New research estimates average long-term green hydrogen price at $32/MWh

New research from Norway has found that deploying around 140 GW of green hydrogen generation capacity by 2050 could make green hydrogen economically viable in Europe. Reaching this scale may help balance system costs effectively while increasing renewable integration, making green hydrogen a self-sustaining technology without subsidies, according to the scientists.

November 11, 2024 Emiliano Bellini

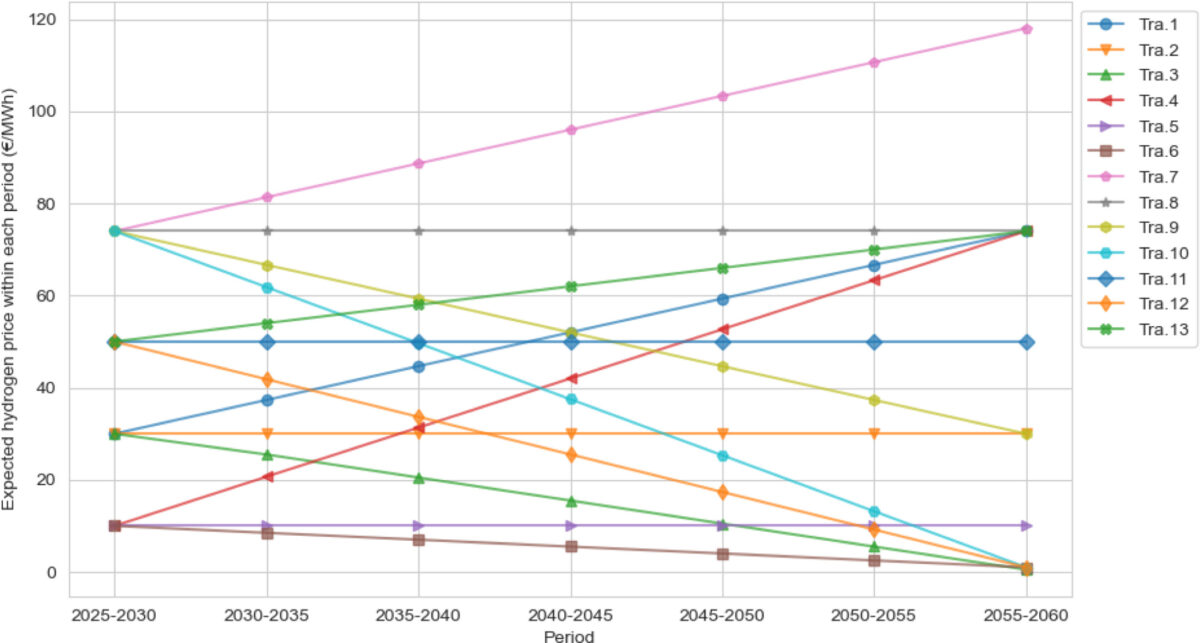

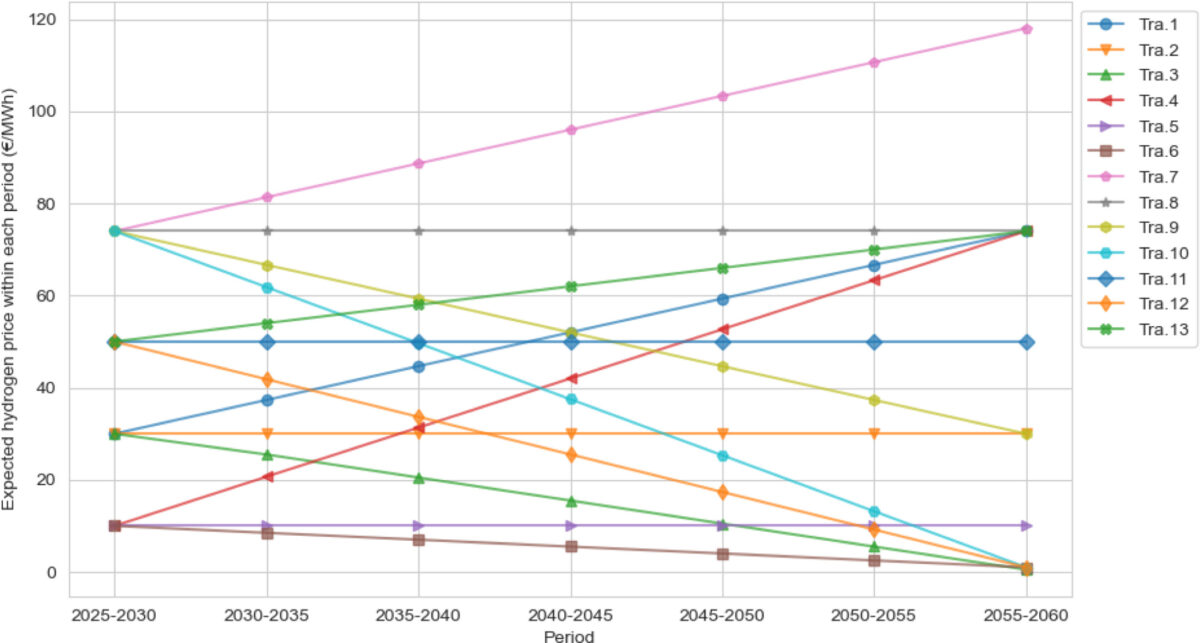

Long-term hydrogen price trajectories

Image: Norwegian University of Science and Technology, Applied Energy, Common License CC BY 4.0

Share

Researchers at the Norwegian University of Science and Technology (NTNU) have investigated the effects of incorporating green hydrogen into the European power system and have found that deploying around 140 GW of green hydrogen generation capacity by 2050 may help hydrogen technologies become technically and economically viable.

