bonds

Add to myFT

Gap in borrowing costs between developing and emerging markets at 16-year low

Investors price in rate cuts in Latin America and eastern Europe as west tightens

Central banks in Latin America and eastern Europe acted more quickly to raise rates in response to inflationary pressures when economies reopened © Reuters Central banks in Latin America and eastern Europe acted more quickly to raise rates in response to inflationary pressures when economies reopened © Reuters

Gap in borrowing costs between developing and emerging markets at 16-year low on twitter (opens in a new window)

Gap in borrowing costs between developing and emerging markets at 16-year low on facebook (opens in a new window)

Gap in borrowing costs between developing and emerging markets at 16-year low on linkedin (opens in a new window)

Save

current progress 0%

Mary McDougall in London

32 MINUTES AGO

6 Print this page

Receive free Sovereign bonds updates

We’ll send you a myFT Daily Digest email rounding up the latest Sovereign bonds news every morning.

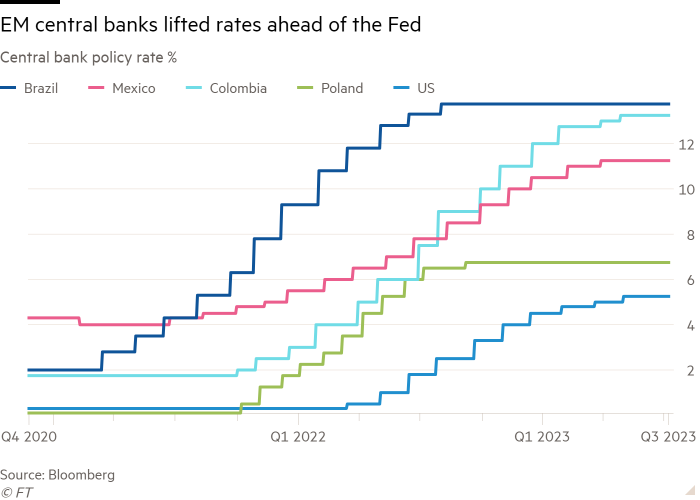

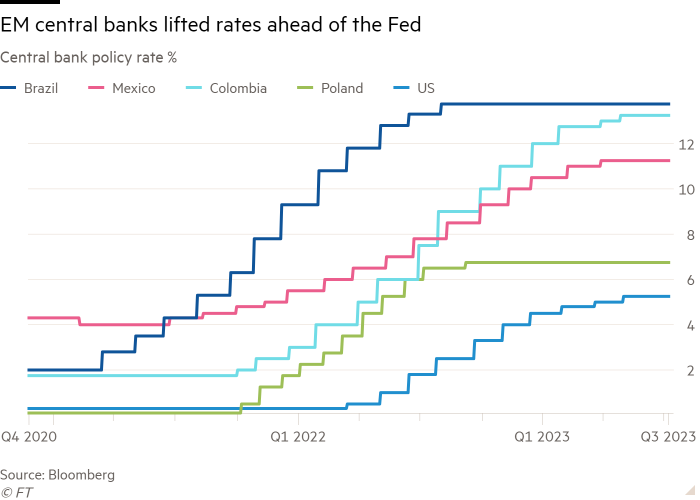

The gap in government borrowing costs between emerging and developed markets has fallen to the lowest level since 2007, as investors price in imminent interest rate cuts in some big emerging economies and further tightening in the west.

The spread this week fell to less than 2.9 percentage points, the narrowest in 16 years, down from 4.8 points a year ago, according to data from Allianz Global Investors.

“There has been a massive divergence between local currency emerging market debt and developed markets this year,” said Richard House, chief investment officer for emerging market debt at Allianz Global Investors.

“Investors are recognising the narrowing of the credibility gap between policymakers?.?.?.?Emerging markets have done a good job at navigating this inflation shock and I’m not sure you could say the same about some of the western central banks”.

