<< If indices fall, value might not go down.>>

Now depends on what you mean by "value". It is important not to mistake a Graham style value with a Buffett style (buy & hold). Not all value is equal as we have come to learn on the value thread so one needs to understand the type of company they bought and what category it fits into.

Having written that, one should also note that Graham mentioned that "value" stocks will be punished every bit and maybe more in a downturn. If you can raise cash during the period to keep chugging then great, but then why go through that headache? I would rather take advice from a writer like Harry Schultz who advocates for capital protection first and foremost. Who's to say in a real downturn you have the means to keep adding cash? What if you need to tap into the cash you would have had?

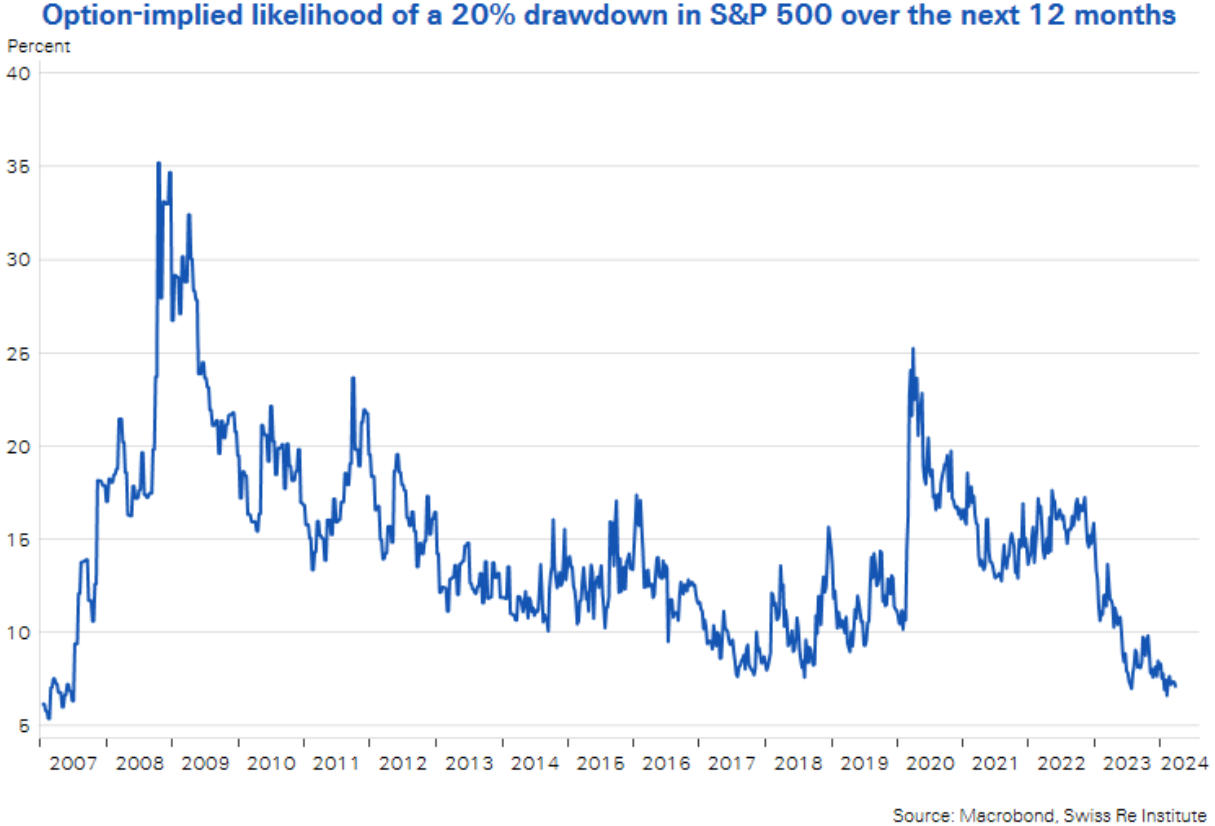

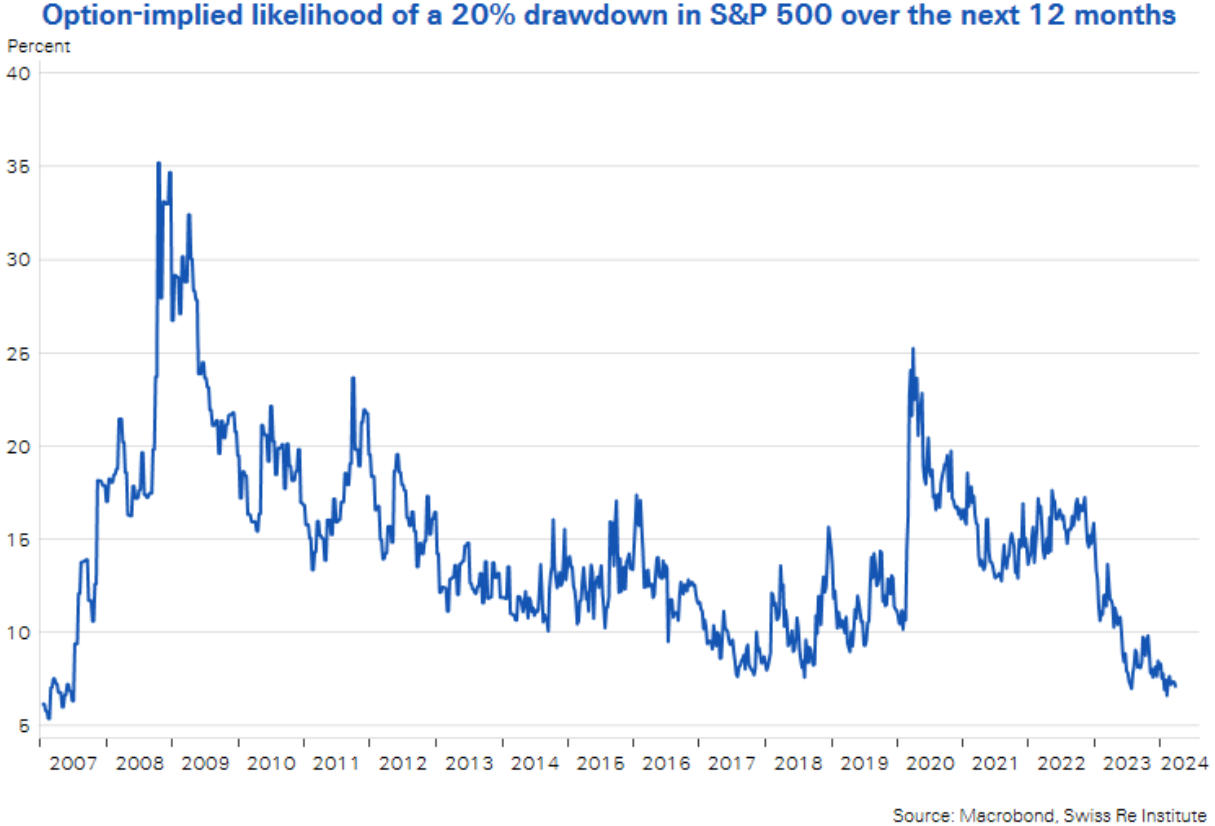

I saw this chart on X and it draws my eyes to the concern one should have. Option-implied likelihood of a 20% drawdown in the S&P (not just tech) over the next 12 months is at the lowest levels since 2007:

At this time I must take a contrarian view here and protect my capital. Why? Because at the first sign of trouble this chart tells me we're at risk of the market moving the other way to protect & crystalize those paper profits. Selling begets more selling in these situations.

<< if it were already undervalued at $10, wouldn't you buy? You don't know if it's going to fall.>>

