it is what it is, if that is what is ...

am passing the gold / silver markets over to you in good order and hoping you shall take good care of it until the morning on my side

from behind paywall

zerohedge.com

Precious Metals' Monster Momentum

BY THE MARKET EAR

TUESDAY, OCT 22, 2024 - 17:25

Gold and the dollarThe short term gap between gold and the DXY (inverted) is huge...but we saw similar dollar strength earlier this year, without gold doing much to the downside.

Source: Refinitiv

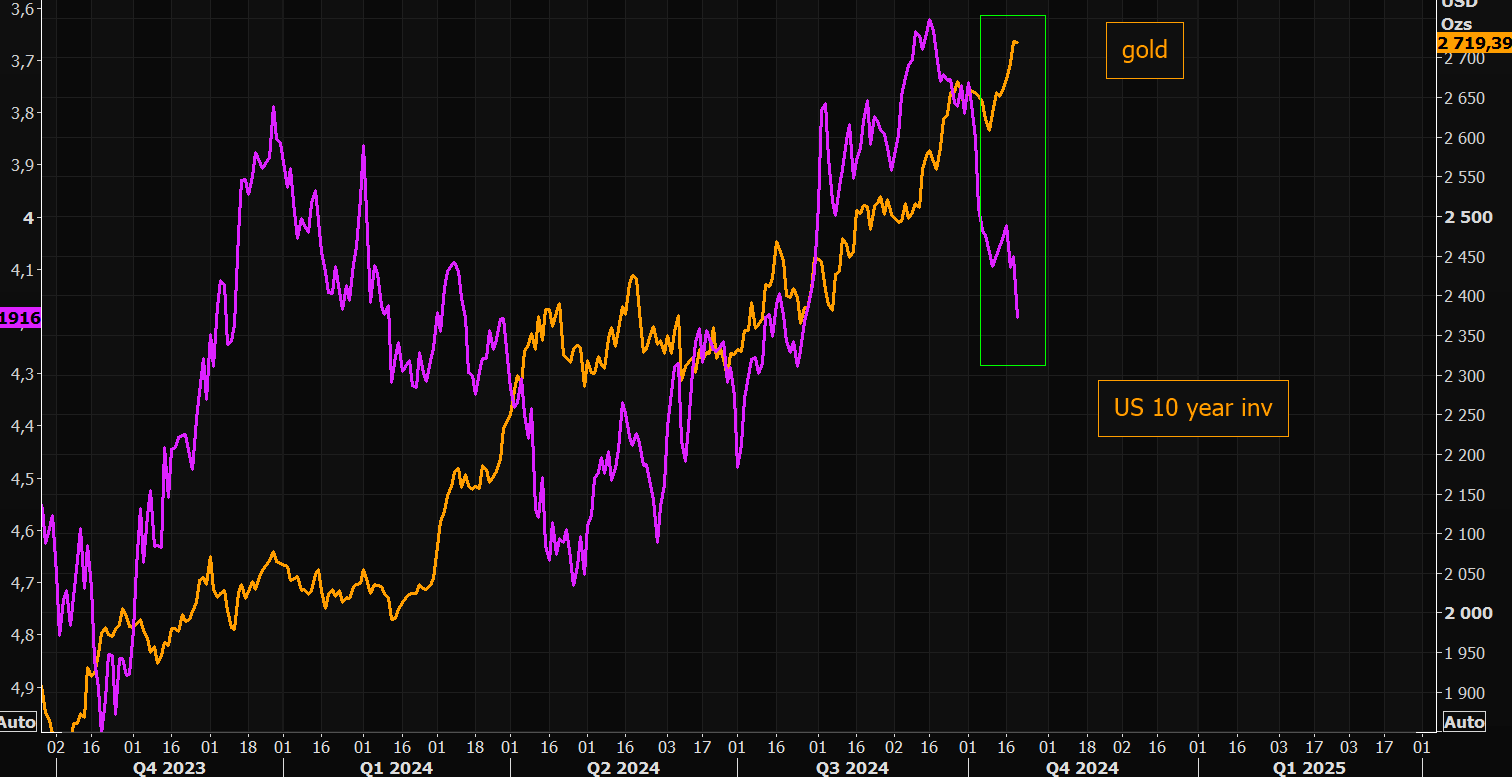

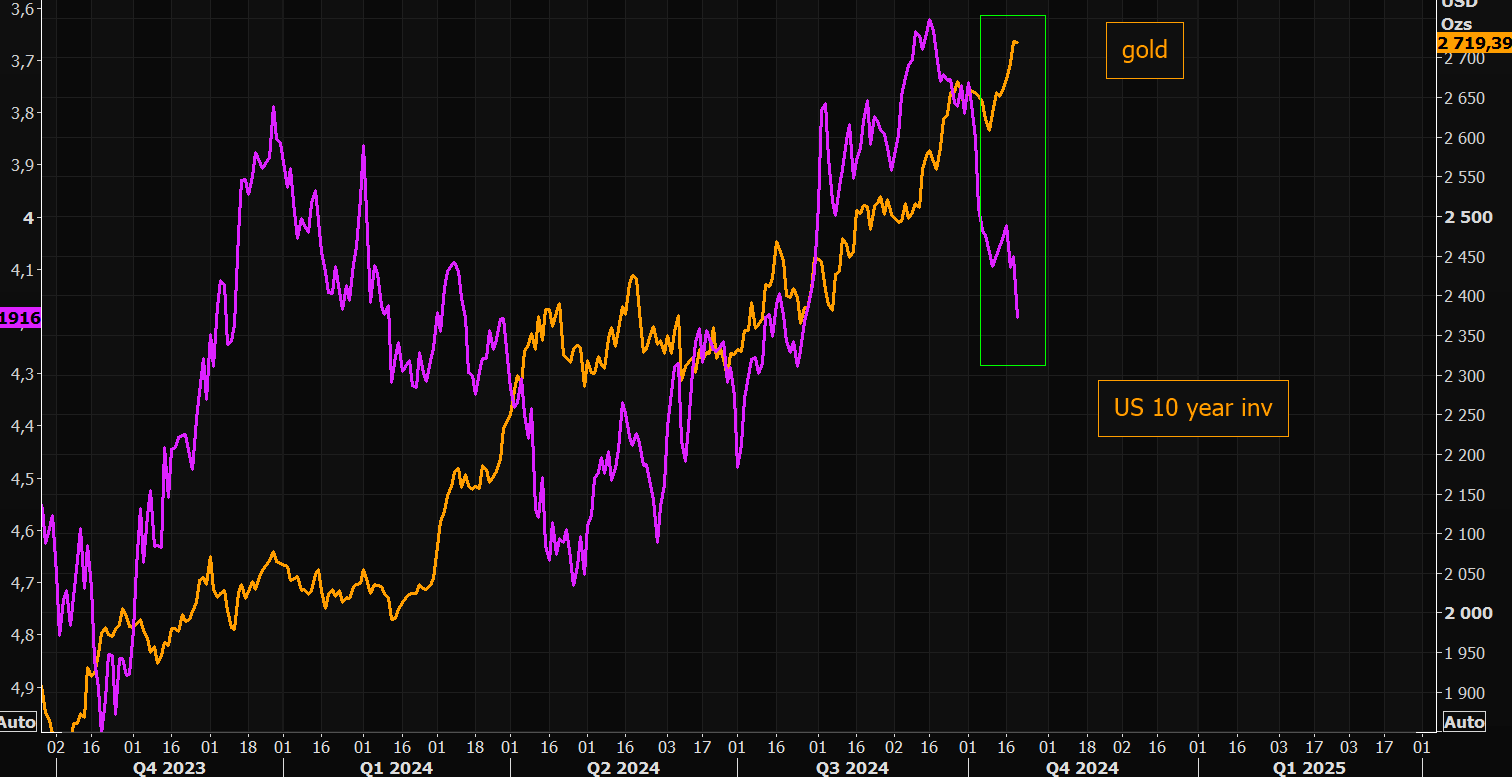

Gold and ratesThe short term gap between gold and the 10 year (inverted) is very wide, but we saw a similar, and even more extreme action in rates earlier this year with gold holding...

Source: Refinitiv

Trailing goldThe following chart with data courtesy of the World Bank shows gold’s trailing 1-year price performance on a monthly basis from 1970 to the present.

Gold’s 12-month gain of 37 percent is right on the 1-standard deviation level, making it statistically unusual, but the history of the yellow metal suggests further upside is likely.

