Latest Snowy 2.0 business case a surprise, but batteries might eat its lunch

David Leitch

May 24, 2024

9

Share via Email

Commentary

Pumped Hydro

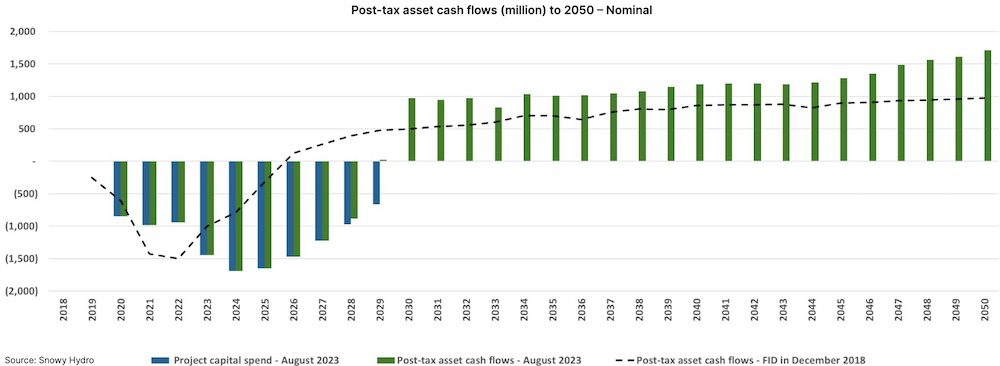

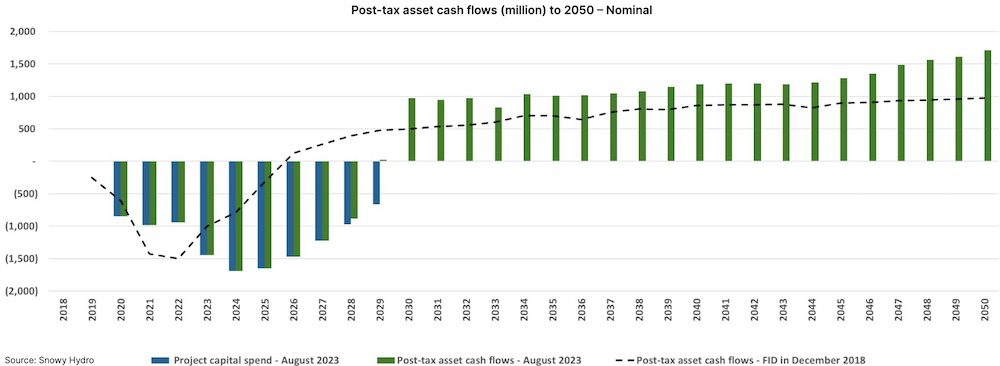

Snowy Hydro, just a few days after revealing the latest problems for its luckless tunnelling machine Florence, has published its updated (as of August 2023) business case on its website, which claims an increase in the project’s net present value, despite the blow out in costs.

I am a bit out practice at looking at Net Present Value (NPV) calculations, so reviewing this was a chance to get a bit of “match practice”.

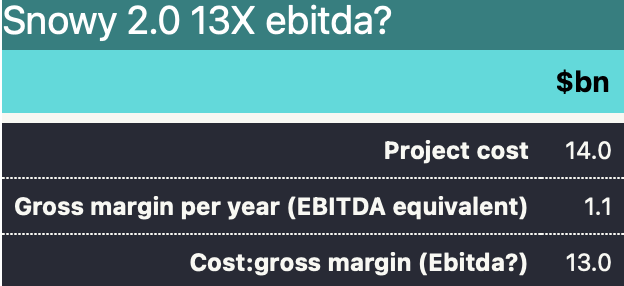

In the brief time available to review the numbers there is nothing that jumps out as being completely unreasonable. In fact, if we take Snowy’s estimate of annual after tax cash flows as reasonable, the project looks attractive. This was a surprise to me.

