Boeing & Aerospace

Business

Crisis-hit Boeing delivered less than half as many jets as Airbus in 2024

Jan. 14, 2025 at 6:28 pm

Boeing was forced to reassess its safety and quality management after a 737 MAX fuselage blew a hole on an Alaska Airlines flight a year ago. MAX production in Renton, seen here in June, slowed dramatically for all of... (Jennifer Buchanan / The Seattle Times)

By

Dominic Gates

Seattle Times aerospace reporter

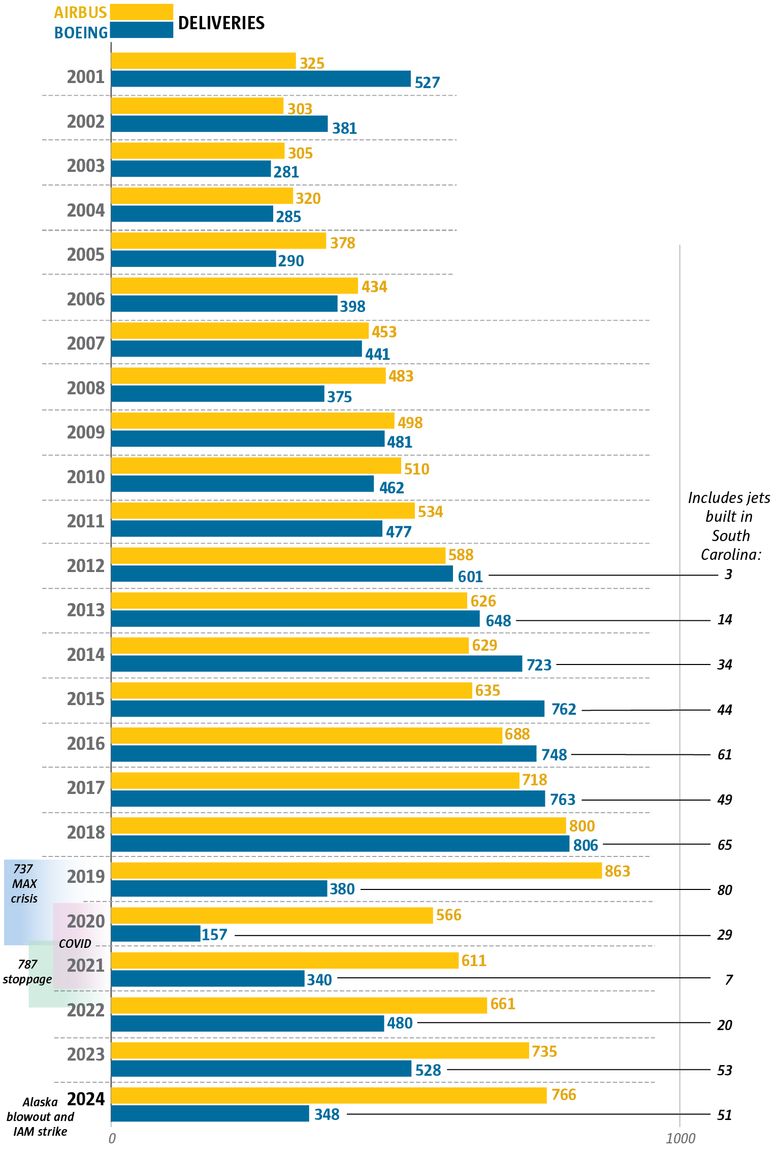

