JPMorgan now sees U.S. recession this year after Trump's tariffs

Apr. 04, 2025 5:53 PM ET

By: Anuron Mitra, SA News Editor

JPMorgan on Friday updated its U.S. economic outlook and now sees the country slipping into a recession in 2025 after factoring in President Donald Trump's sweeping reciprocal tariffs.

The imposition of the steepest American trade barriers in over a century has hammered sentiment across the globe. Wall Street slumped to its worst session since 2020 on Thursday, and the rout extended into Friday, bringing overall weekly losses to a whopping -9.08%.

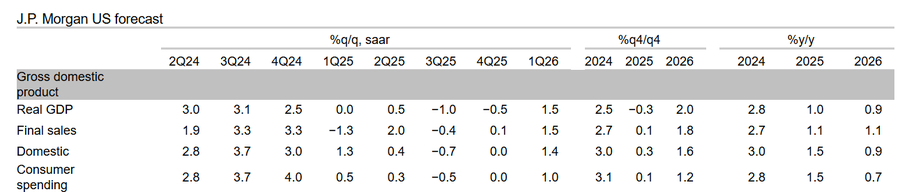

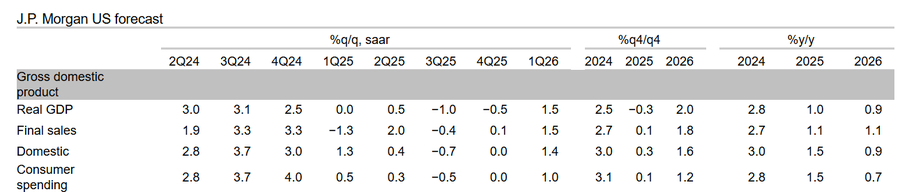

"We now expect real GDP to contract under the weight of the tariffs, and for the full year (4Q/4Q) we now look for real GDP growth of -0.3%, down from 1.3% previously. The recession in economic activity is projected to push the unemployment rate up to 5.3%," JPMorgan's Michael Feroli said, referring to gross domestic product.

See below the chart provided by JPMorgan with its updated forecasts:

JPMorgan JPMorgan

"We expect the weakest months to be concentrated in the middle of the year. Even so, from a quarterly perspective we look for contractions in 3Q and 4Q," Feroli observed.

JPMorgan also believes that the hit to consumers from tariff-sparked inflation could be higher than the jump in prices seen post the COVID-19 pandemic.

"The most readily quantifiable effect of higher tariffs on activity runs through higher inflation, and hence lower real income and lower real consumer spending. The pinch from higher prices that we expect in coming months may hit harder than in the post-pandemic inflation spike, as nominal income growth has been moderating recently, as opposed to accelerating in the earlier episode," Feroli said.

"The forecasted contraction in economic activity is expected to depress hiring and over time to lift the unemployment rate to 5.3%. If realized, our stagflationary forecast would present a dilemma to Fed policymakers," he added.

Federal Reserve chair Jerome Powell on Friday said the economic impact of tariffs was likely to be larger than expected, adding that the central bank was in no hurry to act on interest rates and would wait and see how events play out. |

JPMorgan

JPMorgan