Boeing & Aerospace

When Boeing balked at new jet, Airbus moved. Now the A321 will ‘make an awful lot of money’

July 22, 2024 at 4:17 pm

1 of 3 | An Airbus A321 XLR aircraft during a flying display on the opening day of the Farnborough International Airshow in Farnborough, England, on Monday. The aviation summit is typically a platform for planemakers to rack up... (Jason Alden / Bloomberg)

By

Dominic Gates

Seattle Times aerospace reporter

FARNBOROUGH, England — It might have been an all-new Boeing jet, a 757 replacement, flying over the Farnborough Air Show on Monday.

Instead it was a new Airbus plane, an extra-long-range derivative of the hot-selling A321neo, the A321XLR.

That Boeing never replaced the 757 was “a huge mistake,” said Bjorn Fehrm, an aviation analyst with Leeham.net. It would have been a “smack-on better competitor to the XLR.”

But with Boeing’s pullback, the XLR stands alone.

Boeing’s similarly sized 737 MAX 10, which is not expected to enter service until 2026, cannot fly so far. Airbus’ A320 jet family now offers airlines a choice of seat capacity and range right up to the scale of a 757, which Boeing stopped building two decades ago.

“We’re giving airlines a machine for any scenario,” said Gary O’Donnell, head of the XLR program, in an interview.

After delivering more than 3,400 of its A320/A321neo jet family, Airbus still has unfilled orders for more than 7,000, of which 5,000 are variants of the A321neo alone.

