re <<serenity>> shall be up-levelled once gold touches US$ 4,000 and GDX / GDXJ crosses 2X previous ATH

gold is a cure for many ailments, and troubled mind is one, am told

the metal is so, or soooooooooo, magical

what posts follow are a clippings from behind the curtain, and they should fortify tranquility

zerohedge.com

Goldman's "April 2nd Game Plan" In Eight Trades

BY TYLER DURDEN

SATURDAY, MAR 29, 2025 - 07:22 AM

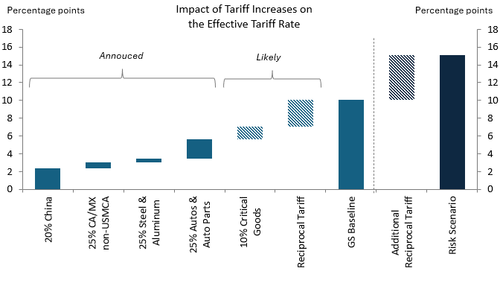

As we reported earlier this week (see " Goldman Warns Market Expectations For Trump's April 2 Reciprocal Tariffs Are Far Too Optimistic") Goldman’s house view on the April 2 reciprocal tariffs, aka "Liberation Day", is more bearish than market expectations, and one explanation for today's selling is that clients are taking off risk because listed products are not capturing the trade fear dynamics efficiently.

So with just a few days left until next week's key event, the bank's thematic research team shares its preferred trades ahead of April 2nd tariff announcements:

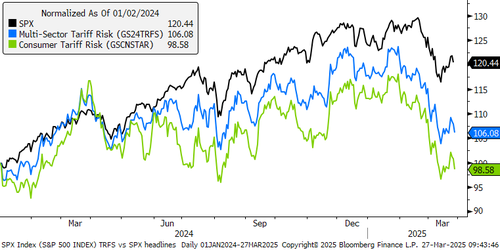

- Short companies at risk to tariffs (GS24TRFS and GSCNSTAR)

- Long companies that benefit from onshoring trends (GSXUSHOR) vs Short companies that would face challenges if they are unable to move operations to the US (GSXUOFFS)

- Long Republican policy outperformers (GS24REPL) vs Short Republican policy underperformers (GS24REPS).

- Short cyclicals ex commods (GSXUCYCL) vs Long defensives ex commods (GSXUDEFS)

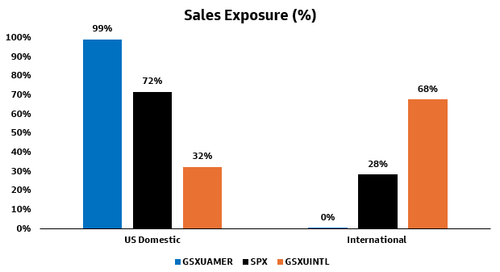

- Long domestic sales (GSXUAMER) vs Short international sales (GSXUINTL)

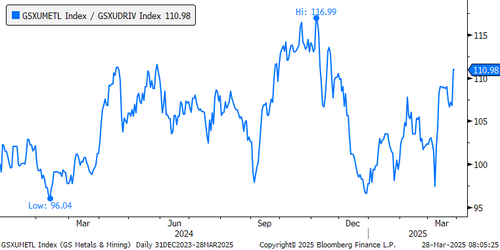

- Long US metals (GSXUMETL) vs Short US autos (GSXUDRIV)

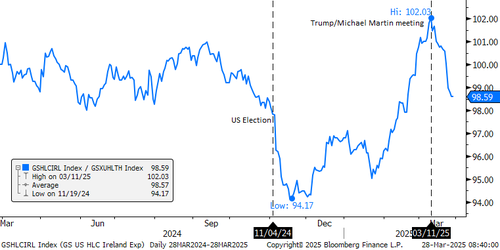

- Short health care companies exposed to Ireland (GSHLCIRL)

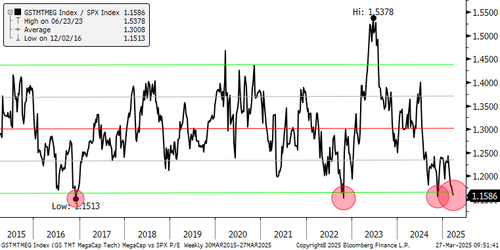

- Long megacap tech companies (GSTMTMEG)

