>> THE F*CKING F*CK

Monday morning, waiting for gold to rise

bloomberg.com

The Most Disruptive Technology in Human History

Nothing has been quite as transformational as money, explains author and economist David McWilliams.

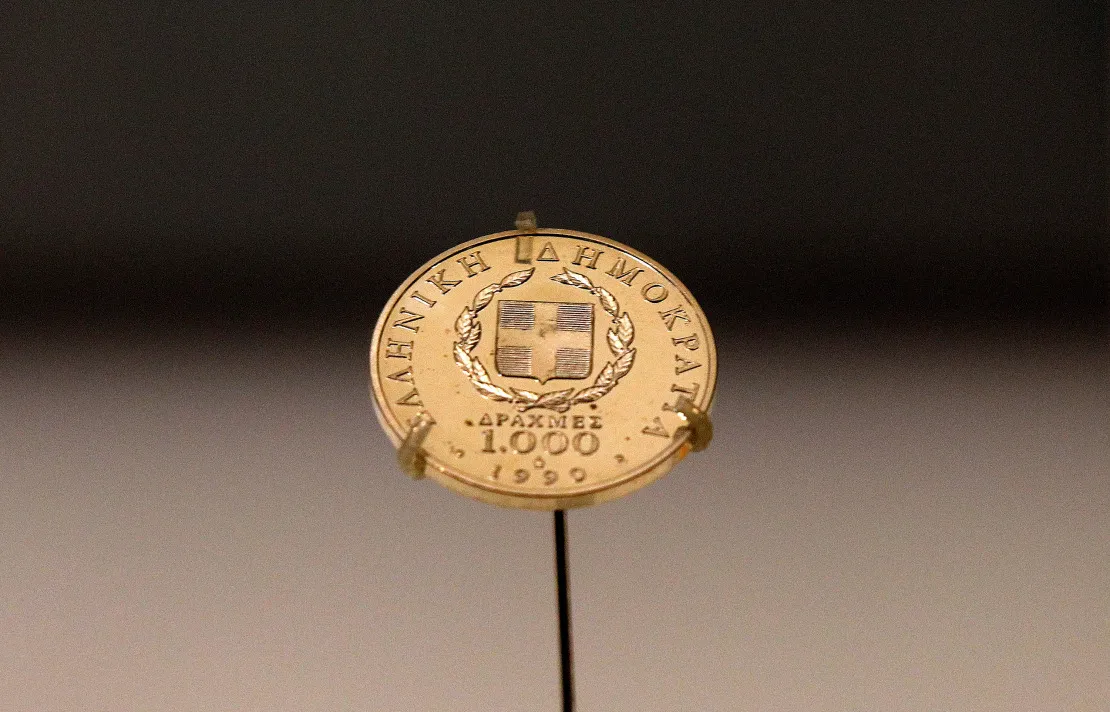

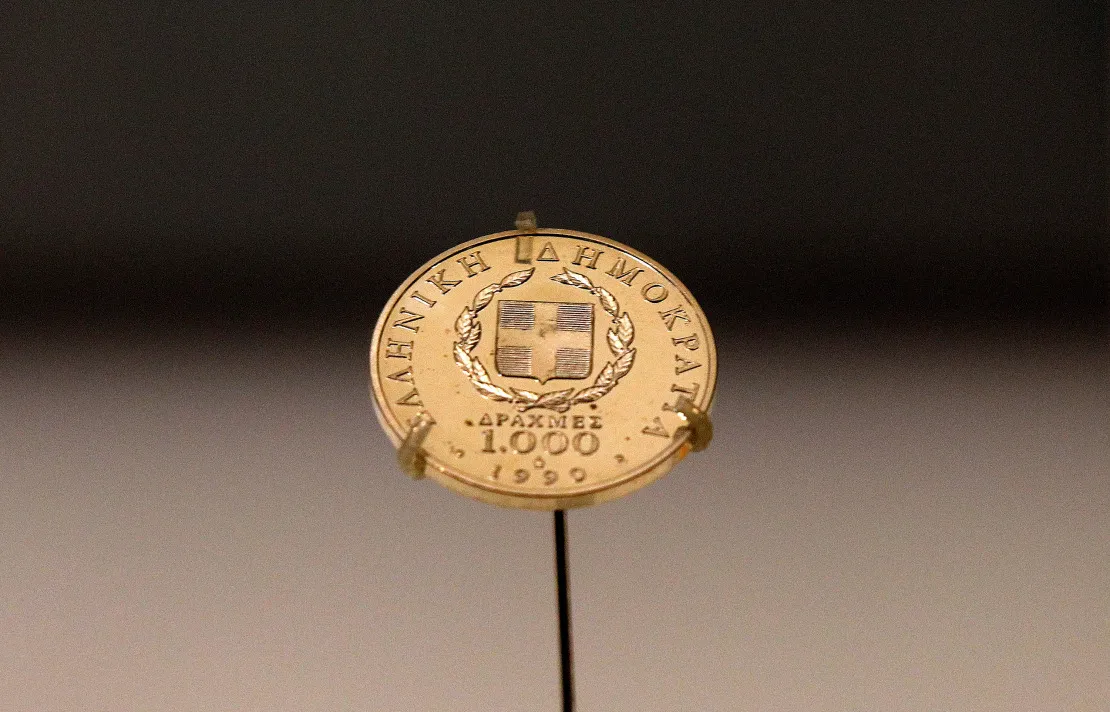

Gone but not forgotten: a Greek 1,000 drachma coin dating from 1999.