“Our study indicates that reaching approximately 140 GW of green hydrogen capacity by 2050 would make green hydrogen economically viable in Europe, but it does not definitively state that lower capacities would render it entirely unviable,” the research corresponding author, Mohammadreza Ahang, told pv magazine. “Instead, it emphasizes that reaching this scale helps balance system costs effectively and increases renewable integration, making green hydrogen a self-sustaining technology without subsidies.”

In the study “ Investments in green hydrogen as a flexibility source for the European power system by 2050: Does it pay off?,” published in Applied Energy, Ahang and his colleagues explained that the novelty of their work lied in its comprehensive approach to evaluating the economic viability and strategic value of green hydrogen as a flexibility source within the European power system by 2050.

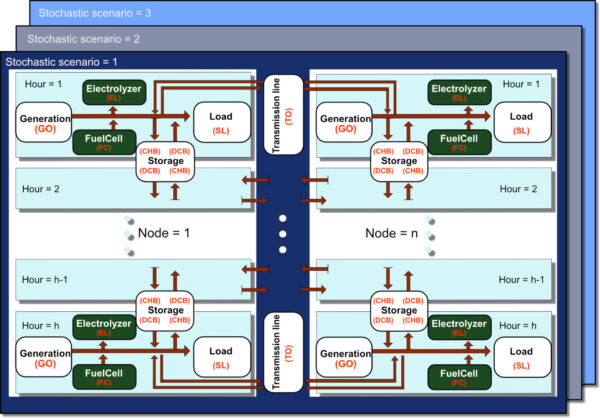

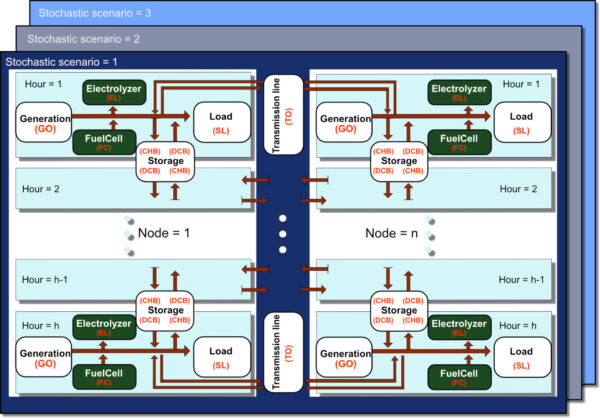

“This study uses the European Model for Power System Investment with Renewable Energy (EMPIRE), a stochastic capacity expansion model that integrates both short-term uncertainties and long-term planning,” Ahang said. “By including hydrogen technology as part of the model, it captures the dynamic and uncertain aspects of power prices, which significantly affect the feasibility of green hydrogen.”

EMPIRE is an o pen-source capacity expansion model designed by NTNUT itself to assess optimal capacity investments and system operation in Europe over medium to long-term planning horizons, typically ranging from 40 to 50 years. It includes generation, storage, and transmission capacity expansion, and is aimed at minimizing total system costs.

Illustration of the power system in EMPIRE Image: Norwegian University of Science and Technology, Applied Energy, Common License CC BY 4.0

“Unlike previous studies that focus primarily on hydrogen cost and conversion efficiencies, this research examines green hydrogen’s role in enhancing the flexibility of the European power system,” Ahang further explained. “Our study investigates how green hydrogen can reduce renewable energy curtailment and increase the temporal flexibility of the power sector, specifically in the context of high-variable renewable energy sources like wind and solar power.”

The authors analyzed various instances of hydrogen integration, with and without external hydrogen demand, which they said allowed for an in-depth understanding of how hydrogen demand from other markets impacts its economic viability within the power system.

In their modeling, the scientists assumed that Europe achieves a climate-neutral power system by the period 2050–2060 and considered two hydrogen scenarios: A no-hydrogen case, in which hydrogen is not able to compete with other technologies to provide flexibility to the system; and a hydrogen case, in which hydrogen capacity are expanded while minimizing the system total costs. Capex, Opex, learning curves, and demand were assessed via the openENTRANCE modelling platform.

The scientists also conducted an assessement of long-term hydrogen price trajectory and estimated the average long-term green hydrogen price at €30 ($32)/MWh. They also explained this price is expected to start at €30/MWh during 2025–2030 and gradually increase to €70/MWh by 2050–2055.

“This price point is critical, as it represents the break-even point for initiating investments in electrolyzer technology, a key component in green hydrogen production,” the paper notes. “Demand from hydrogen markets justify investments in green hydrogen production after 2040.”

The study identified Germany, France, the UK, Italy, Spain, and Norway as countries with strong potential for green hydrogen development. “Our work projects that several key sectors, including transportation, industry, residential, and power, will increase hydrogen demand by 2050. In the Business-As-Usual (BAU) scenario, hydrogen demand in the power sector could reach 43 TWh by 2050,” Ahang concluded.

pv-magazine.com |