Source: Data Trek

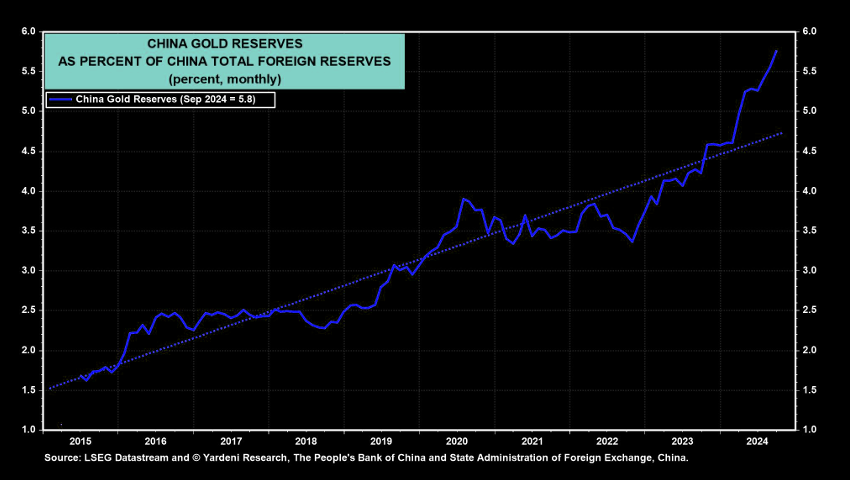

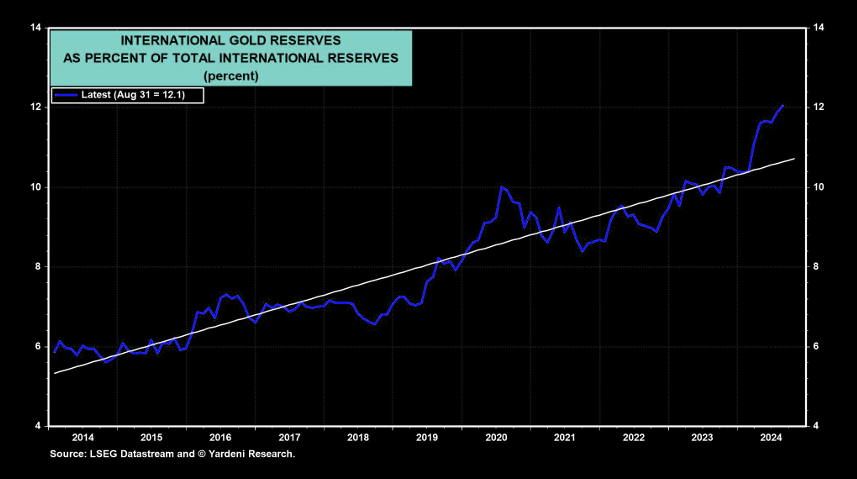

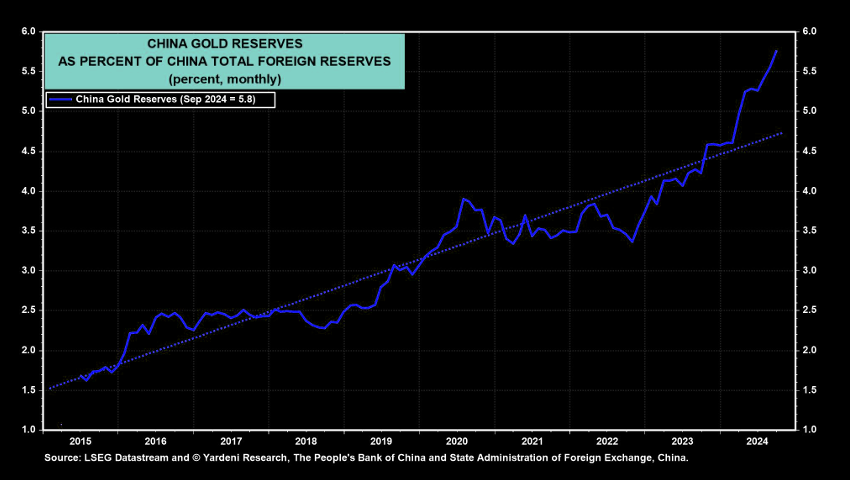

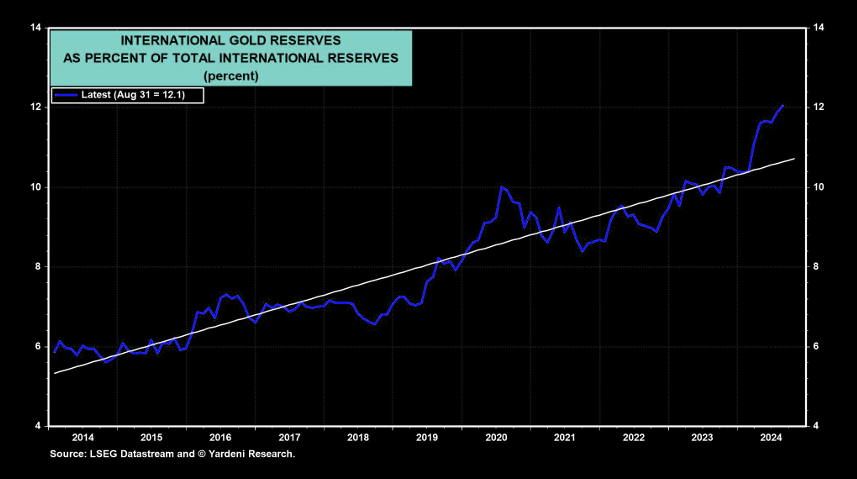

China buying goldChina has increased its gold purchases since Russia invaded Ukraine, likely looking to safeguard its reserve from potential sanctions. The price of gold has climbed 33% ytd to a new record high of $2,750. Global central banks, particularly those of countries unfriendly to the US, have been buying gold for their reserves since the US enacted heavy financial sanctions on Russia in 2022.

