Re <<It’s significantly more complex than rare earth minerals. There is a myriad of items on which both countries depend on each other.>>

I think you are correct. I am guessing as the galaxy is bifurcating, each halve of the galaxy shall and must be able to do what the other halve can do, might do, and want to do, and out of the duplication of efforts some 2 + 2 > 4 ought to make appearance, albeit at some cost.

The cost <=> benefit is irrelevant, therefore inflation in-in, and gold (sorry, I meant 'lovely lovely gold') ought to do ~ 6 - 8.0 - 10% per annum generally, barring spikes up and down, and barring sovereign seizure (which would only drive the pricing further up in all fiat currencies)

Somethings are making me feeling that Globalisation 2.0 and Cold War 2.0 are quite different from earlier edition of same-same.

(1) Cold War 2.0 latest (last two weeks?) is that because Russia & China making missile early warning systems interoperable and seamless, meaning without daylight in between stuff, five 'things' shall happen, the rumour goes

(1-i) China's supplementary but interoperable missile warning system shall face east, west, south, and south

(1-ii) Russia's supplementary but interoperable missile warning system shall face east, west, and partially south, and partially north (west of Ural mountain range)

(1-iii) China + Russia supplementary and interoperable missile warning system shall face north, but to be located in both the Arctic as well as Siberia, and with command nodes in both Russia and China, jointly staffed, for the Arctic, and sovereign staffed in Siberia

(1-iv) Russia shall help China to achieve nuclear parity w/ Russia,

(1-v) China shall help Russia to do intermediate-range rocketry parity w/ China, and to do orbital bombardment as necessary where rockets go in any direction, fly for any length of time, towards any direction, and unload hypersonic sub-munition at any place, conventional and nuclear

some of the above activities shall involve sharing of ideas, trading of stuff, and some shall involve build-operate-train-transfer. Cold War 2.0 is looking different than 1.0.

(2) Globalisation 2.0, under terms of mutual respect, equality of status, territorial integrity, national governance sovereignty, etc etc and all for one and one for all, BRICS+ as well as SCO expansion in the cards, starting with the upcoming session, and am guess goal is to proto-parallel the United Nations within 72 months. Believe first up includes Saudi Arabia and Iran both, possible one in each organisation, and be observer in the other, or skip the trial and each be in both entities.

Now below I am guessing more wildly, that the gaming shall entail ...

(3) Sovereign defaults shall mass-happen, to go well with mass debt jubilee

(4) Anyone shorting stocks are committing financial suicide

(5) Socialisation of pension losses must happen

(6) Cities burn due to dislocation of reset that must be expected, and digital currencies, 24-7 monitoring, networked and remote kill-switch cars make sense, same same social crediting, etc etc shall go wide and deep, else societal breakdowns happen

(7) I am not sure how Ukraine figures in all of the above but suspect Ukraine is balled up in the above

(8) W/r to Politico, I had been aware of the dysprosium but not the terbium issue, and haven't a clue of what either looks like, but they sound like acupuncture pressure points politico.com

Together, China and Myanmar produce 100 percent of the world’s “heavy” rare earth elements, primarily dysprosium and terbium. Distinguished from “light” rare earths by their higher atomic numbers, heavy rare earth elements “blanket” the strongest rare earths magnets to protect them from high temperatures, said Ryan Castilloux, founder of the independent research group Adamas Intelligence. They are used in stealth aircraft, missiles and other military equipment. “While China dominates production as a whole, its grip is greatest on the heavy rare earths,” he said. “It’s a relatively small, niche segment of demand overall, but very strategically important to almost any modern nation.”

... and Politico forgot to mention "yuchuanite-(Y)" because of publication date, so excusable :0)))

https://www.globaltimes.cn/page/202302/1285430.shtml China recently discovered a new rare-earth mineral in South China's Guangdong Province, which was named after a senior Chinese mineralogist Chen Yuchuan, further supporting rare-earth resources exploration in the region. According to the official website of the Institute of Mineral Resources under Chinese Academy of Geological Sciences (CAGS), the new mineral named yuchuanite-(Y) was discovered by Liu Peng, researcher of CAGS and associate professor of State Key Laboratory of Continental Dynamics under Northwest University (NWU), in Yushui copper mine which is located in northeastern Guangdong Province.

In the meantime, August 1st is the day, according to Bloomberg (heart medicine is also not rare, but if located in the bedroom and needed in the garage, a supply chain issue arises)

bloomberg.com

China Restricts Export of Chipmaking Metals in Clash With US

Beijing will limit gallium and germanium exports from Aug. 1 Both metals are indispensable for producing some chips

Alfred Cang

3 July 2023 at 23:45 GMT+8

China imposed restrictions on exporting two metals that are crucial to parts of the semiconductor, telecommunications and electric-vehicle industries in an escalation of the country’s tit-for-tat trade war on technology with the US and Europe.