How the Airbus A321neo has run away with the large single-aisle jet market

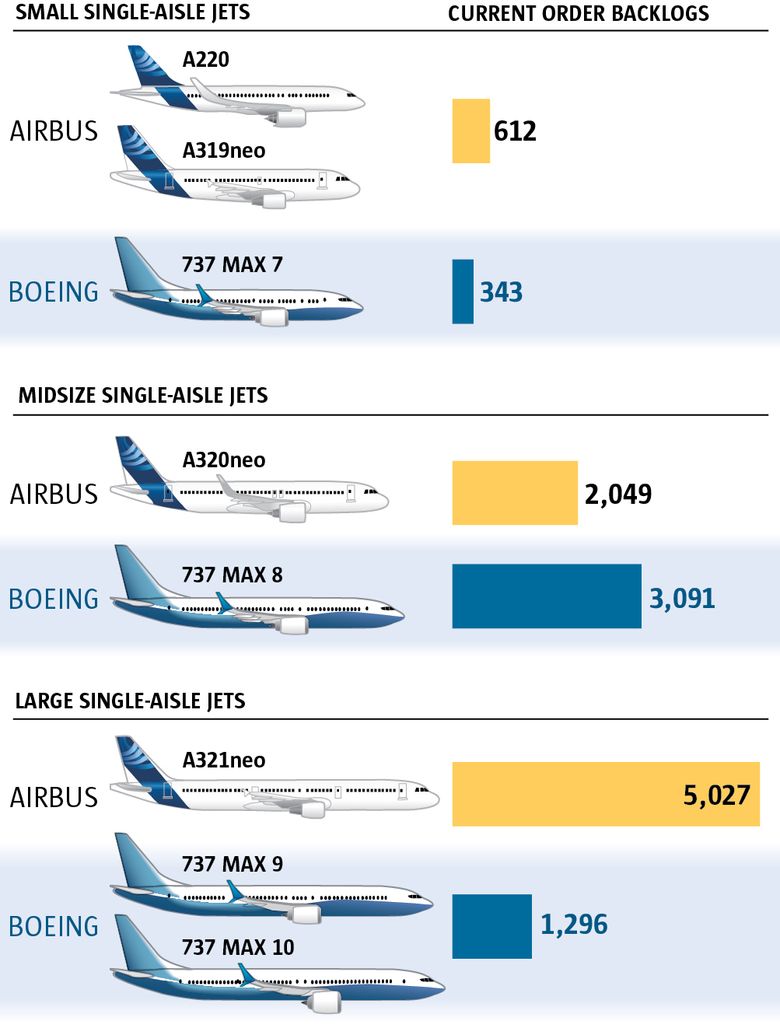

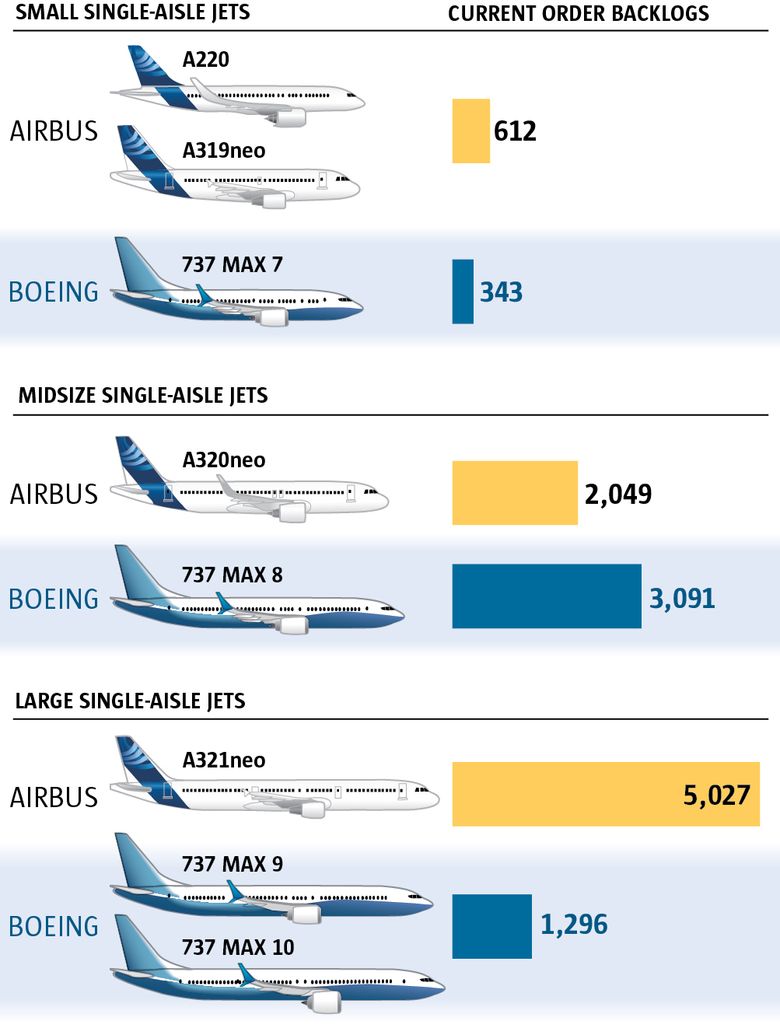

The single-aisle jet market is reflected in the current order backlogs of Airbus and Boeing. Airbus has an advantage at the smaller end of this sector with its new A220 jet. In the middle, Boeing’s 737 MAX 8 is doing very well against the A320neo. But in the larger single-aisle jet segment, sales of the A321neo easily eclipse those of Boeing’s MAX 9 and MAX 10 models.

Airbus and Boeing figures as of the end of June (Mark Nowlin / The Seattle Times)

This latest XLR model, which won European Union Aviation Safety Agency approval to fly passengers only on Friday, already has more than 500 orders. It’s due to enter service with Iberia this fall, flying between Madrid and Boston.

Longtime aviation analyst Richard Aboulafia of AeroDynamic Advisory said that, until the next generation of aircraft comes along in the late 2030s, “Airbus gets to make an awful lot of money.”

Attendees photograph an aerial display from a balcony beneath an Airbus logo during the opening day of the Farnborough International Airshow in Farnborough, England, on Monday. (Hollie Adams / Bloomberg)

Fundamentally similar, but changed everywhere

O’Donnell explained that Airbus’ seemingly simple decision to add an extra built-in fuel tank to provide the additional range required extensive engineering, “fundamentally changing pretty much all of the aircraft in order to stretch it for that extra distance.”

He said 80% of the structure is upgraded for strength to support the extra weight of the aircraft.

“The parts are fundamentally the same. They’re just slightly thicker to take the extra loads,” O’Donnell said.

That means the XLR can go down the same assembly line as the other A321neo models.

