re <<wow wee>> I figure gold wins if Team Trump stays the course, and wins bigger if Team Trump panics or loses 'uge, and at the mo the Team is doubling-down on a losing trade war, placing all Joes and Janes of the front of the contact-line, when the USA domain 'has no cards' in so far as manufacturing supplying chain is concerned

Let us see how the gamble works and works out, considered or otherwise on the fly

“Everyone thinks April 2nd will be ‘peak fear’ day, but I guess that will really depend on whom he is playing golf with on April 1st.”

zerohedge.com

Hartnett: The "Sell" Signal Is Over, But April 2 Looms

BY TYLER DURDEN

SUNDAY, MAR 23, 2025 - 06:05 AM

Last week we pointed out that whether due to skill or chance, Michael Hartnett's "sell" signal - which as we reported back in December had been triggered with just two weeks left in 2024 - had once again successfully marked the peak of the market, and a few weeks later culminated with a 10% S&P correction in 20 days, the 5th fastest correction in the last 75 years (the fastest ever was 8 days, during the onset of Covid – 2/27/20), a 14% drop in the Nasdaq, 20% drop in the Mag7, and a 5% slide in the ACWI -5%.

Still, as we also pointed out last week, the Bank of America strategist refused to press US shorts, predicting that this is not the start of a bear market for US stocks but only a correction (reminding readers that "markets stop panicking when policy makers start panicking" something he believed would happen sooner or later, and judging by the tentative appearance of the Fed Put last week, he was right again).