Gallium and germanium, along with their chemical compounds, will be subject to export controls meant to protect Chinese national security starting Aug. 1, China’s Ministry of Commerce said in a statement Monday. Exporters for the two metals will need to apply for licenses from the commerce ministry if they want to start or continue to ship them out of the country, and will be required to report details of the overseas buyers and their applications, it said.

Read more: What Are Gallium and Germanium? Niche Metals Hit by China Curbs

China is battling for technological dominance in everything from quantum computing to artificial intelligence and chip manufacturing. The US has taken increasingly aggressive measures to keep China from gaining the upper-hand and has called upon allies in Europe and Asia to do the same, with some success. The export limits are also coming at a time when nations around the world are working to rid their supply chains of dependencies on overseas equipment.

Impact on the tech industry “depends on the stockpile of equipment on hand,” said Roger Entner, an analyst with Recon Analytics LLC. “It’s more of a muscle flexing for the next year or so. If it drags on, prices will go up.”

China is the dominant global producer of both metals that have applications for electric vehicle makers, the defense industry and displays. Gallium and germanium play a role in producing a number of compound semiconductors, which combine multiple elements to improve transmission speed and efficiency. China accounts for about 94% of the world’s gallium production, according to the UK Critical Minerals Intelligence Centre.

Still, the metals aren’t particularly rare or difficult to find, though China’s kept them cheap and they can be relatively high-cost to extract. Both metals are byproducts from processing other commodities such as coal and bauxite, the base for aluminum production. With restricted supply, higher prices could draw out production from elsewhere.

“When they stop suppressing the price, it suddenly becomes more viable to extract these metals in the West, then China again has an own-goal,” said Christopher Ecclestone, principle at Hallgarten & Co. “For a short while they get a higher price, but then China’s market dominance gets lost - the same thing has happened before in other things like antimony, tungsten and rare earths.”

Read More: Why the Fight for ‘Critical Minerals’ Is Heating Up: QuickTake

Other countries that produce gallium include Japan, South Korea, Russia and Ukraine, according to the CRU Group, a metals industry intelligence provider. Germanium is also produced in Canada, Belgium, the US and Russia.

Shares of companies that make compound semiconductors, such as Wolfspeed Inc. and NXP Semiconductors NV, were little changed or traded higher when US exchanges opened on Monday. A representative for Wolfspeed didn’t immediately respond to requests for comment. A spokesperson for NXP had no immediate comment.

China’s move comes after the US and its allies stepped up rhetoric against the country in recent weeks. US President Joe Biden’s administration is planning to block sales of some chips used to run artificial-intelligence programs, people familiar with the matter said last week. The Chinese government earlier this year banned US chipmaker Micron Technology Inc.’s products from some of its critical sectors after saying it found “relatively serious” risks in a cybersecurity review.

The Dutch government announced on Friday measures that will prevent ASML Holding NV — a company with a near-monopoly on the machines needed to make the most advanced semiconductors — from selling some of its machines to China.

— With assistance by Debby Wu, Thomas Seal, Clara Hernanz Lizarraga, Benoit Berthelot and Scott Moritz

(Updates with analyst comment in fourth paragraph, additional details throughout)

bloomberg.com

What Are Gallium and Germanium? Niche Metals Hit by China Curbs

China will limit exports of two key metals from August It’s the latest step in a tit-for-tat trade war on technology

