Global energy storage fleet to surpass 1 TW/3 TWh by 2033, WoodMac says

According to the latest forecast from Wood Mackenzie, the global energy storage market (excluding pumped hydro) is on track to reach 159 GW/358 GWh by the of 2024 and grow by more than 600% by 2033, with nearly 1 TW of new capacity expected to come online.

July 11, 2024 Marija Maisch

Distributed Storage

Energy Storage

Markets

microgrid

Utility Scale Storage

World

Image: Wood Mackenzie

Share

From pv magazine ESS News site

The global energy storage fleet continues to grow in leaps and bounds on the back of the growing demand for clean firm capacity and rapidly falling battery storage prices. However, analysts suggest that the industry is only in the starting blocks, with exponential growth to be expected in the years to come.

According to the latest forecasts from research and consulting firm Wood Mackenzie, the global energy storage market (excluding pumped hydro) is on track to reach 159 GW/358 GWh by the end of 2024.

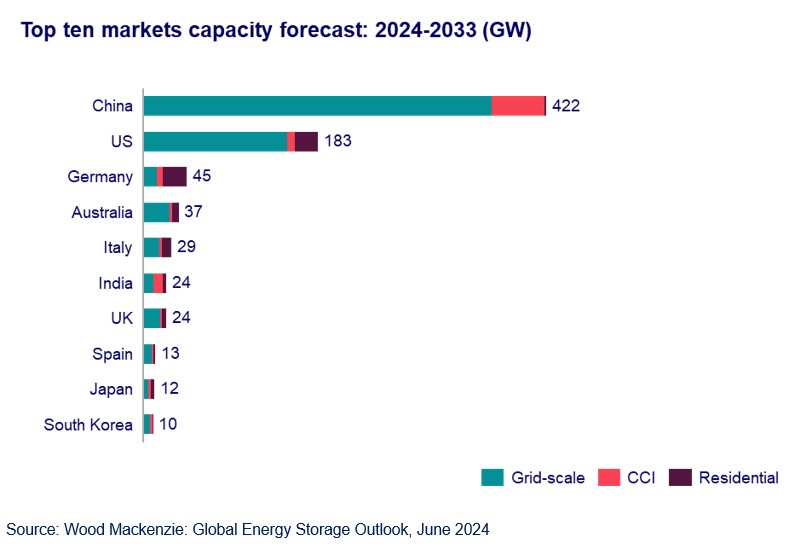

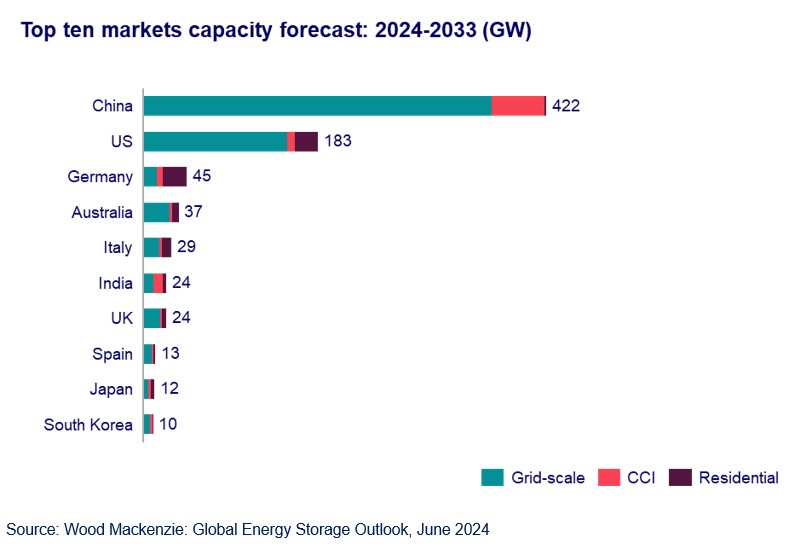

Looking ahead, 926 GW/2,789 GWh will be added between 2024 and 2033, marking a 636% increase, Wood Mackenzie’s Q2 global energy storage market outlook update finds. This makes energy storage one of the fastest-growing markets in the power industry as renewable integration challenges rise.

“Global energy storage deployment in 2023 achieved record-breaking growth of 162% compared to 2022, installing 45 GW/100 GWh. While impressive, the growth represents just the start for a multi-TW market as policy support in terms of tax exemption and capacity and hybrid auctions accelerate storage buildout across all regions,” said Anna Darmani, principal analyst, energy storage at Wood Mackenzie.

China remains the global leader in terms of energy storage deployment, due to its booming solar market, with an average of 42 GW/120 GWh annual capacity additions forecasted in the next 10 years.

In Europe, grid-scale projects are booming as developers aim to seize opportunities from emerging contracted revenues. Demand from the distributed segment has decreased by 23% in 2024 as electricity prices stabilize.

However, WoodMac expects distributed market growth to resume from 2026 on the back of lower system costs and regulatory changes.

WoodMac’s Q2 outlook also includes forecasts for wind and solar uptake. It finds that from 2024 to 2033, developers will bring more than 5.4 TWac of new solar and wind capacity online, increasing the cumulative global total to 8 TWac.

Annual capacity will increase from approximately 500 GW of new solar and wind capacity installed in 2023, and average 560 GW annually over the 10-year outlook. Specifically, global solar deployment will add 3.8 TWac of new project capacity by 2033 compared to 1.6 TW of wind power.

“Solar PV leads the deployment race, accounting for 59% of global capacity due to come online between 2024 and 2033. Energy storage will have the most balanced geographic footprint over the outlook due in part to its important role in helping to make renewable power available,” says Luke Lewandowski, vice president, global renewables research at WoodMac.

pv-magazine-australia.com |