s enterprise value to be $17.8 billion while its fair value is $9.23 per share, above the previous estimates but below the current market price.

Palantir's DCF Model (Historical Data: Seeking Alpha, Assumptions: Author) Palantir's DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

Even though at first it might seem like Palantir is now overvalued after the latest rally, I remain bullish about the company in the long run and believe that several other things need to be considered in addition to the valuation argument.

First of all, even in the current environment, Palantir is able to grow at an aggressive rate and if the macro environment improves next year, then the company would have an opportunity to improve its top-line growth rate even more. In such a scenario, this would lead to the upward revision of revenue assumptions and a subsequent improvement of fair value calculations. At the same time, if the disinflationary process accelerates and the Fed decides to cut rates next year, then the cost of capital for Palantir would also decrease and lead to a greater fair value as well.

On top of that, Palantir remains a growth stock that rarely trades close to its fair value during good times. Therefore, if the macroeconomic environment improves, then there’s a case to be made that Palantir’s shares would be able to aggressively appreciate and disconnect from its fundamentals as was the case before 2022 during the good times.

Risks To ConsiderConsidering the bullish argument that was presented above, the only major risk to Palantir’s growth story is the lasting unfavorable macroeconomic environment that has already destroyed the shareholder value last year and could suppress growth in the following quarters. If that’s the case, then fundamentals would outweigh various growth opportunities and kill the stock’s momentum that would result in its depreciation in the short to near term.

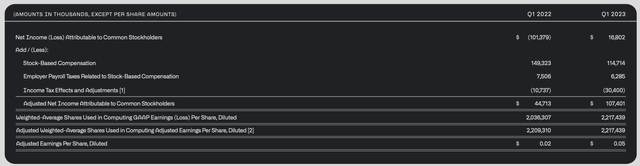

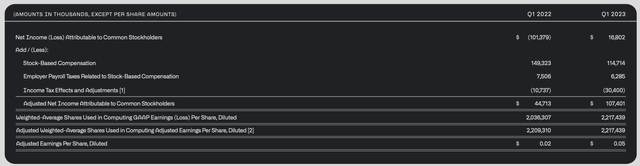

Other than that, there are no other major risks that could make it harder for Palantir to achieve its goals. The company is already profitable and is expected to remain so in the current environment, while the Y/Y decreases of stock-based compensation expenses each year indicate that the biggest bearish argument against investing in Palantir becomes irrelevant with each passing quarter.

Palantir's Financials (Palantir) Palantir's Financials (Palantir)

The Bottom Line Palantir’s successful performance in Q1 along with the expected further scaling of its business at an aggressive rate in the following years indicates that the company’s growth story is far from over. If the macroeconomic environment improves in the following quarters, then there’s a case to be made that Palantir’s shares would be able to appreciate even more as the uniqueness and the effectiveness of the company’s solutions in the enterprise software market would continue to give it an edge over others and outweigh the risks.

This article was written by

Bohdan Kucheriavyi

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, |