Just out, new and updated.

Eric

LCOE of Solar & Wind Still Super Cheap — New Lazard Report

10 mins ago

Zachary Shahan Tell Us What You're Thinking!

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Lazard recently released its latests analysis of LCOE (levelized cost of energy) for different power sources. As has been the case for the past several years, solar and wind power remain highly competitive (aka cheap). However, estimates on the high end of the price range have come down a bit while estimates on the low end of the price range have risen a little for the first time in years ever.

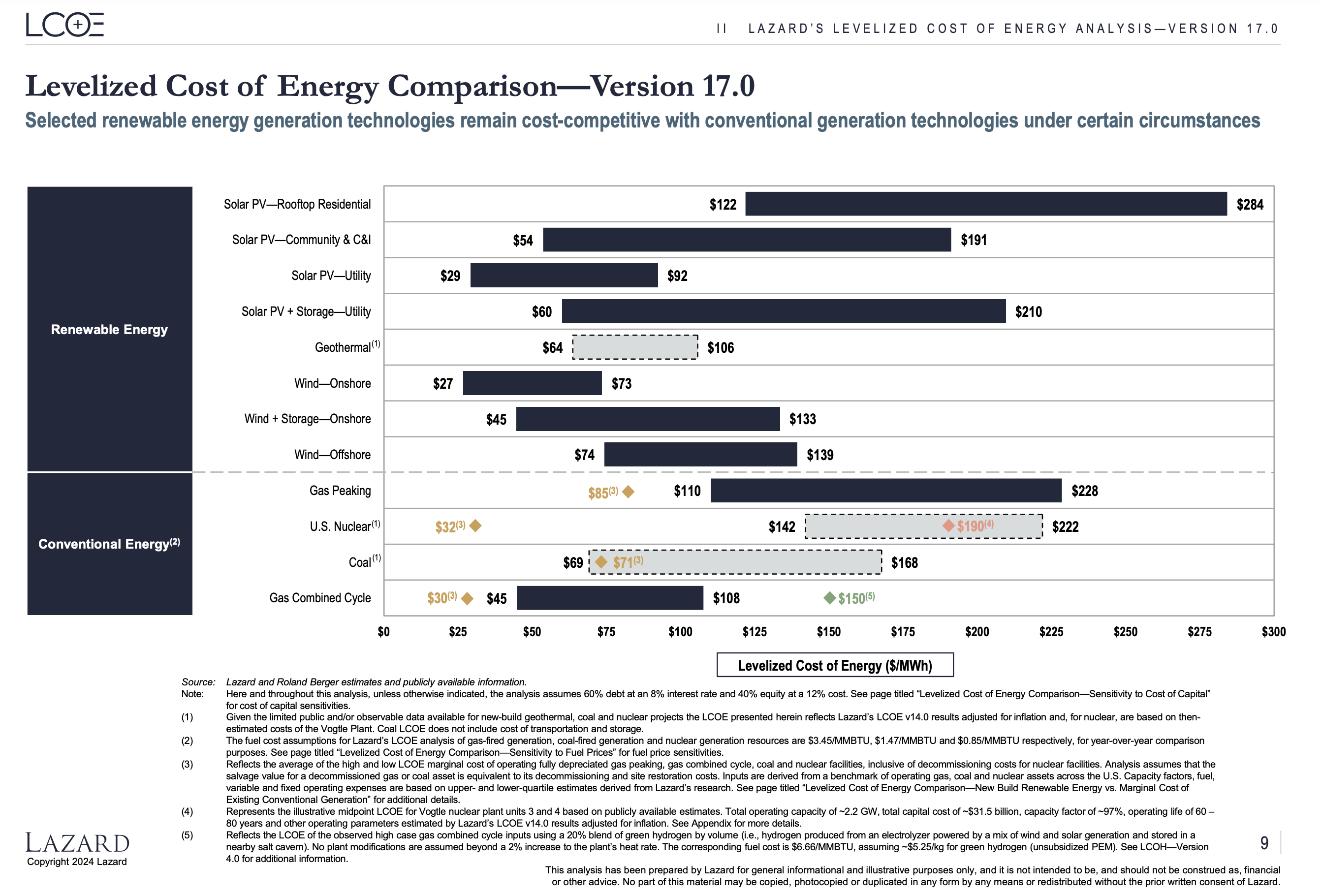

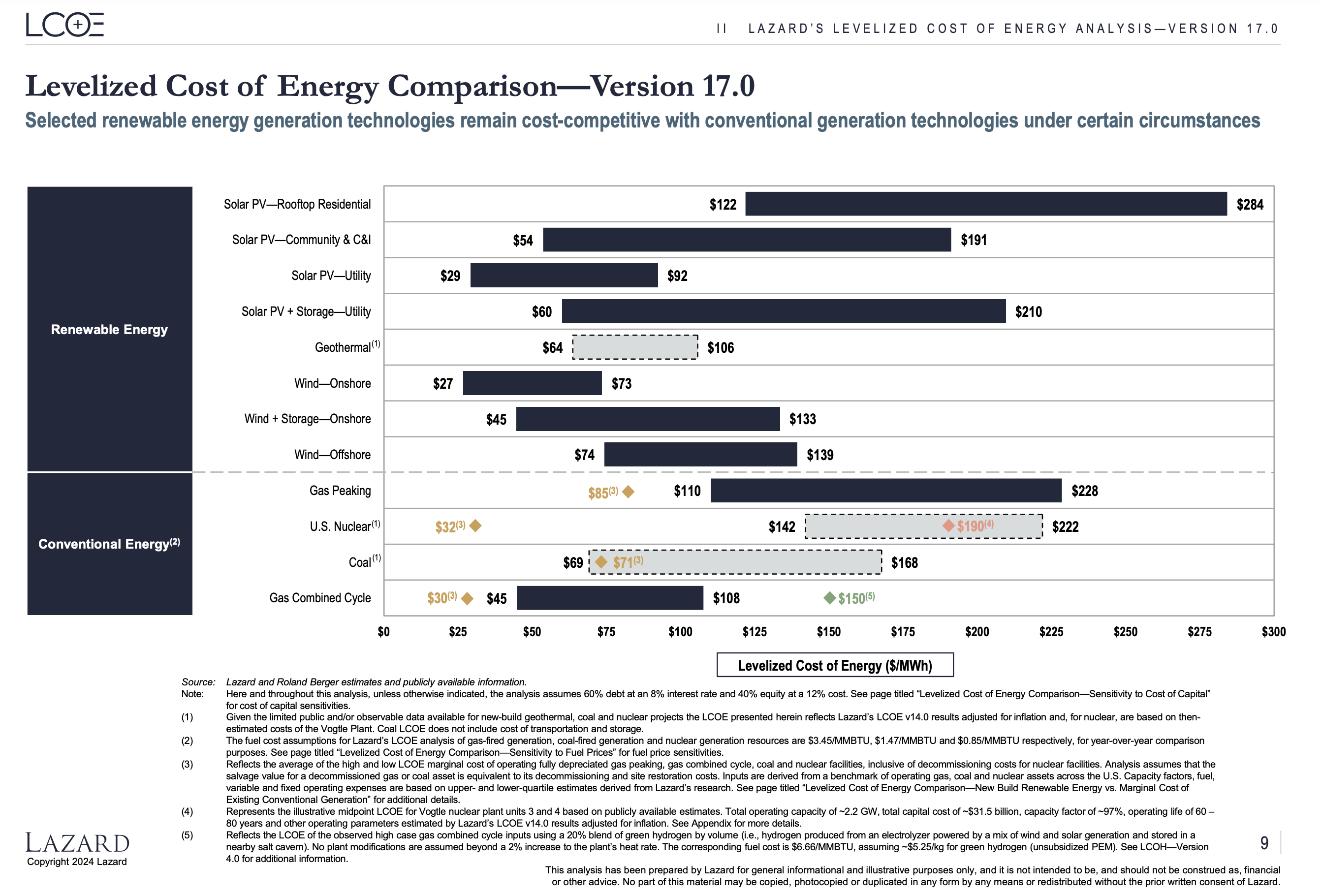

Chart courtesy of Lazard.

As you can see in the chart above, which visualizes version 17 of Lazard’s cost of energy comparison across the electricity sector’s main power sources, utility-scale solar power and onshore wind power are by far the cheapest sources for new electricity generation.

Naturally, as everyone knows, solar and wind power have relatively low capacity factors, and making them really useful and comparable to a fossil gas power plant in utility means adding stationary energy storage as well. Adding in storage, onshore wind power has the same low cost as combined cycle gas power plants, and utility-scale solar is not far off. Of course, if the grid needs all of that electricity when the sun is shining and the wind is blowing, those cheaper power plants without storage are still the cheapest new electricity you can get.

Offshore wind power is also creeping into a more competitive position. But, let’s be honest, it’s still considerably more costly on the low end than even onshore wind power combined with energy storage.

Fossil gas power plants are clearly still competitive on a LCOE basis — being allowed to get away with severe methane leaks, of course, that add a large social cost not included in the LCOE.

Coal and nuclear power are basically priced out of the market now. But, together, they bring us to one final interesting point for this article. Lazard includes some little diamonds in its chart for extra matters it’s examining. The yellow ones are indicating operating costs alone, assuming an already built power plant. As Lazard puts it: “Reflects the average of the high and low LCOE marginal