Sitka Announces Expansion of RC Gold Project with Acquisition of Victoria Gold's Clear Creek Property, Yukon

accesswire.com

Monday, 24 June 2024 08:00 AM

- New property acquisition from Victoria Gold completes amalgamation of contiguous district-scale gold camp at RC Gold Project in Yukon

- Victoria Gold now a significant shareholder with an initial 8% interest in Sitka Gold

- Adds four high-priority targets for intrusion related gold deposits

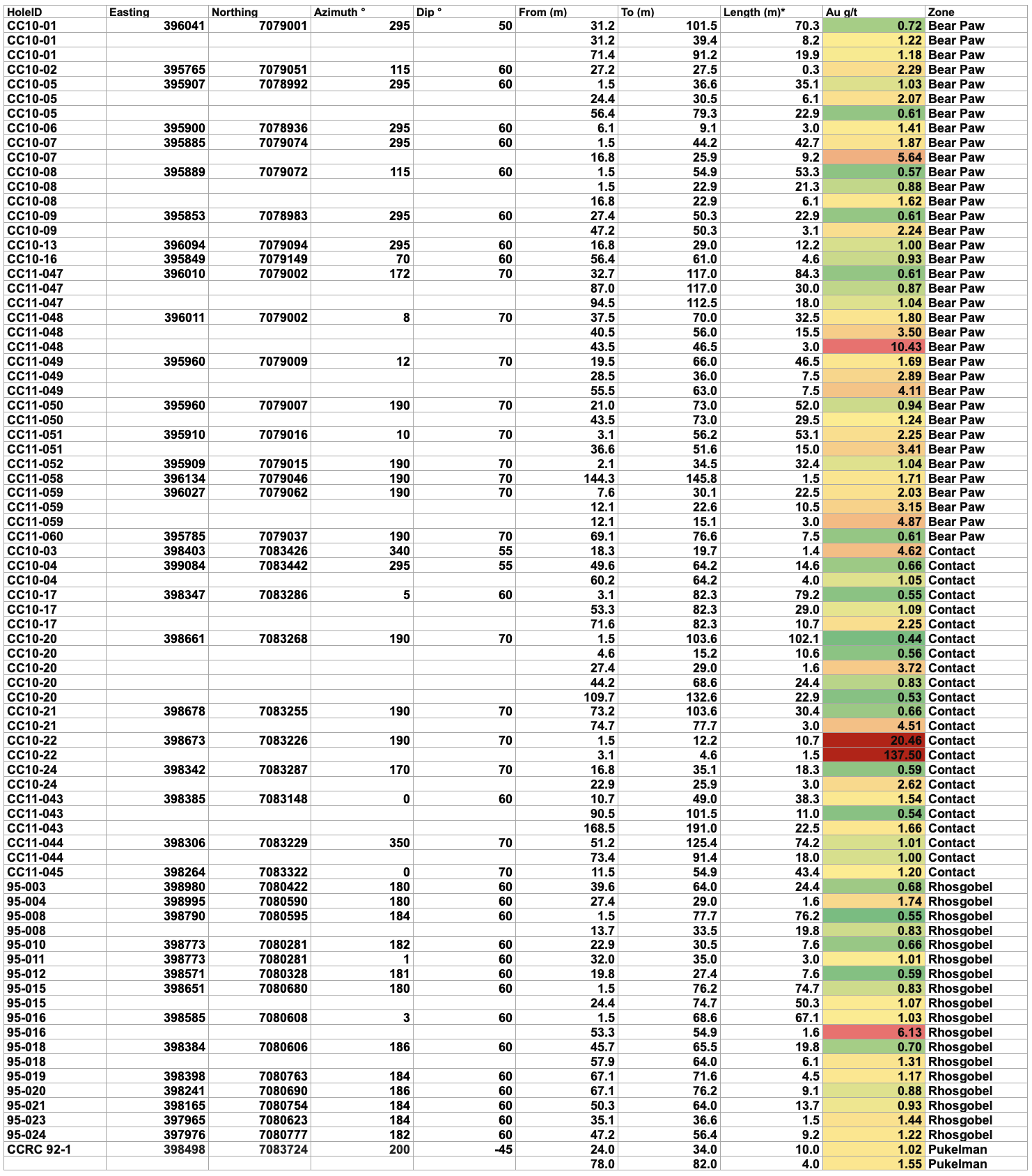

- Historical drill results of up to 20.46 g/t Au over 10.7 metres (Contact), 1.87 g/t Au over 42.6 metres (Bear Paw), 1.03 g/t Au over 67.1 metres (Rhosgobel) and 1.20 g/t Au over 10.0 metres (Pukelman)

- Newly identified mineralized corridor from Blackjack gold deposit projects over 5 kms through intrusions located on the newly acquired property