Archie Hunter

4 July 2023 at 03:27 GMT+8

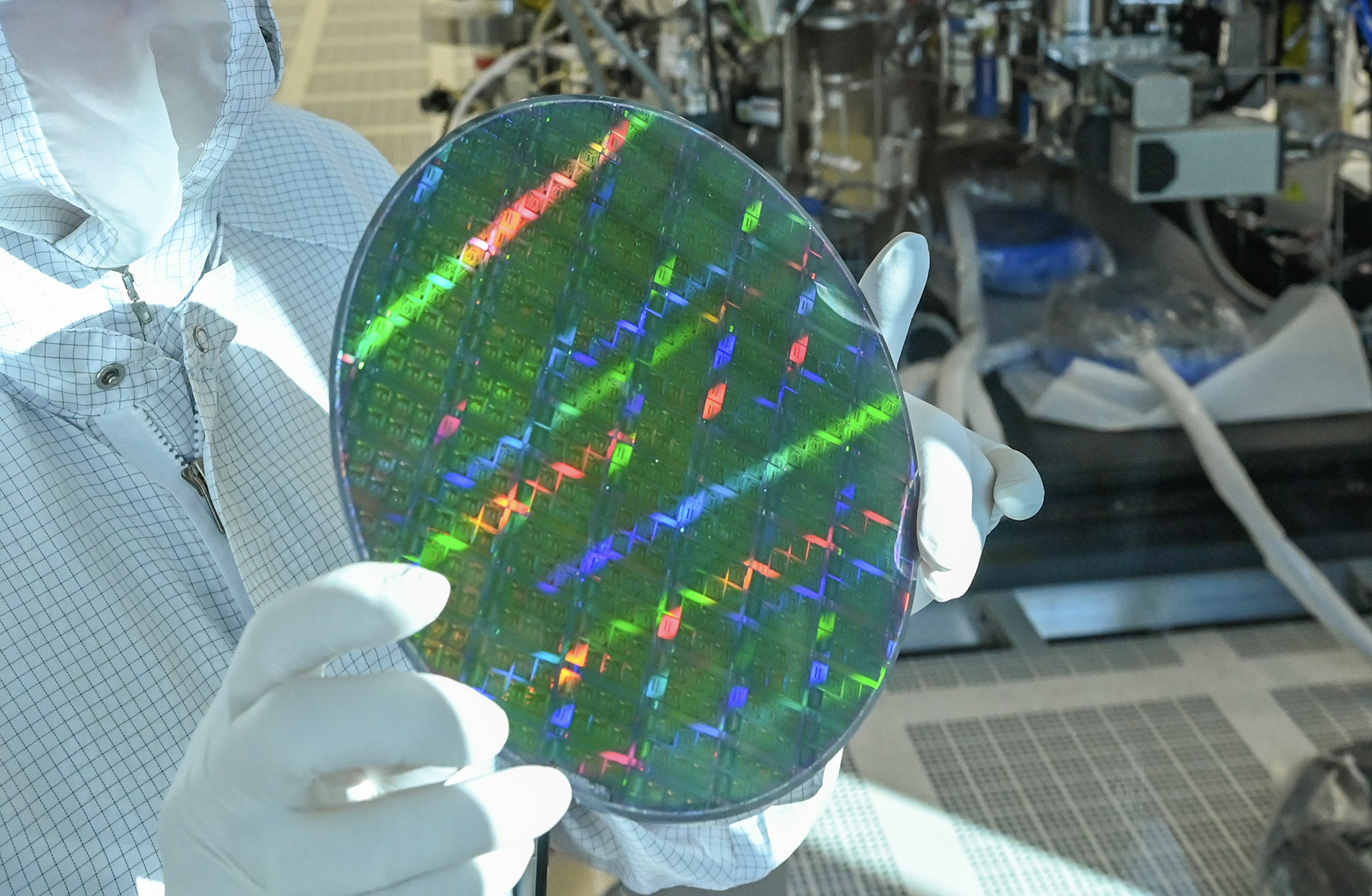

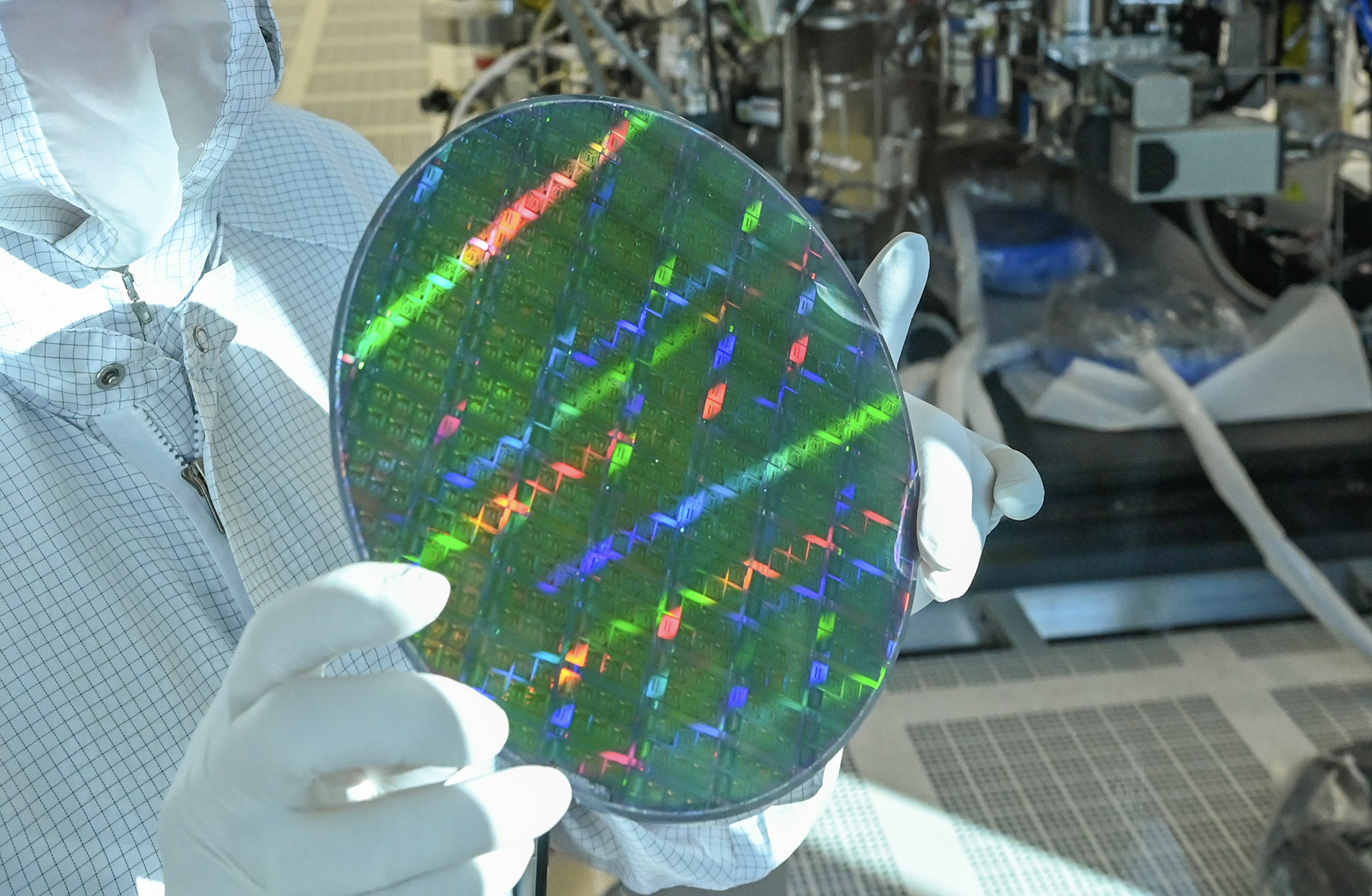

Photographer: Patrick Pleul/dpa-Zentralbild/picture alliance/Getty Images

China is clamping down on exports of two obscure yet crucial metals in an escalation of the trade war on technology with the US and Europe.

But what exactly are gallium and germanium and how important are they? Here’s a quick recap:

What happened?

Beijing announced it will impose curbs on both metals, along with their chemical compounds, in order to protect Chinese national security starting Aug. 1. Exporters will need to apply for licenses from the commerce ministry if they want to start or continue to ship them out of the country and will be required to report details of the overseas buyers and their applications.

What are gallium and germanium?

Both silvery-white in appearance and commonly classified as “minor metals,” the metals aren’t typically found on their own in nature. Instead, they’re produced in small concentrations as a byproduct from refineries focused on other, more mainstream raw materials like zinc or alumina.

The markets are tiny when compared with other commodities like copper or oil — for example, US imports of gallium metal and gallium arsenide wafers in 2022 were valued at only about $225 million according to government data. But their use in strategic industries mean that the curbs could still have far-reaching impact.

What are they used for?

The two metals have a vast array of specialist uses across chipmaking, communications equipment and defense. Gallium is used in compound semiconductors, which combine multiple elements to improve transmission speed and efficiency, in TV and mobile phone screens, solar panels and radars. Germanium’s uses include fiber-optic communication, night-vision goggles and space exploration - most satellites are powered with germanium-based solar cells.

