Data center infrastructure revenue to reach $282B in 2024, capacity to triple by 2030

Jan. 11, 2025 1:48 PM ET

By: Anuron Mitra, SA News Editor

sankai/E+ via Getty Images sankai/E+ via Getty Images

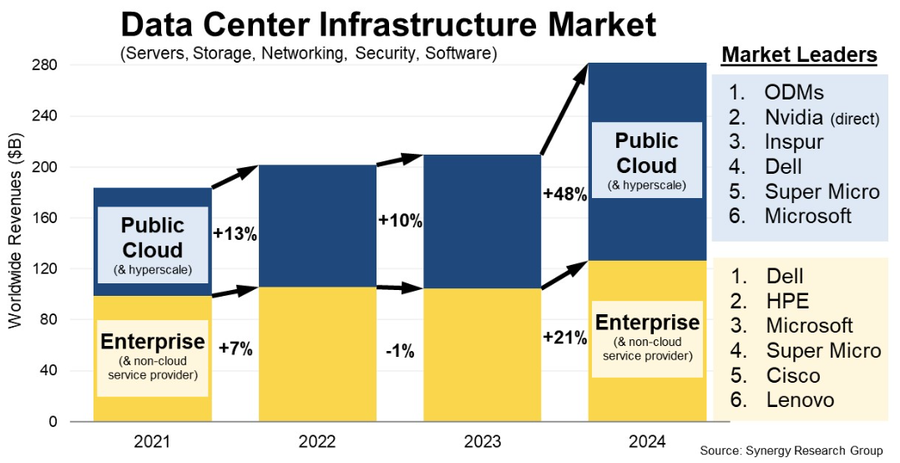

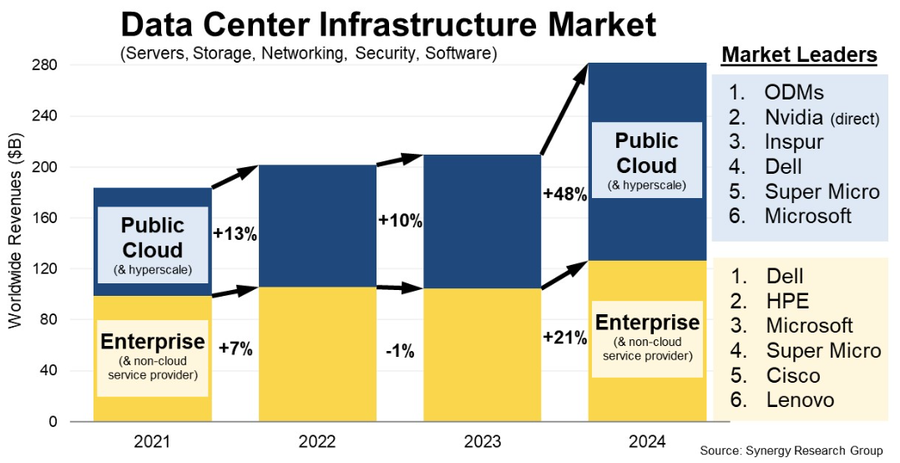

Total data center infrastructure equipment revenues probably reached $282B in 2024, and hyperscale data center capacity is expected to triple by 2030, according to analytics firm Synergy Research Group.

The artificial intelligence (AI) boom has led to massive demand for high-powered graphics processing units ((GPUs)), which in turn has led to major investments in data centers to support those chips.

“GPUs and generative AI systems lit a fire under the market in 2024, resulting in record growth rates for the industry. While the ongoing success of public cloud has been the main driving force behind data center investments for well over a decade now, no-one imagined a 2024 market for data center gear reaching over $280B,” John Dinsdale, a chief analyst at Synergy Research Group, said on Tuesday.

See the following graphic shared by Synergy:

Synergy Research Group Synergy Research Group

Overall worldwide spend on data center hardware and software in 2024 probably grew 34% Y/Y, Synergy said, primarily due to a 48% jump in spending on public cloud infrastructure.

Market Leaders of 2024Synergy's figures are based on actual data for the first three quarters of 2024, along with the analytics firm's forecast for Q4.

Excluding original design manufacturers, Synergy found that Dell ( DELL) was the overall leader in server and storage segment revenues. Meanwhile, Cisco ( CSCO) emerged as the leader in the networking segment, while Microsoft ( MSFT) featured prominently in the rankings "due to its position in server OS and virtualization applications."

"Nvidia ( NVDA) now features heavily as a supplier both to other system vendors and directly to service providers. Outside of these five, the other leading vendors in the market are HPE ( HPE), Super Micro ( SMCI), Lenovo ( OTCPK:LNVGY)( OTCPK:LNVGF), VMware ( AVGO), Huawei, IBM ( IBM) and Arista Networks ( ANET)," Synergy said.