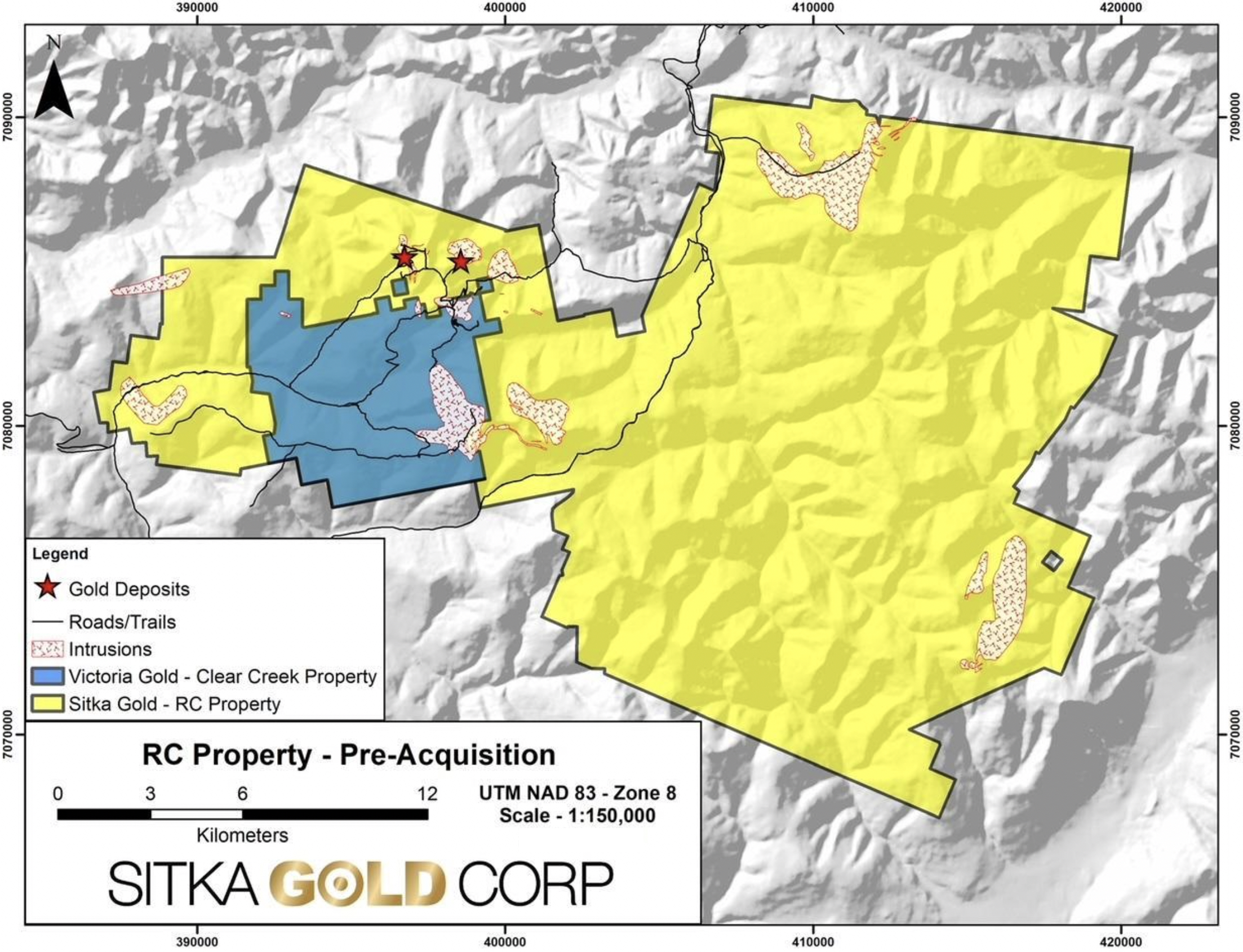

VANCOUVER, BC / ACCESSWIRE / June 24, 2024 / Sitka Gold Corp. ("Sitka" or the "Company") (TSXV:SIG)(FSE:1RF)(OTCQB:SITKF) announces that the Company has executed a definitive asset purchase agreement (the "Purchase Agreement") with Victoria Gold Corp. (the "Vendor") dated June 24, 2024 in connection with the acquisition (the "Acquisition") of a 100% interest in the Clear Creek property (the "Property"), located adjacent to the Company's RC Gold Project, (see Figures 1 and 2). The Clear Creek Property claims adjoin Sitka Gold's road accessible RC Gold Project ("RC Gold" or the "Project"), located approximately 100 kilometres east of Dawson City, Yukon and cover the southern portion of the Clear Creek Intrusive Complex. The Property encompasses several regions of intrusion-related gold mineralization that have undergone various levels of exploration, including historical reverse circulation and diamond drilling.

"We are very pleased to complete the purchase of the Clear Creek Property and to welcome Victoria Gold as a major new shareholder of the Company," said Cor Coe, Director and CEO of Sitka Gold. "The purchase of Victoria Gold's Clear Creek Property marks a significant milestone in the evolution of the RC Gold Project as it consolidates the entire Clear Creek Intrusive Complex under one owner. The newly acquired property has an excellent road network accessing the target areas allowing Sitka to effectively use capital to conduct low cost drilling within this newly discovered