re <<Let's save money>>

yeah, let us do THAT!

BTW, I shall GetMoreGold with every morsel of cash still in my possession, including whatever I can muster us in the crypto ledger that be USDT / USDC to add to hoard of PAXG.

I think the Trump might NOT settle for 'G2' where US$ + CNY devalue against all other fiat currencies and against Gold+Silver, but instead go for an absolute devaluation against ALL fiat currencies including CNY, so as to try to bring home more of the manufacturing faster, and not to friend-shore to Canada and Mexico. His objective is to Make America Great Again by making enough money to pay down the US$36 trillion debt and do so without paying much interest rate penalty.

How? Either you and I are stupid f*cking f*cks or astute ones with much imagination. It is just mathematics requiring no imagination as long as the world is willing to use USD whether my necessity or by extortion. The Trump already threatened w/r to de-dollar-ers. String together the dots; do it NOW.

reuters.com

Trump repeats tariffs threat to dissuade BRICS nations from replacing US dollar politico.com

Trump trade advisers plot dollar devaluation Advisers close to the former president — particularly his former trade chief Robert Lighthizer — are considering policies that would weaken the dollar relative to other currencies, which could juice U.S. exports but also fuel inflation.

thenationaldesk.com

Trump aims to create US sovereign wealth fund with potential TikTok stake ... would explain what is happening in the gold market where JPM is allegedly shipping gold from London to New York. For if sovereign wealth fund is good for TikTok, then good for everything else besides TikTok, and

Let us get ready, just in case. Doing the mathematically obvious is no crazier than Riviera Gaza, just might work.

(1) issue as many as necessary the famous trillion dollar platinum coins en.wikipedia.org. , first to pay off the debt and redeem all t-bills

(2) issue some more more famous trillion dollar platinum coins Message 35013376 , to fund

- sovereign fund, in the absence of trade surplus

- Greenland

- Canada

- Gaza

- ...

- Bitcoins

- Gold

- NASDAQ

- NYSE

- S&P500

- Equity markets of other domains

(3) together with the drill drill drill protocol, the trillion dollar platinum coins can, mathematically, enable all Team USA citizens to never ride <<coach on United>>

(4) Here it is, a sample from EBay ebay.com

One Trillion-Dollar Trial Coin One Trillion-Dollar Trial Coin

(5) Here is the economic / constitutional theory behind the protocol that solves all problems

Are we, meaning you and I, on the same f*cking page?! if not, start reading, weep if necessary, but read, for the time to claiming consolation prize is on count-down, and all stuff shall soon rocket, not just gold & silver

bloomberg.com

The Trillion Dollar Legal Memo

FOIA Files obtained a series of memos from the Justice Department that show a “large denomination platinum coin” was discussed at the highest levels of government.

Jason Leopold

2 August 2024 at 22:30 GMT+8

An artist’s imagined version of a 1 trillion dollar US coin. Illustration: DonkeyHotey/Wikipedia

Who’s up for a game of Mad Libs? I’m hoping to recruit a team of players, preferably anyone from the Justice Department’s Office of Legal Counsel. I need help un-redacting a set of documents I just received from the agency, related to its legal work on the trillion-dollar platinum coin. If you’re not already getting FOIA Files in your inbox, sign up here.

Ahhhhh, the trillion-dollar-coin. It’s the bête noir of some economists who see such a thing as, at best, a harebrained thought experiment. It’s an economic elixir for others who view it as a way to circumvent the unhealthy cycle of national debt crises.

It’s also a topic that’s near and dear to me, not least because I’ve spent more than a decade trying to pry loose details about it. Now, I finally have something to share from behind the platinum curtain. But — spoiler alert — what I’m able to share with you is pretty barebones, due to heavy redactions.

Before I dive in, I want to fill you in on the epic, and somewhat agonizing, backstory to this latest FOIA haul. It dates back to 2011, when the US government was dangerously close to running out of cash, and politicians were engaged in what is now a regular political showdown over the debt ceiling.

President Barack Obama had been negotiating with Congress to raise the debt ceiling. Republicans, including newly elected Tea Party conservatives, demanded deep spending cuts. A bitter standoff ensued. Then-Treasury Secretary Timothy Geithner warned lawmakers that the US government was staring down economic Armageddon. Uncertainty roiled the markets.