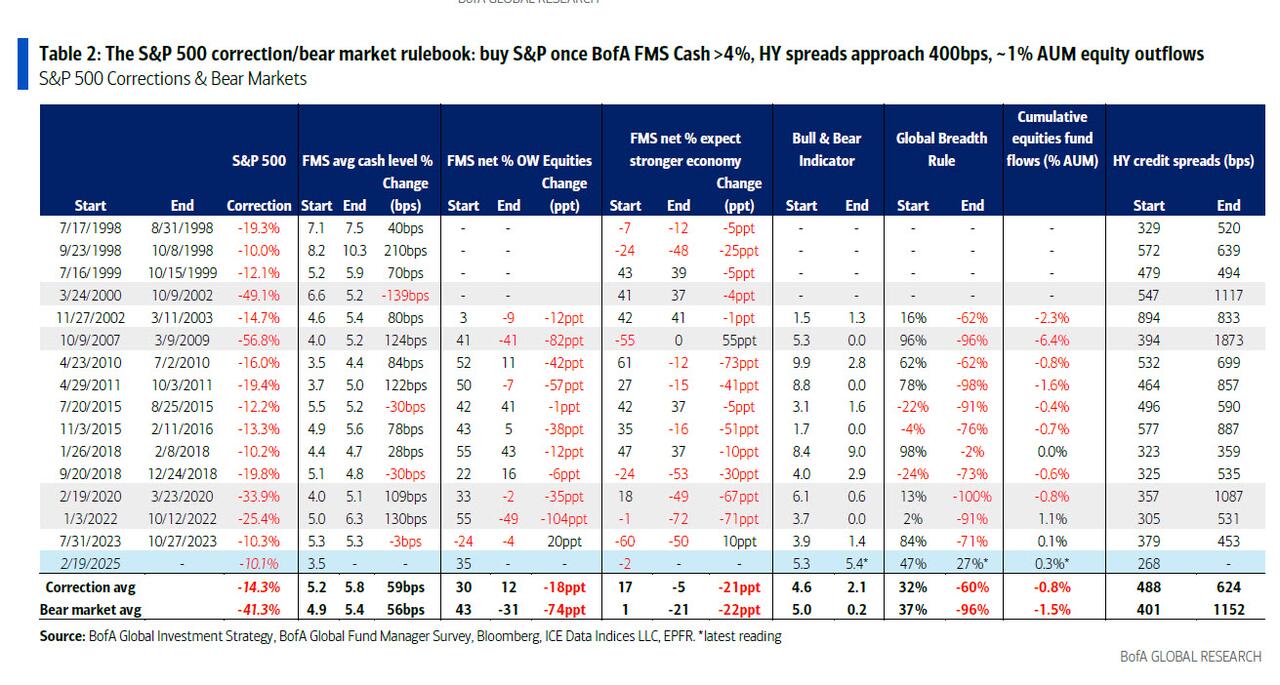

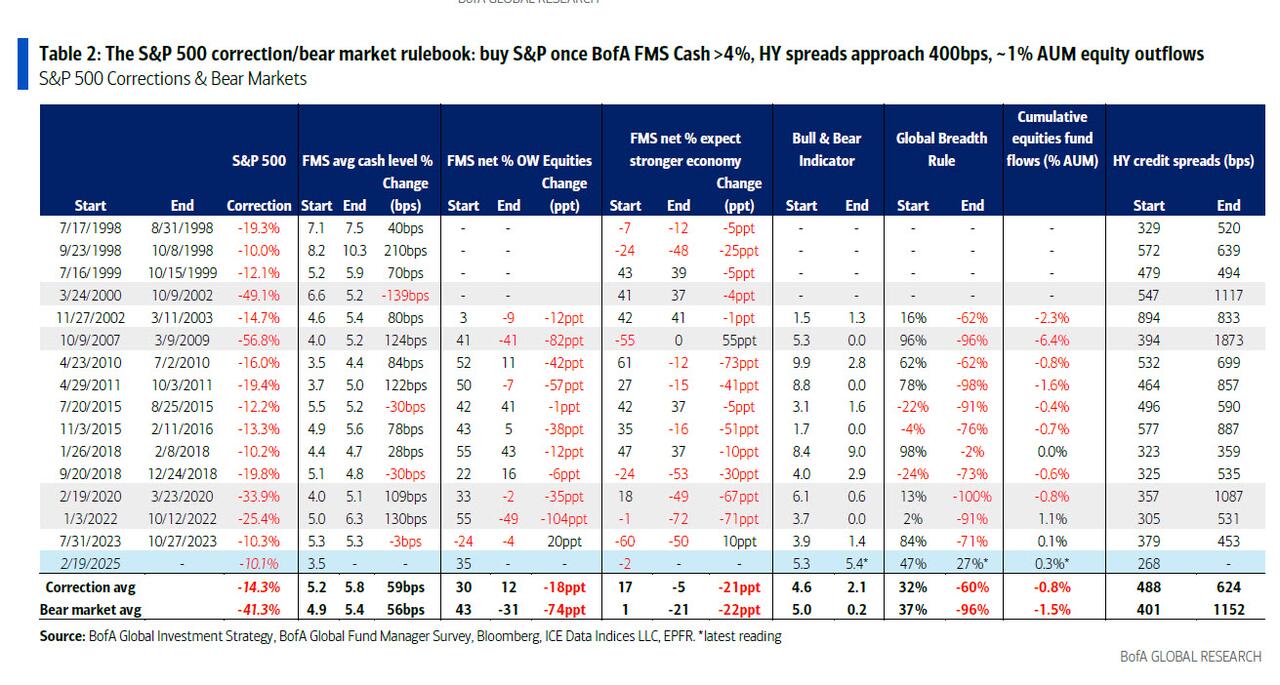

Furthermore, since the Trump cabinet realizes that an equity bear market threatens a painful recession, Hartnett also believes that fresh declines in stock prices will provoke flip in trade & monetary policy back to a “he loves me” stance; As such, a history of market corrections compiled by the strategist suggests "S&P 500 a good buy at 5300 as BofA FMS cash surges above 4%, HY spreads approach 400bps, and equity outflows accelerate."

There was another reason why Hartnett did not feel like pressing a short into the sliding market.