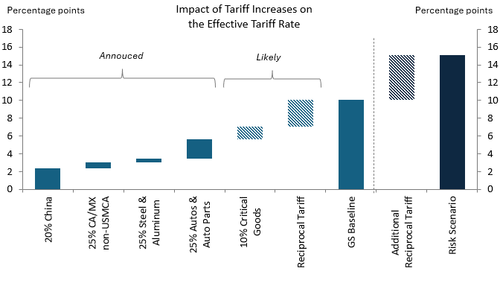

Let's take a closer look at each of these, but first we start with a recap of what we wrote on Tuesday, namely the views of Goldman's political analyst, Alec Phillips, whose take on the looming tariffs was as follows: (1) officials anticipate negotiations with trade partners after April 2nd, (2) GIR’s recent survey shows investors expect a 9pp reciprocal tariff rate on average, and (3) we expect April 2nd tariff announcements to trigger a negative surprise effect on markets.

[url=] [/url] [/url]

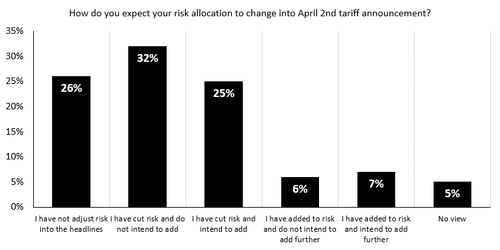

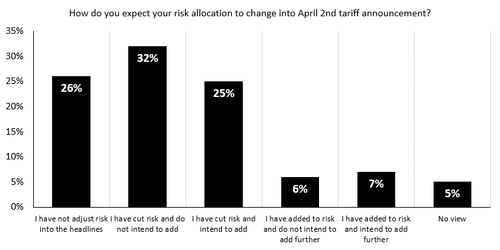

When Goldman asked its clients how they expect their risk allocation to change into April 2nd tariff announcement, the majority answered they have cut risk and do not intend to add (107 votes).

[url=] [/url] [/url]

Which bring us to Goldman's preferred trades starting with the most obvious one:

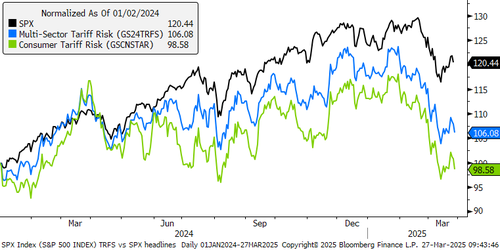

1. Short companies at risk to tariffs

Tariff-sensitive pockets of the market (GS24TRFS and GSCNSTAR) have experienced a technical rebound since mid-March. Goldman likes these baskets considering their fundamentals are at risk if tariffs are imposed. GS24TRFS consists of US companies across multiple sectors that have multi-regional supply chains. This is Goldman's favorite implementation to hedge uncertainty around tariff policies. Goldman's research points out that 15 trading partners account for 90% of imports and more than 100% of the trade deficit.

[url=] [/url] [/url]

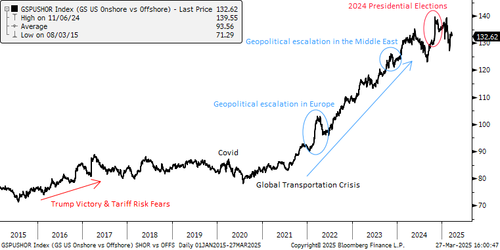

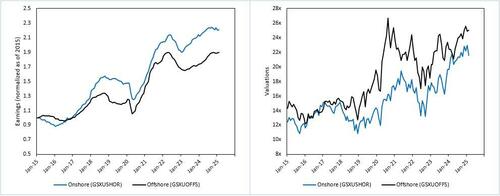

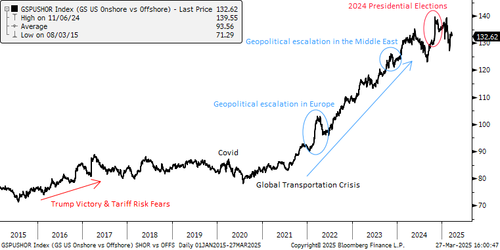

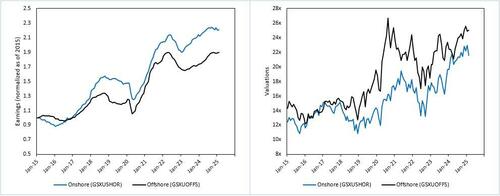

2. Long companies that benefit from onshoring trends and short companies that could face challenges due to significant offshore exposure