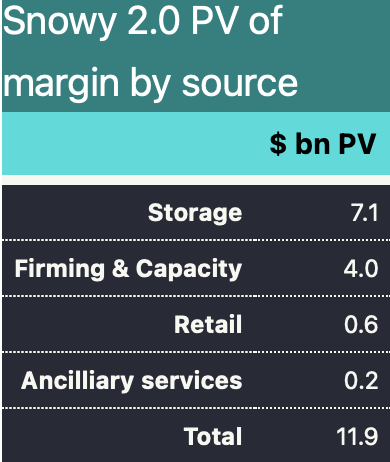

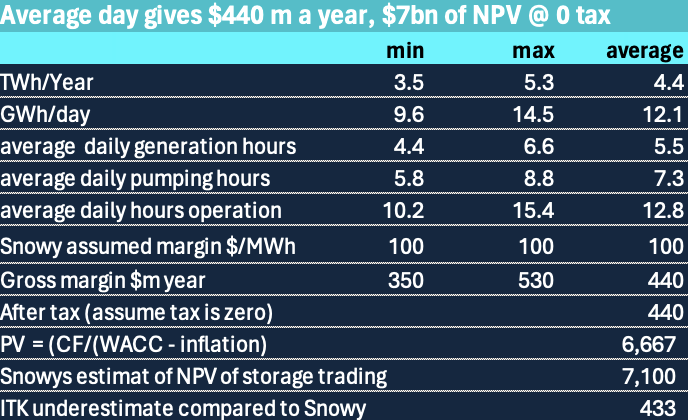

Although I barely scratch the surface on the biggest component of value – that is simple storage trading, which Snowy estimates is worth $7 billion based on earning an average trading margin of $100/MWh – my own calculations suggests it’s a reasonable estimate, in and of itself.

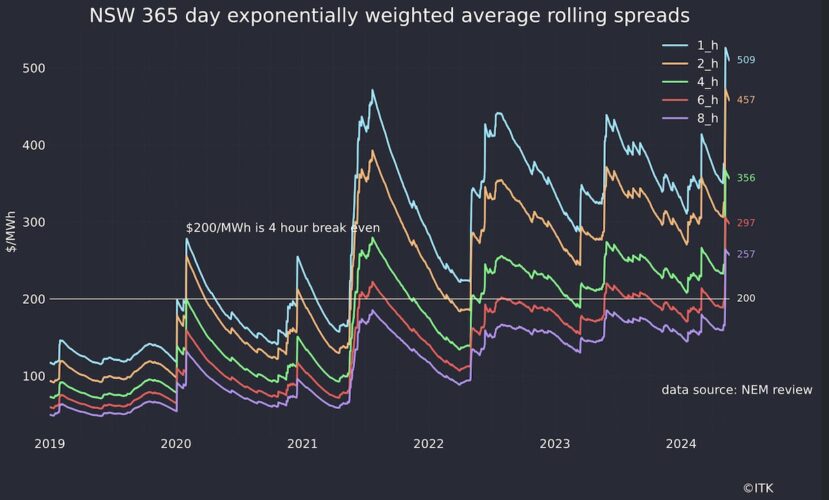

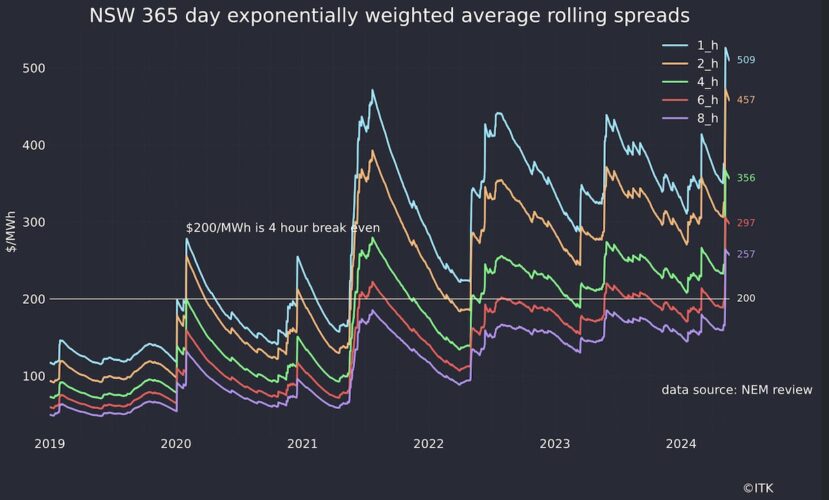

That is, I’d expect an asset that generates up to 2.2 GW with very large storage could earn $100/MWh for 4 to 6 hours per day. A battery needs double that margin to justify being built and historic margins have mostly been above $100.