I have had stocks that were undervalued and then dropped more making them SUPER undervalued. No point in standing in front of Mr. Market and watching an undervalued stock fall more. More to your point, you're right, I don't know if it will fall more, but the nice thing is I can change my stance quickly and deploy my capital if I am wrong. And if I'm wrong I didn't lose any money here did I? I may have missed a few gains, but not any money.

<< My new final check is "if the company falls 50% tomorrow, how would you feel?" In the past, many companies I bought, I wouldn't want to decline quickly. If BIDU or ELA fell 50% on Monday, I'd be comfortable with that.>>

Something I took from early Dr. Burry writing & even guys like Schultz is to take your profits. Set mental stops and review them daily to see where the stock is. Has support broken? If so, time to cut and move on to something else. I once did have the buy & hold mindset that folks like Buffett or even Lynch preach about, but it just doesn't work for me anymore. Not to mention Lynch had a pretty high turnover himself if I recall with somewhere around 300% in the early years and later down to somewhere around 100% - so even he didn't really live that.

Either way, one must invest how they are comfortable with. Like golf, you're really just competing against yourself out there. It's your money you lose if you're wrong and your money you make if you're right. What works for Buffett, Lynch, Burry, Sean, or Harshu is going to be completely different.

One must invest how they are comfortable. My gut is telling me to move out of the way for a bit and watch.

-Sean |