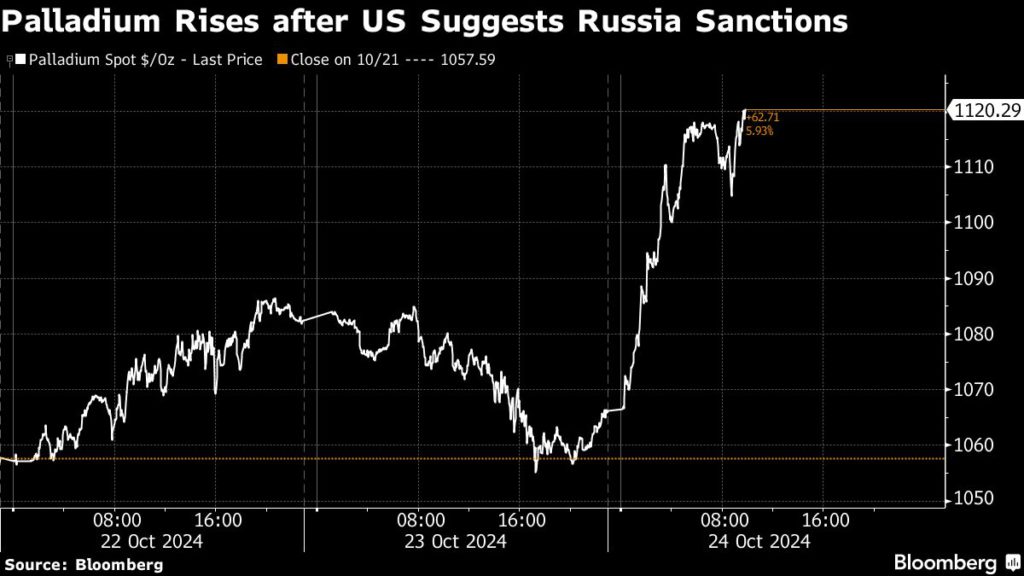

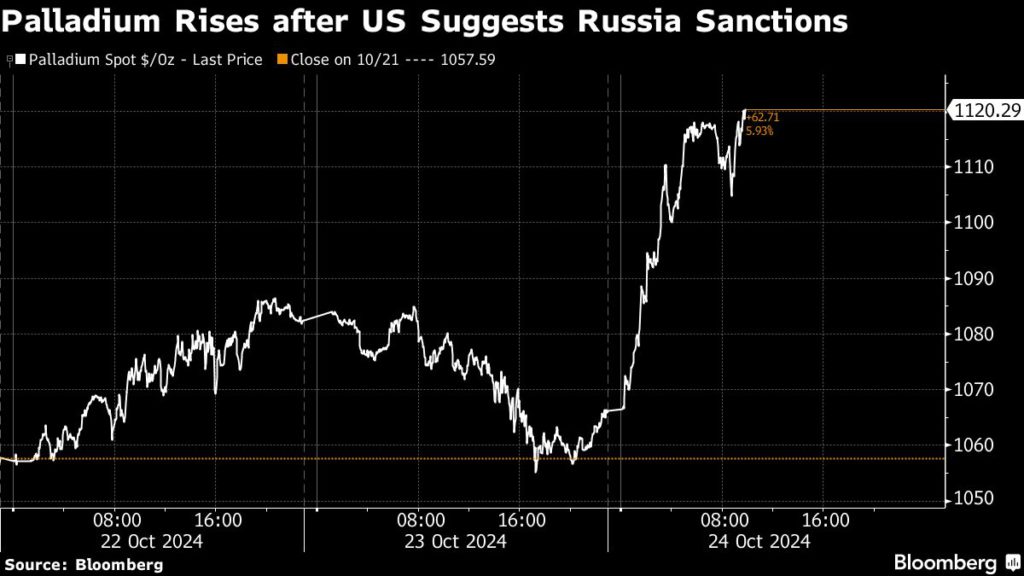

Palladium price jumps after US suggests sanctions on Russian exports

mining.com

While Norilsk Nickel accounts for around 40% of global output, the company now sells most of its output to China, according to a person familiar with situation. It still sells some to the US, as no import ban for the metal is currently in place, the person said.

Still, sanctions risks “have reignited buying activity,” said Daniel Ghali, senior commodity strategist at TD Securities. Commodity trading advisor trend followers are adding to their palladium bullish positions, he said. “Fear is the trade.”

Shares of the four biggest palladium producers in South Africa — the world’s second-largest source of the metal — all jumped by more than 10%. One of them, Sibanye Stillwater Ltd., recently announced cuts to palladium output at its US mines due to weak prices.

Palladium has fallen about 37% since the start of last year and almost two-thirds from a March 2022 peak, which miners attribute to a subdued global economy and destocking by manufacturers.

The possibility of removing Russian palladium from the market may tighten the market as “South Africa and the other major producers won’t be able to fill the gap,” said Dan Smith, head of research at Amalgamated Metal Trading.

Gold pared gains after latest data pointed to economic resilience in the US, reinforcing bets that the Federal Reserve may take a measured approach to monetary easing. Rising yields and higher borrowing costs tend to weigh on gold, as the metal doesn’t pay interest.

Palladium rose 5.1% at $1,119.88 an ounce as of 10:38 a.m. in New York. Gold gained 0.3% at $2,723.98 after earlier rising by as much as 1%. The Bloomberg Dollar Spot Index was down 0.1%. Silver slid while platinum advanced.

(By William Clowes and Yvonne Yue Li) |