However, I also think there will be lots and lots of competition in the storage trading space. Still, with margins over the past year closer to $300/MWh than $200 there is plenty of headroom for competition.

What I haven’t done is look at firming and capacity contracts, that are the second largest source of value, and nor have I looked at the integration of both them to check that for plausibility. Time for lunch.

Overview

Snowy 2.0 represents that for the first 15 years of operation it will earn roughly $1.2 billion of gross margin. The trading gross margin is the difference between the price electricity is sold for and the price paid for it, after adjusting for the round-trip efficiency factor of say 0.75. I also use storage margin or storage reward for the same concept.

The round trip efficiency has two consequences. First it means that to generate for 4 hours you have to pump for 5.3 hours. But when you pump for 5.3 hours it’s likely that the average cost per hour of pumping will be higher than if you only pumped for 4 hours. You get less choice in the hours to pump.

I have used $12 billion for cost which is Snowy’s number. At a minimum there is also capitalised interest to be considered. I would roughly estimate $0.5 billion.

I am happy to exclude most of the transmission costs. In the first place it’s normal to do so, no matter what some say. Secondly I specifically think the business case for Humelink and VNI West is very strong even if Malcolm Turnbull had never indulged his nation building urges.

However, the component of Humelink that is basically only used for connecting Snowy 2.0 should be legitimately added to project cost. Including that and the capitalised interest would likely get to $14 billion, even if there are no further increases.

Snowy 2 casual value. Source: Snowy, ITKe

Notice in the table below, the basically universal view of people selling business cases that things will get better in the far distant future. In this case, as the dollars are nominal, inflation is your friend.

Snowy 2,PV by year. Source:Snowy

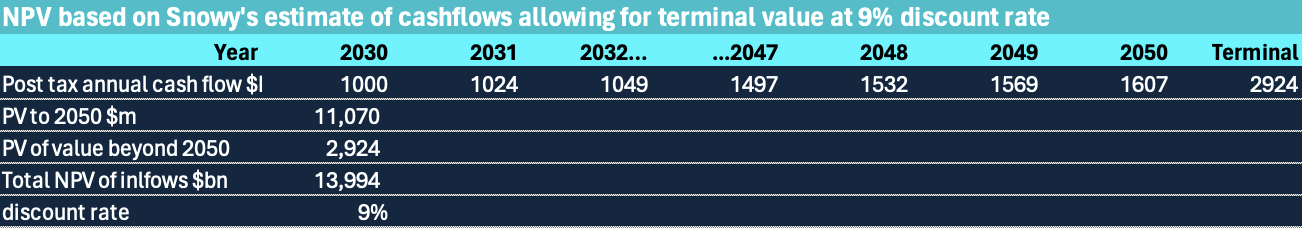

If we assume Snowy’s estimate of its after tax cash flows are accurate, then once we allow for the value beyond 2050 as little as it is, then I estimate the project’s underlying rate of return is about 9%.

Snowy IRR 9%?. Source:Snowy, ITKe Snowy IRR 9%?. Source:Snowy, ITKe

The vast majority of the value is created from the storage reward, but Snowy also plans to sell firming products. It is in a position to do this, up to a point, because of the quantity of stored energy and also its access to its own traditional generation capacity as a backup.

However, it cannot double-dip on the same MW for two different revenue streams at the one time. That is, it can’t be selling the same MW in the spot market and also firming someone else’s solar plant at the same time.

