Grow up Mr Cox, and realize that your ability to suck off of us is coming to an end. The debt that the government has gone into to give you your incredible status of living for doing nothing is over.

September 15, 2023 | A Minsky Moment For Canada Has Arrived

Hilliard MacBeth

Visit Guest's Website

Canada’s Minsky Moment has arrived, as the demand for new credit slows and a substantial portion of household mortgage borrowers are not paying the interest on their debt, much less repaying the principal.

Hyman Minsky was an American economist who focused on the business cycle and debt. Since mainstream economics ignores debt, banking and financial cycles, Minsky was on the sidelines of the economics profession.

Minsky talked extensively about the phenomenon in history of long periods of economic stability and growth followed by a period of serious financial instability when debts have become too large, and a banking crisis ensues.

The housing and debt situation in Canada today is an excellent example of his description of the final phase of the financial cycle, which he called the Ponzi Finance stage. This stage occurs when some borrowers cannot pay even the interest on their debt, and many will never be able to repay the principal amounts owed.

Recent reports by bank lenders indicate that as many as 20 percent of all mortgage borrowers are in negative amortization, which means their monthly payments are smaller than the interest they owe each month according to the amortization schedule of their mortgage contract.

Other borrowers are able to make payments that cover their interest but have slipped in the repaying of the principal, which means their original 25-year term for the mortgage contract is now 30 or 35 years or even longer.

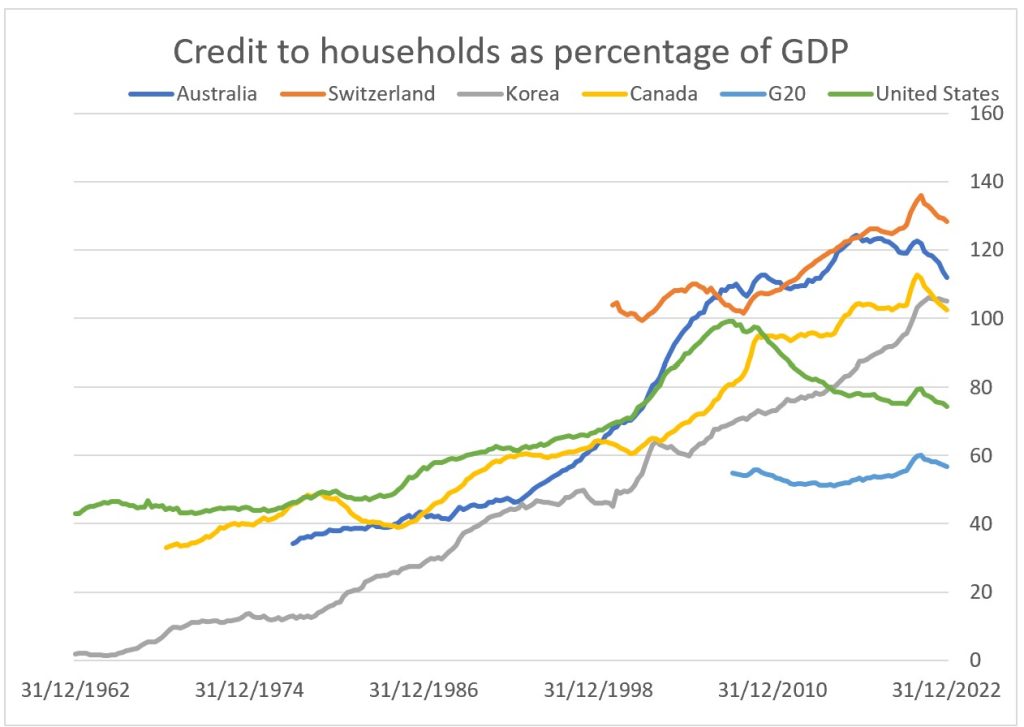

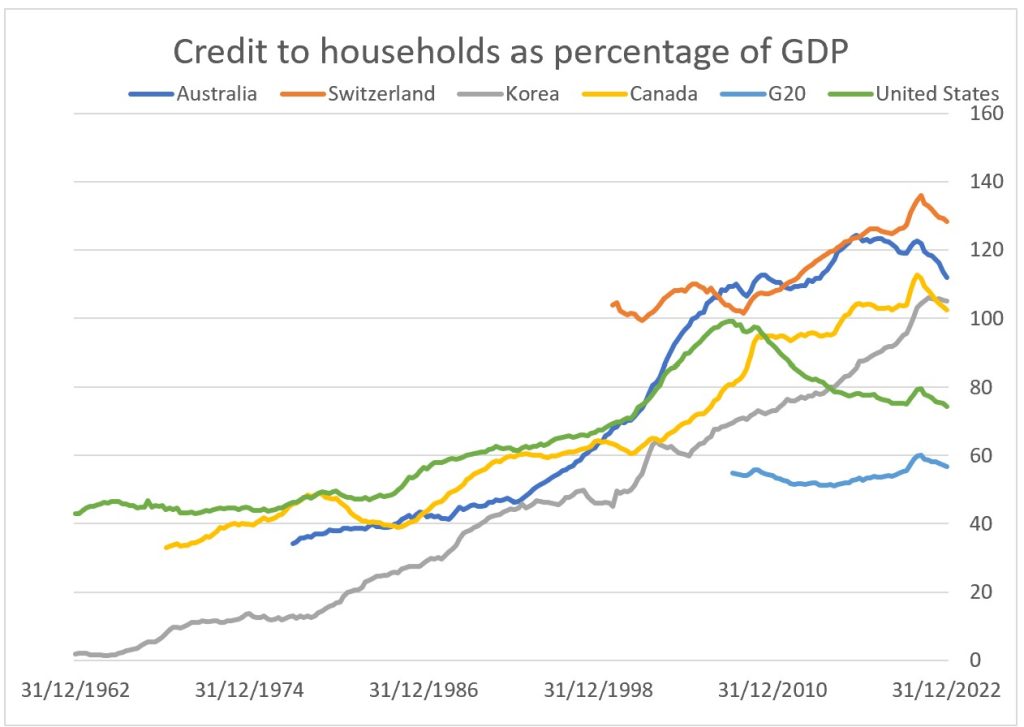

The Bank for International Settlements p rovides data showing Canada is one of only four countries where households debts are greater than 100 percent of GDP. Canada is at 102, Australia at 111, Korea at 105 and Switzerland is at 128. The U.S. is at 74 percent while the G20 average is even lower at 62 percent.

Source: BIS

Philip Colmar, of MRB Partners, in a recent op-ed piece in the Globe and Mail, makes a convincing argument that Canada’s massive housing and debt bubble is about to burst.

He attributes the development of the “massive housing bubble” to more than two decades of “cheap money and lax lending standards” and notes that “Excessive home prices are worrying, but mounting household debt burdens is where the outlook becomes ugly.”

He says, “Regardless, Canada will face a difficult decade ahead once the housing bubble begins to deflate. Policy makers will have their work cut out for them, as the day of reckoning is fast approaching.”

A Minsky Moment arrives when there’s a sudden shift to panic among lenders, investors and borrowers over debt.

When banks realize that customers cannot afford to pay even the interest on their loans, they apply much stricter lending standards.

The subsequent drop in the availability of credit leads to a decline in consumer demand for houses, autos, furniture and home renovations, and eventually to the forced sale of distressed assets.

As happened in the U.S. from 2006 to 2012, house prices will decline dramatically. Housing affordability is restored, but only after years of debt restructuring.

Hilliard MacBeth |