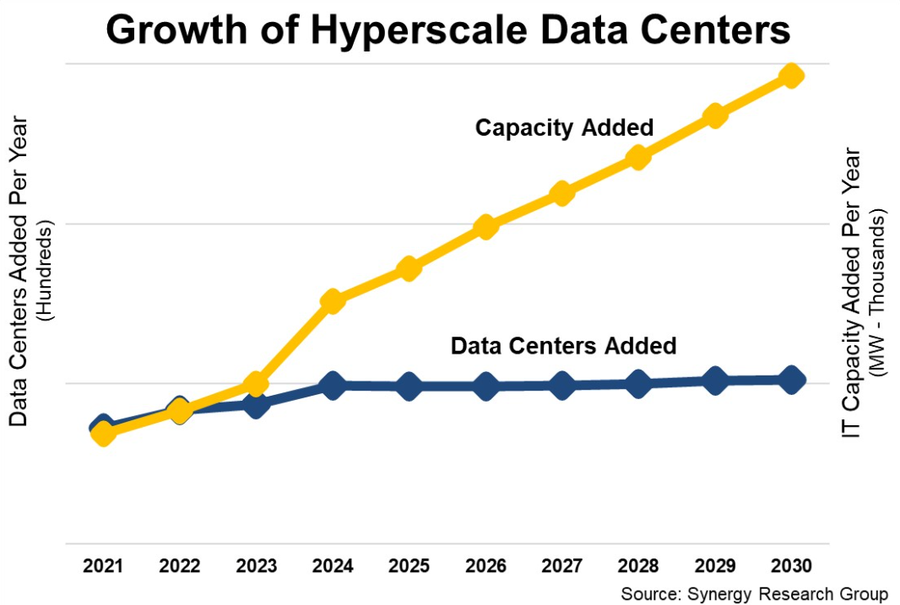

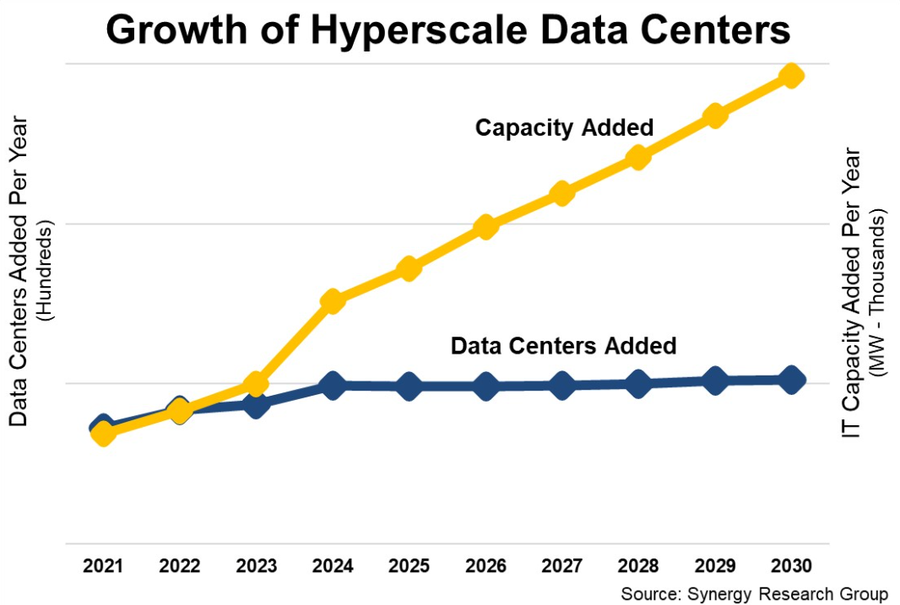

'Supercharged' Generative AISynergy Research believes that the average capacity of hyperscale data centers to be opened over the next four years will be almost double that of current capacity.

“The number of operational hyperscale data centers continues to grow inexorably, having doubled over the past five years. That installed base will continue to grow, but the most marked change in the market is the ever-increasing capacity of data centers that are being brought online," Synergy's John Dinsdale said on Thursday.

"The trend has always been for the critical IT load of hyperscale data centers to grow in size over time, but generative AI technology and services are power hungry and have supercharged that trend. Meanwhile, as the average IT load of individual data centers ramps up, the number of operational hyperscale data centers will continue to steadily grow," the analytics firm added.

See the following graphic shared by Synergy:

Synergy Research Group Synergy Research Group

Here are some exchange-traded funds of interest tied to the technology sector, AI and robotics: ( VGT), (NYSEARCA: XLK), ( IYW), ( FTEC), ( IXN), ( RSPT), ( AIQ), ( BOTZ), ( DTEC), ( GINN), (IRBO), ( ROBT), ( TECB), ( XT), ( THNQ), and ( CHAT). |

sankai/E+ via Getty Images

sankai/E+ via Getty Images