SKIP NAVIGATION

Share Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

FINANCE

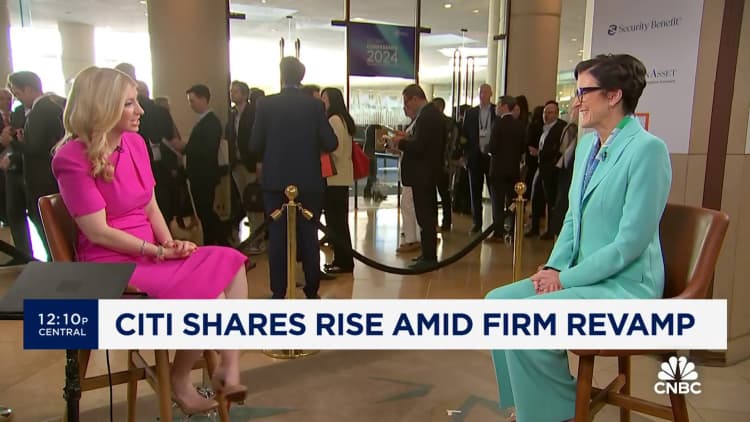

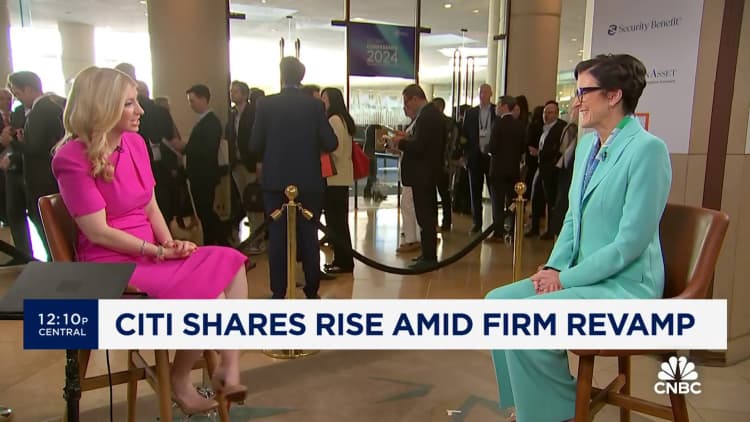

Citigroup CEO Jane Fraser says low-income consumers have turned far more cautious with spending

PUBLISHED MON, MAY 6 20243:22 PM EDTUPDATED MON, MAY 6 20243:45 PM EDT

Hugh Son @HUGH_SON

WATCH LIVE

KEY POINTS

- Citigroup CEO Jane Fraser said Monday that consumer behavior has diverged as inflation for goods and services makes life harder for many Americans.

- Fraser, who leads one of the largest U.S. credit card issuers, said she is seeing a “K-shaped consumer.”

- That means the affluent continue to spend, while lower-income Americans have become more cautious with their consumption.

WATCH NOW

VIDEO04:57

Citigroup CEO Jane Fraser: It’s hard to get a soft landing

Citigroup CEO Jane Fraser said Monday that consumer behavior has diverged as inflation for goods and services makes life harder for many Americans.

Fraser, who leads one of the largest U.S. credit card issuers, said she is seeing a “K-shaped consumer.” That means the affluent continue to spend, while lower-income Americans have become more cautious with their consumption.

“A lot of the growth in spending has been in the last few quarters with the affluent customer,” Fraser told CNBC’s Sara Eisen in an interview.

“We’re seeing a much more cautious low-income consumer,” Fraser said. “They’re feeling more of the pressure of the cost of living, which has been high and increased for them. So while there is employment for them, debt servicing levels are higher than they were before.”

The stock market has hinged on a single question this year: When will the Federal Reserve begin to ease interest rates after a run of 11 hikes? Strong employment figures and persistent inflation in some categories have complicated the picture, pushing back expectations for when easing will begin. That means Americans must live with higher rates for credit card debt, auto loans and mortgages for longer.

“I think, like everyone here, we’re hoping to see the economic conditions that will allow rates to come down sooner rather than later,” Fraser said.

“It’s hard to get a soft landing,” the CEO added, using a term for when higher rates reduce inflation without triggering an economic recession. “We’re hopeful, but it is always hard to get one.”

Don’t miss these exclusives from CNBC PRO

View More

VIDEO08:12

Watch CNBC’s full interview with Citigroup CEO Jane Fraser

TRENDING NOW

-

25 years in prison to 4 months: Inside the final verdict on a crypto billionaire CEO archrivalry

-

Americans can’t stop ‘spaving’ — here’s how to avoid this financial trap

-

‘Twist’ in Warren Buffett’s succession plan raises eyebrows among Berkshire’s Omaha faithful

-

UBS swings back to profit and smashes earnings expectations for the first quarter

-

Microsoft signs deal with Swedish partner to remove 3.3 million metric tons of carbon dioxide

FROM THE WEB

Florida real estate struggles as ‘motivated’ sellers flood marketFlorida is seeing its inventory of homes for sale skyrocket and price growth stagnate, largely due to homebuilders rushing to accommodate a flood of newcomers.CNBC

Jim Cramer blasts Starbucks CEO in a CNBC interview after horrible quarter: ‘I am stunned’Jim Cramer asked Starbucks CEO Laxman Narasimhan in an interview on CNBC why he should hold the stock for the Club portfolio for another quarter.CNBC

Hedge funds are ‘dead as a doornail,’ says chairman of ultra-rich investors’ club Tiger 21Hedge funds are “dead” as an investment asset class among members of Tiger 21, a network of ultra-high net worth investors, said founder Michael Sonnenfeldt.CNBC

Why hundreds of U.S. banks may be at risk of failureOf about 4,000 banks, 282 banks face threats from commercial real estate and higher interest rates, according to a study by Klaros Group.CNBC

MORE IN FINANCE

Guo Wengui chief of staff Yvette Wang pleads guilty to $1 billion fraud conspiracy in New YorkDan Mangan

MORE FROM CNBC

Buffett says Berkshire sold its entire Paramount stake: ‘We lost quite a bit of money’Yun Li

- News TipsGot a confidential news tip? We want to hear from you.

GET IN TOUCH - CNBC NewslettersSign up for free newsletters and get more CNBC delivered to your inbox

SIGN UP NOWGet this delivered to your inbox, and more info about our products and services.

- Advertise With Us PLEASE CONTACT US

© 2024 CNBC LLC. All Rights Reserved. A Division of NBCUniversal

Data is a real-time snapshot *Data is delayed at least 15 minutes. Global Business and Financial News, Stock Quotes, and Market Data and Analysis.

Market Data Terms of Use and DisclaimersData also provided by

|