From behind the curtain … good news if true … can also mean last-hooray of crypto that has no utility

zerohedge.com

Revaluing Gold To Buy Crypto Is A High-Stakes Gambit

BY TYLER DURDEN

TUESDAY, MAR 04, 2025 - 11:40 PM

Authored by Simon White, Bloomberg macro strategist,

Speculation is swirling that the US will revalue its gold reserves to fund the purchase of crypto.

While not a base case, that possibility should be taken seriously given the potential knock-on effects on the Federal Reserve’s independence, inflation expectations, the gold market and the reserve status of the dollar.

As if tariffs were not enough for the market to digest, at the weekend President Trump announced a strategic reserve fund for crypto that will include Bitcoin, ether and three smaller tokens. But he left the question of how the crypto will be purchased unanswered. That leaves open the possibility of a revaluation in the US’s gold reserves.

[url=] [/url] [/url]

A gold revaluation could weaken or strengthen the dollar’s reserve status, compromise the independence of the Fed, and break the paper gold market while fueling a surge in demand for the physical asset.

Those are not trivial effects.

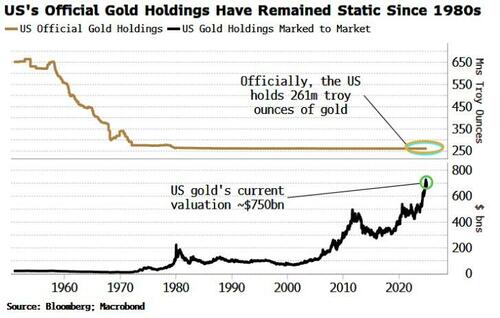

Treasury Secretary Scott Bessent’s recent comments on monetizing the asset side of the balance sheet points to one feasible way of financing the crypto fund: the US could revalue its gold holdings.

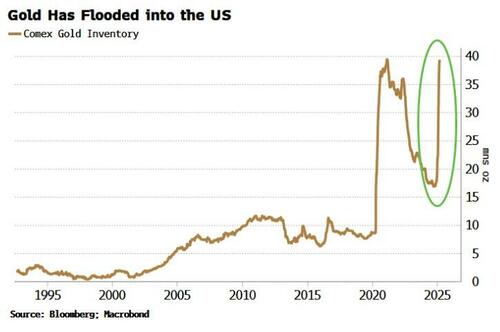

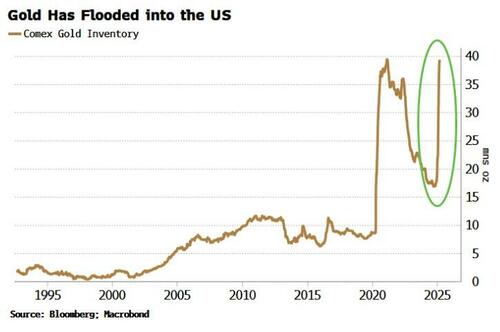

The precious metal has re-established itself as the ultimate geo-political asset in recent years. In recent weeks gold has been traveling from Europe and filling up warehouses for futures delivery in the US, probably due to a squeeze in the physical metal in vaults in London and Switzerland. That gold has not yet left the US.

[url=] [/url] [/url]

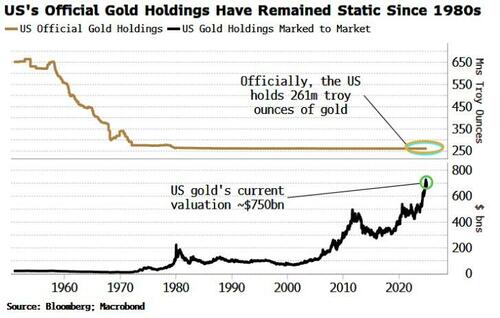

Officially the US government already has over 8,000 tons of gold stored in Fort Knox and other depositories. But there has been a long-standing rumor a lot of it is not actually there. Cue Elon Musk and Donald Trump’s plan for a live audit of the Fort Knox gold (easier said than done). Some believe this stunt would help bring opinion on side of revaluing the gold for the purpose of buying crypto.

How this might happen is a masterclass in accounting acrobatics.