Snowy2 Margin by source. Source:Snowy

Snow’s NPV is a bit easier because volume is fixed. There is no growth

In most cases, much of the debate around the value of a business centres on forecasting the growth rate of cash flows. However, for an individual unit of production like a single factor, or in this case a pumped hydro project, the volumes have a fixed limit, the only variable to be forecast is the average price.

In saying that, Snowy 2.0 has a huge amount of storage – 175 GWh relative to any other long duration storage project. The mooted Borumba project has similar size in power capacity but even its 48 GWh is modest compared to Snowy 2.0.

I am well aware that the ability of Snowy to replenish its storage whenever it wants to is hotly contested, but I don’t propose to consider that in this note. I have zero knowledge on that topic.

Looking at the Storage gross margin

Before doing some specific analysis I can take some numbers I update every week on battery margins that assume a battery operator has perfect foresight and can pick the highest prices to generate at and lowest prices to pump at every day.

The red line is a six hour spread and the green 4 hours. Those margins over the past year average $297 and $356 per year. These are 3X the numbers assumed in the Snowy value case so very supportive.

Storage margins. Source:NEM Review, ITK Storage margins. Source:NEM Review, ITK

Equally, a new four-hour battery at recent CSIRO Gencost, which in this instance I think are well in the ballpark, requires between $200/MWh and $300MWh to justify the initial investment.

In practice, the batteries are built on the assumption that frequency regulation will provide some of the revenue. Like Snowy once the battery is built, it can undercut Snowy because Snowy’s round trip efficiency is worse than a battery.

Snowy says the design life is 150 years, whereas a battery design life is 20 years. Snowy’s capital cost goes up every year, whereas for the next decade or so battery costs will fall, say, 6% a year.

