VanEck is bullish on gold, saying the precious metal will retake $2,075/oz

Jun. 15, 2023 11:09 AM ET

SPDR® Gold Shares ETF (GLD), IAU, GDX, NUGT SGOL, GLTR, DUST, SGDM, RING, OUNZ, JDST, GOAU, BAR, GLDM, AAAU, XAUUSD:CUR

By: Jason Capul, SA News Editor

8 Comments

Kumer/iStock via Getty Images Kumer/iStock via Getty Images

VanEck is bullish on gold ( XAUUSD:CUR) as the exchange traded fund issuer makes the case for gold to reach $2,075/oz.

At the moment, the precious metal trades near the $1,956/oz level which indicates that if VanEck were to be correct, gold has roughly a topside potential gain of roughly 6% from the current market price.

"Geopolitical tensions, lower U.S. dollar exposure in EM and a possible U.S. recession drive our gold price target. We make the case for gold reaching $2,075 and maintaining a higher floor price," VanEck stated in a recent investor note.

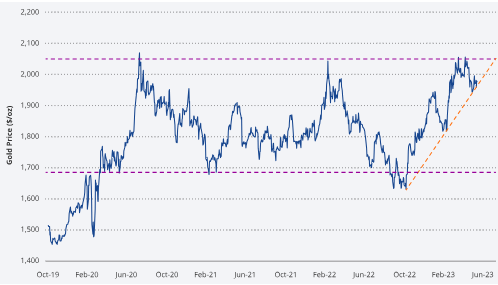

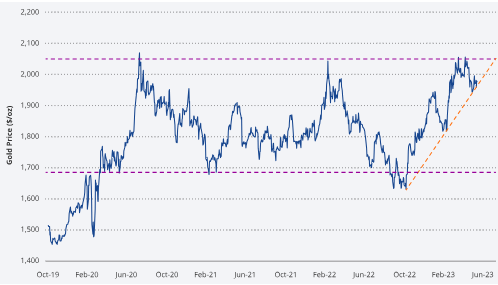

The ETF issue also highlighted that the $2,075/oz marker is a technical level that has been retested multiple times. First was during the 2020 COVID-19 outbreak, next was the 2022 Russian invasion of Ukraine, and thirdly was the retested level in early 2023 with Silicon Valley Bank collapse.

See below the technical chart where gold looks to attempt to break out to the top side.

For investors that share the same viewpoint on gold they may look towards exchange traded funds that offer access and exposure to the precious metal. Some funds include spot gold ETFs along with gold mining ETFs. See below a list of 15 popular gold focused ETFs along with their year-to-date returns.

No. 15: Direxion Daily Gold Miners Index Bear 2X Shares ETF ( DUST) -14.3%.

No. 14: Direxion Daily Junior Gold Miners Index Bear 2X Shares ETF ( JDST) -8.4%.

No. 13: Direxion Daily Gold Miners Index Bull 2X Shares ETF (NYSEARCA: NUGT) +0.7%.

No. 12: ABRDN Physical Precious Metals Basket Shares ETF ( GLTR) +0.8%.

No. 11: iShares MSCI Global Gold Miners ETF ( RING) +1.7%.

No. 10: Sprott Gold Miners ETF ( SGDM) +3.7%.

No. 9: VanEck Gold Miners ETF (NYSEARCA: GDX) +3.7%.

No. 8: iShares Gold Trust ETF (NYSEARCA: IAU) +6.2%.

No. 7: SPDR Gold Shares ETF (NYSEARCA: GLD) +6.2%.

No. 6: VanEck Merk Gold Trust ETF ( OUNZ) +6.3%.

No. 5: GraniteShares Gold Trust ETF ( BAR) +6.3%.

No. 4: Goldman Sachs Physical Gold ETF ( AAAU) +6.4%.

No. 3: ABRDN Physical Gold Shares ETF ( SGOL) +6.5%.

No. 2: SPDR Gold MiniShares ETF ( GLDM) +6.5%.

No. 1: U.S. Global GO GOLD and Precious Metal Miners ETF ( GOAU) +9.6%. |

Kumer/iStock via Getty Images

Kumer/iStock via Getty Images