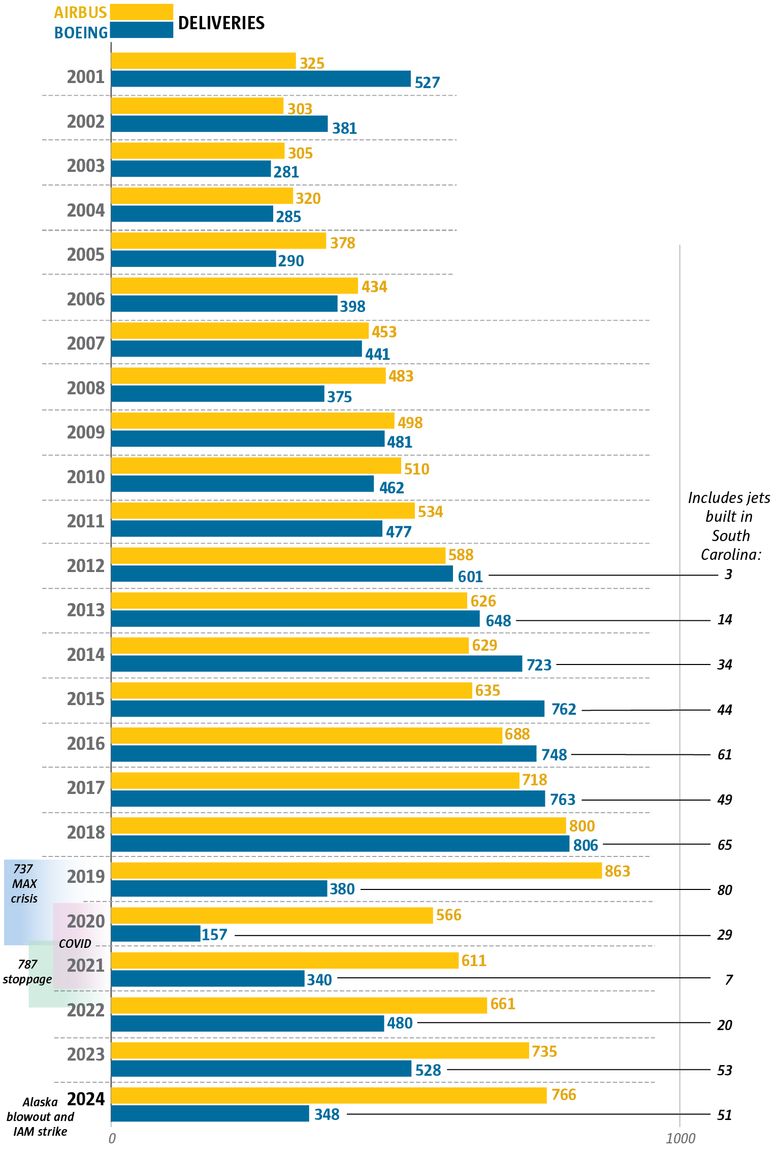

Year-end jet orders and deliveries figures released Tuesday by Boeing reveal how much Airbus dominated its crisis-ridden U.S. rival in 2024.

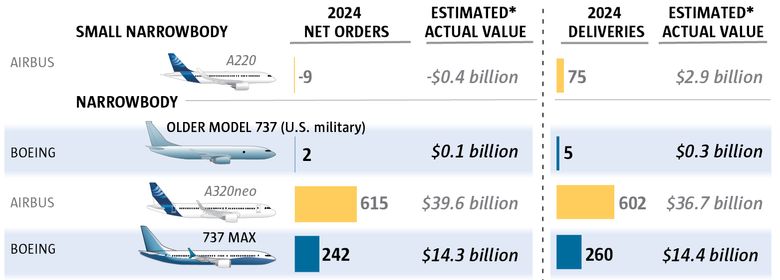

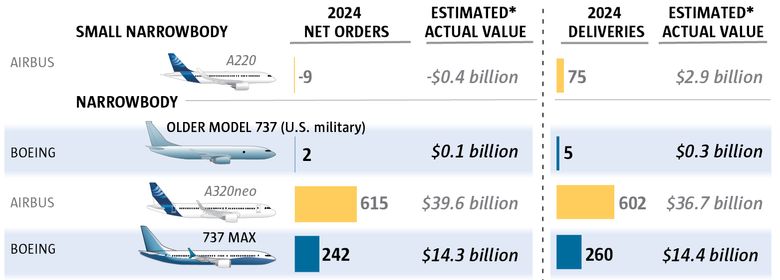

In the smaller narrowbody jet sector that services domestic and intermediate-range flights, Airbus delivered 602 of its A320neo jet family aircraft while Boeing delivered just 260 of the 737 MAXs that compete head-to-head.