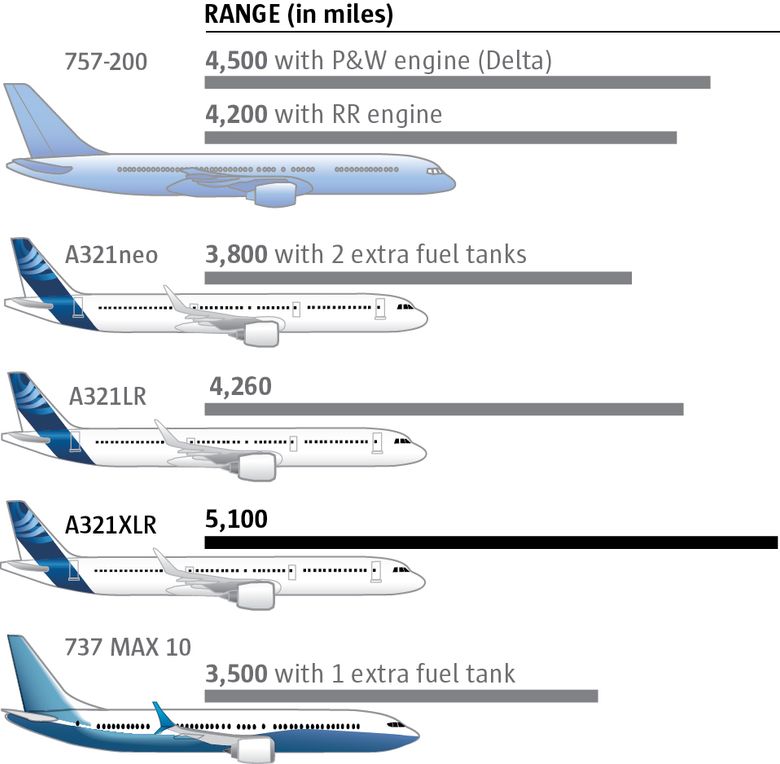

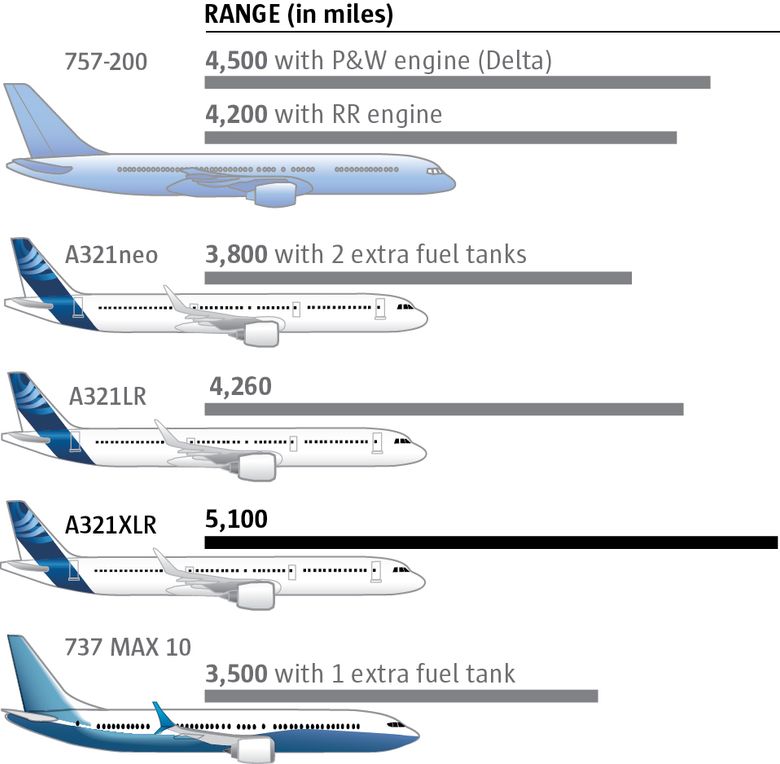

How far the A321neo variants can fly compared with the old Boeing 757 and the new 737 MAX 10

U.S. transcontinental routes require a range of about 3,500 miles. A Boeing 757 can just fly a transatlantic route, say from JFK to Shannon on the west coast of Ireland. The Airbus A321LR matches the 757’s range. The Airbus A321XLR will allow airlines to fly transatlantic, reaching into the interiors of the U.S. and Europe. This single-aisle jet, much cheaper for an airline to fly than the large twin-aisle aircraft typically flying transatlantic, could open new, less dense routes, say from Brussels to Philadelphia, or Rome to Cincinnati.

Source: Independent analysis by Bjorn Fehrm of Leeham.net gives each jet’s range assuming it is configured to seat 200 passengers. (Mark Nowlin / The Seattle Times)

Yet the wheels, tires and brakes are new; the main landing gear is a new design; the nose landing gear is reinforced; the movable flaps on the wings are reinforced.

And because the big extra fuel tank built into the lower rear fuselage blocked a clear path for cables from the cockpit, Airbus converted the rudder on the vertical tail fin to a fly-by-wire part that moves through an electronic signal, not a physical cable connection. The rudder had been the only movable surface in this jet family that was not fly-by-wire.

The changes became much more extensive when EASA demanded more fire protection measures around the extra fuel tank.

Structure was added to the jet’s belly to absorb crash loads and pads to protect the belly if it slid along the ground. The base of the tank was coated with a rubber lining that would hold off fuel spill in the case of a puncture.

The fuselage skin around the tank was changed to a stronger aluminum-composite laminate. An air gap between the belly fairing and the tank slows heat transfer from an external fire.

At the start of last year, Airbus took two flight test planes out of the sky and added all these newly designed fire safety elements for certification.

EASA was satisfied and Airbus worked in tandem with the U.S. Federal Aviation Administration to clear the design.