high-grade Reduced Intrusion Related Gold System. The potential for this area, including the newly acquired Clear Creek Property, to host several multi-million ounce intrusion related gold deposits is becoming more evident as we continue to systematically explore the region.

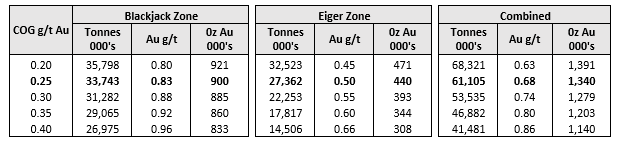

"Sitka's recent discovery of the Blackjack and Eiger deposits has proven that the district hosts very significant gold deposits, with the higher-grade, Blackjack gold deposit being the cornerstone to develop the potential of the region with an initial inferred 900,000 ounce resource from surface grading 0.83 g/t gold (see news release dated January 19, 2023). With the entire Clear Creek Intrusive Complex now under Sitka's 100% ownership we will be pushing to unlock value in this target rich area as we pursue additional discoveries while expanding these wide open deposits."

"We have been impressed with the exploration success that Sitka has demonstrated at its RC Gold Project," stated John McConnell, President and CEO of Victoria Gold. "Combining the RC Gold Project and Victoria's Clear Creek Property consolidates this new Yukon gold camp. Sitka has a strong exploration team with decades of experience in Yukon. We expect Sitka will have further success exploring the combined project and Victoria will benefit as a significant Sitka shareholder."

Figure 1 - RC Property prior to acquisition of Victoria Gold's Clear Creek Project. Figure 1 - RC Property prior to acquisition of Victoria Gold's Clear Creek Project.