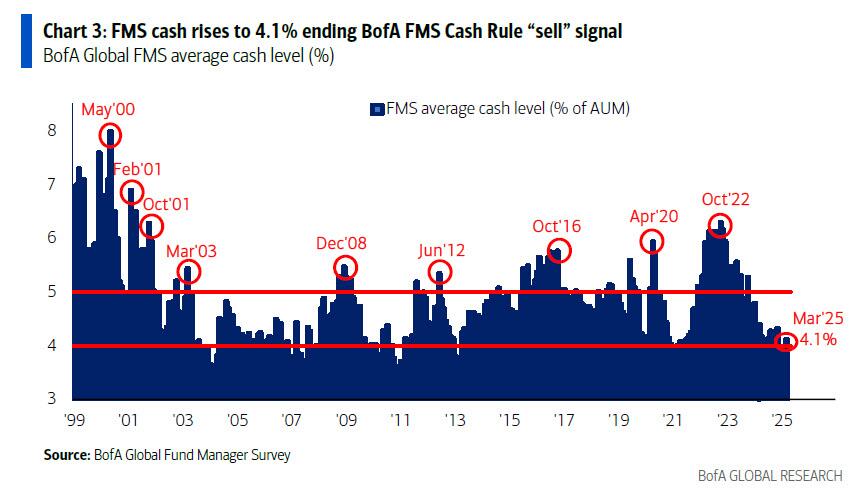

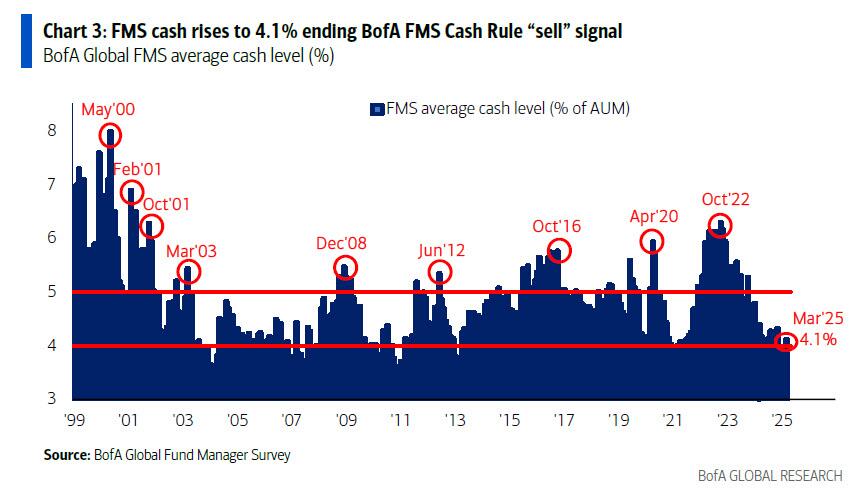

Last weekend, with just days until the latest, March, Fund Manager Survey, we said that if the "March Global FMS (released Tuesday March 18th) shows cash levels up from 3.5% to >4.1% would end the “sell signal” that was triggered in December for stocks, and indicate bulk of correction done."

That's precisely what happened, and a few days later, Hartnett reported in the latest Fund Manager Survey (available to pro subs) that cash jumped from 3.5% to 4.1% - the biggest jump in cash allocations since March 2020 - ending FMS “sell signal” triggered on Dec 17th."

And while Hartnett highlighted that alongside the surge in cash levels, the survey also noted the 2nd biggest drop in global growth expectations ever and the biggest drop in US equity allocations ever, his advice to those reading the infamously schizophrenic survey was to "watch what they do, not what they say", and sure enough, the same week we learned that the mood on Wall Street had turned apocalyptic, in his latest Flow Show (available to pro subs) Hartnett reports the following market bottoming indicators:

- i) markets just experienced the biggest week of 2025 inflows to global/US equity funds,

- ii) huge 2-week buying of stocks by BofA private clients

- iii) for every $100 of inflows into US equity funds since US election <$1 of outflows in recent weeks