“The FAA are on board all the way,” O’Donnell said. “So we would expect the FAA to follow with a reasonably short time after the EASA certification.”

A 757 replacement

The genesis of all that work was an effort by Airbus to counter the threat of Boeing developing an all-new jet in this market segment.

After delivering just over 1,000 of its 757 narrowbody jets, in 2004 Boeing abandoned production of its largest and longest-range single-aisle aircraft. You’ll still find them flying, carrying Seattleites on seven-hour flights to Iceland and on to Europe.

By 2018, Boeing was publicly discussing designing a 757 replacement, a newer, more efficient jet that would be a bit bigger and even longer range — sized to fill a niche between current narrowbody 737 MAXs and the small widebody 787.

In an effort to stave off the threat of what Boeing was calling the New Midmarket Airplane, or sometimes the Middle-of-the-Market airplane, and reduce its market, Airbus at the Paris Air Show in 2019 launched the A321XLR.

Farnborough 2024: Essential stories from the big air show Airbus, Boeing execs diverge in style, mood as aviation’s biggest event kicks off

With aviation’s future clouded, Airbus looks forward. Boeing holds on

Korean Air orders up to 50 Boeing 777X, 787 jets at Farnborough air show

But by then, Boeing was newly engulfed in crisis after two deadly crashes grounded its remaining narrowbody, the 737 MAX. Boeing balked and never launched the New Midmarket Airplane.

Airbus was left with no competition to its A321neo that now looks stronger than ever with the XLR added to the lineup.

At a preshow interview with trade magazine Aviation Week, Airbus CEO Guillaume Faury said the company will delay launching a replacement for the A320/A321 jet family so that it won’t be ready for airlines to fly until near the end of the next decade. He said that will provide “time to make money” from the immense A320/A321 backlog of orders.

Airbus survives a stumble

The amazing success of the A320/A321neo jet family has survived one enormous setback on a par with some of Boeing’s stumbles.

Last year, engine maker Pratt & Whitney discovered that contaminated powdered metal was used in production of some critical parts inside its geared turbofan engines, causing cracking inside one of the engines airlines can choose when buying an A320neo.

This has turned into a multibillion-dollar disaster for Pratt & Whitney’s parent RTX, formerly Raytheon. More than 3,000 engines have be removed from airplanes already delivered for inspections and rework that take almost a year.

RTX projects an average of 350 airplanes to be on the ground through 2026, with much higher numbers this year. In April, more than 530 A320neos, a third of the delivered airplanes, were grounded.

This is of course also a disaster for those airlines, though RTX is paying compensation.

But Airbus seems to have escaped relatively unscathed. RTX since early this year is delivering clean engines to Airbus, so it doesn’t affect newly built aircraft. So orders have kept rolling.

The damage has been more to Pratt & Whitney’s reputation than to Airbus’.

Because the A320neo offers an engine choice, the other engine maker CFM International is reaping more orders for its LEAP engine, which is also the sole engine that powers Boeing’s MAX jets.

Boeing suffered immense financial damage when its under-construction 787s had to be reworked because of fuselage gaps so small the ones in service were never grounded.

In contrast, Airbus’ luck held and it shook off this major quality lapse that harmed its customers. Sales of the A321 continued to soar.

Is the XLR a game changer?

John Plueger, CEO of influential Los Angeles-based airplane lessor Air Lease Corp. sees the XLR as offering airlines new capabilities that may “take a bite out of the widebody jet market” that serves international air travel.

This narrowbody plane, the type a low-cost carrier might buy, can fly not just transatlantic but with “greater penetration into both continents, both in Europe and the United States” Plueger said.

He said lessors like to buy planes that they can lease to multiple customers and the customer base of the A321neo is unmatched.

“It makes the MAX 10 more of a niche aircraft,” Plueger said.

Andy Cronin, CEO of another lessor, Dublin-based Avolon, has ordered 100 A321neos, some of which he will take in the XLR version.

Cronin said “the bulk of the market will continue to be the midrange stuff, rather than people going for the ultralong range.”

Still, he said, the XLR fits well, extending the network possibilities.

Fehrm of Leeham.net is more effusive about the XLR’s prospects.

“It will change the face of long-range flying,” he said. “Low-cost carriers, which typically fly single-aisle jets only, can now buy an XLR, same pilot rating, same engines, same maintenance, same everything” as an A321neo.

“Suddenly, they can fly real long range,” said Fehrm.

American has ordered 54 XLRs and United 50. Both have announced plans for fancy, lie-flat business class seats for long-haul flying of up to nine hours in an XLR.

Dominic Gates: 206-464-2963 or dgates@seattletimes.com; Dominic Gates is a Pulitzer Prize-winning aerospace journalist for The Seattle Times.

seattletimes.com |