Photographer: Simon Dawson

By John Stepek

25 October 2024 at 20:13 GMT+8

Welcome to the award-winning Money Distilled newsletter. I’m John Stepek and this is the Friday Roundup, where we review the week’s news, discuss the latest Merryn Talks Money podcast and link to various intriguing topics that arose this week.

Money is history’s most disruptive technologyIt’s been a hectic week, what with Prime Minister Keir Starmer (via a careless choice of words) saying that shareholders aren’t working people, and sweeping speculation about what the Budget might hold — the most pertinent of which for the readership of this newsletter is probably the threat to impose employer National Insurance on pension contributions.

Amid all that, you might ponder the point of putting aside any money for your kids, but that sort of pessimism won’t get you through the coming week. So you’ll be glad to hear that Merryn and I had a good chat about Junior ISAs and what you should consider before you decide to put any money into them.

Also, when Merryn popped out for a little break this week, I sneakily got Mr. Marcus Ashworth back into the podcast booth and we had a good natter about what the record-breaking gold run tells us about the state of the world, and Marcus put me straight about various geopolitical conspiracy theories (the spoilsport).

One of the world’s oldest forms of money has had a pretty decent week.Photographer: Ore Huiying/BloombergSpeaking of gold — that takes us to this week’s main episode, in which Merryn interviews the economist and author David McWilliams about his new book, Money: A Story of Humanity.

Honestly, while I know I’m biased, I think Merryn Talks Money is a great podcast, with great guests, and consistently high standards (particularly the ones without that Scottish guy). But this episode is one of the best yet. Share it with your pals who don’t care about finance, but perhaps enjoy The Rest Is History (I’m a fan too). This’ll be right up their street.

How Money Has Shaped All of Human History

Disruption: Money is a social technology. You’ve perhaps heard it phrased that way before and it is becoming the dominant “paradigm,” but I haven’t seen anyone make the case as clearly, or as entertainingly, as McWilliams.

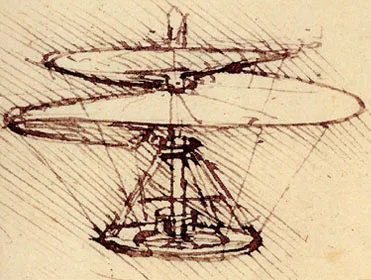

Almost right from the start, money in one form or another has been there. And it’s played a key role in enabling every other critical evolutionary development throughout human history, from the discover of writing to fine art (McWilliams posits that Leonardo Da Vinci might never have made his name had it not been for an earlier Leonardo).

Aye very clever, but where would you be without Fibonacci, eh?

Denarii: How and why did the Emperor Tiberius cause and then cure a massive credit crunch in Ancient Rome? McWilliams explains what happened and tells Merryn why he reckons Ben Bernanke could’ve learned a thing or two (Bernanke clearly doesn’t spend enough time thinking about the Roman Empire).

Dominion: Was the massive and rapid success of Christianity in part a societal immune response to the disruptive rise of meritocracy and commercialisation, as Rome became an increasingly monetised economy? I’m not entirely sure what I think of this presumably rather contentious argument, but it’s a fascinating one to ponder.

The Vatican: built on money?Photographer: Alessia Pierdomenico/BloombergDemocracy and the Drachma: How coinage enabled democracy in ancient Greece, and the EU destroyed one of the world’s oldest surviving currencies.

Debasement: What links the fall of the Roman Empire, the French revolution, the US Civil War, and a failed Nazi plot to bring down Britain from within during World War II? The devaluation of currency, either deliberately or accidentally.

Dante: This, incidentally, is why a very specific group of sinners are allocated the floor of Hell just above Satan’s in Dante’s inferno.

There's a reason we go to incredible lengths to prevent counterfeiting.Photographer: Simon Dawson

Destabilising: One of money’s most potent qualities is that it enables us to live in the future, says McWilliams. That’s why it needs to be treated with respect. Since the great financial crisis in 2008, we’ve been playing fast and loose with that respect, which has played a major role in the political unrest we’ve seen in the last decade or so.

Don’t get upset (if you’re a Bitcoin fan): Trigger warning — McWilliams has come up with perhaps the most gently damning metaphor for Bitcoin I’ve heard yet. I won’t spoil it for you.

If after all that, you fancy reading the book (and you should), here’s the details again — Money: A Story of Humanity. |