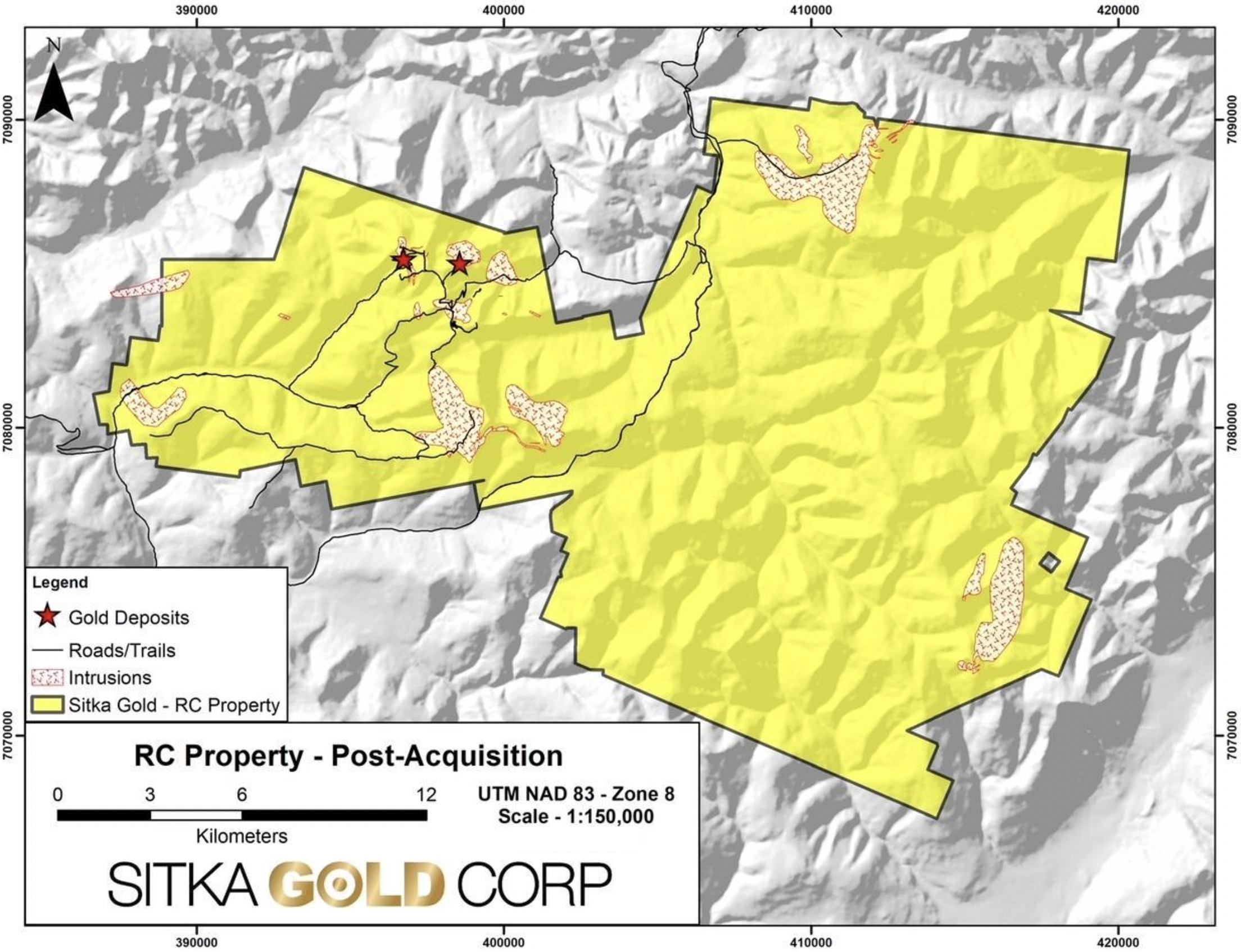

Figure 2 - Consolidated RC Gold Project after acquisition of Victoria Gold's Clear Creek Property. The RC Gold Project now encompasses the entire Clear Creek Intrusive Complex, a cluster of known gold-bearing intrusions in the heart of the Tombstone Gold Belt. Figure 2 - Consolidated RC Gold Project after acquisition of Victoria Gold's Clear Creek Property. The RC Gold Project now encompasses the entire Clear Creek Intrusive Complex, a cluster of known gold-bearing intrusions in the heart of the Tombstone Gold Belt.

