The Big 6 stocks’ valuations are cheaper than the rest of the S&P 500 – UBS

Jan. 02, 2025 2:35 PM ET

By: Monica L. Correa, SA News Editor

We Are We Are

Although the biggest stock stocks in the S&P 500 ( SP500) represent over a third of the index, its valuations are cheaper, according to UBS.

The S&P 500 ( SP500) has become increasingly concentrated over the past decade. The largest six stocks – ( AAPL), ( AMZN), ( GOOGL), ( META), ( MSFT), ( NVDA) – now represent 31.2% of the total market cap of the index compared to 11.2% in 2013.

And because of the higher returns of the “Big 6” over the past two years, “it is natural to assume that their valuations would be extended,” said Jonathan Golub, chief U.S. equity strategist at UBS, in a note.

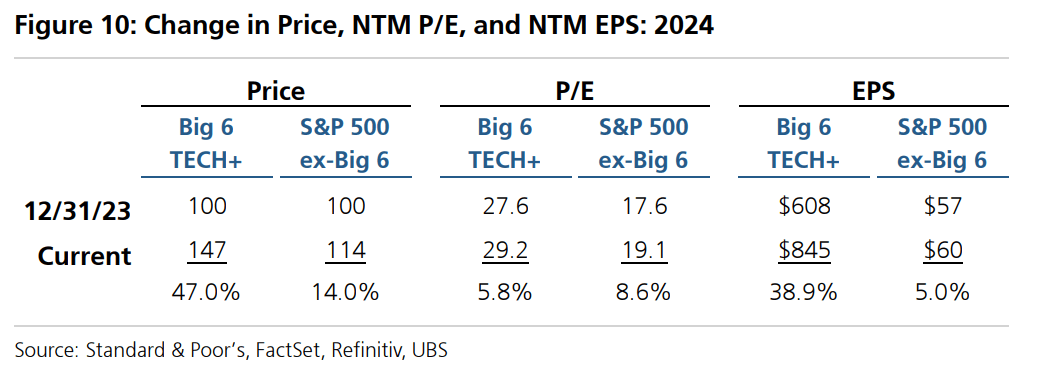

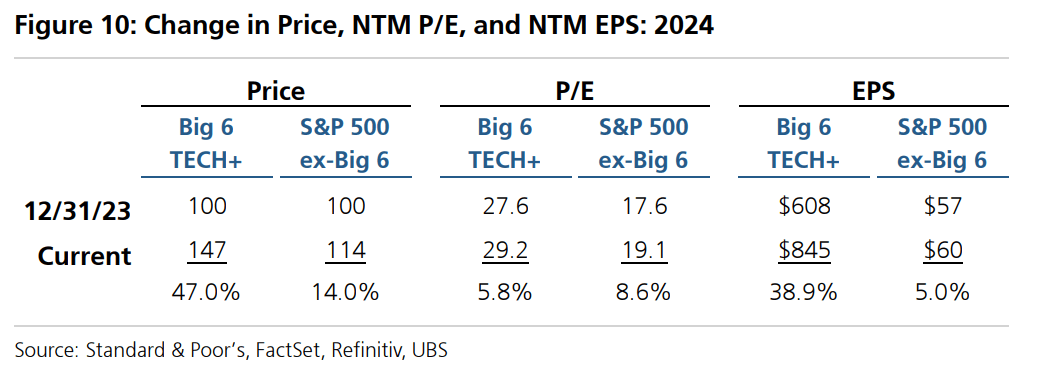

However, their multiples have increased less than the rest of the market. “Earnings have contributed far more to the mega-cap tech stocks in 2024 than the rest of the market (38.9% vs. 5.0%), and valuations up less (5.8% vs. 8.6%).”

“Put differently, the ‘Big 6’ have become cheaper relative to the rest of the market over the past 12 months,” said Golub.

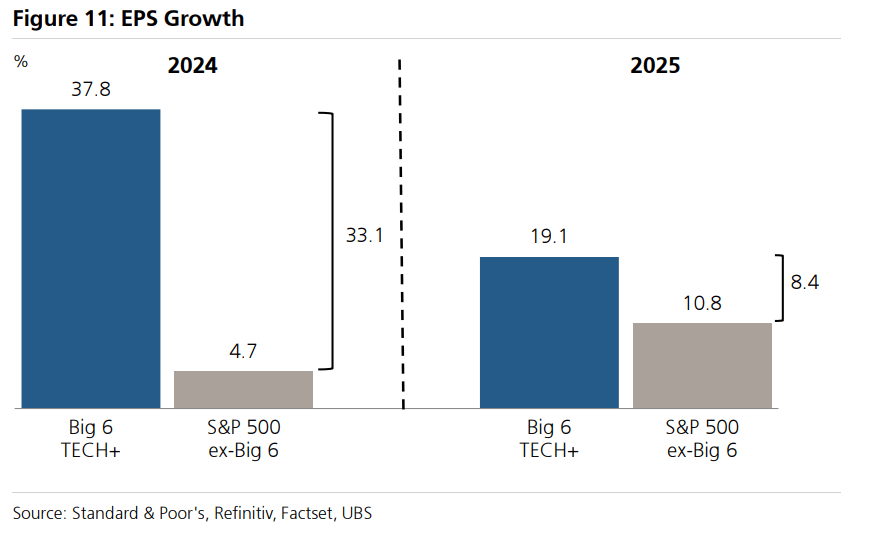

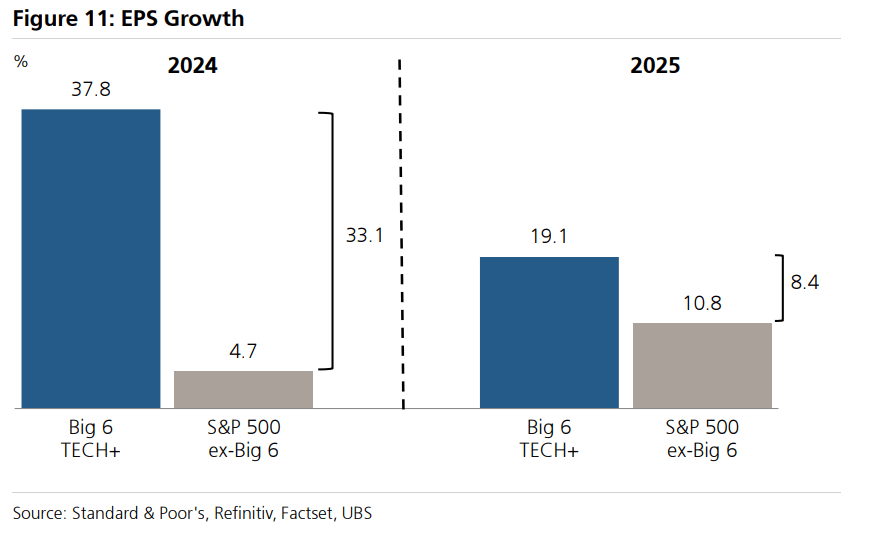

In addition, consensus growth expectations for the “Big 6” are expected outpace the rest of the S&P 500 ( SP500) again in 2025 at 19.1% vs. 10.8%, and while the 2025 EPS spread is expected to narrow compared to 2024, “it is nonetheless well above the 30-year average of 5%,” said Golub.

“Our work indicates that the change in earnings expectations — revisions — are more important for stock returns,” he concluded. “The ‘Big 6’ earnings estimates for 2024 have been steadily revised higher, while the remainder of the market drifts lower. 2025 earnings estimates are following a near-identical path.”

|

We Are

We Are