cost of operating fully depreciated gas peaking, gas combined cycle, coal and nuclear facilities, inclusive of decommissioning costs for nuclear facilities. Analysis assumes that the salvage value for a decommissioned gas or coal asset is equivalent to its decommissioning and site restoration costs. Inputs are derived from a benchmark of operating gas, coal and nuclear assets across the U.S. Capacity factors, fuel, variable and fixed operating expenses are based on upper- and lower-quartile estimates derived from Lazard’s research.” One interesting thing here is that this figure for combined-cycle fossil gas power plants and nuclear power plants is still quite low, but onshore wind and utility-scale solar (without storage) are actually lower already on the low end. In the case of coal power (and gas peaking plants), the figure is quite high. This is why we’ve seen so many coal plant closures in recent years, and will see more in the next few years. Stay tuned.

Regarding a point noted at the top — high-end estimates for solar and wind power LCOE coming down while low-end estimates go up — that was the matter that Lazard decided to highlight and discuss before any others in its executive summary. Here’s what Lazard wrote: “Despite high end LCOE declines for selected renewable energy technologies, the low ends of our LCOE have increased for the first time ever, driven by the persistence of certain cost pressures (e.g., high interest rates, etc.). These two phenomena result in tighter LCOE ranges (offsetting the significant range expansion observed last year) and relatively stable LCOE averages year-over-year. The persistence of elevated costs continues to reinforce the central theme noted above—sizable and well-capitalized companies that can take advantage of supply chain and other economies of scale, and that have strong balance sheet support to weather fluctuations in the macro environment, will continue leading the build-out of new renewable energy assets.”

There’s more from the Lazard report to pull out and report on, but this was a good place to start on the core findings of the analysis as they concern power generation technologies, particularly solar and wind power.

Related story: Renewable Energy Provides 99% of New Generating Capacity in Both April & YTD

cleantechnica.com |