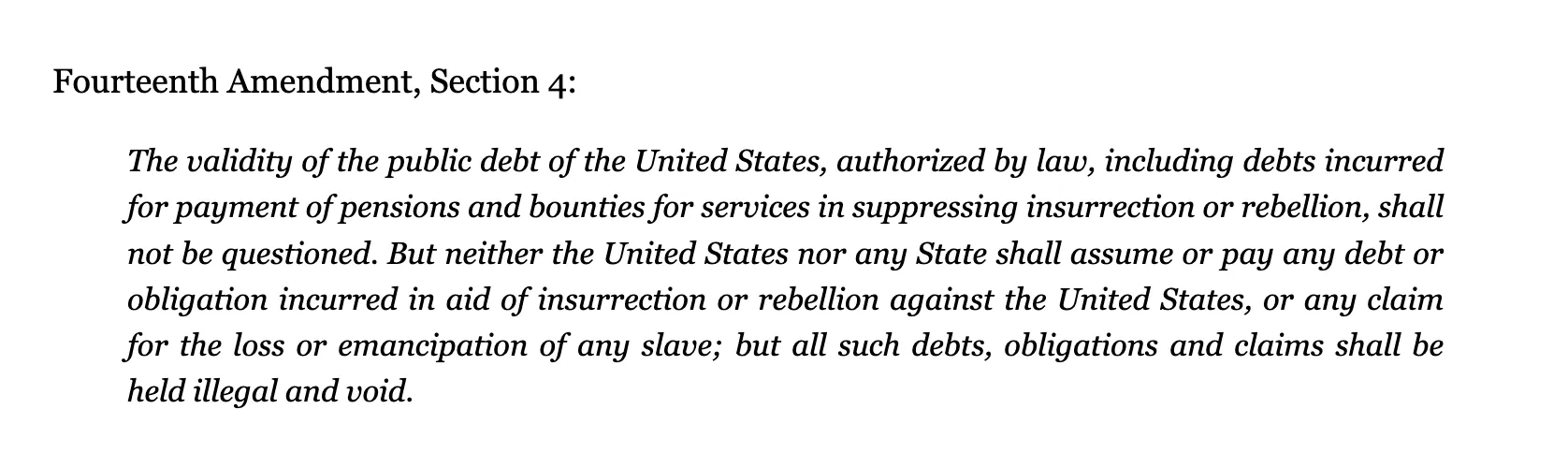

It was in that context that Obama’s top advisors sought guidance from the Office of Legal Counsel. They wanted to know whether Obama could bypass Congress and unilaterally raise the ceiling under Section 4 of the 14th Amendment of the US Constitution, which guarantees the validity of public debt.

Any guidance from the Office of Legal Counsel was never made public, because those discussions are considered confidential.

FOIA Fodder

During Obama’s talks, a radical idea to sidestep the debt ceiling bubbled up from various political and financial blogs: the Treasury Department could simply mint a trillion dollar platinum coin, deposit it with the Federal Reserve and use it to pay down debt. The notion seemed totally bonkers. Yet, experts posited that it was perfectly legal. (My Bloomberg News colleague, Joe Weisenthal, has written extensively about the virtues of a platinum coin).

The idea for the trillion dollar coin never really got past the bloggers, and Treasury shot down the 14th Amendment as a workaround. Nevertheless, Obama negotiated a deal with Republicans to raise the debt ceiling.

Then in 2013 the same thing happened. The debt ceiling needed another boost. Congress refused to budge without more spending cuts and the US was headed for a cliff yet again. That crazy idea about the trillion dollar coin? This time, it attracted tons of mainstream support and gained some credibility. There was even a Twitter hashtag, #MintTheCoin.

The White House wasn't convinced it was viable. Yet, rumors swirled that the Office of Legal Counsel had weighed in. So that year I filed a request for emails and legal memos or opinions on the trillion dollar coin, as well as any legal guidance about the 14th Amendment option.

In its initial response, the agency confirmed that it had documents. But it said it was withholding everything, pursuant to various FOIA exemptions, to protect confidential, protected communications. Other reporters who sought similar documents got the same response.

That was that.

Round two

In 2016, a source planted a seed. They suggested there might be a story about how the Office of Legal Counsel indeed studied the trillion dollar coin, secretly.

I had nothing to lose so I filed another request, tweaking the language slightly. A few weeks later, one of the agency’s FOIA analysts asked me to narrow my request, strongly suggesting that I’d get some documents if I complied. I did. But then, about a month later, the analyst sent me a letter saying the documents they located would be withheld in their entirety!