Well over half of those Airbus deliveries were of the larger A321neo, against which Boeing has no airplane that can match it in size and range.

Airbus dominance in that market segment skewed the overall figures dramatically. Boeing delivered a total of 348 commercial jets in 2024, while Airbus delivered 766.

Airbus is the world’s No. 1 jet maker for the sixth consecutive year

Airbus has outproduced Boeing since the second 737 MAX crash in 2019. Last year, the fallout from the Alaska Airlines midair fuselage blowout and then the Machinist strike in the fall cut Boeing production to its lowest level since the COVID-19 pandemic.

Sources: Boeing, Airbus (Reporting by Dominic Gates, graphic by Mark Nowlin / The Seattle Times)

Market pricing data from aircraft valuation firm Avitas peg the Airbus deliveries as worth $52 billion, exactly twice the value of Boeing’s deliveries.

Boeing’s troubles last year are well documented. It had to cut production of the 737 MAX drastically after the midair fuselage blowout on an Alaska Airlines flight a year ago.

And a nascent recovery from that stalled in the fall when a 52-day Machinists union strike stopped almost all Boeing jet production in its Puget Sound assembly plants.

Focused on restoring quality and safety, Boeing chose to restart production very slowly and carefully after the strike.

The entire aerospace industry’s supply chain remains severely weakened by the loss of experienced workers during the COVID pandemic. So Airbus couldn’t ramp up production as fast as planned due to parts shortages, limiting its ability to take further advantage of Boeing’s weakness.

Airbus Commercial CEO Christian Scherer, in a media teleconference last week, listed the “weak links in the chain” including supply of engines, seats, galleys, and some aero structures, particularly those made by troubled partsmaker Spirit AeroSystems, the supplier Boeing will acquire later this year.

“The challenges that this industry is throwing at us, the world is throwing at us, are not going away,” Scherer said, adding that Airbus is therefore putting intense effort into helping out suppliers and to recruit and train new employees.

“Airbus has shown leadership and pulled the industry up,” said Scherer.

Airbus and Boeing suffered similar supply chain problems. That Airbus came out so far ahead is down to Boeing’s self-inflicted wounds.

Boeing must begin to turn its fortunes around this year to avoid falling further behind because Airbus plans a relentless production increase as it fixes its supply chain.

Airbus now operates eight A320 jet family assembly lines — two in Toulouse, France; four in Hamburg, Germany; one in Tianjin, China; and one in Mobile, Ala. — all now equipped to build the larger A321 model.

Scherer reiterated that Airbus plans to increase production of the A320 family from 50 per month in 2024 to 75 per month in 2027.

To implement that ramp-up, Airbus plans to add another A320 assembly line in Mobile and another in Asia by 2026.

Airlines rush to order Airbus as demand for jets soars

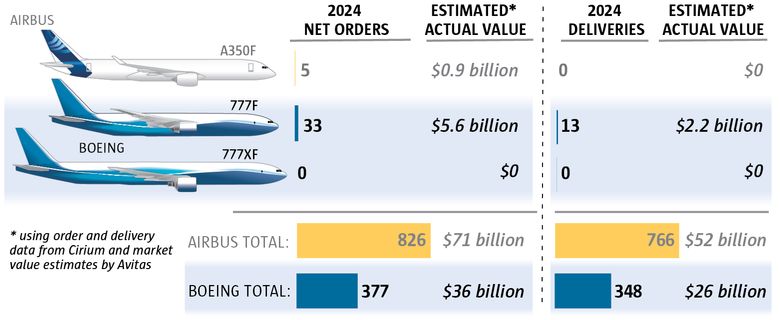

On the sales front, Boeing also lagged Airbus badly. Airbus won 826 net orders in 2024, while Boeing won 377.

Separately, Boeing removed a net 60 orders from its official backlog in 2024. Those are not canceled, but according to accounting principles can no longer be counted as firm orders due to uncertainty as to whether the customers can take delivery.

