Wolf thinking:

"But a bond market freakout over accelerating inflation and a lax Fed – resulting in higher long-term yields that really matter for the economy – would nudge the Fed to switch its bias to rate hikes again. To keep long-term yields from rising too much, the Fed will need to show the bond market that it’s serious about inflation, and that it will crack down again if inflation re-accelerates substantially.

That’s the irony: The Fed might have to hike short-term rates again to make sure long-term interest rates remain “moderate” – paying attention to the third part of its mandate, to conduct monetary policy “so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.” The mandate is silent about the Fed’s short-term policy rates. It’s “long-term interest rates” that are in the mandate, and the way to get there is to keep inflation in check."

Poor 10Y Auction Tails Despite Surging Yields

by Tyler Durden

Wednesday, Feb 12, 2025 - 08:29 AM

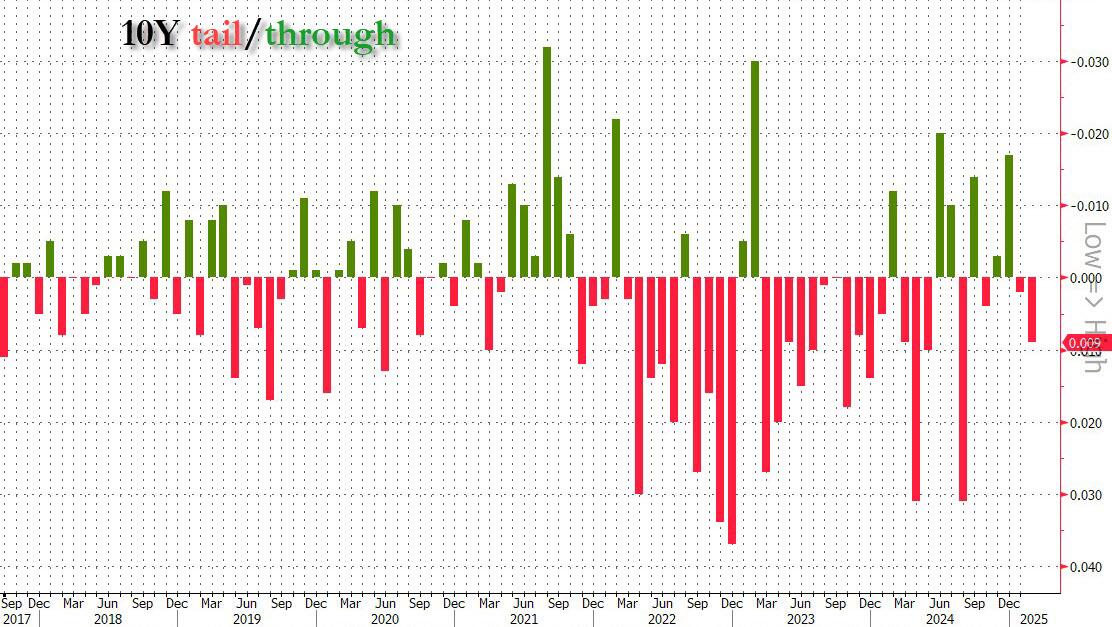

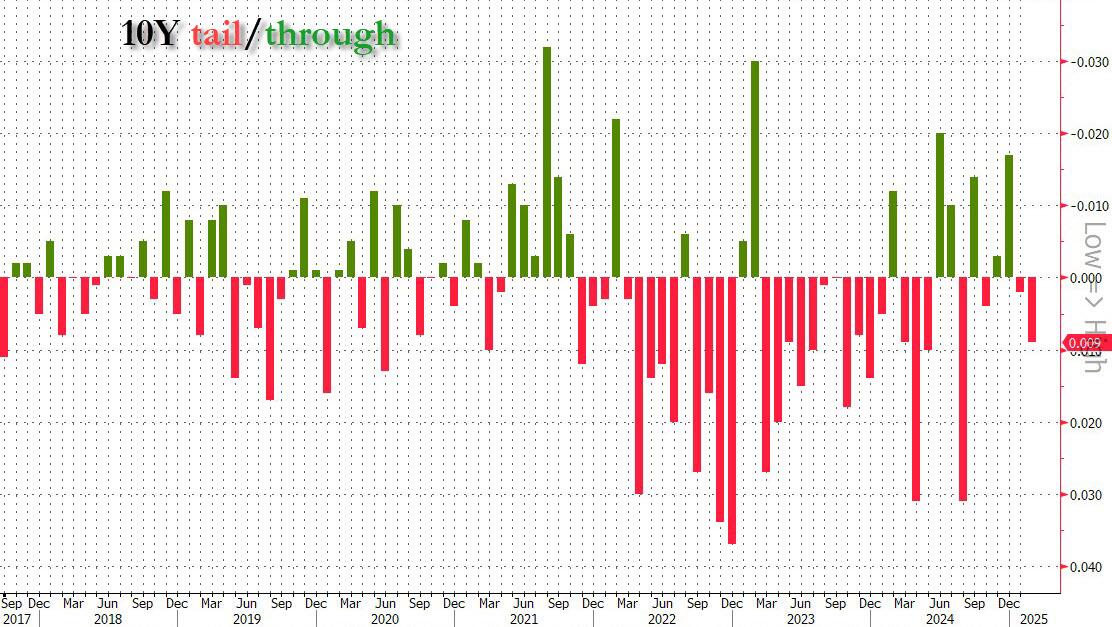

After yesterday's stellar 3Y auction, many were expecting today's sale of benchmark 10Y paper to also be very solid too, especially after the massive post-CPI concession which sent the 10Y surging by over 10bps. It did not quite work out that way, and when the Treasury sold $39BN in 10Y paper at 1:00pm ET, the auction tailed by 0.9bps, the biggest tail since August, in a sale that left a lot to be desired.

[url=] [/url] [/url]