Historical work in the Clear Creek district has mainly focused on the southern Clear Creek Intrusive Complex. In 1992 Noranda conducted the first drilling in the area targeting "Fort Knox" type mineralization with six holes testing the Pukelman Intrusion (See Table 1, Figure 3), Eiger Intrusion and Saddle area. The drilling in the Pukelman intrusion intersected sheeted quartz veining within megacrystic quartz monzonite which returned values of 1.02 g/t gold over 10.0 m from 26.0 m in RC-92-1 and 0.68 g/t gold over 16.0 m from 78.0 m in RC-92-1. In 1995, Kennecott conducted wide spaced shallow reverse circulation drilling on the Rhosgobel intrusion (See Table 1, Figure 3), identifying an east-west trending zone of sheeted quartz-tourmaline veining within megacrystic quartz monzonite, 1200 metres long, 200 metres wide, and 65 metres deep. No drilling has been conducted since Kennecott's initial drilling of this target. Highlights from Kennecott's drilling include CCRC95-15 which intersected mineralization over its entire 74.7m length grading 0.83 g/t gold, including 1.57 g/t gold over 6.1 m at the bottom of the hole. CCRC95-16 intersected 1.03 g/t gold over its entire length of 67.1 m including 1.43 g/t gold over the final 30 metres of the hole. In 1999, the Bear Paw Breccia Zone (See Table 1, Figure 3), a hydrothermal quartz breccia, was discovered by Redstar Resources with hole BP99-1, which intersected 26.7 m grading 2.00 g/t gold. In 2010 and 2011 Golden Predator drilled several zones on the property including the Contact Zone (See Table 1, Figure 3) intersecting 42.7 m of 1.87 g/t gold and 10.7 m of 20.46 g/t gold within sheeted veining hosted in metasediments and associated with an east-northeast trending structure and intrusive dykes along the southeast margin of the Pukelman intrusion. No drilling has been conducted on the Property since the 2011 program.

A large database of geological, geochemical, and geophysical information exists for the Property. The database of information combined with the increased understanding of the controls on mineralization developed by Sitka Gold suggests there is significant potential for the discovery of additional intrusion related gold deposits. A prime example is the recent drilling by Sitka that has identified a north-south trending structural corridor hosting higher-grade mineralization within the Blackjack deposit. The corridor trends southward from the Blackjack deposit through the Pukelman West intrusion and along the western margin of the Rhosgobel intrusion (see Figure 4) located on the Property. This structural corridor linking these intrusions appears to extend for over 10 kilometres and represents a significant exploration target.

Figure 3: Location of zones of gold mineralization that have had limited historical drilling within the newly acquired Clear Creek Property. Figure 3: Location of zones of gold mineralization that have had limited historical drilling within the newly acquired Clear Creek Property.

Figure 4: Plan map showing multiple priority target areas on the newly acquired Clear Creek Property and the newly identified Blackjack Mineralized Corridor that extends for over 10 kilometres through the Saddle, Pukelman West and Rhosgobel Intrusive Stocks. Figure 4: Plan map showing multiple priority target areas on the newly acquired Clear Creek Property and the newly identified Blackjack Mineralized Corridor that extends for over 10 kilometres through the Saddle, Pukelman West and Rhosgobel Intrusive Stocks.

Table 1: Significant drill hole results from the Clear Creek Property

*Intervals are drilled core length, as insufficient drilling has been completed at this time to determine true widths

Table References

- Robinson, S.D. and R. A. Doherty, 1988. Geological, Geochemical, Geophysical and Diamond Drilling 1988 Summary Report on the Rum, Rye and Roll Claims ((assessment report 092748)

- Feulgen, S. and J.C. Stephen, 1989, Initial Diamond Drilling Report on the Rain, Wind, Sleet Claims, Left Clear Creek, Yukon (assessment report 092752)

- Bidwell, G., 1993. Clear Creek Project, 1992 Reverse Circulation Drill Program (assessment report 093097)

- Coombes, S., 1995. 1995 Assessment Report on the Clear Creek Option; prepared by Kennecott Canada Inc. (assessment report 093372).