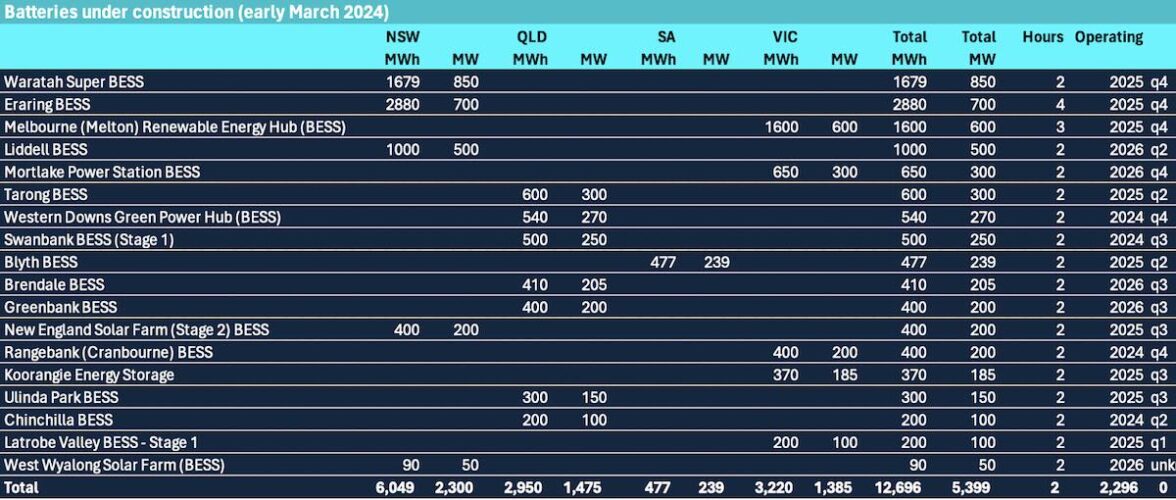

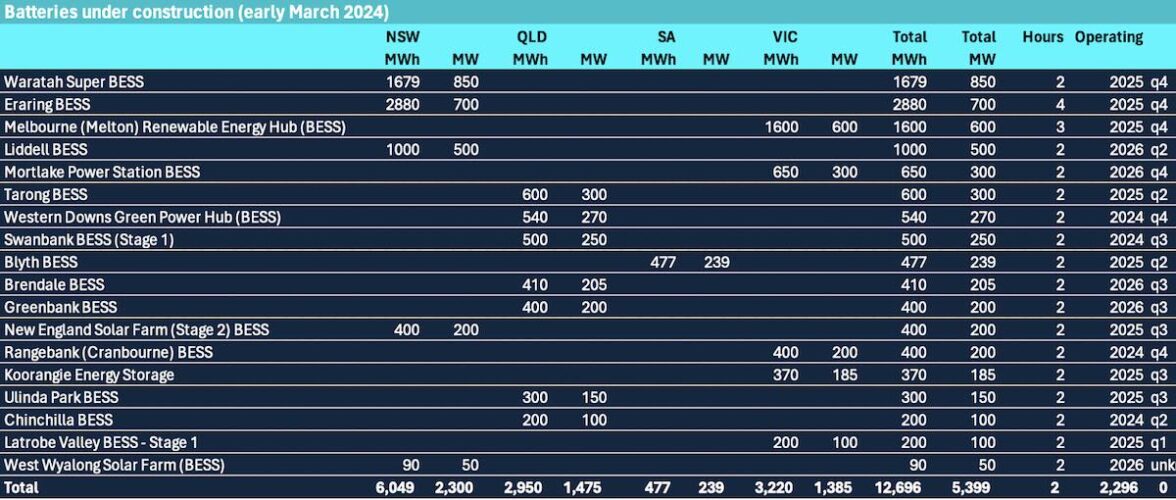

I have no doubt at all that when 5 GW of new batteries under construction are actually operating, and even assuming that only say 75% of that is devoted to trading, that margins will fall from the current levels.

Bateries being built. Source:www.renewmap.com.au Bateries being built. Source:www.renewmap.com.au

However, if margins fall to the $100/MWh assumed by Snowy the batteries will not recover their capital costs.

Looking at it in a fairly casual NPV perspective, my first guess is that if we ignore tax the numbers support Snowy’s estimate of the storage NPV at around $7 billion.

To see that, I made use of the “Gordon Growth formula.” This approximates the NPV of an anual cash flow as CFWACC-g where: CF=Cash Flow WACC=Weighted Average Cost of Capital g=Growth Rate (assumed to be inflation).

The TWh a year and assumed margin were supplied in the business case document. They are almost credible.

Finance 101 in 3 paragraphs

TL:DR – At the risk of boring readers, a reminder that the NPV (which my ex boss used to say stood for No Present Value) makes use of the concept that people will pay more for $1 that they get today compared to $1 in a year’s time and $1 received in two years’ time.

If the rate of interest is 10% you would pay 1/1.1 for $1 to be received in one year and $1.21 for $1 to be received in two years time and so on. By estimating the cash inflows and outflows for each year and choosing a discount rate one calculates the NPV.

Many a textbook has been written about the choice of discount rate which, for something involving risk uses the Weighted Average Cost of Capital (WACC). But the simplest and oldest version is the after tax cost of debt plus the cost of equity, using the proportions of each. The cost of equity is a long topic mainly because of the uncertainly around the appropriate measure of risk

NPVs involve forecasts of future cash flows which are highly uncertain. The NPV is also sensitive to the choice of discount rate and the number of years over which the cashflows are forecast.

However, for any reasonable discount rate, cashflows more than 30 years in the future have little impact on the NPV. Or, to put it another way, cash flows received in the earlier years of the project have a much bigger impact than out year ones.

David Leitch

David Leitch is a regular contributor to Renew Economy and co-host of the weekly Energy Insiders Podcast. He is principal at ITK, specialising in analysis of electricity, gas and decarbonisation drawn from 33 years experience in stockbroking research & analysis for UBS, JPMorgan and predecessor firms.

Share on Twitter

Share on Facebook

Share on Pinterest

Share on LinkedIn

Share on Reddit

reneweconomy.com.au

My comments:

Hydro still has a place but the vast amount of storage from now into the future is batteries.

They can be put practically anywhere on the grid or behind the meter in your home or business.

The future of large scale energy storage (electrical) has arrived.

Cheaper today than any other storage medium.

And that trend will only continue to get ever cheaper into the future.

Eric |