[Insert expletives here.]

That very day I asked the Office of Legal Counsel’s FOIA office to reopen my request, arguing that they’d negotiated with me in bad faith. Somewhere along the way, my request fell into a black hole and I stopped hearing back from them.

Meanwhile, in 2021 and last year, Joe Biden’s administration struck last minute deals to raise the debt ceiling, narrowly averting defaults. Right on cue, the trillion dollar coin resurfaced in news coverage. Some lawmakers, including Democratic Representatives Jerrold Nadler and Rashida Tlaib, spoke in favor of it. Treasury Secretary Janet Yellen called it a “ gimmick.”

Third time’s a charm

Still stinging over the Office of Legal Counsel’s failure to respond to my 2016 FOIA request, I decided to file a third one, in January 2023. This time I asked for opinions, memoranda, and emails mentioning or referring to the platinum $1 trillion coin.

The agency’s FOIA officer warned that it could take until September 2025 to complete my request. But they dangled a deal: They could process it more quickly if I agreed to narrower search parameters, which included foregoing a “search of custodians’ emails that would otherwise be required.”

I was dubious, to say the least. That’s the same raw deal the agency cut with me in 2016. But I wasn’t willing to wait until 2025, and I didn’t think I had a good shot of winning the release of records if I chose to sue. So, WTH, I rolled the dice.

Persistence pays

Well, FOIA Files readers, earlier this month I finally got the documents — after 11 years!

They show that a “large denomination platinum coin” was indeed discussed at the highest levels of government. But there’s a huge caveat. The records are pretty heavily redacted.

Still, there's useful details to glean, many of which will be of interest to all you trillion dollar coin aficionados. As far as I’m aware, this is the first time since discussions about the platinum coin began more than a decade ago that the DOJ has released any portion of its analysis related to it.

Here's what I got: four separate documents, which amount to 38 pages of draft memos marked “for the files” from 2013, 2015, 2021 and 2023. Half of it is completely redacted. But what was left untouched includes a few breadcrumbs, including some names of Justice Department attorneys who took part in the discussions. Of course I called all of them. Those that I was able to reach told me to pound sand.