- Stammers, M.A., 2000. 1999 Geochemical and Diamond Drilling Assessment Report on the Clear Creek Property (assessment report 094058)

- Weeks, S. and R. Falls, 2001, 2000 Geological, Geochemical and Diamond Drilling Assessment Report on the Clear Creek Property (assessment report 94165)

- O'Brien, 2010;Assessment Report, 2010 Diamond Drilling Program, Clear Creek Property (Assessment report 095539)

- Shutty, 2011; Assessment Report, 2011 Exploration Program, Clear Creek Property (Assessment Report 095984)

Transaction Terms

Pursuant to the Purchase Agreement, the Company issued to Vendor an aggregate of 21,843,401 common shares in the capital of the Company (the "Shares") as an initial payment, representing 8% of the issued and outstanding shares of Sitka after giving effect to the issuance of the Shares. In order to complete the Acquisition, the Company is required to make the following additional payments (each a "Deferred Payment"):

- $2,000,000 on or before August 30, 2025;

- $3,000,000 on or before June 24, 2026; and

- $6,000,000 on or before June 24, 2027.

During the term of the Purchase Agreement while the Deferred Payments are pending, Sitka will act as operator of the Clear Creek Property and have control over its work programme. The Company may, in its sole discretion, satisfy any Deferred Payment in cash or through the issuance of such number of Shares as is equal to the amount of the applicable Deferred Payment based on the volume weighted average price of the Shares on the TSX Venture Exchange (the "Exchange") (or such other exchange upon which the Shares are then listed) for the 20 consecutive trading days immediately prior to the due date of the applicable Deferred Payment, provided however that in the event that any such Share issuance would result in the Vendor holding greater than 19.9% of the issued and outstanding Shares of the Company, the Company must first obtain: (i) the written consent of the Vendor to receive such Shares; and (ii) approval of the shareholders of the Company in accordance with Exchange policies.

As additional consideration, upon completion of the Acquisition, the Company will grant to the Vendor a 5.0% net smelter return royalty on the Property (the "NSR Royalty"). The Company shall have the right at any time following the grant of the NSR Royalty to purchase from the Vendor 60% of the NSR Royalty by way of a one-time cash payment of $10,000,000.

In the event that the Company publicly delineates proven and probable mineral reserves (within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") of 2,000,000 ounces or more of gold or gold equivalent on the Property, then the Company shall make an additional payment of $10,000,000 in cash to the Vendor within 60 business days of such public delineation. In the event that the Company has not made such public delineation before the fifth anniversary of the Purchase Agreement, then the Vendor shall have the right to cause an evaluation by an independent qualified person (within the meaning of NI 43-101) to be conducted as to the extent of the mineral resources on the Property, and, in the event such qualified person determines the existence of measured and/or indicated resources (within the meaning of NI 43-101) of 2,000,000 ounces or more of gold or gold equivalent on the Property, then the Company shall make the $10,000,000 cash payment to the Vendor within 60 business days.

In connection with the Purchase Agreement, the parties have entered into an investor rights agreement pursuant to which, among other things: (i) at any time in which the Vendor shall have beneficial ownership of at least 15% of the issued and outstanding Shares of the Company, the Vendor shall have the right to nominate one director to the board of directors of the Company; and (ii) the Vendor has been granted certain customary anti-dilution and registration rights.

About the flagship RC Gold Project

The RC Gold Project consists of a 431 square kilometre contiguous district-scale land package located in the heart of Yukon's Tombstone Gold Belt. The project is located approximately 100 kilometres east of Dawson City, which has a 5,000 foot paved runway, and is accessed via a secondary gravel road from the Klondike Highway which is usable year-round and is an approximate 2 hour drive from Dawson City. It is the largest consolidated land package strategically positioned mid-way between Victoria Gold's Eagle Gold Mine - Yukon's newest gold mine which reached commercial production in the summer of 2020 - and Victoria Gold's former producing Brewery Creek Gold Mine.

