Re <<trade>>

bloomberg.com

JPMorgan Plans $4 Billion US Gold Delivery Amid Tariff Fears

By Jack Ryan and Jack Farchy

1 February 2025 at 02:12 GMT+8

Updated on

1 February 2025 at 06:44 GMT+8

JPMorgan Chase & Co. will deliver gold bullion valued at more than $4 billion against futures contracts in New York in February, at a time when surging prices and the threat of import tariffs are fueling a worldwide dash to ship metal to the US.

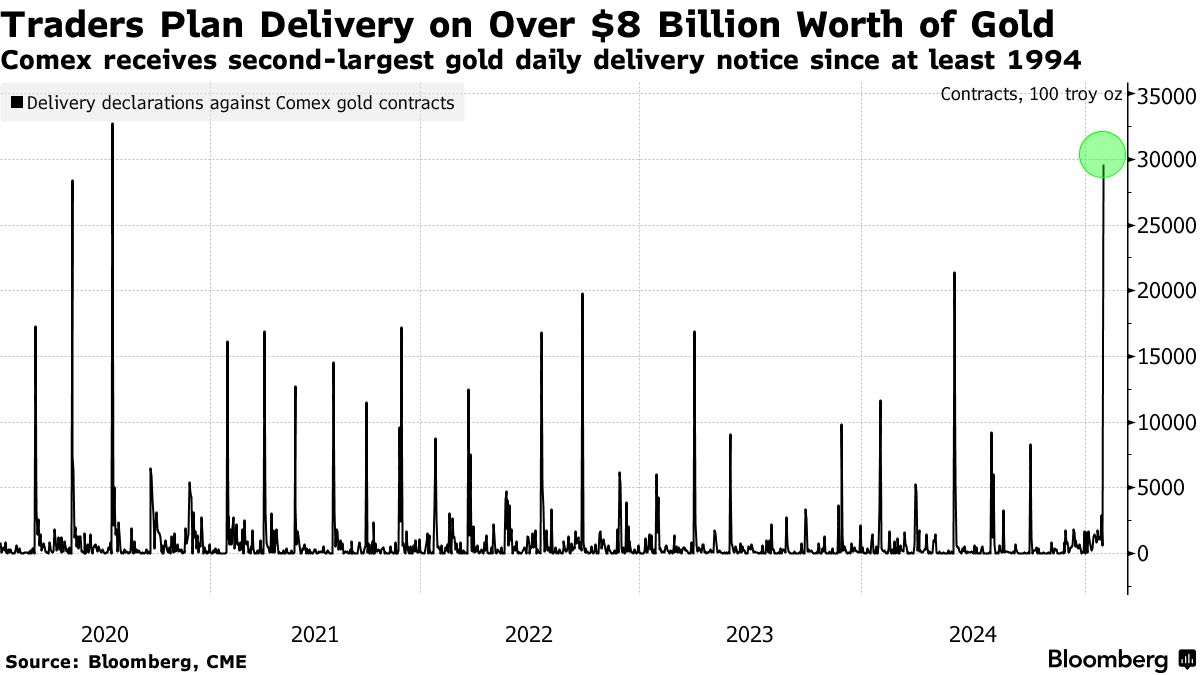

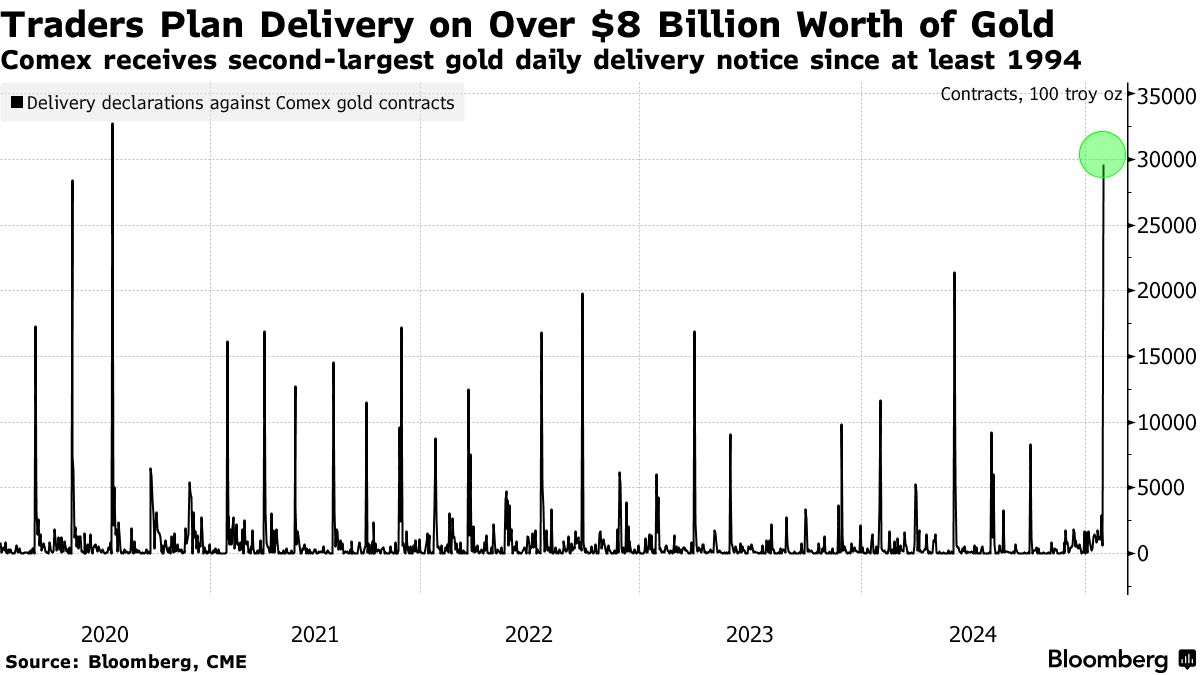

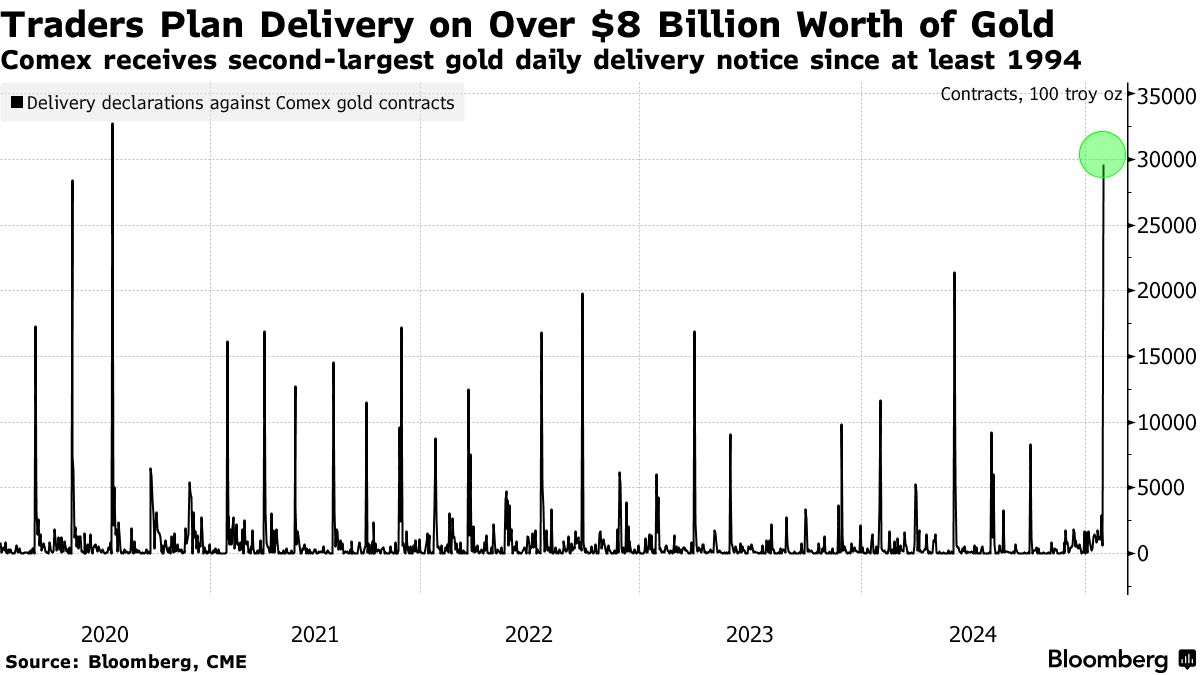

The bank, which is by far the world’s biggest bullion dealer, was one of several institutions to declare plans on Thursday to deliver bullion against contracts traded on CME Group’s Comex that will expire in February. The delivery notices — which total 30 million troy ounces of gold — were the second largest ever in bourse datagoing back to 1994.

Fears of imminent tariffs on imports following the election of US President Donald Trump have caused prices for gold futures on Comex to surge over spot prices in London. Spot prices shot to record highs this week, but the additional premium on Comex has created a lucrative arbitrage opportunity for the handful of banks that can quickly fly bullion between key trading hubs.

Similar pricing dynamics have emerged in other Comex contracts too, and the disparity has become so large that traders have started flying silver into the country. The precious metal is usually too cheap and bulky to justify the cost of airfreight, and one industry veteran says it’s the first time they’ve seen it happen.

While millions of ounces of gold trade on Comex every day, typically only a small fraction of that goes to physical delivery, with most long positions being rolled over or closed out before they expire.

The exchange is often used to hedge positions in London, the largest trading hub, with banks offsetting longs with paper short positions in New York. Since the day of the US election though, physical inventories in the exchange’s depositories have swelled by 13 million ounces, around $38 billion of gold.

Big Banks Make Massive Gold Delivery on ComexJPMorgan accounted for half of the delivery notices

Source: CME

It is unclear whether JPMorgan or the other banks were delivering bullion physically to take advantage of an arbitrage opportunity, or were simply using the deliveries to exit existing short positions. JPMorgan and exchange owner CME Group Inc. declined to comment.

JPMorgan issued delivery notices for 1.485 million ounces of gold to meet physical delivery for the February gold 100-ounce contract, with deliveries on Feb 3. That accounted for roughly half the total to be delivered, with Deutsche Bank AG, Morgan Stanley and Goldman Sachs Group Inc making up the bulk of the rest.

Deutsche Bank, Morgan Stanley and Goldman declined to comment.

— With assistance from Yvonne Yue Li |