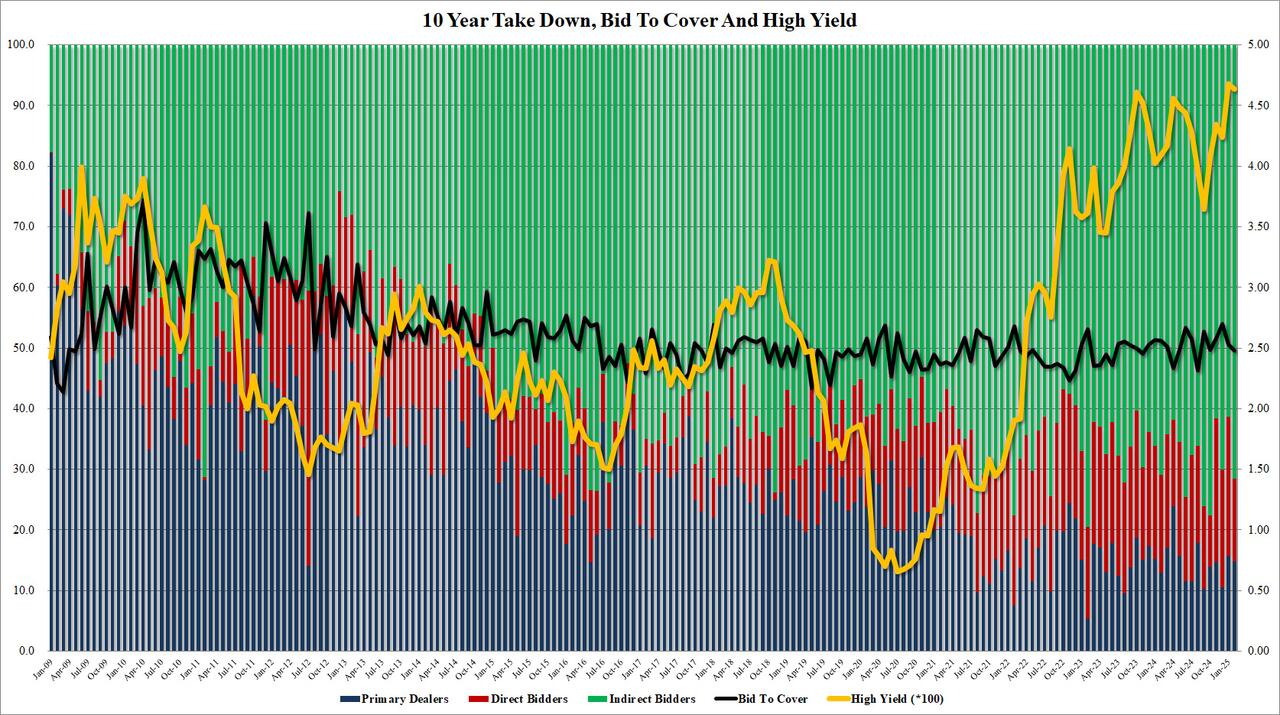

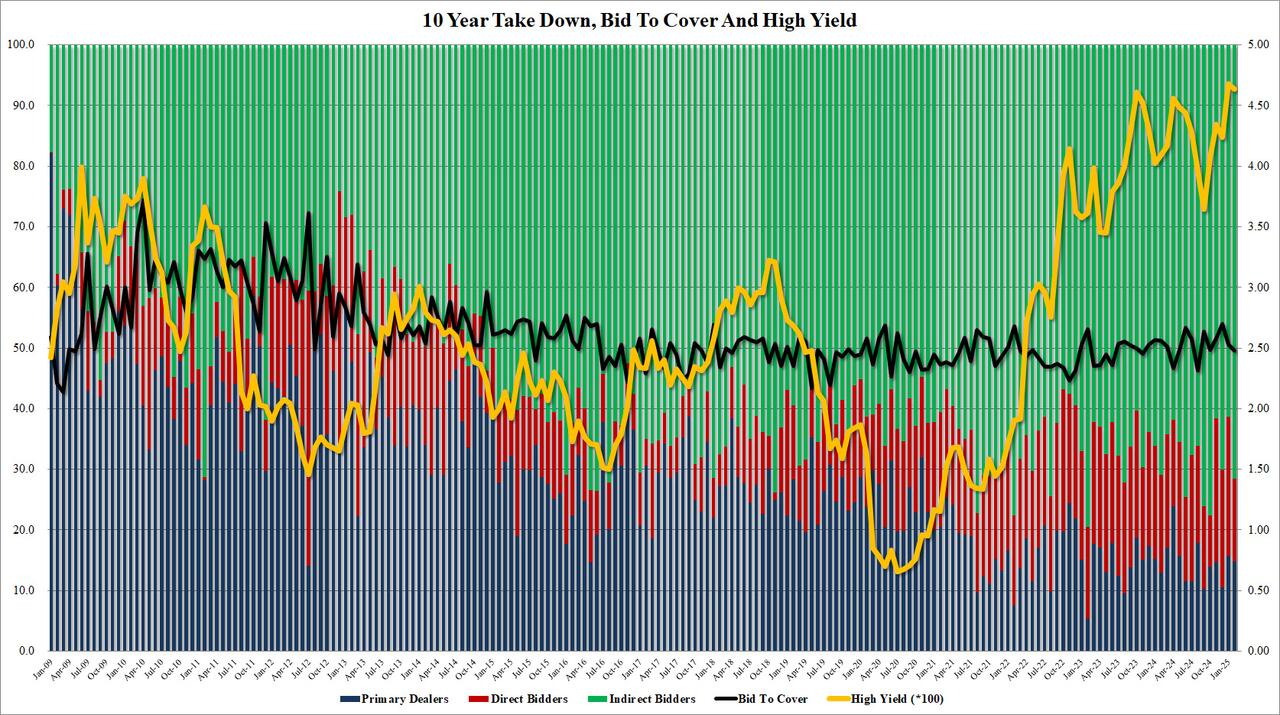

The bid to cover dropped to 2.48 from 2.53, this was the lowest bid to cover since August.

The internals were better with Indirects rising tom 71.6% from 61.4%, the highest since October 24. And with Directs awarded 14.8%, Dealers were left holding just 13.6%, the lowest since last October.

[url=] [/url] [/url]

Overall, this was a disappointing, if hardly terrible auction, and considering the massive surge in yields, it probably should have had better participation, although the market was hit by way too many other news to care about this particular sale and predictably, the 10Y barely moved in the secondary market after the news of the auction broke. |

[/url]

[/url] [/url]

[/url]