Micron Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

BENZINGA 10:15 AM ET 9/24/2024

Symbol Last Price Change |

| MU | 93.19 | -0.38 (-0.4061%) | | QUOTES AS OF 10:15:38 AM ET 09/24/2024 |

Micron Technology, Inc (MU) . will release earnings results for its fourth quarter, after the closing bell on Wednesday, Sept. 25.

Analysts expect the Boise, Idaho-based company to report quarterly earnings at $1.13 per share, versus a year-ago loss of $1.07 per share. Micron is projected to post quarterly revenue of $7.64 billion, up from $4.01 billion a year earlier, according to data from Benzinga Pro.

On Sept. 17, Micron announced the availability of the Crucial P310 2280 Gen4 NVMe solid-state drive (SSD) which expands Micron’s P310 portfolio to address PCs, laptops and PlayStation 5. The company said a version with a heatsink will be released in the coming months, suited for use with PlayStation 5 and desktop gaming PCs.

Micron shares gained 2.9% to close at $93.57 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Stifel analyst Brian Chin maintained a Buy rating and cut the price target from $165 to $135 on Sept. 19. This analyst has an accuracy rate of 70%.

- Wells Fargo analyst Aaron Rakers maintained an Overweight rating and cut the price target from $190 to $175 on Sept. 18. This analyst has an accuracy rate of 85%.

- UBS analyst Timothy Arcuri maintained a Buy rating and slashed the price target from $153 to $135 on Sept. 17. This analyst has an accuracy rate of 78%.

- Citigroup analyst Christopher Danely maintained a Buy rating and cut the price target from $175 to $150 on Sept. 17. This analyst has an accuracy rate of 79%.

- Morgan Stanley analyst Joseph Moore maintained an Equal-Weight rating and decreased the price target from $140 to $100 on Sept. 16. This analyst has an accuracy rate of 71%.

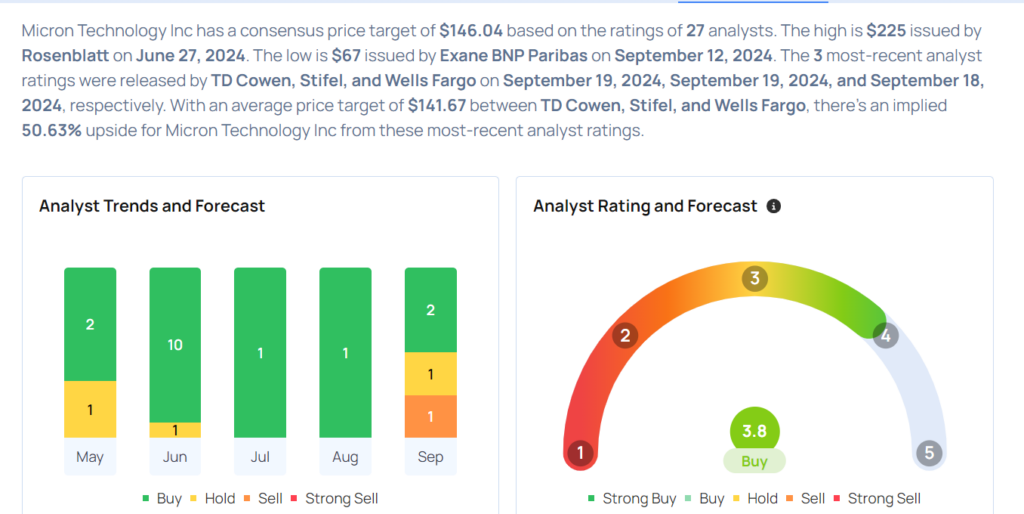

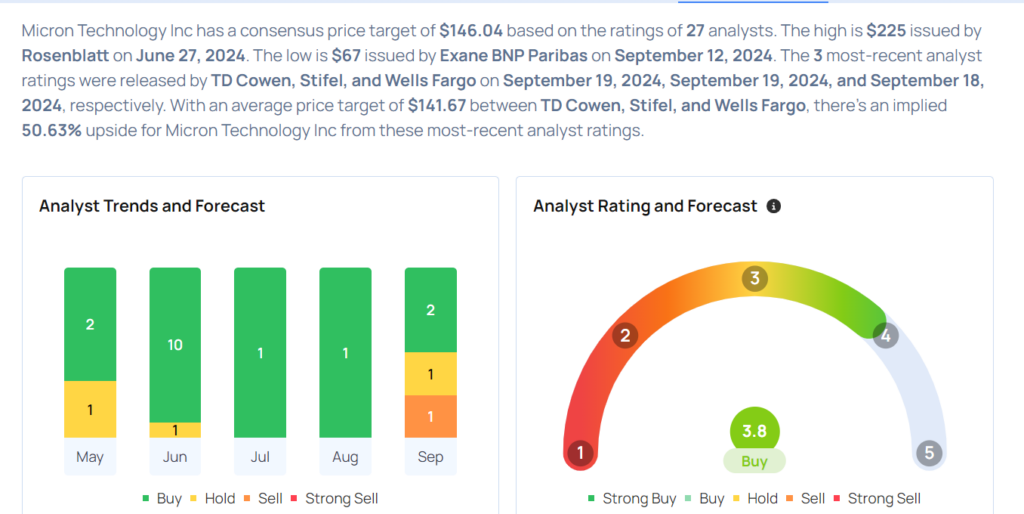

Considering buying MU stock? Here’s what analysts think:

<figure class="wp-block-image size-large is-resized"> </figure </figure |

</figure

</figure