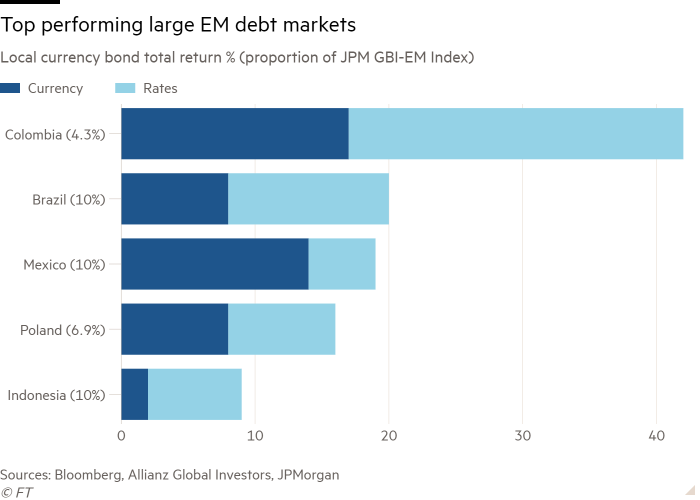

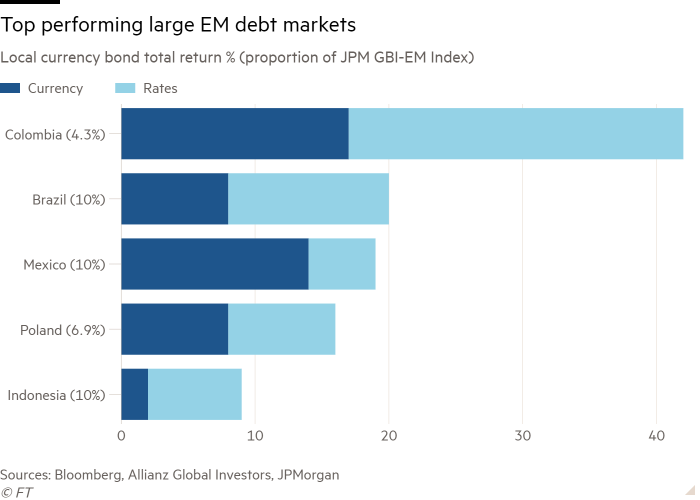

Central banks in Latin America and eastern Europe — regions that are home to the best performing bond markets in the world this year — acted more quickly to raise rates in response to inflationary pressures when economies reopened after coronavirus pandemic restrictions were eased.

JPMorgan’s widely-followed benchmark of emerging market local currency government bonds has delivered a 7.5 per cent total return year to date, boosted by the Latin American sub-index, which has risen 21 per cent, and by central and eastern Europe, which has gained 11 per cent.

In contrast, US government bonds have delivered total returns of just 1.6 per cent this year, as measured by an ICE Bank of America Index of government bonds, while German bonds — the de facto benchmark for the eurozone — have delivered total returns of 1.2 per cent.

Given the still high real yields on offer in emerging market debt, declining inflation and the prospect of rate cuts that should boost bond prices, many investors are positioning for further gains.

“Local currency rates and bonds present a very attractive opportunity over the next six months and beyond,” said Liam Spillane, head of emerging markets debt at Aviva Investors, singling out Mexico, Peru, South Africa, Czech Republic and Poland where he thinks markets have underestimated the potential for rate cuts.

Iain Stealey, international chief investment officer for fixed income at JPMorgan Asset Management, said he expected emerging market local currency bonds “to continue to do well given high real rates, central banks which are largely done with hiking and declining inflation”.

“Our preference is for countries with high real rates like Brazil, Mexico and Indonesia as well as countries where we expect inflation to fall sharply, like the Czech Republic,” he added.

Economic prospects across the developing world look relatively strong too. In a recent note to clients, Bank of America forecast that emerging economies will grow by an average of 4.1 per cent in 2024, ahead of a 0.5 per cent growth in the US, which would be the highest growth differential in a decade.

The performance of local currency debt reflects the relative resilience of some of the larger emerging economies, which typically have deep local bond markets. Smaller and less developed emerging markets, which rely more heavily on foreign currency borrowing, have struggled this year as rising bond yields in the west dim the appeal of their dollar-denominated debt.

Higher US interest rates have driven some countries that rely on dollar-denominated debt, including Pakistan, Tunisia and Egypt, into debt stress and closer to default, according to David Hauner, head of emerging market cross-asset strategy and economics at Bank of America.

“You have one very positive story which benefits the mainstream, more liquid markets and at the same time you have a silent debt crisis in the frontier markets,” Hauner said.

Copyright The Financial Times Limited 2023. All rights reserved.

Reuse this content(opens in new window)(opens a new window) CommentsJump to comments section

Latest on Sovereign bonds

News in-depth Kenya

‘We must tighten our belts’: Kenya searches for cash to meet debt bills

Municipal bonds

Municipalities aren’t going to drive US economic growth

Unhedged podcast16 min listen

Why the bond market matters now

Gilts

UK plans to overturn ban on ‘naked’ short selling in gilt market

Markets

Global stocks edge up as investors weigh inflation outlooks in US and China

Pensions industry

New York City pension boss shuns stocks as interest rates rise

US Treasury bonds

Surging real yields spark worries over buoyant stock market

Follow the topics in this article Sovereign bonds

Add to myFT Emerging market investing

Add to myFT Mary McDougall

Add to myFT

Comments

Feedback

Useful links

Support

View Site Tips Help Centre Contact Us About Us Accessibility myFT Tour Careers

Legal & Privacy

Terms & Conditions Privacy Policy Cookies Copyright Slavery Statement & Policies

Services

Share News Tips Securely Individual Subscriptions 4-b62d-cb33-4c278e6fdf61&cpccampaign=B2B_link_ft.com_footer]Professional Subscriptions Republishing Executive Job Search Advertise with the FT Follow the FT on Twitter FT Channels FT Schools

Tools

Portfolio Today's Newspaper (ePaper) Alerts Hub Business School Rankings Enterprise Tools News feed Newsletters Currency Converter

Community & Events

FT Community FT Live Events FT Forums FT Board Director Board Director Programme

More from the FT Group

Markets data delayed by at least 15 minutes. © THE FINANCIAL TIMES LTD 2023. FT and ‘Financial Times’ are trademarks of The Financial Times Ltd.

The Financial Times and its journalism are subject to a self-regulation regime under the FT Editorial Code of Practice.

×

×

archive.ph |

Central banks in Latin America and eastern Europe acted more quickly to raise rates in response to inflationary pressures when economies reopened © Reuters

Central banks in Latin America and eastern Europe acted more quickly to raise rates in response to inflationary pressures when economies reopened © Reuters