Policy

Europe’s energy storage fleet reaches 89 GW

The fleet of energy storage projects in Europe, including both pumped hydro and battery energy storage systems of all sizes, is expanding rapidly. This growth is set to continue at a strong pace through 2030, fueled by technological advancements, supportive policies, and other key factors.

By

Marija Maisch

Apr 01, 2025

Markets

Policy

Supply chain

Image: European Association for Storage of Energy

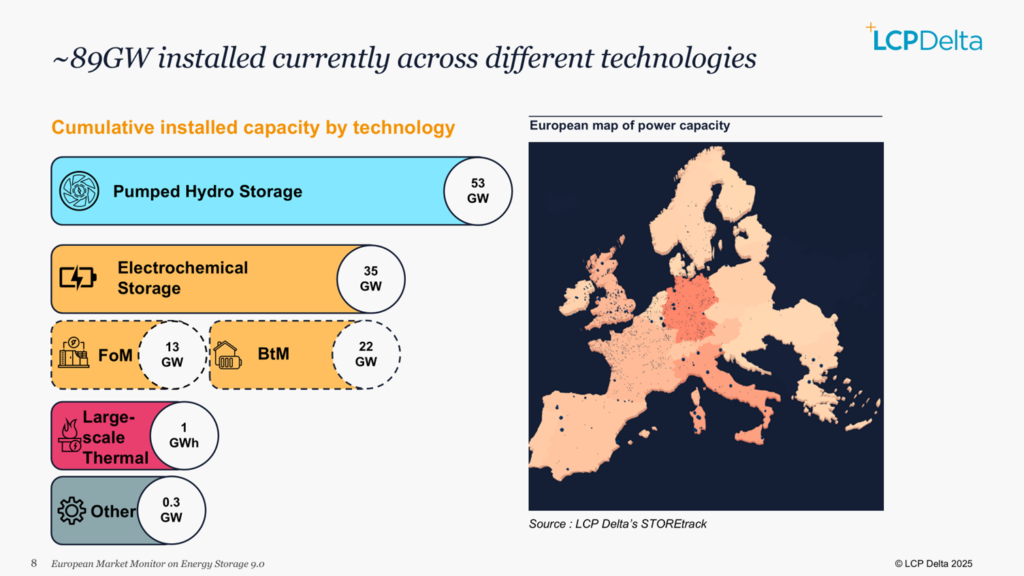

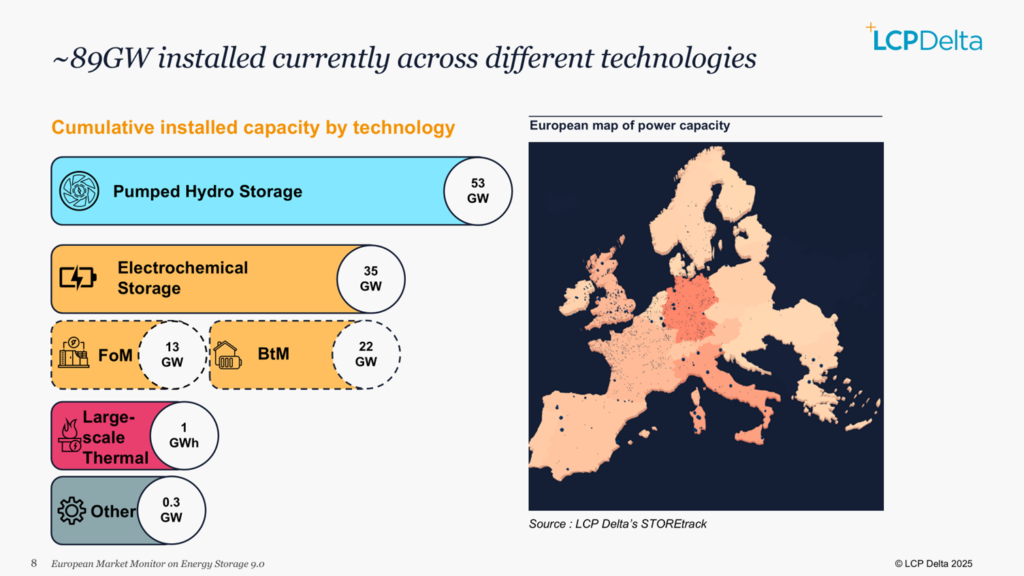

Europe continues to grow its energy storage fleet at pace, advancing its transition to a more sustainable and resilient energy system. According to a new report authored by LCP Delta and the European Association for Storage of Energy (EASE), the continent reached a cumulative 89 GW by the end of 2024.

The latest edition of the report titled European Market Monitor on Energy Storage (EMMES) finds that 2024 has been a record year for energy storage deployment. Pumped-hydro storage (PHS) dominated the market, accounting for 53 GW of total capacity. Meanwhile, electrochemical storage reached 35 GW, with many installations in homes and businesses. Large-scale thermal projects accounted for around 1 GW.

The rate of energy storage adoption varied across European countries in 2024. Image: EASE

Italy, France, Germany and Spain hosted the largest PHS capacities.

