Manufacturing

Overcapacity in storage continues, says CEA Q2’24 report

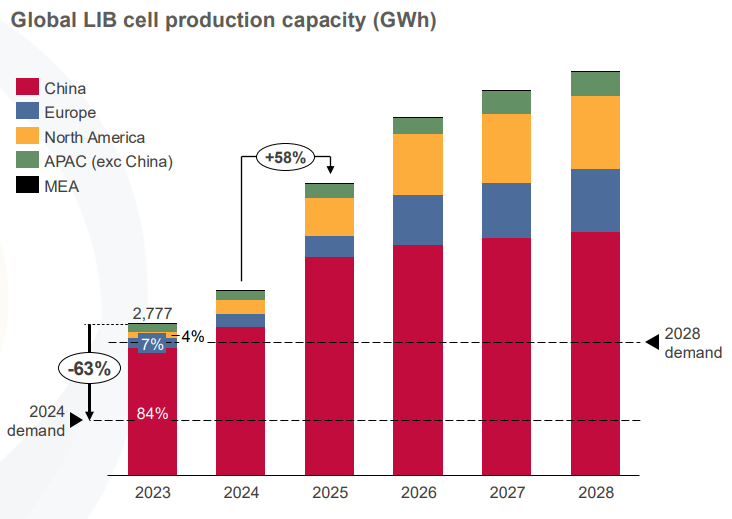

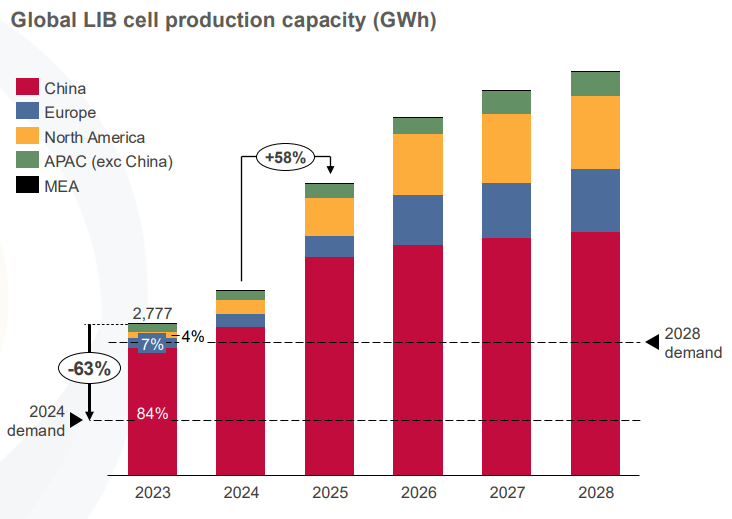

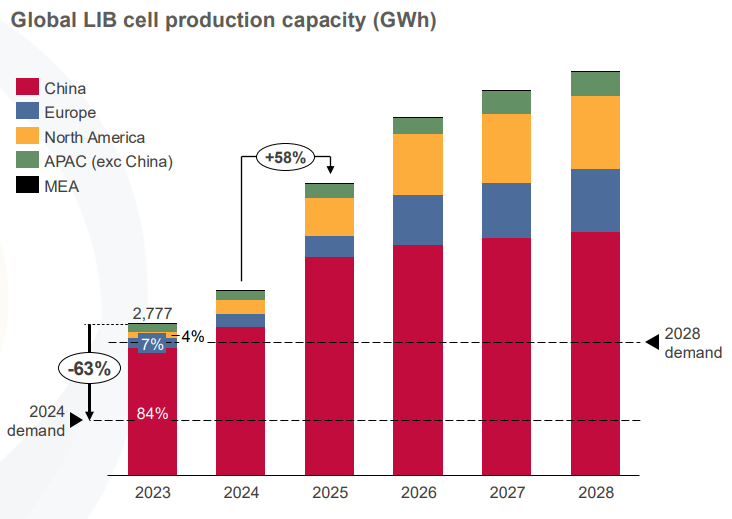

CEA’s quarterly report indicates that the global lithium-ion battery market continues to face overcapacity in Q2 2024, a trend observed in recent quarters.

By

Tristan Rayner

Oct 02, 2024

Industry

Manufacturing

CEA data | Image: CEA

Clean Energy Associates (CEA) has released its latest Energy Storage Systems (ESS) Supplier Market Intelligence Program (SMIP) report, reporting on Q2 2024, covering major lithium-ion battery cell suppliers and battery energy storage system (BESS) integrators.

The report highlights ongoing overcapacity issues faced by battery manufacturers due to a slowdown in electric vehicle (EV) sales. However, it notes a positive development on the ESS and BESS side: demand remains strong, with 32 GWh installed globally in Q1 2024—an impressive 45% increase from the previous year. This growth is primarily driven by decreasing lithium iron phosphate (LFP) cell prices and an improved supply chain from Chinese manufacturers.

Chinese suppliers maintain a dominant position in the production of LFP battery cells, leading the ESS battery market due to their technological advantage. Nevertheless, the report indicates that the scope for direct current (DC) block integration is expanding, suggesting that competition in the ESS integration market may increase soon.

18 suppliers hold 85% of the 2024 global cell production capacity, with China’s dominance on show in these figures. Still, no new capacity expansion plans were announced in the last quarter, opening up the possibility that supply may wait for demand to pick up again.

Elsewhere, South Korean suppliers are shifting focus away from Chinese markets, taking advantage of policies that limit Chinese supplier access, particularly in North America. Conversely, Chinese suppliers plan to expand into other regions in Asia and the Middle East to circumvent U.S. tariff regulations, according to CEA.

As the likes of Northvolt have struggled to stick to original plans and scaled back, North American domestic production is poised for large-scale expansion. This includes plans for domestic LFP cell production for stationary storage applications as early as 2026.

In Europe, Tier 1 suppliers announced they have started LFP cell production, but only for EVs thus far, according to the report, including a 30 GWh EV-dedicated LFP plant in Spain.

The report sample is available from CEA here, with the full 231 page report further available as well.

ess-news.com |