Companies are once again encouraged to move operations to the US. Goldman likes its onshoring pair (GSPUSHOR) for the following reasons: (1) any company moving operations to the US is supporting higher capex levels for players enabling onshoring trends (non-residential construction, manufacturing facilities automation, etc…), and (2) while the new administration is being frugal, Trump did mention a potential infrastructure bill during the inauguration:

[url=] [/url] [/url]

Goldman's onshoring pair is rebalancing today to reduce exposure to AI, adjust for tariff sensitivity, and refresh liquidity. The new pair has onshoring winners growing earnings at a faster pace but are cheaper than companies that could face challenges in this environment. GSXUSHOR is composed of companies that help enable companies to more operations onshore, diversified across non-residential construction companies involved in building manufacturing facilities, automation, transportation, and companies that have moved operations domestically. GSXUOFFS consists of companies at risk to tariffs because of how global their manufacturing footprint is.

[url=] [/url] [/url]

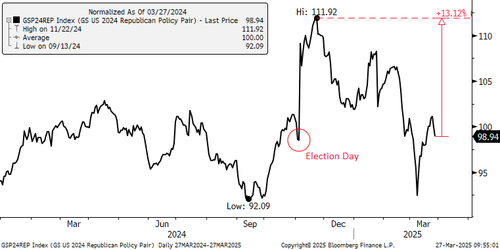

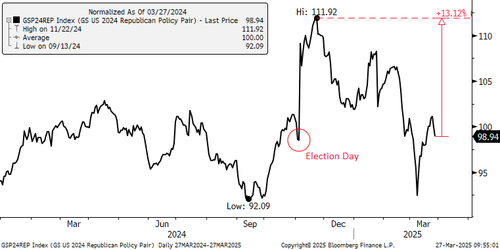

3. Long Republican policy outperformers and short Republican policy underperformers

Republican policy outperformers vs underperformers (GS24REPL vs GS24REPS) is trading near election day levels, but are still ~10% away from election results highs. We started the year with high growth expectations, multiple rate cuts scheduled, and an overall positive outlook mainly driven by the new administration. But investors are not seeing this yet. Instead, the administration is focused first on tariffs, government spending cuts, and immigration reform while deregulation, tax cuts, AI and infrastructure spending are still in progress. Growth fears driven by recent economic data as well as current policy focus has unwound all gains since the election in the Goldman Republican Policy Outperformers vs Underperformers pair (GSP24REP). This is an opportunity to buy the dip considering the bank continues to have high conviction in the new administration’s de-regulation plans, AI and Infrastructure spending plans. It is a matter of when, and not a matter of if.

[url=] [/url] [/url]

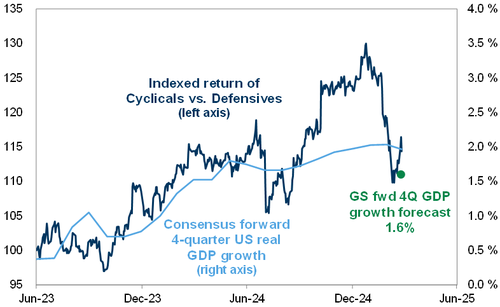

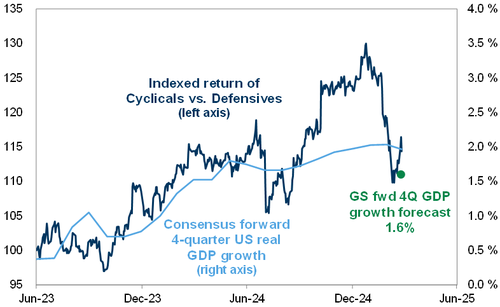

4. Short cyclicals and long defensives excluding commodity exposure

Cyclicals vs Defensives ex commodities have rebounded in the last couple of days and are not pricing in growth above GS forecasts for 2025 (Credit to Jenny Ma in GS equity strategy research for this chart)

[url=] [/url] [/url]