How important is China?

Trade flows in these small and niche markets are tricky to track, but China is overwhelmingly the top source of both metals — accounting for 94% of gallium supply and 83% of germanium, according to a European Union study on critical raw materials this year.

And while both metals can be substituted, doing so could cost more and may hinder performance of the technology, according to CRU Group, a metals industry intelligence provider.

So can other countries produce more?

Neither metal is particularly rare, but processing costs can be high. Because China has exported them relatively cheaply for so long, there are few facilities elsewhere to extract the metals. As China increased its production, other countries including Germany and Kazakhstan have pared back.

But if China’s move sends prices soaring, analysts expect production from other suppliers will rise to meet demand.

Recycling could also be key. Factory-floor scrap already accounts for some supply, while germanium scrap is also recovered from the windows in decommissioned tanks and other military vehicles, according to the USGS.

Where else are the metals produced?

Excluding China, other countries with gallium production capacity include Russia and Ukraine, where the metal has been produced as a byproduct of alumina, as well as South Korea and Japan — as a byproduct of zinc. In North America, germanium is recovered alongside zinc, lead and other metals at Teck Resources Ltd.’s Trail smelter in British Columbia.

Other producers include specialty materials maker 5N Plus Inc., and Indium Corporation in the US. In Europe, Belgium’s Umicore SA is a producer of both metals.

And some mining projects contain higher concentrations of the metals and could offer an opportunity to increase supply — such as the Kipushi zinc project expected to start up next year in the Democratic Republic of Congo.

— With assistance by Ian King |