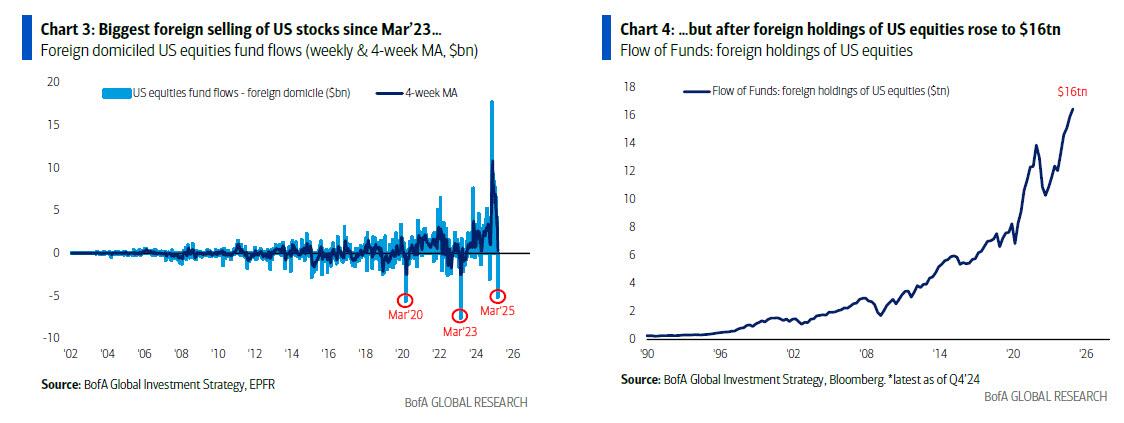

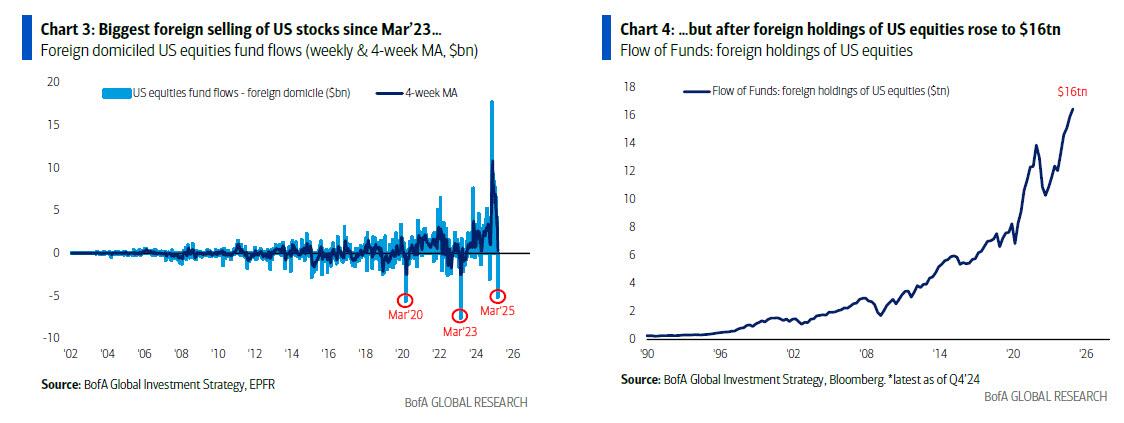

- iv) foreigners selling but after accumulating $16tn position in US stocks

In other words, after all the fire and brimstone global investors are... not anywhere close to short US or global equities.

Which is not to say this is the all clear. Recall, last week Hartnett said to wait and "buy SPX at 5300 once BofA FMS cash surges above 4%, HY spreads approach 400bps, and equity outflows accelerate." Well, the cash has indeed surged above 4%, but many of the other signals have yet to hit.

Meanwhile, confusion reigns, and as Hartnett wrote in his first Zeitgeist quote of the week, even the reaction to the (dovish) FOMC appeared to puzzle the market: "2-year Treasury yields traded like the Fed was dovish, but dollar traded like the Fed was hawkish, price action which just tells risk-takers to stay on the sidelines."

There is little confusion how we got here, however... and in his "tale of the tape", Hartnett notes that this week is the 5-year anniversary of 2222 S&P 500 COVID low; the past 5 years has seen US nominal GDP soar 50%, thanks to a 65% increase in US government spending, triggering lots of Main Street/Wall Street inflation, and leading to a collapse in US Treasuries.

Looking ahead, Hartnett says that next 5 years will be marked by fiscal inflationary excess in China, Japan, Europe, but offset by fiscal disinflation in US, which is why Hartnett once again urges clients to go long BIG: Bonds (US Treasuries), International stocks, Gold (US$ in bear).