The Fed owns gold certificates backed by the US’s gold holdings, marked at $42.22 per ounce, a value that’s been unchanged since 1973. If the US revalued its gold to the current market price, it would re-issue new gold certificates which it would require the Fed to exchange for the old ones.

[url=] [/url] [/url]

As if by magic, the Fed’s assets would swell by three-quarters of a trillion dollars (if all the gold is there), which the bank would match by expanding the Treasury’s account at the Fed (the TGA) on the liability side of its balance sheet.

The Treasury could then use the TGA to draw down dollars to buy crypto.

Senator Cynthia Lummis has already introduced a bill, The Bitcoin Act of 2024, that if voted into law would compel the Fed to monetize the government’s gold revaluation, and advocates buying one million Bitcoin.

First of all, that would raise serious questions about the Fed’s independence, which has already been de facto eroded in recent years. That would increase consumers’ and the market’s long-term inflation expectations, leading to structurally higher yields (not taking into account the effects of DOGE government savings).

Then there is the impact on the dollar, which could go two ways.

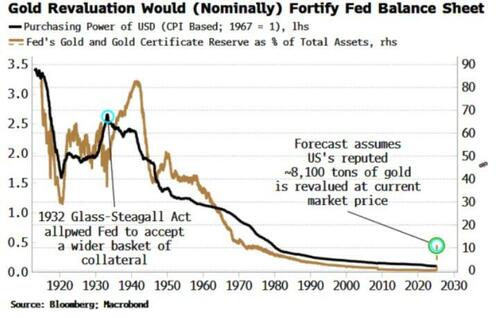

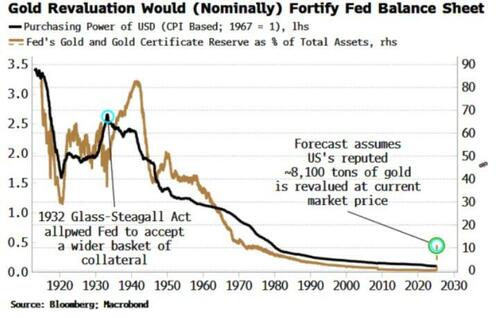

It could bolster the currency. Its purchasing power has been steadily eroded at the same rate that the Fed’s balance sheet has deteriorated. From owing mainly gold and short-term government bills in the 1920s and 1930s, the Fed has gradually bought riskier assets, starting off with longer-term government bonds, all the way down to a willingness to buy high-yield corporate debt during the pandemic.

A gold revaluation would, all other things equal, take the gold on the Fed’s balance sheet to its highest level versus its other assets in 50 years.

[url=] [/url] [/url]

It could do even more than that as the gold price would likely rise if the US revalued its holdings. Even if we assume the price is then fixed again, the market might factor in the rising value of a hard asset on the government’s balance sheet, on which the dollar is a liability. It’s conceivable the crypto purchased would be seen in that way too.

On the other hand, the market could decide that the accounting legerdemain is actually reckless backdoor QE, and government ownership of crypto is risky, both of which would undermine the real value of the dollar.

It’s an even bigger issue if it adds to fears of a Mar-a-Lago accord, in which the US would countenance allowing the dollar’s reserve status to be diminished as it tries to reduce its trade deficit and potentially renegotiate its debt obligations with the rest of the world.

The most immediate problem arising from a gold revaluation, however, would be in that market itself. The last time a US president revalued gold, in 1933, there was no futures market. If, as I suspect, a gold revaluation creates a squeeze in the physical metal, it would leave those short the futures scrabbling to find metal to deliver while the price keeps rising.

It’s often the large bullion banks, such as JPMorgan, which are short. Unless the government wants to see the banking system jeopardized it would need to go down the route of fixing a price, then forcing all the long future positions to accept cash settlement with the shorts.

But doing this would massively undermine the paper gold market.

Why have a paper claim for something if, at the exact time you want to exercise that right, you could have it taken away?

Demand for the physical metal would surge.

High and volatile gold prices are rarely good for stable macro-economic conditions.

A gold revaluation is still an unlikely scenario. It’s possible the crypto fund never sees any crypto. Nevertheless, any risk where the magnitude of the effect is large - even if the probability of it happening is low - should be given serious consideration. |

[/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url]