On January 19, 2023 Sitka Gold announced an Initial Mineral Resource Estimate prepared in accordance with National Instrument 43-101 ("NI 43-101") guidelines for the RC Gold Property of 1,340,000 ounces of gold(1). The road accessible, pit constrained Mineral Resource is classified as inferred and is contained in two zones: The Blackjack and Eiger deposits. Both of these deposits are at/near surface, are potentially open pit minable and amenable to heap leaching, with initial bottle roll tests indicating that the gold is not refractory and has high gold recoveries of up to 94% with minimal NaCN consumption (see News Release July 13, 2022). The Mineral Resource estimate is presented in the following table at a base case cut-off grade of 0.25 g/t Au:

RC Gold Inferred Mineral Resource Estimate

Notes

1. Mineral resource estimate prepared by Ronald G. Simpson of GeoSim Services Inc. with an effective date of January 19, 2023. Mineral Resources are classified using the 2014 CIM Definition Standards.

2. The cut-off grade of 0.25 g/t Au is believed to provide a reasonable margin over operating and sustaining costs for open-pit mining and processing

3. Mineral resources are constrained by an optimised pit shell using the following assumptions: US$1800/oz Au price; a 45° pit slope; assumed metallurgical recovery of 85%; mining costs of US$2.00 per tonne; processing costs of US$8.00 per tonne; G&A of US$1.50/t.

4. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

5. Totals may not sum due to rounding.

To date, 56 diamond drill holes have been drilled into this system for a total of approximately 19,962 metres including 16 drill holes totalling 6,515 metres completed in 2023 focused on expanding the initial resource. The drilling in 2023 produced results of up to 219.0 m of 1.34 g/t gold including 124.8 m of 2.01 g/t gold and 55.0 m of 3.11 g/t gold in drill hole DDRCCC-23-047 at Blackjack (see news release dated September 26, 2023). The Company recently completed two drill holes totalling 1,085 metres during the winter phase of a planned 15,000 metre diamond drilling program at the RC Gold Project for 2024.

(1) Simpson, R. January 19, 2023. Clear Creek Property, RC Gold Project, NI 43-101 Technical Report, Dawson Mining District, Yukon Territory

RC Gold Deposit Model

Exploration on the Property has mainly focused on identifying an intrusion-related gold system ("IRGS"). The property is within the Tombstone Gold Belt which is the prominent host to IRGS deposits within the Tintina Gold Province in Yukon and Alaska. Notable deposits from the belt include: Fort Knox Mine in Alaska with current Proven and Probable Reserves of 230 million tonnes at 0.3 g/t Au (2.471 million ounces; Sims 2018)(1); Eagle Gold Mine with current Measured and Indicated Resources of 233 million tonnes at a grade of 0.57 g/t Au at the Eagle Main Zone (4.303 million ounces; Harvey et al, 2022)(2); the Brewery Creek deposit with current Indicated Mineral Resource of 22.2 million tonnes at a gold grade of 1.11 g/t (0.789 million ounces; Hulse et al. 2020)(3); the Florin Gold deposit, located adjacent to Sitka's RC Gold project, with a current Inferred Mineral Resource of 170.99 million tonnes grading 0.45 g/t (2.47 million ounces; Simpson 2021)(4) and the AurMac Project with an Inferred Mineral Resource of 347.49 million tonnes grading 0.63 gram per tonne gold (7.00 million ounces)(5).

(1) Sims J. Fort Knox Mine Fairbanks North Star Borough, Alaska, USA National Instrument 43-101 Technical Report. June 11, 2018. s2.q4cdn.com

(2) Harvey N., Gray P., Winterton J., Jutras M., Levy M.,Technical Report for the Eagle Gold Mine, Yukon Territory, Canada. Victoria Gold Corp. December 31, 2022. vgcx.com

(3) Hulse D, Emanuel C, Cook C. NI 43-101 Technical Report on Mineral Resources. Gustavson Associates. May 31, 2020. minedocs.com

(4) Simpson R. Florin Gold Project NI 43-101 Technical Report. Geosim Services Inc. April 21, 2021. sedar.com d=4984158

(5) Banyan Gold News Release Dated February 7, 2023 (Technical Report to be filed within 45 days of news release) banyangold.com

Upcoming Events

Sitka Gold will be attending and/or presenting at the following events*:

- Yukon Mining Alliance Property Tours, Dawson City, Yukon: June 20 - 26, 2024

- Takestock Investor Forum, Stampede Event, Calgary, Alberta: July 3, 2024

- Precious Metals Summit, Beaver Creek, Colorado: September 10 - 13, 2-024

*All events are subject to change.

