Hey! Company Analysis

I asked for opinions on the "Value Investing" thread about a cargo company I’m researching, and they suggested I ask here.

Euroseas (ESEA) – Containerized Cargo

I'm still investigating small-cap cargo companies, trying to understand why selling volumes are so high despite strong fundamentals (aside from a slightly higher debt-to-peers ratio).

I'm still in the research phase, but I need an outside perspective. The odds that I see something the market doesn’t are very low. However, most cargo companies have taken a big hit over the past month—so maybe the whole industry is trading below intrinsic value? Anything important happened besides Attacks on Suez Channel?

I stopped reading about the general cargo market (it peaked in 2023–2024, but global trade will continue, with a forecasted 3.9% CAGR). However, I'm sure I'm missing key industry standards or warning signs—any suggestions?

My financial analysis isn’t fully complete yet, but I’ve reviewed the last four quarterly reports, company guidance, and official news from the past year.

From what I see so far, Euroseas has solid ROIC, margins, and a slight decline in forecasted earnings growth (from 13.4% to 11.9%), which isn’t bad compared to peers. Most competitors are seeing ~45% earnings declines.

Brief Overview of Business Model & Operations(Excluding recent deals)

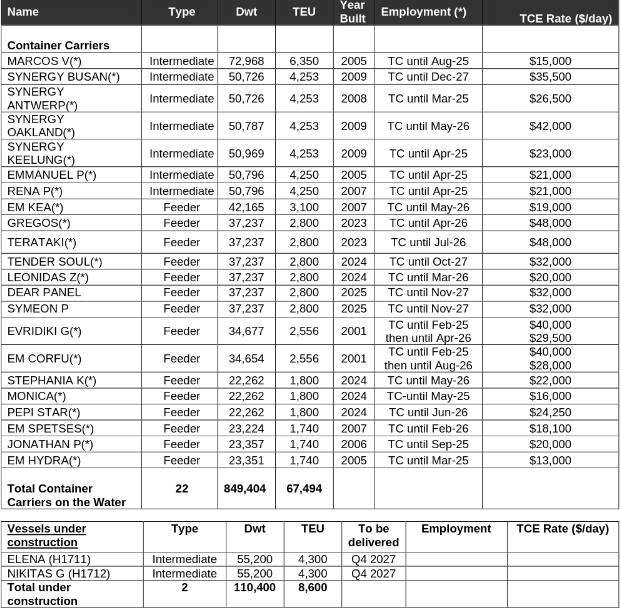

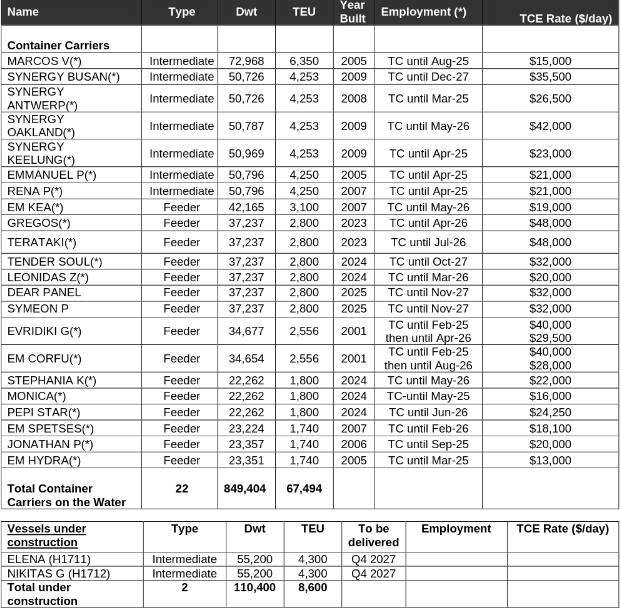

Euroseas purchases, leases, and charters its ships through subsidiaries, selling and renewing its fleet over time. As of January 2025, they operate 25 vessels:

- 17 feeder container ships

- 7 intermediate container ships

- +2 intermediate ships on order (delivery expected in 2027)

They recently arbitraged three feeder vessels, announcing plans to phase them out due to higher depreciation costs and lower demand for small TEU transport. However, this month, they sold one of those ships for $11M (after tax).

That sale raised some concerns about management—but considering depreciation, years of earnings, and ship acquisition costs, it doesn’t seem like a bad deal.

After recent purchases, their average fleet age is 11–12 years. Once the two new ships are delivered (which have better margins and align with intermediate ship demand), this should decrease by a couple more years.

Margins & Fundamentals vs. Peers

If you want to check the numbers yourself, note that their $60M sale of two intermediate ships hasn’t been reported in the latest quarterly reports yet.

What I’d Like to Ask:- What’s your experience with the cargo/container/logistics market?

- What might I be overlooking about this company?

- Should I go deep and calculate NOPLAT for a DCF model?

- By breaking down revenue per ship (including new and under-construction vessels), deducting operating expenses, taxes, and other factors that aren’t reflected in existing financial reports.

- Since online DCF calculators (like Alpha Spread or Finbox) won’t account for this new data.

After rethinking, I might compare larger, more sustainable peers. If I find one or two better-positioned companies with growth potential, I’ll invest in both for diversification—or skip the sector entirely.

Any comments or advice would be appreciated. Thanks! |