If those were cut from the tally, Boeing’s net orders for last year would fall to 317.

Because of lack of clarity about which Boeing sub-models of the MAX were among the canceled orders, assessing the value of the orders is less precise than the calculated value of deliveries. That said, the data indicates Boeing’s 377 net orders were valued at about half that of the Airbus orders.

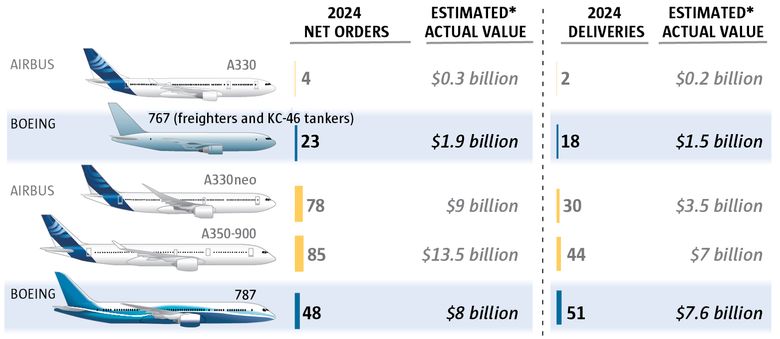

In 2024, with Boeing in crisis, Airbus dominated in both jet production and sales

Airbus vastly outproduced Boeing in narrowbody jets and also delivered one more widebody aircraft than Boeing. In sales, Airbus won orders last year worth double the dollar value of Boeing’s orders.

Sources: Boeing, Airbus (Reporting by Dominic Gates, graphic by Mark Nowlin / The Seattle Times)

Despite tremendous demand for new airplanes, airlines hesitated to place new orders for Boeing jets and cancelled some prior orders due in part to the well-publicized troubles and in part to the delay in getting three new airplane models — the MAX 7, MAX 10 and 777X jets — certified for service by the Federal Aviation Administration.

Airbus had 52 orders cancelled in 2024, while Boeing had 192 cancellations.

Fully 135 of the Boeing cancellations were from one airline, Jet Airways of India, which was liquidated last year. Boeing had earlier taken those orders out of its official backlog when Jet ceased operations back in 2019.

Airbus and Boeing each made big bets in the Indian market, with very different outcomes.

Boeing sold heavily to both Jet and low-cost carrier SpiceJet, while Airbus won big orders from SpiceJet rival IndiGo.

Jet is out of business; SpiceJet went through a sharp downturn and shrank dramatically. IndiGo is now India’s largest airline.

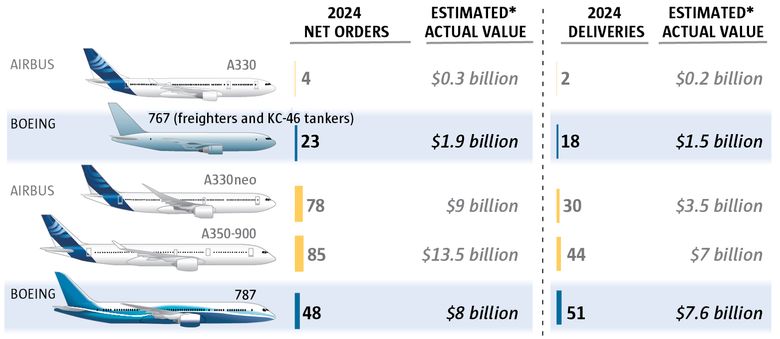

Boeing losing its edge in widebody jets

Boeing has historically had an edge over Airbus in the market for larger, more expensive widebody jets.

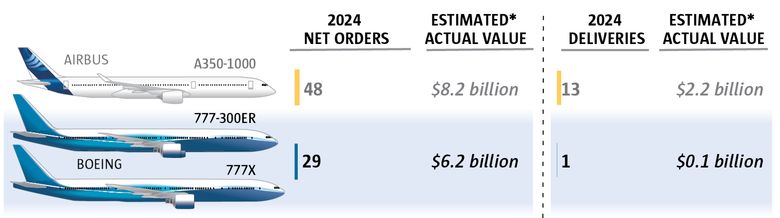

But even there, Airbus in 2024 delivered 89 widebodies, one more than Boeing. And Airbus won 220 net orders for widebody jets last year, while Boeing won 133.