About Sitka Gold Corp.

Sitka Gold Corp. is a well-funded mineral exploration company headquartered in Canada. The Company is managed by a team of experienced industry professionals and is focused on exploring for economically viable mineral deposits with its primary emphasis on gold, silver and copper mineral properties of merit. Sitka is currently exploring its flagship RC Gold Project within the Tombstone Gold Belt in the Yukon Territory with a 15,000 metre diamond drill program planned for 2024. The company is also advancing the Alpha Gold Project in Nevada and currently has drill permits for its Burro Creek Gold and Silver Project in Arizona and the Coppermine River Project in Nunavut.

*For more detailed information on the underlying properties please visit our website at www.sitkagoldcorp.com

The scientific and technical content of this news release has been reviewed and approved by Cor Coe, P.Geo., Director and CEO of the Company, and a Qualified Person (QP) as defined by National Instrument 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS OF

SITKA GOLD CORP.

"Donald Penner"

President and Director

For more information contact:

Donald Penner

President & Director

778-212-1950

dpenner@sitkagoldcorp.com

or

Cor Coe

CEO & Director

604-817-4753

ccoe@sitkagoldcorp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary and Forward-Looking Statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward-looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions with respect to, among other things, the Company's anticipated work programs; the anticipated benefits of the Acquisition; the expected completion of the Acquisition and the timing thereof; the consideration payable pursuant to the Acquisition and the timing thereof; and expectations regarding exploration on the Company's mineral properties.

In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that the benefits of the Acquisition will be as expected; that the Acquisition will be completed on the timing anticipated; that the Company will complete its proposed work programs; and that exploration results on the Company's mineral properties will be anticipated.

These forward-looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, market uncertainty; the results of the Company's anticipated work programs; the risk that the Acquisition will not close on the timetable anticipated or at all; risks related to reliance on technical information; risks related to exploration and potential development of the Company's projects; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; and uncertainty as to timely availability of permits and other governmental and stock exchange approvals.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

SOURCE: Sitka Gold Corp |

Figure 1 - RC Property prior to acquisition of Victoria Gold's Clear Creek Project.

Figure 1 - RC Property prior to acquisition of Victoria Gold's Clear Creek Project. Figure 2 - Consolidated RC Gold Project after acquisition of Victoria Gold's Clear Creek Property. The RC Gold Project now encompasses the entire Clear Creek Intrusive Complex, a cluster of known gold-bearing intrusions in the heart of the Tombstone Gold Belt.

Figure 2 - Consolidated RC Gold Project after acquisition of Victoria Gold's Clear Creek Property. The RC Gold Project now encompasses the entire Clear Creek Intrusive Complex, a cluster of known gold-bearing intrusions in the heart of the Tombstone Gold Belt. Figure 3: Location of zones of gold mineralization that have had limited historical drilling within the newly acquired Clear Creek Property.

Figure 3: Location of zones of gold mineralization that have had limited historical drilling within the newly acquired Clear Creek Property. Figure 4: Plan map showing multiple priority target areas on the newly acquired Clear Creek Property and the newly identified Blackjack Mineralized Corridor that extends for over 10 kilometres through the Saddle, Pukelman West and Rhosgobel Intrusive Stocks.

Figure 4: Plan map showing multiple priority target areas on the newly acquired Clear Creek Property and the newly identified Blackjack Mineralized Corridor that extends for over 10 kilometres through the Saddle, Pukelman West and Rhosgobel Intrusive Stocks.