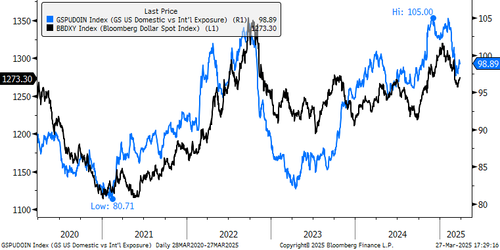

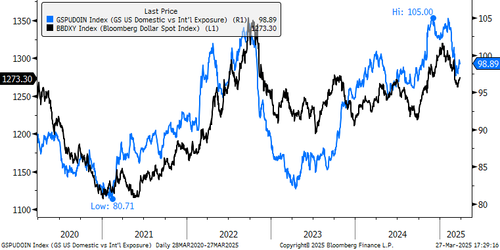

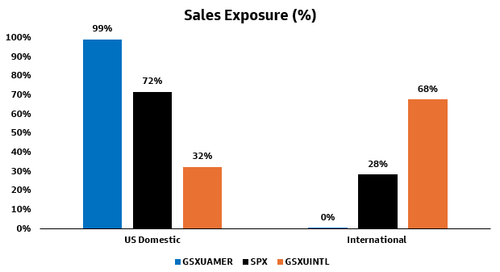

5. Long companies with high domestic sales and short companies with high international sales

In the scenario where a trade war escalates, Goldman would go long companies that have primarily US sales exposure, in the case where trade partners decide to reduce purchases from US listed companies

[url=] [/url] [/url]

The bank's dollar sensitive pair provides more extreme exposure to sales % domestically vs internationally in comparison to the S&P 500

[url=] [/url] [/url]

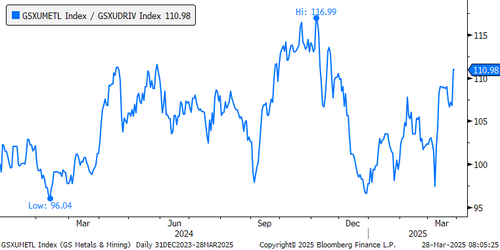

6. Long US metals and short US autos ex TSLA

Goldman has noticed investors targeting specific industries, by going long US metals and going short US autos, excluding TSLA. GS research sent an update earlier this week, exploring Trump’s incremental 25% tariff on autos and certain auto parts.

[url=] [/url] [/url]

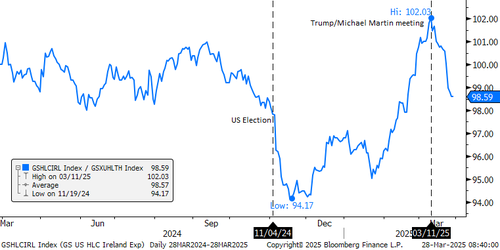

7. Short health care companies exposed to Ireland

Healthcare investors have been intensely focused on the prospect of pharmaceutical tariffs this week following Trump’s comments during his cabinet meeting on Monday pointing to an update in the “near future”. Investor focus following these comments centered in around exposure to Ireland – given the country’s significant manufacturing footprint and/or domiciling for a broad array of the healthcare sector. On the back of this focus, Goldman put together a basket of healthcare stocks with exposure to the country from a manufacturing, IP and/or domiciling perspective – based on its review of public disclosures, footprint analyses and our conversations through the week on this theme.

[url=] [/url] [/url]

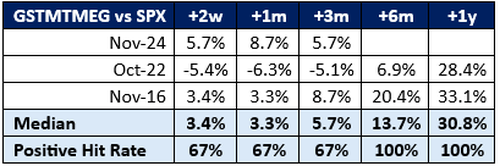

8. Long megacap tech companies:

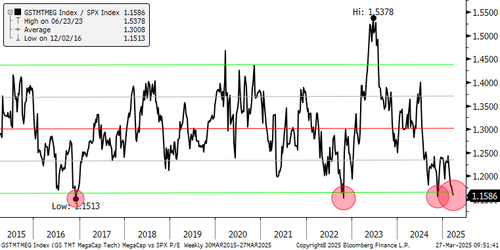

MegaCap tech, i.e., Mag 7 and the likes (GSTMTMEG) valuation premium over the market is reaching the lowest level in the last decade. Pretty much the entire Goldman trading desk likes going long Megacap tech at these levels.

[url=] [/url] [/url]

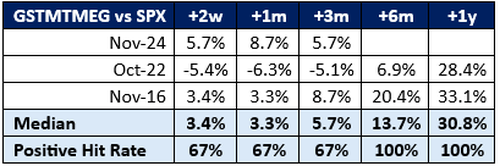

Here is the performance of megacap tech performance relative to the S&P 500 following the trough on relative valuations: quite bullish for mega tech.

[url=] [/url] [/url] |

[/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url]