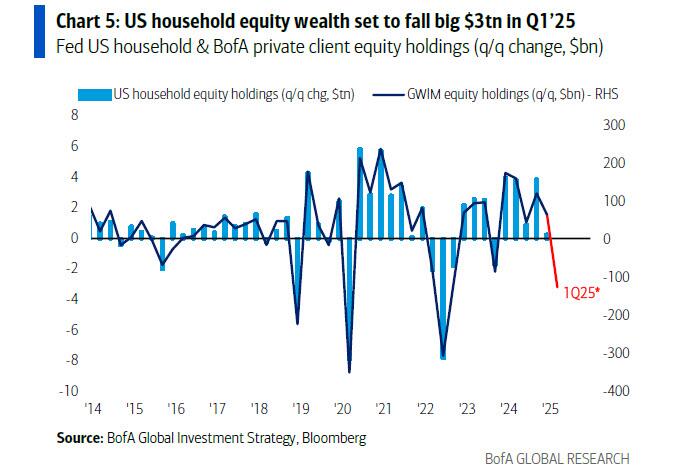

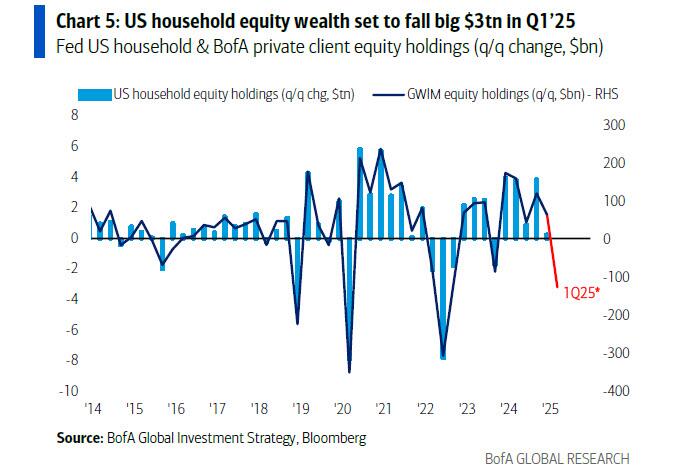

Another reason to be cautious on US stocks is that the pain for the US consumer is just starting. Consider that much of the outsized consumer spending in the US in recent years was aided by big US equity gains; indeed, in the post-covid era we have seen household equity wealth surge $9tn in 2024 to $56tn; but using BofA private client equity data, Hartnett estimates US household equity wealth could fall $3tn in Q1’25.

Meanwhile, US fiscal, monetary, and trade policy are currently all hawkish not dovish, which means the US yield curve set to invert once more.

Finally, looking at the biggest picture, Hartnett says that the biggest Q1 asset price catalysts were DeepSeek & DOGE, not tariffs. In other words, for Hartnett the fact that China, Germany stocks are up 20% since the US election and the monster international equity inflows...

... say no one really believes trade war = recession/bear market.

