<Critical Metal For Bombs & Bullets Explodes Higher In Mega-Squeeze Amid Global Shortage

FRIDAY, MAR 07, 2025 - 03:40 PM

The critical mineral used in many defense and military applications—particularly munitions—is facing a severe global shortage. This crisis threatens supply chains across the US and Europe at a time when stockpiles of bombs and bullets have been depleted due to prolonged war in Eastern Europe.

Bloomberg reports that antimony prices have jumped nearly fourfold compared to a year ago after Beijing tightened exports last year. This has triggered a scramble among Western defense firms to secure new supplies of the critical metal, which is essential for bullet cores, explosives, and shrapnel weapons.

[url=] [/url] [/url]

There is hope for the West: A new Australian mine, operated by Larvotto Resources, is set to become operational next year, providing a new antimony supply stream for Western defense firms.

Larvotto's managing director, Ron Heeks, told Bloomberg in an interview that the war in Ukraine has depleted Western weapon stockpiles that will need to be replaced.

"The antimony and lead from these munitions would normally be recycled into new weapons, but those have gone to the front line in Ukraine," Heeks said.

Bullets and bombs remain a small segment of the demand for antimony, which is dominated by flame retardants, lead-acid batteries, and the chemicals industry.

Excluding battery use, Heeks noted that global demand for the critical metal is about 120,000 tons per year, while current production stands at only 80,000 tons.

Chinese exports of antimony, gallium, and germanium to the US were hit with trading restrictions in Decemeber over the Biden administration's AI chip war with Beijing.

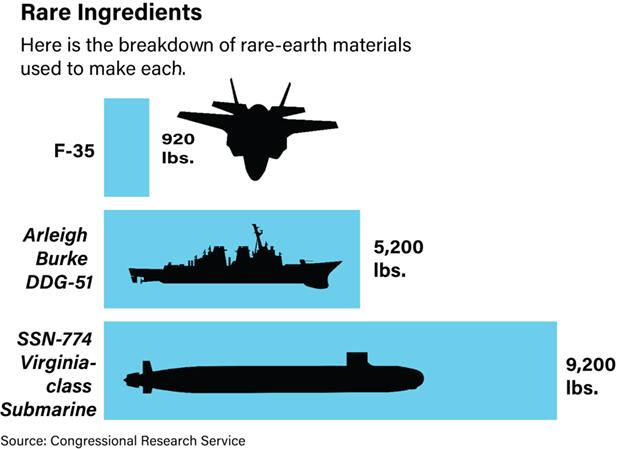

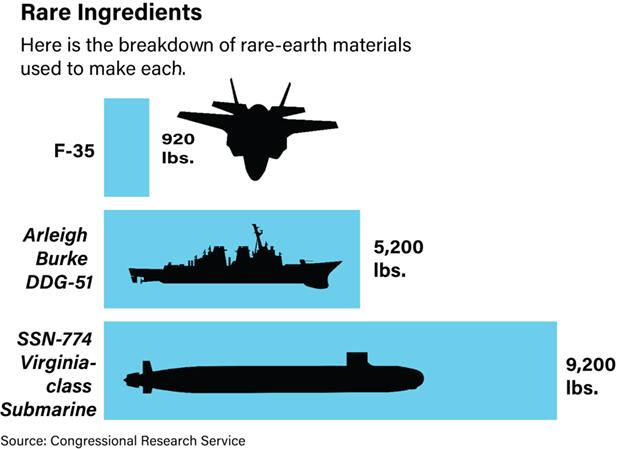

China's dominance in the global mining and processing of rare earth metals is alarming...

[url=] Source: Bloomberg[/url]President Trump's 'America First' policy includes strategically decoupling critical supply chains from China, covering rare earths, critical metals, base metals, AI chips, and other essential materials crucial for the US defense industry.> Source: Bloomberg[/url]President Trump's 'America First' policy includes strategically decoupling critical supply chains from China, covering rare earths, critical metals, base metals, AI chips, and other essential materials crucial for the US defense industry.>

zerohedge.com |

[/url]

[/url] Source: Bloomberg[/url]President Trump's 'America First' policy includes strategically decoupling critical supply chains from China, covering rare earths, critical metals, base metals, AI chips, and other essential materials crucial for the US defense industry.>

Source: Bloomberg[/url]President Trump's 'America First' policy includes strategically decoupling critical supply chains from China, covering rare earths, critical metals, base metals, AI chips, and other essential materials crucial for the US defense industry.>