there was a sizable 10 yr auction today. Must not have gone too well.

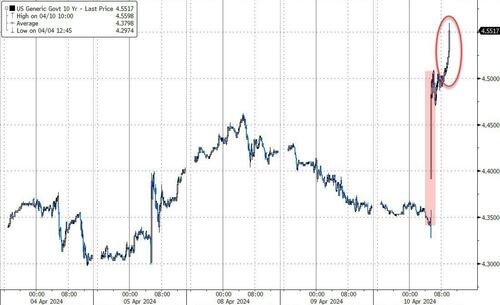

TNX taken out back and beaten silly

...and here it is:

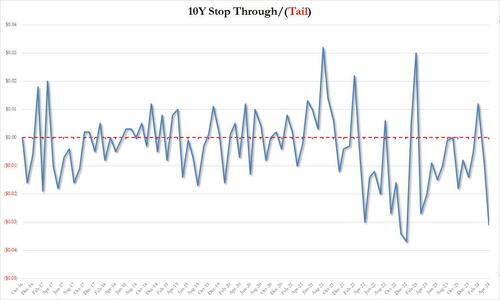

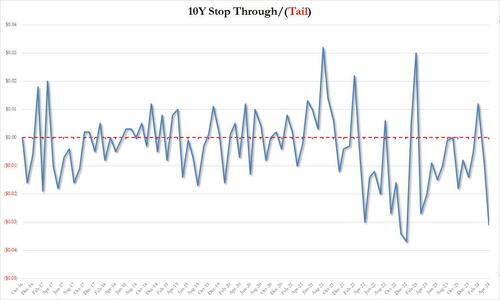

Yields Soar After Catastrophic 10Y Auction Shocks With 3rd Biggest Tail On Record

by Tyler Durden

Wednesday, Apr 10, 2024 - 07:20 AM

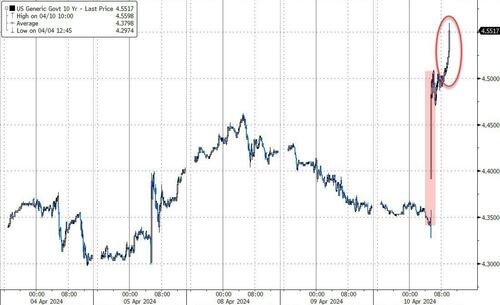

Earlier today we said that while the CPI report would be the day's main highlight, the real shocker should inflation come in hot, would be today's 10Y treasury auction. And when the Treasury sold $39 billion in a 9-Year 11-Month reopening moments ago, all hell broke loose.

Stopping at a high yield of 4.560%, this was not only almost 40bps higher than last month's 4.166% and the highest since October, it also tailed the 4.529% When Issued by a whopping 3.1bps, a surge compared to last month's tail of just 0.9bps, but also the highest tail since the 3.7bps in Dec 2022 and also the third largest tail on record!

[url=] [/url] [/url]

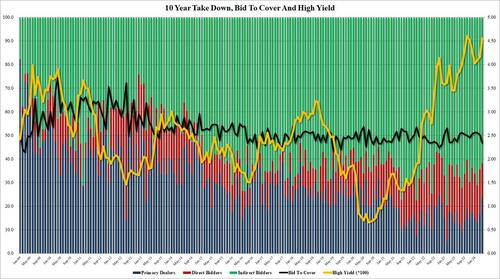

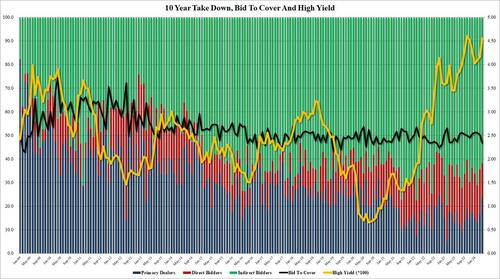

But wait, there's more: the Bid to Cover in today's auction tumbled to just 2.336, down from 2.512 in March and the lowest since Dec 2022; it was also well below the recent average of 2.49.

The internals were even uglier, with foreign buyers tumbling from an already low 64.3% to 61.8% the lowest since Oct 23 and far below the six-auction average of 65.9; and with Directs also sliding to just 14.2%, the lowest since Nov 21, Dealers ended up stepping up bigly and taking down a whopping 24.0%, the highest since November 22.

[url=] [/url] [/url]

The market reaction was instantaneous and brutal with 10Y yields, already trading at session and 2024 highs, spiking by 6 bps to another day high of 4.56%, and fast approaching a level where not only stocks will tumble but the entire economy collapses as it grinds to a halt, similar to where Biden's approval rating will be in the very near future.

[url=] [/url] [/url] |

[/url]

[/url] [/url]

[/url] [/url]

[/url]