Airbus sales chief Benoit de Saint-Exupéry savored that outcome, saying the European plane-maker overtook Boeing in both widebody deliveries and orders mostly due to the growing success of the large A350 jet.

Midsize to large widebody

Sources: Boeing, Airbus (Reporting by Dominic Gates, graphic by Mark Nowlin / The Seattle Times)

Airbus delivered 57 of those jets and won orders for 138 more.

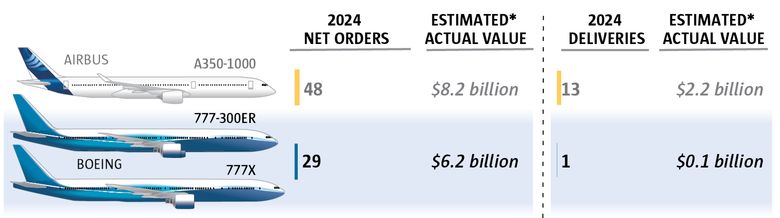

Underlining the threat especially from the very large A350-1000 model, Boeing has no new widebody jet ready to compete with it.

Boeing delivered its final old-model 777 passenger plane in December, a plane that had been in storage since the COVID pandemic hit in 2020.

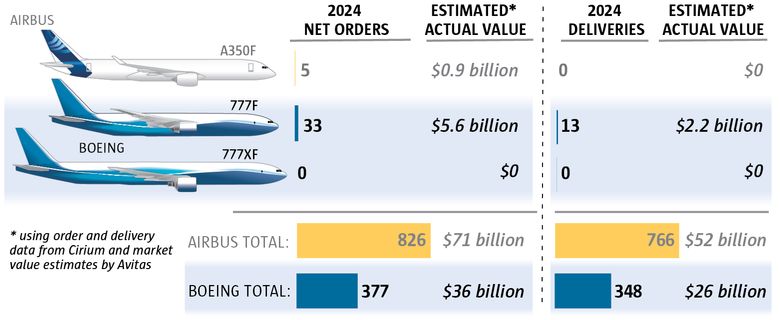

Very large widebody

Sources: Boeing, Airbus (Reporting by Dominic Gates, graphic by Mark Nowlin / The Seattle Times)

With the 777’s replacement, the 777X, long delayed and not scheduled to enter service until late 2026 at the earliest, demand for the A350 has taken off.

“The A350 has clearly emerged as the long-haul leader,” Saint-Exupéry said, adding that he projects it will be “the reference for replacing the big 777 fleet around the world.”

Airbus plans to ramp up A350 deliveries to 12 jets per month and the smaller widebody A330neo to four jets per month by 2028.

And in the one commercial aircraft market where Boeing has until recently faced virtually no competition from Airbus — cargo planes — that niche now is also showing a shift.

Boeing will stop making the 767 freighter in 2027 and the new 777X freighter won’t enter the market until 2028 at the earliest. That offers an opening for the A350F cargo plane.

Large widebody cargo jets

Sources: Boeing, Airbus (Reporting by Dominic Gates, graphic by Mark Nowlin / The Seattle Times)

This month, too late for the 2024 tally, Starlux Airlines of Taiwan ordered five more A350Fs to double its initial order and bring the jet’s order book to 60.

“One of our objective for 2025 is to penetrate the big freight carriers in the U.S.” said Saint-Exupéry, targeting the one cargo market still largely closed to Airbus.

As Boeing begins 2025 with an ambition to correct its course and raise production safely, the pressure from Airbus appears set to grow more intense.

Dominic Gates: 206-464-2963 or dgates@seattletimes.com. Dominic Gates is a Pulitzer Prize-winning aerospace journalist for The Seattle Times.

seattletimes.com |