There was 13 GW of front-of-the-meter (FoM) and 22 GW of behind-the-meter electrochemical storage deployed in 2024 across Europe.

In the FoM segment, Italy experienced a surge in capacity, adding 1.6 GW of installations in 2024, driven by capacity market projects with mainly four-hour durations. Great Britain followed with 1.3 GW of new projects.

For commercial and industrial (C&I) electrochemical storage,Germany led deployment, while other European markets also saw growth. The C&I battery storage market expanded by approximately 28%, despite challenges in the solar PV sector—particularly in Spain, France, and Italy—that affected battery sales for PV optimization, the report finds.

Meanwhile, Germany and Italy remained the top markets for residential electrochemical storage deployment, despite a slowdown. Germany continued to lead Europe’s residential storage sector, adding over 510,000 new installations in 2024, even after a 10% decline, the LCP Delta and EASE find.

However, according to Germany’s Federal Association of Energy Storage Systems (BVES), the 2024 drop in the residential storage segment was much more pronounced, reaching as high as 40%. By contrast, the country’s C&I storage segment grew by 23% and the utility one by 14% year-on-year, BVES finds.

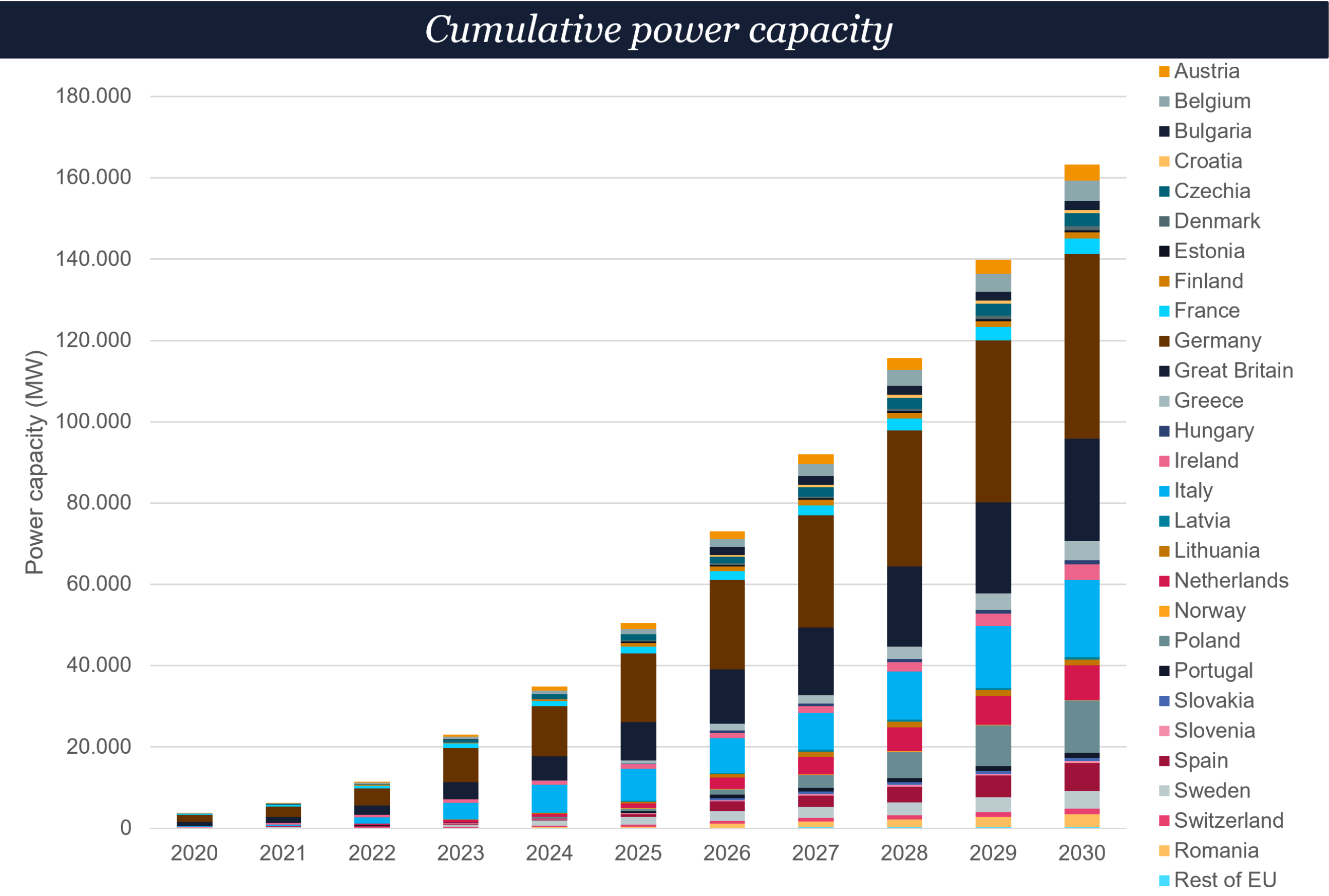

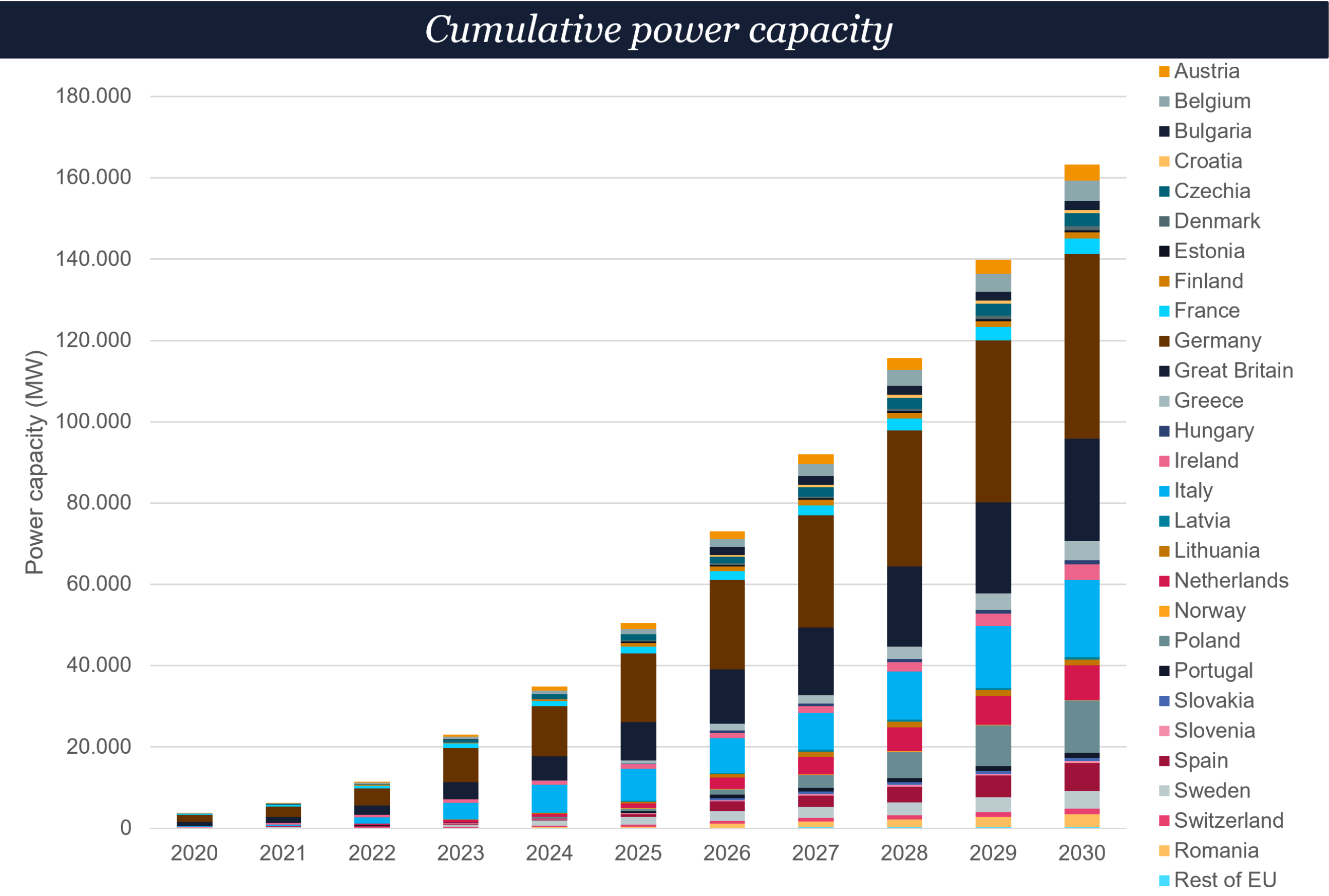

Looking ahead, LCP Delta and EASE project continued strong growth through 2030, driven by technological advancements, policy support, and other key factors.

By 2030, the report projects that increased FoM deployment, declining €/MWh storage costs, and policy advancements—such as the launch of Spain’s capacity market—will create new opportunities across Europe. Italy and Poland are set to play key roles in this expansion, with MACSE and capacity market-backed projects driving deployment.

For C&I storage, recent EU initiatives like the Clean Industrial Deal and Electricity Market Design reform will strengthen market conditions and expand revenue opportunities in the coming years, the report states.

Long-term growth is also expected in residential electrochemical storage across Europe. According to LCP Delta and EASE, residential battery installations will continue rising, driven by falling technology costs, increasing home and transport electrification, consumer concerns over energy price volatility, more dynamic tariff structures, and innovative financing models.

“The EMMES 9.0 data highlights significant growth in the energy storage sector: increased deployment rates, larger energy storage systems, and a rising trend of co-locating storage projects with renewables. From a policy perspective, new legislation specifically targeting storage is expected to lead to robust revenue streams and drive down costs: an extremely positive outlook,” said Jacopo Tosoni, head of policy at EASE.

ess-news.com |