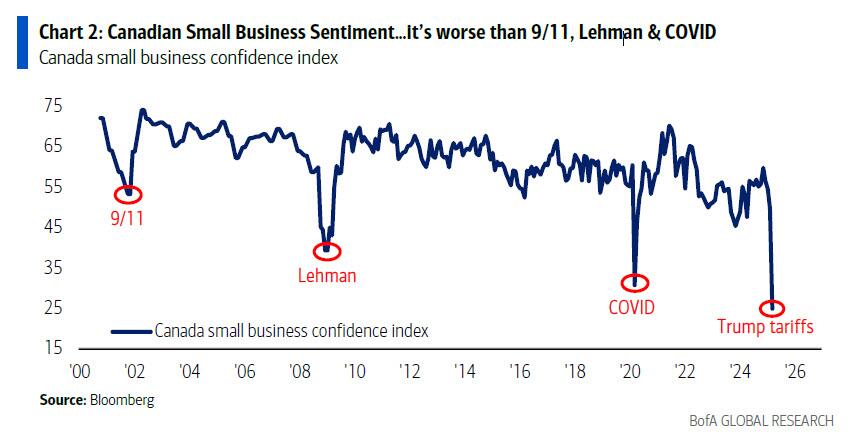

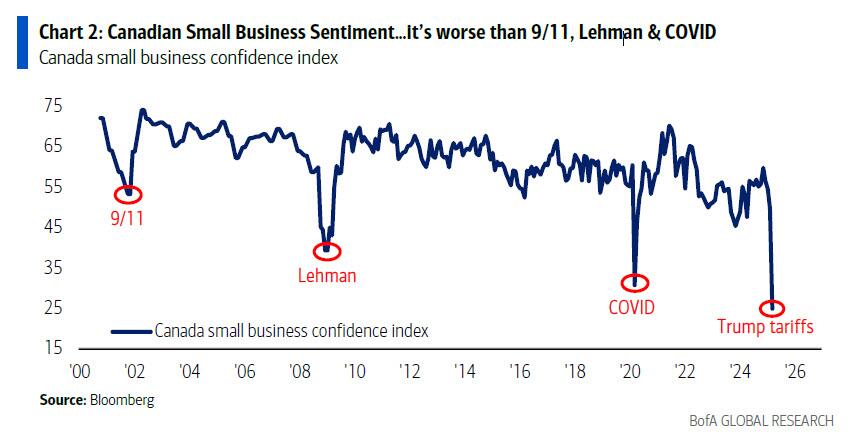

But the looming April 2nd tariff deadline is now starting to finally infect global data - see Canada small biz optimism plunge to record lows...

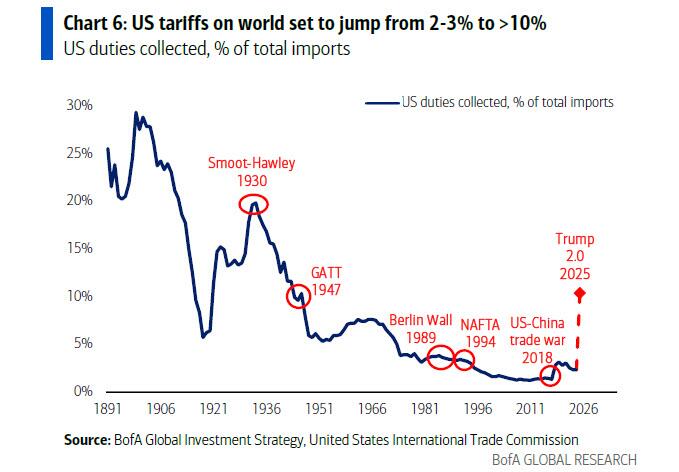

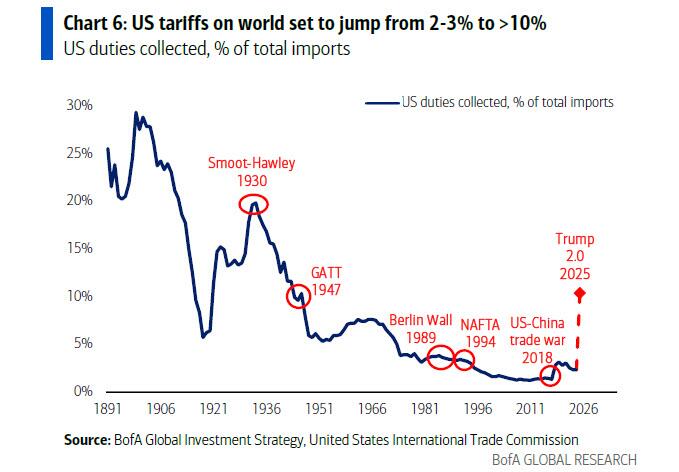

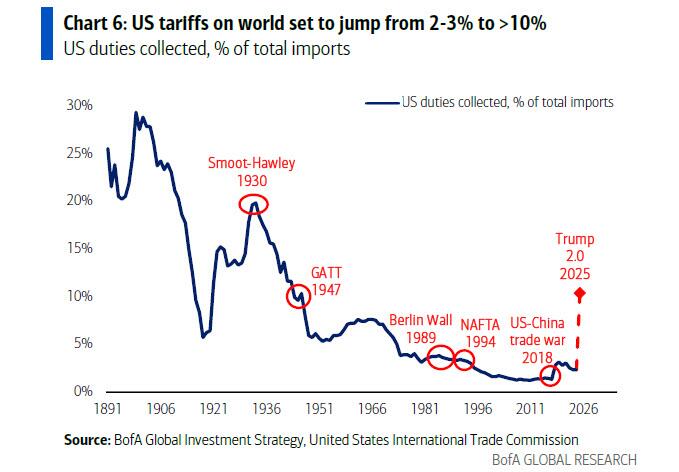

... ahead of US tariffs set to jump from 2-3% to >10%.

Hartnett concludes his tactical view by saying "Bonds & Gold way less vulnerable to “tariff pandemic” than US & International stocks" although as he hedges with his other zeitgeist quote of the week...

“Everyone thinks April 2nd will be ‘peak fear’ day, but I guess that will really depend on whom he is playing golf with on April 1st.”

|