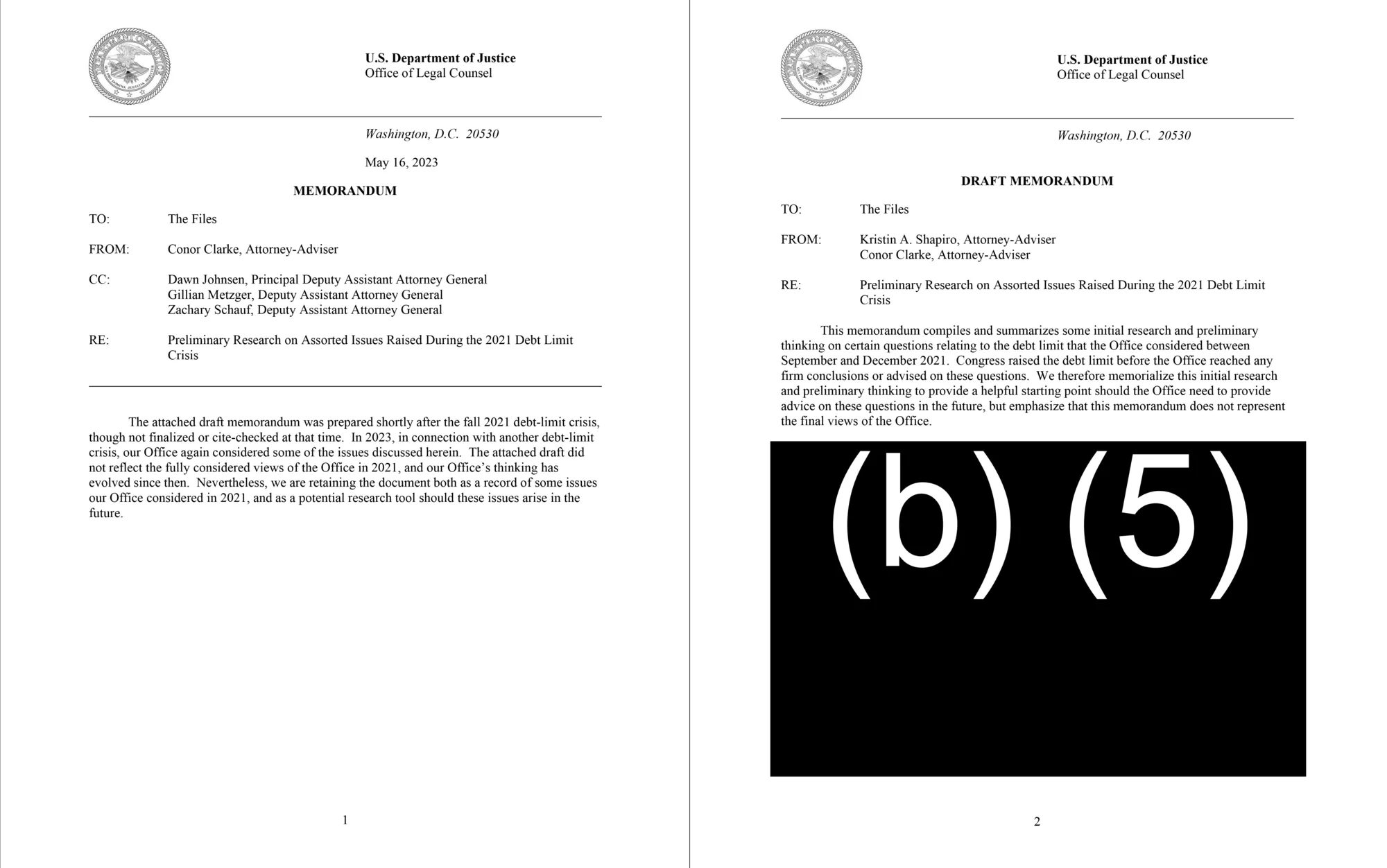

The first memo – “Authority of the Secretary of the Treasury to Issue a Large Denomination Platinum Coin” – came from two top Justice Department attorneys, and was drafted on Nov. 26, 2013.

The memo included a three-page bulleted outline that’s totally redacted. What's interesting, though, is that it says the outline “summarizes our preliminary research and thinking on the question” and offers the attorneys’ “tentative conclusion.” Also, the authors wrote that the outline was “never cleared through other attorneys in the Office, nor did we convey any advice on the question outside of the office.” That suggests the Obama White House never got the legal advice.

Click here to view the documents (page 3)A four-page memo titled “debt ceiling issues” follows. There’s a handwritten note at the top of each page that says “close hold - not for distribution - deliberative.” Sadly, that too is a sea of squid ink.

Click here to view the documents (page 6)The next document is a three-page memo dated Oct. 27, 2015 on Office of Legal Counsel letterhead. It was from the Office of the Assistant Attorney General. Written by a senior lawyer, it memorialized “oral advice” given five days earlier to Treasury Department officials on debt ceiling issues. Even though most of the memo is blacked out, I consider the memo noteworthy. It was written right around the time the trillion dollar coin had popped back into the news, and after then-Treasury Secretary Jack Lew publicly ruled it out as an option.

Click here to view the documents (pages 10, 12)The next memo is dated May 16, 2023, which coincides with the timing of last year’s debt ceiling crisis. There’s a handful of Justice Department attorneys who were copied on it. It basically serves as a cover sheet for an attached memo written in 2021 – during another debt ceiling impasse – along with 26 pages of research “relating to the debt limit that the Office considered between September and December 2021.” Completely redacted.

But there’s a couple of notable excerpts in the memos. The 2021 memo says, “Congress raised the debt limit before the Office reached any firm conclusions or advised on these questions” and warns that it “does not represent the final views of the Office.” The memo written last year by Justice Department attorneys says the Office of Legal Counsel’s “thinking has evolved” since 2021.

Click here to view the documents (pages 13- 14)That’s a tantalizing detail. What does ‘evolve’ mean in this context? Does the office believe Treasury has the legal authority to mint platinum coins? Does it think the president can invoke the 14th Amendment if Congress fails to act on raising the debt ceiling? Or did the Office of Legal Counsel conclude that both propositions weren’t on solid legal ground? We just don’t know.

Now that I have a set of documents to work with, I’m going to try and glean some definitive answers, because there’s no doubt it will come up again. So watch this space. And if you have any tips, please contact me! Even small details could be worth their weight in platinum. |

One Trillion-Dollar Trial Coin

One Trillion-Dollar Trial Coin