Source: Yardeni

Source: Yardeni

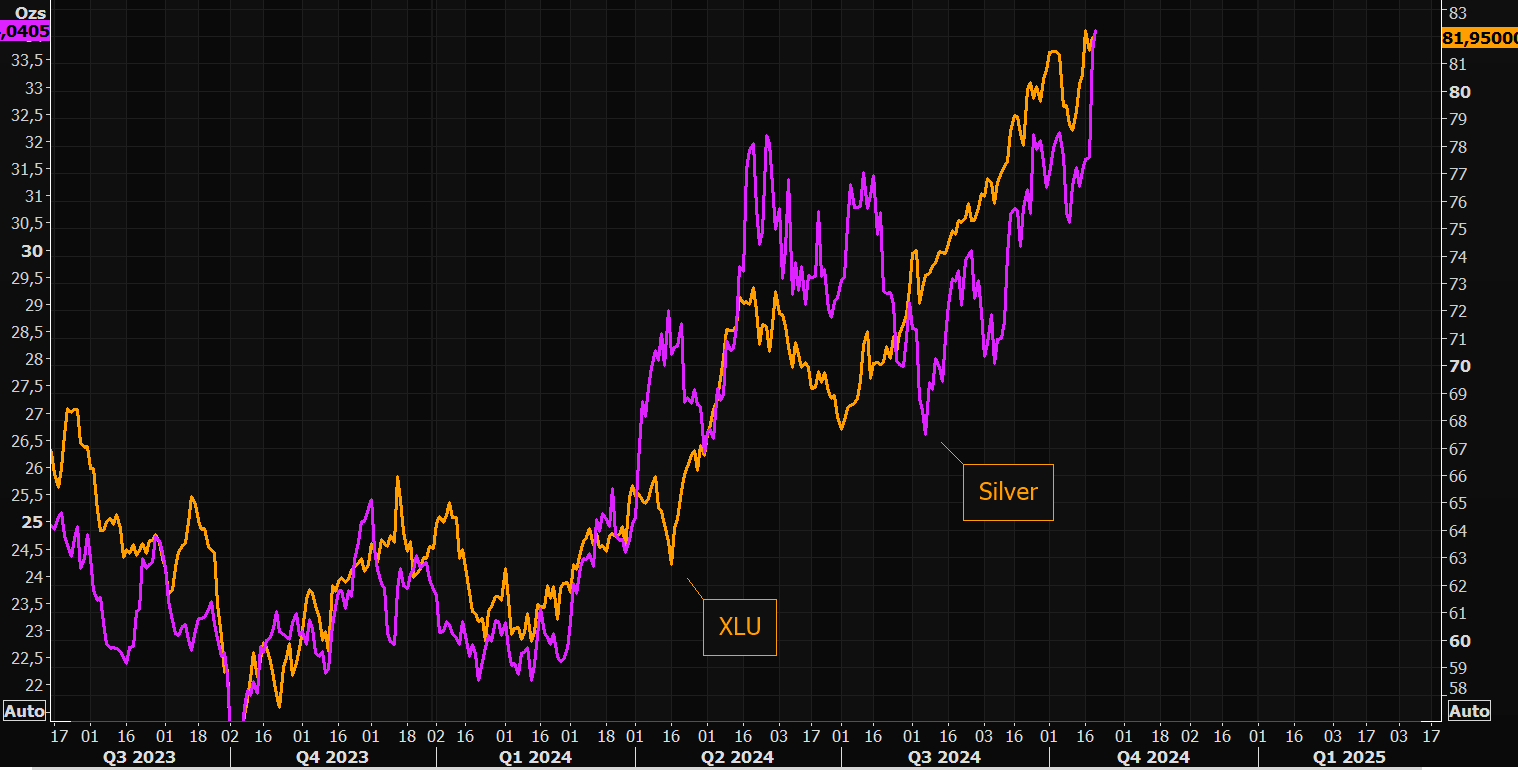

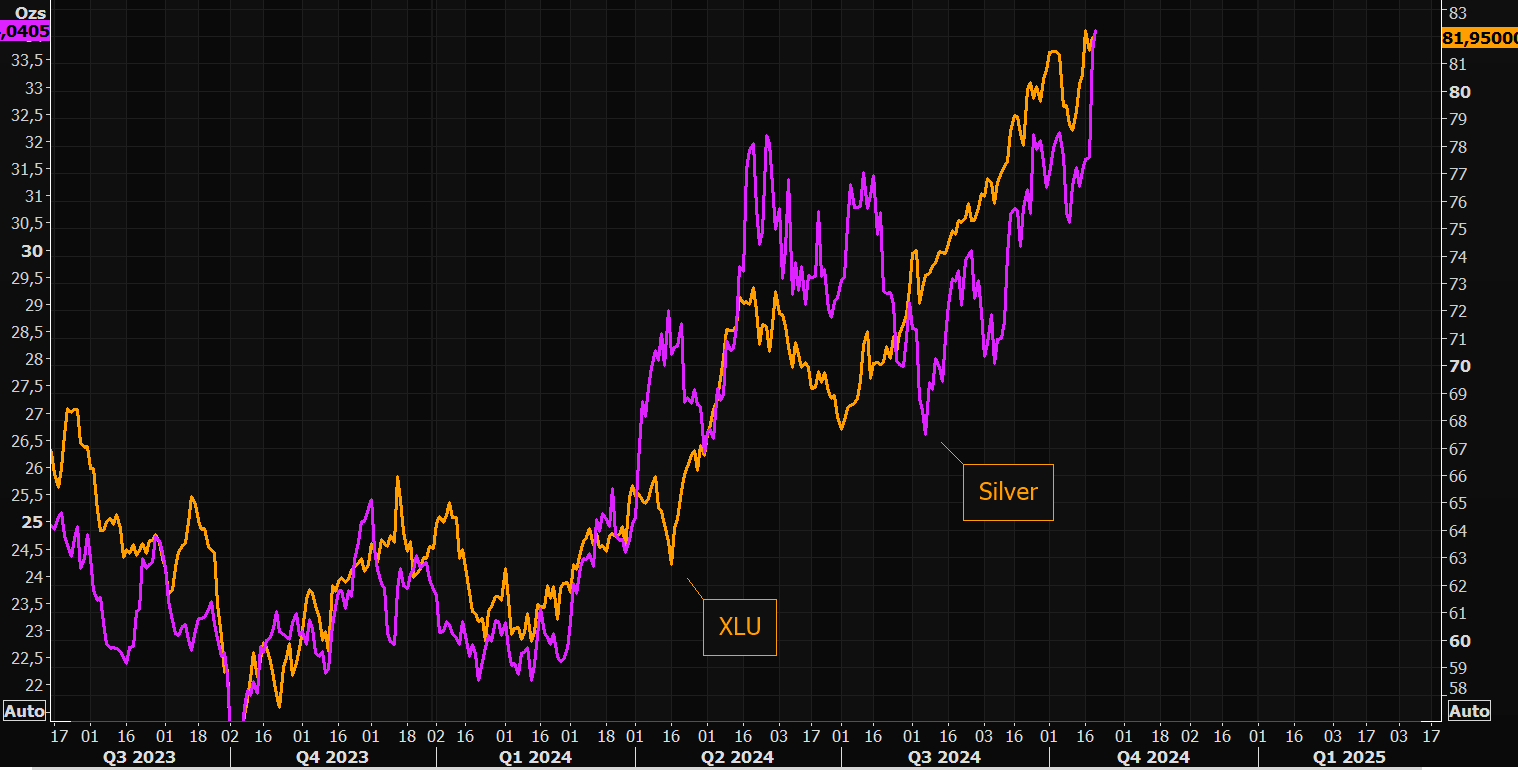

Aggressive silverSilver continues squeezing despite being up some 10% over the past week. RSI is at the most overbought levels in a while, but as we all know, overbought can stay overbought for longer than most think possible.

Source: Refinitiv

Nothing is impossibleSilver's bigger trend channel offers some perspective. We just broke out of a big range, momentum is strong, the 50 crossed the 100 day and the upper part of the channel is way higher.

Source: Refinitiv

To run AI you need.......among other things: power and silver.

Source: Refinitiv |